Private 5G is often dismissed as a niche – slow, complex, and commercially uncertain – but this view misses the point. As analysts argue, its real value lies in transforming mission-critical industries, aligning with emerging AI-driven automation, and delivering genuine growth in a flat telecoms market.

In sum – what to know:

What value – there is an argument that private 5G underpins high-demand industrial use cases across manufacturing, logistics, energy, public safety, and more – where Wi-Fi and public 5G fall short.

What growth – growth depends on ecosystem maturity (devices, edge compute, integration, models), which remain uneven across verticals; but progress is accelerating, including rapid revenue growth in 2024/25.

What stakes – physical AI raises the stakes – in everything from AGVs and drones to on-device agents – and high-reliability private 5G offers a critical springboard, and a path to long-term multibillion-dollar scale.

Here is a replay of a recent conversation. So someone said to me that private 5G is “just a niche” market. And no, it wasn’t Justin Hotard, although it might as well have been; and Nokia’s restructure yesterday (November 19) – which has seen the Finnish vendor (appear to) place its prize private 5G unit on the chopping block – casts a new shadow on this article. But they said it like it was a bad thing – like it doesn’t make any money, or not enough money anyway. They might have added that it’s really complex, really difficult, and frankly too much like hard work. And the response was, ‘well, yes, it is a niche market; but every market is a niche market’. Right?

Because private 5G sits inside the bigger 5G market, which sits inside the broader cellular market, which sits inside wireless, which sits inside the entire comms industry. And at the same time, it’s also part of the IoT story, and part of enterprise networking – which in turn is part of the great big universe of enterprise tech. You get the point: everything is a niche. Industrial AI, generative AI, agentic AI – all niches. And private 5G, within its own niche, contains multitudes: edge, hybrid, and cloud models; network slices and neutral hosts; local-area and wide-area networks; campus-bound and cloud-connected systems; IT, OT, and IoT; off-the-shelf, fully bespoke.

And potentially – eventually, via versions of it – every enterprise in every vertical under the sun. (Someone else said there are 11 million more enterprise venues to connect.) Which is why it is complex and difficult. But that’s the point. Like IoT, like OT, and like every serious enterprise venture, it has to reflect the real work it’s deployed to do – and the realities of the industries doing that work. But more importantly, it’s fascinating and valuable – arguably the most interesting part of the telecoms landscape right now. Like we said in response to Nokia’s new scorch-the-earth policy, as it clears everything except its big mobile and fibre divisions, private 5G punches above its weight.

Private 5G isn’t just about telcos building a few networks to push a few billion handsets every five years. It’s about changing the real economy – the factories, ports, mines, and warehouses that make and move physical things; the schools, hospitals, and offices that create ideas, solutions, and businesses. It’s also the one part of the telecoms world that’s genuinely looking outwards – at how connectivity can transform industries, not just itself. It’s where 5G is being tested, pushed, and proved. In a way, it’s why 5G exists at all: to support the kind of high-end, mission-critical applications that enterprises demand.

Consumers don’t need critical IoT or industrial AI or performant TSN – but businesses do. And the most demanding ones need it to run on private networks. So no, it’s not just a niche. It’s a deep seam of innovation – with crossover impact across every layer of the economy. It’s also, for what it’s worth, the one part of the 5G market that’s actually growing. Dell’Oro calls the market “very large and mostly untapped”. SNS calls it “one of the few bright spots in a gloomy telco industry”. But yeah, it’s about enterprises – and so it is complicated and it is going to take time.

All of which is a rather emotional response to a familiar grumble about a difficult sector, which informed the intro address at Industrial Wireless Forum a couple of weeks back. And so, in light of the tone, and any accusations that it is somehow passionate or polemical or partisan – and also just because the Nokia mothership appears to have put a kaibosh on its own side-hustle – RCR Wireless phoned around, asking the same question: is private 5G just a niche market? And here are the reasoned responses from impartial market watchers with a proper grasp about what on earth is going on in private 5G right now. Note, this was asked before the Nokia bombshell.

Joe Madden, principal analyst, Mobile Experts

“It is tempting to agree with this dismissive comment because private LTE/5G has been slow to grow. But I believe that the negative view that people have is a reaction to overhype in the 2019 timeframe – so many companies were promoting the idea that the 5G standard was going to release a huge latent market for private communications, and that didn’t happen. The expectation was that private 5G was the only thing needed for the market to grow. The reality is that private 5G is one piece of the puzzle, and edge computing, devices, software integration, and business model maturity are all needed for this new business to grow.

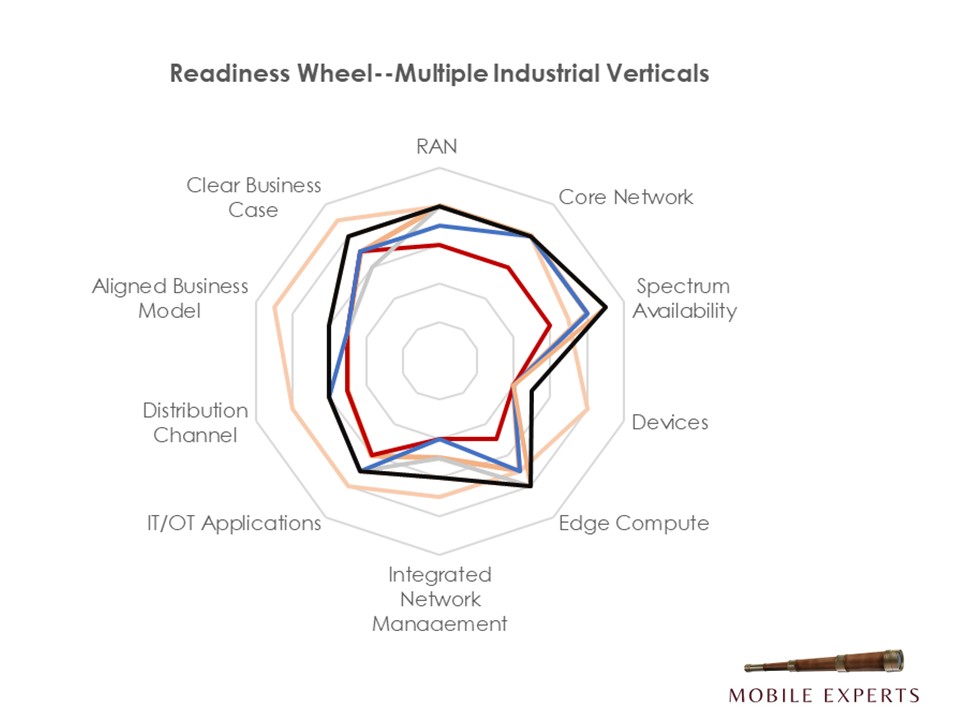

“We’ve created a diagram to illustrate this concept. In the diagram, all of the spokes of the ‘readiness wheel’ need to be in place for the market to roll. Today, many private 5G markets have a ‘flat tire’ because devices are not ready, or because software for IT/OT integration is not developed. Multiple solutions will compete in the market, ranging from local dedicated radios to network slicing. As with any complex market, one size does not fit all opportunities. Mobile Experts splits the market into 13 different vertical sectors, and we find that network slicing will be ideal for some (such as drones, public safety, transportation) but dedicated radios will be ideal for others (manufacturing, logistics, oil & gas).

“A few of these sectors have already become fairly mature, and the software/devices/business model are in place, allowing for significant growth. Other sectors are still waiting for maturity in devices or software and remain in the proof-of-concept stage today. Mobile Experts has just published a technical study on how AI/ML will drive requirements for Private 5G. AI models started with language models to assist with information search, which led to large centralized models. But the AI models are quickly moving into smartphones with small language models (SLMs) and into drones/cars/robots where AI inferences are done locally. There’s a massive movement in AI to support physical automation, not just information automation.

“Of course, physical devices have new constraints related to size, weight, and battery life. Increasingly, the AI models running on end devices like smartphones, robots, drones, cars, and other devices will need to access data from other sources, or access a data-lake that’s bigger than on-device storage can hold. This means that low-latency, high-reliability wireless communications will become indispensable over the next 10 years. It won’t be immediate, and it won’t happen in all sectors of the economy right away. But a few leading applications (like AI agents on phones, AGVs in warehouses, and drones) will drive a combination of AI and private 5G.

“By 2040, we project that the private cellular market will grow to the range of $30 billion in equipment every year and hundreds of billions of dollars in annual service revenue. Getting there is not a straight road, but a collection of winding trails that will converge over time.”

Pablo Tomasi, principal analyst, Omdia

“Overly-hyped expectations and a wrong assumption about the existence of a single global market has been hurting the development of private networks. While there are challenges, one way to appreciate the long-term value of this market is by looking at the wide set of critical and high-demanding verticals that are embracing this technology. These include mining, oil and gas, public safety, ports, and defense.

“The fact that some of the most demanding verticals are choosing private networks shows that this technology brings unique benefits well beyond what is delivered by other connectivity options. From there, a process is underway to learn lessons and tailor products to bring those benefits into similar opportunities.”

Stefan Pongratz, vice president, Dell’Oro Group

“We agree, partially. Our take is that the opportunity for private 5G/6G is large – in the $20 billion range just for the RAN, and even larger when including services and other parts of the network. Opportunity is not the same as a forecast. Adoption varies significantly across the verticals, and it will take some time for private RAN to move the broader public RAN needle. So, it will be a niche technology in some verticals, while adoption will be high in others. Reviewing the current state, it is clear that private wireless is on a very different trajectory than the broader public RAN market.

“Preliminary findings from our recently updated private wireless report suggest that the positive momentum driving the roughly 40 percent increase in 2024 extended into the first half of 25, with worldwide private wireless RAN revenues accelerating rapidly in the first half. Although private 5G adoption is still in its early stages and will take time to materially impact the overall RAN market, we estimate that private RAN accounted for a mid-single-digit share of total RAN revenues in the first half of 2025, up from a low single-digit share in 2022.

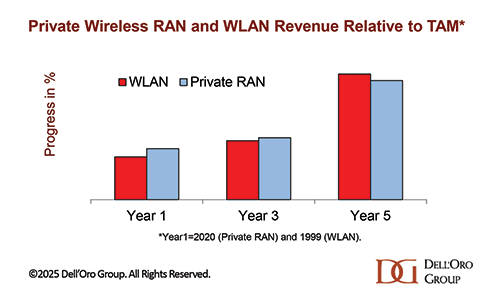

“Overall adoption is mostly in line with expectations when we include both local and wide-area networks. While it is true that this is partly because expectations, especially with the campus segment, have been muted in this initial 5G phase, it is encouraging that private wireless as a share of the TAM is tracking closely with the trajectory of enterprise Wi-Fi adoption in its first five years.

“At the same time, the industry has pivoted. Clearly, the success with WiFi in the carpeted enterprise is constraining the upside with private cellular as a Wi-Fi-plus alternative. But when it comes to wide-area mission-critical networks, public safety, power utilities, railways, mines, ports, or 5G adoption in large industrial Chinese enterprises, private cellular is already moving above the noise. In other words, the upside is limited in areas where Wi-Fi performs well. However, the opportunity for private cellular networks remains significant in environments where Wi-Fi cannot meet performance requirements. This segment is already driving market growth, and the outlook remains healthy.”