5G growth hinges on enterprise demand, from defense to drones, while consumer breakthroughs lag. Operators must monetize APIs, devices, and networks fast — or risk missing the real 5G opportunity. Note, this is an excerpt from a new 5G Market Pulse report, available to download for free here; the original introduction and previous entries have been published online here (intro) and here (SA upgrades) and here (FWA gains) and here (money problems).

In sum – what to know

Enterprise drives growth – real momentum with 5G will come from enterprise markets – defense, private networks, IoT, drones, and automotive, and not flashy consumer apps.

Consumer fizzles out – beyond fixed wireless and maybe AR glasses, there’s little killer consumer demand; operators must rethink (take lessons from enterprise departments).

APIs hold promise – developing 5G network APIs could unlock big enterprise value, but challenges in monetization and developer adoption remain unresolved – of course.

The answer (see previous entry) from Ericsson in London is that new 5G growth – for operators and everybody – will come from FWA connections (growing 14 percent per year, from 159 million to 351 million in 2030; see page 6 in report), and otherwise in new enterprise disciplines and enterprise markets.

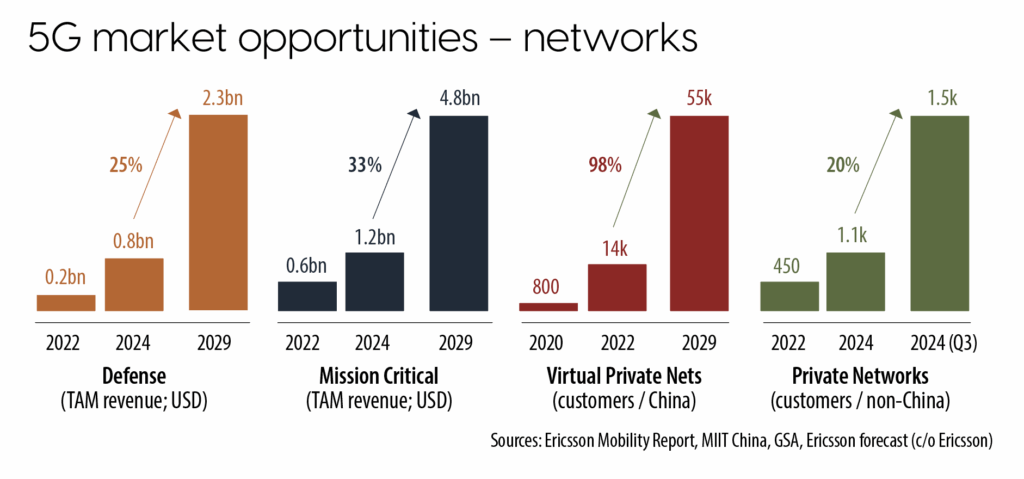

Illustrations of these (see below) are as follow: sales to the defence sector will grow at a compound annual rate (CAGR) of 25 percent in value terms ($0.8 billion to $2.3 billion in 2029); sales of mission-critical 5G will grow at 33 percent (CAGR; $1.2 billion to $4.8 billion in 2029); deployments of virtual private 5G (in China) grew 98 percent (CAGR; 14,000 in 2022 to 55,000 in 2024); deployments of straight private 5G (outside of China) grew at 20 percent (CAGR; 1,100 in 2022 to 1,500 in 2024).

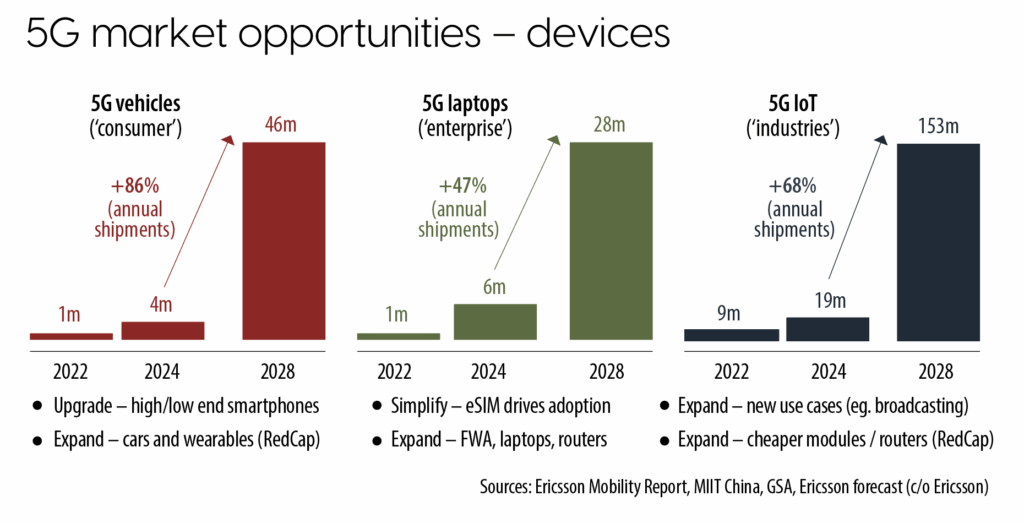

Ekudden comments: “It will not come together as a mobile platform unless we have an end-to-end system. So the cloud part, the enterprise applications, matters enormously. But equally, so does the readiness of the device ecosystem. Having 5G devices will allow us to scale the mobile platform.” He shows a slide (see below) with high-growth shipments of devices in the consumer, enterprise, and industrial markets. Except that Ericsson puts automobiles (86 percent CAGR; four million to 46 million in 2028) into the consumer bucket, laptops (47 percent CAGR; six million to 28 million) into the enterprise bucket, and non-specific ‘5G IoT’ devices (CAGR 56 percent; 19 million to 153 million) into the industrial one.

Not sure about you, but those all sound like enterprise devices.

An aside, and an admission of sorts: this feels (to this writer) a little alarming; five years’ covering the private 5G space, about how the cellular industry is looking outwards at last, and the operator community is still looking inwards, scratching its head and picking fluff from its belly-button. It’s harsh, but it sounds, based on discussion of the 5G SA feature set in national telcos, like they must get more serious about enterprises, and fast.

Douglas at Spirent says: “Yes, and even the focus on FWA blurs into the enterprise space – in multi-occupancy buildings (apartment blocks) and as network-backup in offices. Really, the only [straight] consumer-focus is to bring basic AR to traditional spectacles – like you and I wear.” We are back here, then – at the biggest consumer 5G opportunity outside of FWA.

Ekudden references the success of Ray Ban’s line of (Meta-branded) smart glasses. “They are not yet 5G connected, but Ray Ban [sold] a million such glasses last year.” This is the “mass market [event]” referenced earlier.

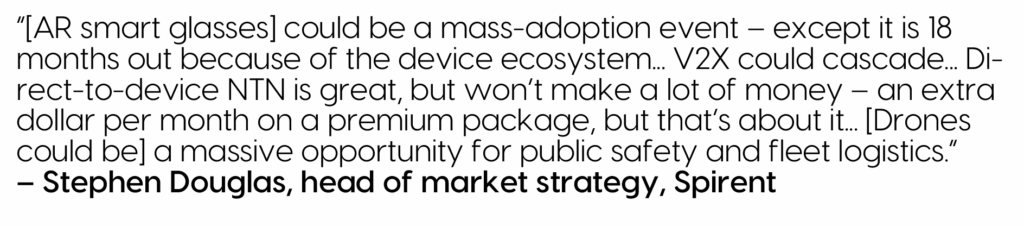

Douglas explains: “It would allow some video and email, some audio; it will be quite optimal, but not very immersive. It will be tethered to a device. That is one of the bigger consumer apps; there are over two billion glasses-wearers worldwide. It could be a mass-adoption event – except it is 18-to-24 months out because it depends on the device ecosystem.” AR glasses (spectacles) made a serious appearance on stands at MWC in March.

But is this really it, the whole consumer 5G opportunity – a wireless router and a pair of specs?

Because, as discussed, the rest is mostly enterprise-geared, requiring deep insight and hard yards, tied to the cultural and economic vagaries of all the world’s different businesses and industries. The exception, perhaps, is V2X, but even that is essentially IoT-on-steroids, and a business-to-business case. Even so, it stands out: regulators are moving to compel automakers to support 5G-V2X to get NCAP five-star safety ratings on vehicles in certain markets (“China in 2026, India in 2027,” says Douglas). “Car makers are global, mostly – so if it goes in there, it goes in everywhere. A lot of regulators are talking about early dispensation in markets where there isn’t necessarily nationwide 5G coverage yet – as long as 5G is supported along motorway corridors,” he explains.

The point is V2X could “start to cascade” – in time. So too could interest in the “low-altitude drone economy” – which looks a surer bet, in revenue terms, than hyped direct-to-device satellite comms. Douglas says of the latter: “It is great, and it is going to happen, but it probably won’t make a lot of money; maybe an extra dollar a month on a premium package, but that’s about it.” By contrast, if the regulatory challenge with beyond visual line-of-sight (BVLOS) tracking of low-altitude drone flights, often out of reach of satellite coverage, can be negated with new ground-level 5G RAN triangulation, then there could be a “massive opportunity for public safety, fleet logistics, and the military”.

Huawei has released ‘tilt antennas’ in China to track drones “100 percent without GNSS”, he says. Or with satellite backup, at least. “A lot of operators are quite interested; it could be quite lucrative,” he adds, acknowledging that Nokia’s work with Swisscom in Switzerland and Citymesh in Belgium to stand-up blue-light drone services on 5G have caught the imagination of the global carrier market. Meanwhile, SA-based network APIs, to be discussed on the main stages at MWC in Barcelona (again), appear like a clever concession without a clear application, nor sufficient interest from developers. Douglas comments: “We are a little sceptical. There’s a lot of interest to test the API framework but not current APIs, if that makes sense. So very basic APIs that are released today, like for SIM swaps, are not being tested. And that is maybe because there’s not a lot of demand yet.”

This was replayed to a Vonage exec at the Ericsson showcase in London in early February, who snorted at the idea, and said SIM-swaps are well-established in major financial services, and some big national carriers. But Douglas says the only demand from operators to test network APIs is to expose more advanced SA features like voice, traffic steering, and enhanced positioning. “And again, that’s all for enterprises, and not for consumers – and again, it’s a couple of years out,” he says, before returning to the (private) shock-and-horror that consumer 5G is a dead rubber. “So yes, the rest of it is really about enterprises, and there is no killer app. All the operators are looking to stack lots of different services to create incremental revenue from 5G.”

Englert-Yang says the same, but also seeks to explain the logic and jeopardy for carriers. “5G APIs are still in early development – with lots of uncertainties and little short-term revenue expectation. There are historic challenges with network APIs to gain traction with developers, which operators and vendors are reliant on. It remains to be seen whether current attempts will succeed.” He references Ericsson’s joint venture on 5G APIs (Aduna) with a bunch of global operators, and Nokia’s acquisition of US startup firm Rapid’s API developer hub to go with its network as-a-code platform. “We are watching to see which strategy pays off. There are high revenue expectations for network APIs four-to-five years from now, which is why vendors are making these investments.”

Even so, nearer-term revenue opportunities with 5G SA and 5G Advanced are fuzzy – and frankly underwhelming. As if the light at the end of the tunnel might be the light of an oncoming train. “The transition to 5G SA awaits clearer monetization strategies,” reflects Englert-Yang. Regionally, carriers in Asia Pacific and North America are leading the way – for rollouts, if not for revenues. “China is the most mature market. Top operators in North America have local implementations, but are not at commercial scale. Turkey, Germany, and Spain are [also] advancing 5G SA capabilities.” But key issues are unresolved, he says: 4G migration strategies, RAN “investment strains”, SA feature development (“slicing and APIs”), and cloud automation of both the infrastructure- and application-layers.

Lots to consider, then – as the whistle blows for the second half. But are we missing the point? If the new SA-version of 5G, just off the training pitch, is full-strength 5G, and 5G-Advanced, just out of the academy, is max-strength 5G, is it even half time yet? Because, for commercial 5G-proper networks, the match has only just started. More than this, the whole point with 5G – which makes it more transformative than previous generational 3GPP upgrades, even without a clear revenue endgame – is that it creates a platform-based business model and technology stack, on top of which operators can riff anyway they want. They just have to get there first – which is the whole digital-change game, and justification of the NSA discipline over the last five years to an extent.