It might be younger than most of the sectors it seeks to serve, but the mobile industry faces the same challenges with digital change as every enterprise vertical. Operators are juggling 5G innovation, enterprise needs, and new revenue models but must also embrace deeper understanding and closer collaboration with their audiences. Note, this is an excerpt from a new 5G Market Pulse report, available to download for free here; the report has been serialised online across a number of previous entries here (intro), here (SA upgrades), here (FWA gains), here (money problems), and here (use cases)!

In sum – what to know:

Universal challenges – telecom faces the same challenges as other sectors with familiar operational and cultural hurdles, and a focus on internal efficiencies first.

Operator pivots – experiments with FWA, tiered pricing, and OTT bundles have seen some success, but telcos need broader strategies to make 5G pay its way.

Enterprise focus – mostly, operators must work harder with enterprises, and collaborate better with the ecosystem, in order to go beyond their old mass-market engagements.

There is an argument as well (see last post), maybe, that the telecom industry’s caution in the face of its own digital change is down to its relative youth. Unlike some of the industrial sectors it seeks to serve with 5G, in the name of digital transformation, the mobile industry is only 45 years old. It was born out of the big-bang in electronics and information technology in the 1970s, characterised as a third industrial revolution. Its networks have helped to sire a fourth industrial revolution, now blurring with a fifth, to virtualise, animate, and educate physical systems, and to remove humans from their automation. As such, these internal operational challenges with SA upgrades are a part of the industry’s first revolution, in ways – where hard-nosed sectors like manufacturing, say, are on their fourth already.

Does this make a difference? Are these others ahead? If you consider how private 5G SA networks are starting to be sold into enterprises to support advanced use cases such as automated logistics-and-production and remote assistance-and-monitoring (see below), then one might perceive a crunch has come for legacy industrial sectors, and they have decided to boldly forge ahead. But this is not actually correct; the operational and cultural challenges are the same, and their business cases are mostly about inward efficiencies, too, rather than outward innovations – whether they manifest in lower costs or higher capacity. So it is the same for every industry, telecoms or not. And the discipline in the end is to make cumulative gambles on possible gains in blind pursuit of an ephemeral vision of total change.

It sounds mad, but that is the sport. And operators are pretty good at it, historically, and are taking new opportunities where they can find them, as with FWA, and otherwise experimenting with bundles (as always) and even new business models. Leo Gergs, senior analyst at ABI Research, just as familiar with the enterprise 5G game, says operators are “pivoting to more innovative revenue streams”. But actually, most of these are branded FWA services; he cites Verizon’s ‘5G Home Internet’ and T-Mobile’s ‘Ultra Capacity 5G’ services in the US, as mid/high-band 5G alternatives to traditional broadband for “data-intensive applications like streaming videos and gaming”. As traditional revenue sources decline, they are “pressured to rethink their pricing strategies and engagement models,” he says.

Bolder perhaps are AT&T’s ‘5G for All’ packages, which introduce tiered pricing for punters to select their data usage. Meanwhile, there have been attempts to integrate over-the-top (OTT) content into subscription bundles. Telefónica has integrated Netflix into its video platforms in Latin America; T-Mobile has done the same, more or less, in Europe. Gergs comments: “While OTT partnerships can increase customer loyalty and engagement, their success has been mixed. Some have seen positive customer uptake [but] the return on investment is uncertain. T-Mobile’s collaboration with Netflix initially attracted customers, but the long-term impact on profitability has been questioned.” And in the end, pricing and bundling are standard sales tactics around the same-old-stuff.

What operators need, in concert, is a “broader, sustainable strategy” that goes beyond rejigging familiar products, he suggests. There is better evidence of this in the enterprise space, maybe. Shadine Taufik, research analyst at the same firm, points to the opportunity to sell 5G as-a-service, including customised control of networks, spectrum, security, and slices on private/hybrid edge setups and globalised wireless WAN infrastructure. The market will boom on the back of “global economic downturn and tightening innovation budgets”, she says, notably among the small and mid-sized enterprise (SME) sector. It will be worth $6.1 billion by 2030, reckon ABI Research. “Companies are paying closer attention to capital expenditure – to remain agile in an ever-changing world,” says Taufik.

The problem is operators are good at re-wrapping and box-shifting airtime and handsets to billions of people that all want the same thing, but not very good at mixing novel 5G SA features into highly-tailored bundles for millions of enterprises that all want something different. “Their old tactics have not impressed [enterprises],” says Taufik, suggesting they have expected enterprises to flock to them for 5G – without taking time to understand and develop a proper business solution around it, and to integrate and collaborate through the process. System integrators (“like Boldyn Networks and NTT Data”) have stepped into the fray, she says, backed by smart network vendors – with a better grasp of Industry 4.0 than their traditional customers. Operators should “empathise” with enterprises, she says.

There are outliers; Verizon Business, the international integrator division of US carrier Verizon, has become “more use-case driven”, she says, “paying attention to the specific applications of cellular across sectors, instead of just offering an umbrella solution”. RCR Wireless has charted its transformation very well, and discussed the mobile market’s adventures with Industry 4.0 over many years; the sense is certain operators, like Verizon, are improving, and will make a collaborative fist of the more varied and complex supply of 5G SA as crucial elements in broader solutions for a range of sectors.

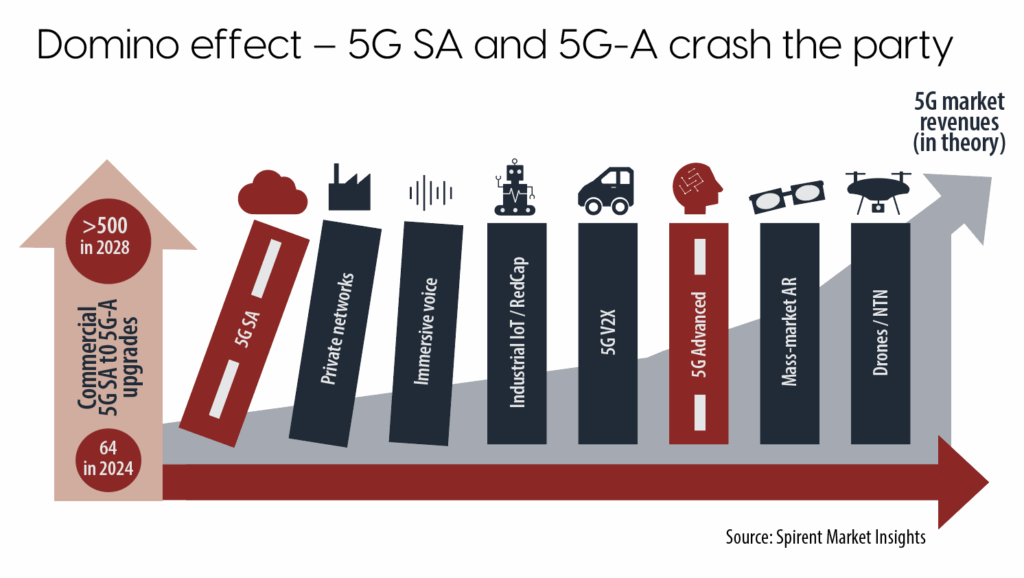

Of all mobile operators, outside of China at least, Verizon is probably the one to have properly toppled the first domino in the whole 5G SA domino run – as imagined by Spirent in the graphic below. Most of the others are waiting on future 5G releases in public networks, but may variously exist in private networks sooner, as later-level 5G releases are adopted in enterprise systems. Ekudden at Ericsson attempts to pull all the strands together, making clear the service provider market is required to limber-up as well. “If it was only one use case, only something that is built with the same logic around subscriber-based rate plans, we would not see the growth that we are predicting. Which requires a change of mindset, and a change in how the industry works,” he says.

“It comes with more collaboration, horizontal architecture, and openness. It also comes with completely business-driven decisions; meaning we come with a proposition that is valuable to enterprises and governments, and to consumers as well. Which is made available via network APIs, and is easily consumable by developers on their preferred platforms. We make sure simple use cases like security and fraud prevention start to pave the way for this new way of doing business with a network platform. The next wave of network innovation is about differentiation.”

But the calculation, at the end of this long discussion, remains a sum of scattered gambles on niche services by mixed performers, all contending with their own internal transformations. And 5G is just the newest ball in this weird ballgame, urgently passed about for the benefit of the home team (internal network operations), and hopefully shuffled forward in pursuit of an unknowable goal (external products and services) – in order to bring a quantifiable victory (growth and money, or even just survival). Last word to Pongratz, who has a sensible view of this 5G mystery – including how to judge its 5G protagonists. “While it is important to think big about the potential technologies and investments required to move beyond MBB, we do need to separate the vision from the forecast,” he says.

He puts it in the context of the developing story around 6G. “The base case is that 6G is for operators, too. If mobile data traffic continues to grow at 15-20 percent per year, networks will run into problems by the end of this decade. Operators can expand capacity using new spectrum or they can densify their networks to squeeze as much as possible using existing sub-6 GHz spectrum. We can debate the use cases all day and talk about the challenges to monetize their investments, but once you focus on what pays the bills, the math is straightforward – the operators are fully aware of the limited tools at their disposal to realise another step-function reduction in costs if this should be needed. At the same time, if mobile data traffic slows to 10 percent per year, it changes the picture completely.”

He concludes: “So I agree with the assessment, when it comes to consumers and enterprises. They have to do more with less or the same to win with consumers – this is an absolute must. This is not the same as parking the car in the garage and going into maintenance mode. But since it is easier to invest the minimum amount to address what we know rather than the right amount to go after what we don’t know, it is a major challenge to find the right mix and set reasonable expectations whilst not becoming risk-averse. We also need to keep in mind that just because the 3GPP standard addresses humans/machines and consumers/enterprises, their adoption curves have little in common.”

And we should put a pin in it, and leave it there. Food for thought, as they say.