Operators are moving through the gears with 5G SA and 5G-Advanced, balancing cap-ex constraints, operational complexity, and uncertain returns. While slicing, RedCap, and private 5G show promise, most are prioritizing efficiency and targeted enterprise services over big spending – reflecting the industry’s search for realistic, sustainable monetization beyond consumer markets. (Note, this is an excerpt from a new 5G Market Pulse report, available to download for free here; the original introduction and previous entries have been published online here and here and here.)

In sum – what to know:

Cautious transition – operators are shifting gradually to 5G SA and 5G Advanced within tight budgets, avoiding another big capex wave.

Complex choices – carriers face tangled decisions around SA, cloud, spectrum, and APIs, slowing market progress.

Enterprise gambles – future revenue hinges on enterprise services like slicing, RedCap IoT, private networks, and NTN.

The point (see previous entry etc) is that spending will not suddenly spiral upwards; operators are not about to gamble the house on niche services on vague promises of incremental returns. “It is unlikely 5G-Advanced will fuel another major cap-ex cycle. Instead, operators will gradually transition their spending from 5G (SA) to 5G-Advanced within confined cap-ex budgets.” Pongratz cites the example of China Mobile, which plans to reduce its capital expenditure (cap-ex) on 5G by 22 percent in 2024/25 while also launching 5G-Advanced in 300-odd cities this year. Again; this is because there is no such thing as a sure-thing amid the scattered gambles on 3GPP feature sets in releases 16-through-20. Back to Douglas at Spirent, who picks up both points – about the empty NSA hype, and the conservatism in the SA casino.

He explains: “Firstly, if I’m blunt, the industry should never have gone with [the 5G marketing around] NSA. It was a big mistake. Because it created this sort of halfway house that is now accepted by the market – where consumers think they’re getting 5G, when they’re only getting a bit of enhanced radio. There aren’t any services around it, really (apart from FWA, maybe RedCap, maybe private 5G). The second thing is the new SA system is complicated. It’s a whole cloud-native service-based architecture. So it’s not just about adopting new technology and skills; it is about the whole operational environment and lifecycle of it – and how to manage a cloud stack with multiple vendors doing multiple software releases with multiple cadences, rather than just every few quarters. It is a massive change.”

Spirent knows; the company is working with over 100 carriers in international markets, testing SA rollouts with 30 of them, at least. He adds: “Even if it is not as big a cap-ex investment as the radio (with NSA upgrades), there is an operational cost down the line that cuts across many departments. Which has slowed down some investments. Plus, moving to full SA has a major impact on spectrum, as well, because you’re not sharing your 4G network anymore. So your 5G network has to be good enough – or else you could degrade performance by migrating to a pure-5G network without 4G aggregation… So there are a lot of moving parts to these SA upgrades. But all of the operators are engaged in the process. They all want to do it. They’ve all got the business cases behind it.”

Bolan at Dell’Oro Group is bolder, and goes further to explain the carrier conundrum to shift from NSA to SA, and beyond. Give them a break, he seems to say – or, at least, understand the minutiae of the sector’s own digital change, which has seen its top-feeders hobbled by choice and indecision. “They have struggled with many choices,” he says, writing them out for us: NSA versus SA, telco cloud versus public cloud, 5G core versus 4G/5G core, 4G voice (VoLTE) or 5G voice (VoNR); and then, when they have put it all on black (“an SA core on a telco cloud”), they have faced choices between virtual and bare metal servers, and how to containerise cloud-native functions. Even the “hype phase” around private 5G has forced them to offer hybrid and/or edge versions.

“A digestion period set in,” he reflects – “as the industry spent millions on enterprise trials… while enterprises decided whether or not to move forward.” It will happen again, he says, as the market deals with new release 18-plus network features and programming interfaces (APIs) – and how / why / when to launch reduced-capability (RedCap) services for mid-range cellular IoT cases, non-terrestrial network (NTN) services for back-woods and high-seas dead-zones, and whatever juiced-up artificial intelligence and machine learning (AI and ML) applications go on top of mobile networks after 2028. “These are now seen as the latest efforts for operators to figure out how to monetize their investments in 5G,” says Bolan.

But choices lead to questions, he says. When will the mass (enterprise) market bite on private 5G? Will network APIs even scale in the market – to make 5G-bound apps a “catalogue item versus a custom item”? Will NTN services be viable – and shift top-line earnings, anyway? He comments: “The jury is out on the timing [of all these technologies]… The industry will go through another digestion period that could take several years – maybe four or five – before we see more market growth.” Against such a complex backdrop, of technical upgrades and organisational shifts, and such a dynamic industrial climate, about how to orchestrate digital change against the cadence of a dozen other ‘vertical’ markets grappling with the same (see last chapter, pages 20), operators are left with a bunch of scattered gambles.

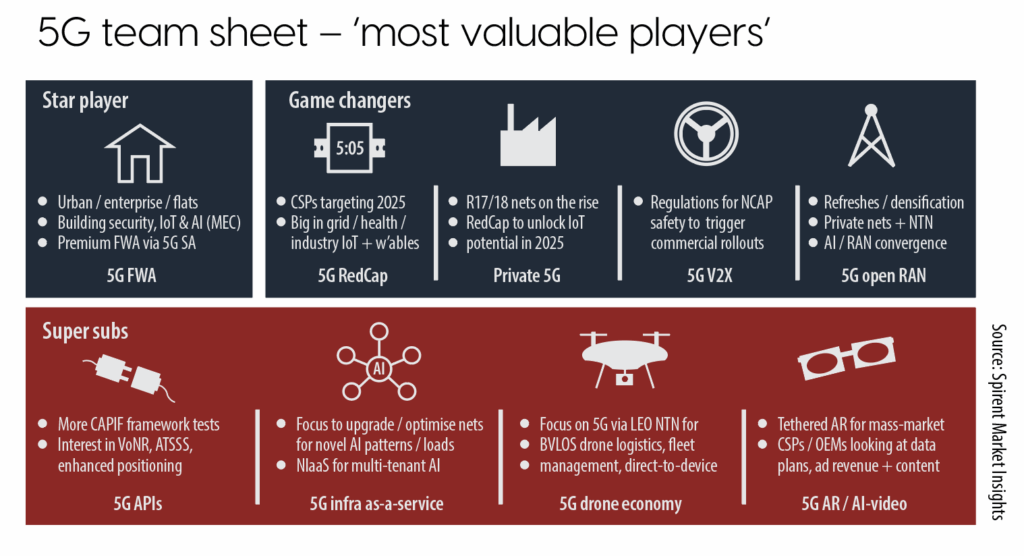

So what of these gambles? Which SA features will precipitate new revenues? Which should be relied on, separately or collectively, to shift the needle? Well, guess what; Spirent has a slide (see below), and Douglas has an answer. He puts these accumulator bets into some kind of order, ranking the ‘most valuable players’ (as per the original football analogy): FWA is the ‘star player’, as discussed, and 5G RedCap, private/hybrid 5G and slicing, and 5G vehicle-to-everything (5G-V2X) are ‘game changers’, with the kind of baller promise to get a result, maybe. Besides, there is a bench of ‘super subs’: APIs to monetise intrinsic 3GPP features, infrastructure as-a-service (NIaaS) for multi-tenant AI, drone fleets and direct-to-device satellite/NTN services, and… AR spectacles, tethered to handsets.

As an inward looking infrastructure concern, open RAN is a ‘future game changer’ too, “late to the game” when 5G deals were signed in 2019/20, but with potential to take share in brownfield refreshes and small-cell densification projects through the second half of the 2020s, plus with private 5G deployments for enterprises and satellite NTN rollouts. Douglas comments: “RedCap is a real priority in a lot of markets. There’s a lot of testing, not just on the device side but on the network side – including with slices [and SLAs] and so on. But the push is about optimising networks and spectrum, too. RedCap is not some holy grail for new revenue. It is more about consolidating all that legacy cellular IoT stuff. It is more efficient with spectrum, and will free-up high-value bandwidth for other services.”

Beyond, the talk in testing is about 5G SA and 5G Advanced for public/private network roaming, mission-critical networks for first responders (in the US, notably) and railways (in Europe, as GSMR goes end-of-life in 2030), and network APIs and slices “so verticals… can use their enterprises credentials as part of authorisation mechanisms to integrate more cleanly into their security zones”. Operators are “very targeted” to drive new revenue growth, reckons Douglas. But which hold most promise?!!! After inevitable hype, followed by some years of anti-hype (by self-proclaimed “slice deniers”; Dean Bubley, take a bow), slicing should be taken seriously, it seems. “There are auspicious signs,” says Englert-Yang at ABI Research.

He points to successful trials and deployments with governments and enterprises – in China (consumer/enterprise) and India (consumer), notably. “From these, we see that slicing is a flexible technology that can be combined with IoT, QoS (quality-of-service), FWA, and more for a highly targeted monetization approach that suits each national market.” The FCC has taken a “clearer position” on net-neutrality, he suggests as a point-of-note – “which supports telco investments”. He goes on: “There is lots of potential. Slicing capabilities are still evolving from static, predefined slices to semi-dynamic slicing with real-time control. This and other advancements like improved mobility will come with 5G Advanced and should support slicing monetization long term.”

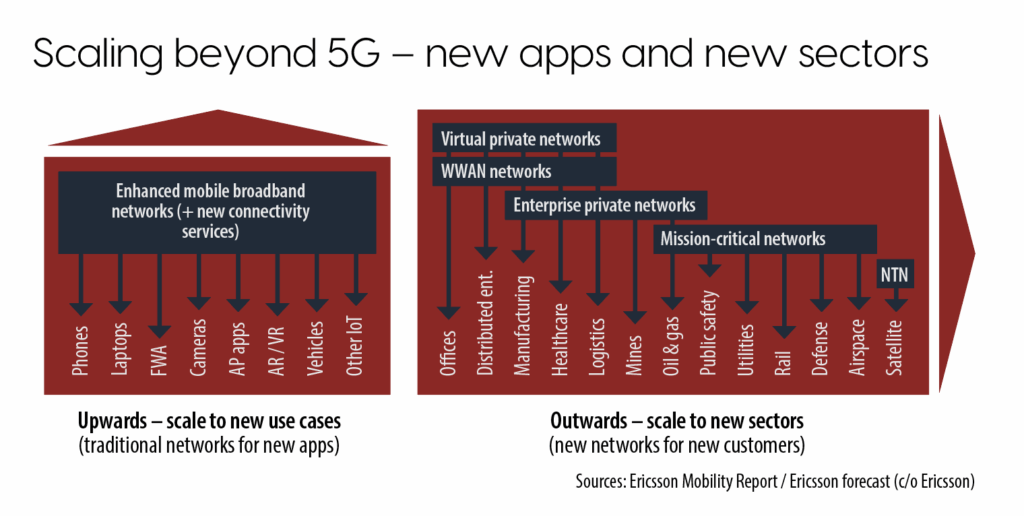

But all of those things – apart from FWA, and wearables (and even ‘healthcare’ wearables fall both sides of the line) – are enterprise services, surely? In London, Ekudden suggests “this 5G story” has “two vectors” going forward, and presents a slide with them written as new ‘use cases’ and new ‘sectors’ (see above). The first starts with FWA, he says, but soon gets into “AR leveraging 5G” (a reference to AI glasses, which we will return to) as a “mass market [event], maybe in 2027. Besides, he flags rising interest in 5G-connected cameras, vehicles, and ‘other IoT’. The second “vector” is about 5G’s new role in manufacturing, healthcare, logistics, mining, oil and gas, public safety, utilities, rail, defence, airspace… and, weirdly, satellites, tacked on the end like a ‘vertical’ market.

The satellite/NTN ‘sector’ is a “complimentary technology in the stack [which] allows this limitless reach”, he explains. But the message from Ericsson, about “how to grow the global mobile market beyond eight billion subs”, is that most of the vague opportunities that 5G might enable are with enterprises, and not consumers. “Enterprises are adopting 5G… for performance reasons [or to support] a mobile workforce,” says Ekudden, going on to discuss how 5G is morphing with wireless WAN and private/hybrid network setups, before putting forecast numbers against the clearest vector-two opportunities, as the Swedish firm sees it.