Nokia’s latest strategic reboot – splitting its business in two and sidelining private networks – looks like a bold bet on an AI-fuelled future. But in shedding the unit where it is market leader, the company risks abandoning an innovative long-term growth engine while the broader telecoms market continues to flatline.

In sum – what to know:

AI-first pivot – Nokia restructures around ‘network infrastructure’ and ‘mobile infrastructure’ to align with the “AI supercycle”, bolstered by Nvidia’s $1bn investment.

Retrenchment – Analysts say the move retreats to Nokia’s traditional comfort zone, sidelining private networks – a segment it dominates with strong long-term upside.

Implications – Nokia’s exit signals a broader telco failure to scale enterprise cellular; analysts warn it’s a “last wake-up call” as private 5G continues growth in spite of overhype.

In case there was any doubt, Nokia has jumped on the AI gravy train (which is really a mystery train, and quite possibly an LLM loco-motive to cloud la-la land), and also unhitched some of its difficult old rail cars in the process. It seems at once entirely logical, and completely mad – and follows on the heels of Nvidia’s $1 billion investment in the firm, which appears (on paper) like a vehicle to combine its twin AI strategies around fibre infrastructure (for hyperscalers et al) and wireless infrastructure (for telcos). So what have we got? At its Capital Markets Day in New York (November 19), Nokia said it will split its business into two operating segments to align with the “AI supercycle”.

At the same time, it has put its private networks business, within its existing ‘enterprise campus edge’ division, on the chopping block, alongside a bunch of other non-priority items. It said it will make a decision on their futures in 2026 – presumably to give it time to find buyers for all of them. And really, Nokia’s broader strategy, to split the business into two main units, looks like a move to carve it all up, and sell it a piece at a time. There have been rumours for some time, of course – related to both the main business, and the private networks piece.

Nokia said its two new priority units, active from January 2026, will deliver ‘network infrastructure’ and ‘mobile infrastructure’, respectively. The first will comprise optical, internet protocol (IP), and fixed networks, and is presented as its “growth segment”; the second will combine its cellular core and radio network portfolios (plus ‘technology standards’, formerly Nokia Technologies), and drive its 6G ramp-up – presumably as a post-2030 ‘growth segment’, while it gambles on AI infrastructure in between times as telcos see out the last days of an underwhelming public-5G investment cycle. Seems fine, right? About in line with every other corporate strategy shift in recent times?

What is mad – bonkers, even – is what it is dumping over the side: including its ‘enterprise campus edge’ solutions (its private 5G unit; part of its soon-to-be-defunct ‘cloud and network services’ division); its fixed-wireless access hardware (part of its existing ‘network infrastructure’ unit); and its microwave radio solutions (currently part of ‘mobile networks’). Clearly, RCR (or maybe just me) has a line here, having written about telco adventures in the Industry 4.0 game for a decade at least. And RCR is following the same path editorially, of course; but there is grief and grievance at the bigger trend, and a whole bunch of head-shaking at Nokia’s move at the same time. And it is not just us.

Pablo Tomasi, principal analyst at Omdia, told RCR Wireless: “I was expecting a reduction of interest/investment in the industrial campus area, but this is very extreme. It is accelerating to ride the AI train. I assume it has decided it has no patience for a long-term transformative market such as private networks. The challenge it faced in mobile networks probably did not help as this indirectly put pressure on its previous strategic bets – such as campus – to showcase short-term gains. To me, its new strategy is a retrenchment into its safe space of fixed and mobile connectivity. For the private networks market, it is a tough blow because Nokia has been instrumental in driving it.”

Leo Gergs, principal analyst at ABI Research, reflected: “It is a consequence of wrong actions from the wider industry. It is frustrating to see. Nokia’s pivot to AI infrastructure, sidelining the enterprise edge, is symptomatic of a bigger telco failure: that this industry has fought turf wars – one technology versus another – instead of creating a unified connectivity layer that enterprises could trust… [And] ironically, AI was never part of the story, which backfired. Instead of using AI to make private networks simple and scalable, telcos waited for AI applications to magically appear. That was the mistake. This is not the end of enterprise cellular, but it is the last wake-up call.”

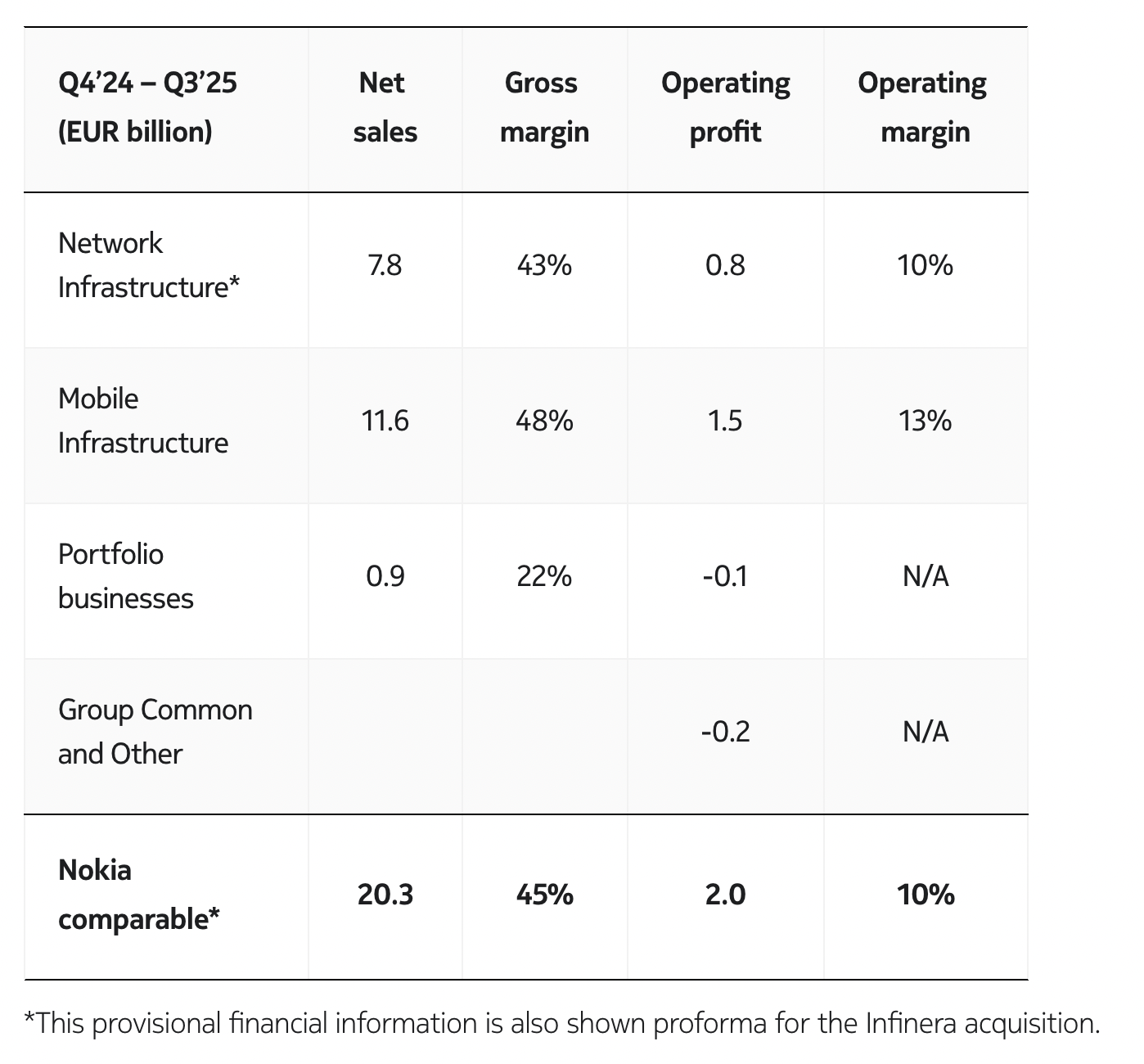

Its new non-essentials will be repurposed as ‘portfolio businesses’, pending a final decision on their “future direction” in 2026; and so they are in limbo. Nokia showed a slide at Capital Markets Day that re-calculated its 12-month 2024/25 run-rate if the new structure was already in place: the new divisions have delivered $7.8 billion (network infrastructure) and $11.6 billion (mobile infrastructure) in sales, respectively, on margins of 43% and 48% (and profit, somehow, of $0.8 billion and $1.5 billion). The rest have delivered a paltry $0.9 billion, at a loss of $0.1 billion. But wait; because the news suggests Nokia is also ready to quit a high-growth business, however niche, where it is king.

So the niche ‘value’ is higher, arguably. In private networks, Nokia is the undisputed heavyweight champ, right now – a double-digit upside since the start, in a market that will grow for 20-30 years, and which also blurs with a bunch of parallel AI-adjacent value-generation opportunities (including hardware and software; useful edge placements for Nvidia GPUs). Whereas the big telecoms market (public networks) is totally flat – or pretty flat, anyway (1% growth, according to slides in New York). In private networks, Nokia has made the running, along with a few others – for the whole market. It has the lion’s share (upwards of 50 percent, reckon some analysts), and real authority.

It has got to be mad to knock that on the head – if that is its plan. Surely? Its broader enterprise business, cutting across various of its priority and non-priority portfolio segments, is considerable, too, and complementary to its private 5G shtick – and hardly got a mention in New York, versus its big cloud and telecoms focus. Someone reflected: “Nokia is the only telco that has managed to diversify over the last five years – after the telco market started to decline. It has a strong enterprise business, overall, which cuts across most of its existing segments, and a really strong-growth enterprise unit (in campus-edge / private-network sales) as well.”

They added: “It seems to be burying its best success stories.”

There is more from Tomasi at Omdia and Gergs at ABI Research, as well – who have both watched this market at close quarters. Tomasi added: “The market for fully-dedicated private networks will continue to exist but return to a much more niche state. Other ecosystem players will try to expand on the back of this with hybrid and other public network based solutions, though I believe these solutions should in most cases not be used to target the dedicated campus needs.”

Gergs said: “The proposition on its own was never strong enough to fight two realities: the abundance of alternatives and the fact that connectivity itself was never the priority. Enterprises only cared about what it enabled: automation, safety, and now AI-driven insights… The industry must converge fragmented technologies into one intelligent connectivity layer and leverage AI to make deployment effortless. Only then can enterprises define and scale AI use cases that unlock real value. The arrogance and fragmentation of the past created chaos; the future demands openness, simplicity, and collaboration. If telcos don’t act now, they will lose the enterprise opportunity forever.”

As well, Ibraheem Kasujee at Analysys Mason, commented: “Nokia is betting heavily on AI and scalable network opportunities and doesn’t see private networks fitting into either. Nokia has done well in private networks – excluding China, it is the clear market leader and its revenue has consistently grown in double digits year-on-year. But its revenue is small in absolute terms… It is a shame because Nokia has really helped to drive the private networks market. Beyond its high market share it has invested a lot in developing the wider ecosystem and trying to innovate by developing its own applications.”

He added: “There will be a lot of interest if Nokia does put the campus edge unit up for sale. Whoever takes over has a strong position to build on if they have the patience needed to address the private networks market.”

The timing kinda stinks, too. At press, yesterday, RCR Wireless was putting together a piece, salvaged from the introductory address at Industrial Wireless Forum, in defence of the whole private 5G market – in response to a comment that private 5G is “just a niche market”. Turns out, it might as well have been Nokia that said it – or part of Nokia, anyway, seeing as maybe (or apparently) its top brass don’t value, in broad terms, the bold awork of its rank-and-file. We will run the piece anyway because there are others in the space, including Ericsson (unless it is a fast-follower out the exit door, too), and because Nokia’s enterprise unit will soldier on, even under different stewardship.

But it is worth including some of the additional commentary about the state of the market, here. Joe Madden, founder and principal analyst at Mobile Experts, responded: “It is tempting to agree with this dismissive comment because private LTE/ 5G has been slow to grow. But the negative view that people have is a reaction to overhype in the 2019 timeframe – so many companies were promoting the idea that the 5G standard was going to release a huge latent market for private communications, and that didn’t happen… By 2040, we project that the private cellular market will grow to the range of $30 billion in equipment every year and hundreds of billions of dollars in annual service revenue. Getting there is not a straight road, but a collection of winding trails that will converge over time.”

Stefan Pongratz, vice president at Dell’Oro Group, said: “The opportunity for private 5G/6G is large – in the $20 billion range just for the RAN, and even larger when including services and other parts of the network. Opportunity is not the same as a forecast. Adoption varies significantly across the verticals, and it will take some time for private RAN to move the broader public RAN needle. So, it will be a niche technology in some verticals, while adoption will be high in others… It is clear that private wireless is on a very different trajectory than the broader public RAN market… The positive momentum driving the roughly 40 percent increase in 2024 extended into the first half of 25, with worldwide private wireless RAN revenues accelerating rapidly in the first half.”

There will be more from both Madden and Pongratz, plus others, in the niche-debate article itself.

In the meantime, here is a longer social media post from Ian Fogg at CCS Insight about the whole Nokia strategy. He writes: “The new strategy continues to articulate the importance of seizing the AI opportunity… For the mobile radio networks teams this will be a further re-confirmation of their importance after the Nvidia announcement about AI RAN. But the wording here implies it is a longer term move, into the 6G era to revitalise the area. The other strategic priorities are either marketing… or straightforward financial market messages.

“Fixed wireless access CPEs are no longer a focus – which mimics Nokia’s previous withdrawal from mobile handsets, and reflects lower synergies with networks. Neither are private mobile networks central to Nokia’s strategy – despite its leadership position in this market and clear opportunities in the public safety, defense, and wider public sector markets which Nokia does see as important.”

Fogg goes on: “Bringing radio networks and core software into one unit makes sense. Growing end-to-end automation – with AI among other tools – and the enhanced capabilities of 5G SA and [its] cloud cores means removing silos… and should enable better innovation. Cynics will rightly argue that this will also hide the weaker margin in the more hardware-centric radio access networks compared with core and IP licensing… It is notable that the AI and data centre-centric parts of Nokia remain in the same unit with fixed networks. I see more synergies between the fixed access network business with radio networks and core software, than I do with data centers.

“However, the new strategy appears to be tackling the weaker parts of Nokia’s business, which is likely why network infrastructure has seen few changes. The defense business is still important but has been placed into a separate unit that can draw on technology from across Nokia’s new operating segments. This separation reflects a different customer base and needs. It also means Nokia can choose precisely what metrics it considers wise to report publicly.”

Inside Nokia’s private 5G omnishambles – read more here.