T-Mobile US COO and incoming CEO Srini Gopalan said the carrier had its ‘best Q3 in over a decade’

In sum – what to know:

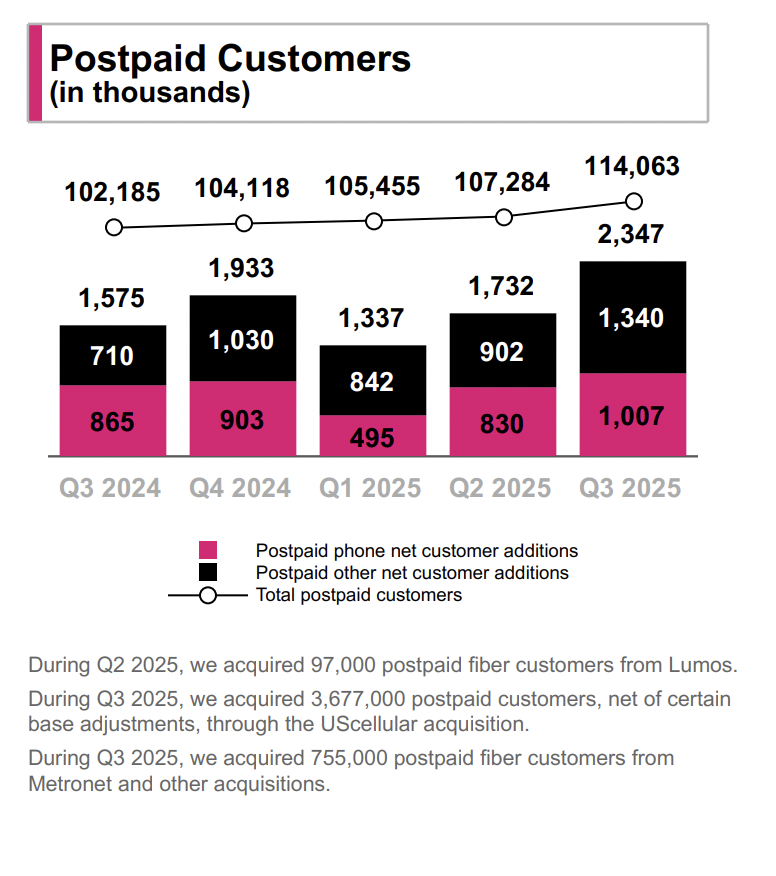

Subscriber growth surges: T-Mobile added a record 2.35 million postpaid customers in Q3 2025 — including 1 million postpaid phone lines — cementing its lead in U.S. wireless growth.

Raised full-year outlook: The company lifted its 2025 guidance for postpaid adds, EBITDA, and free cash flow, signaling confidence despite higher spending.

Capex concerns weigh on sentiment: Shares dipped as T-Mobile boosted capital expenditure guidance to $10 billion, reflecting heavy investment.

T-Mobile US reported strong results for the third quarter of 2025, announcing record customer additions and raising full-year guidance, while also signaling elevated capital expenditure that weighed on investors’ sentiment.

Subscriber momentum leads the charge

T-Mobile delivered exceptional net customer additions. Total postpaid net customer additions reached 2.3 million for the quarter, an increase of roughly 772,000 from a year ago. Within that, postpaid phone net additions came in at 1.0 million — the highest Q3 level in more than a decade and an industry-leading figure.

Putting these numbers into perspective, T-Mobile COO and incoming CEO US Srini Gopalan said on the investor call: “We had our all-time best postpaid customer account growth … we achieved our best-ever total postpaid net additions and delivered over a million postpaid net additions … What I like is how broad-based this growth is. It’s in the top 10 markets; it’s in smaller markets and rural areas.”

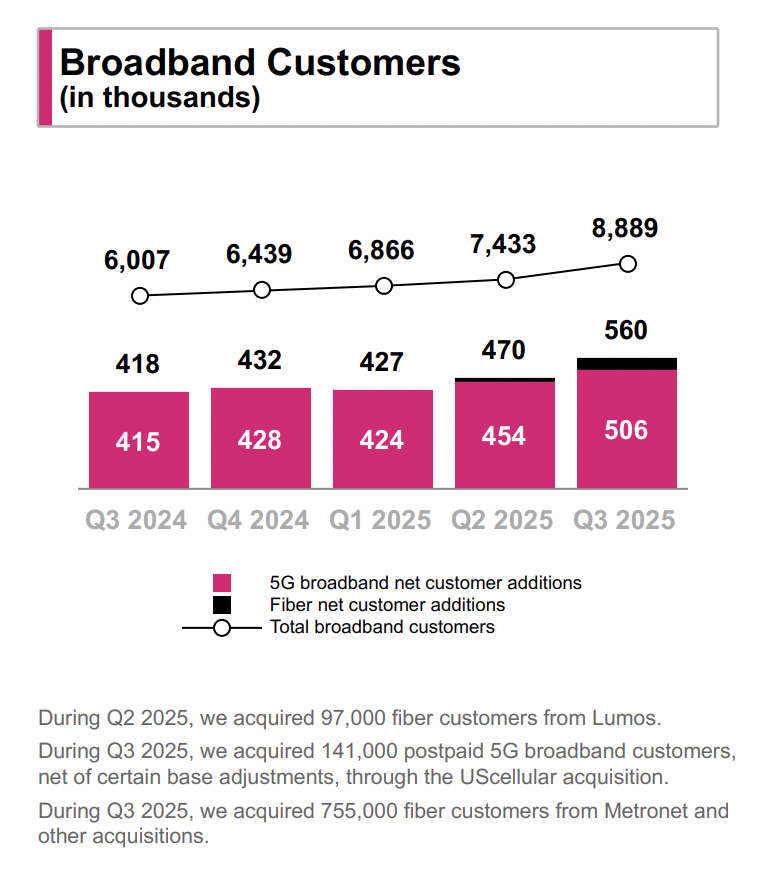

Beyond its core wireless business, T-Mobile also added 560,000 broadband customers (up 34 % year-over-year), including 506,000 5G broadband net adds, ending the quarter with about 7.955 million 5G broadband customers. Gopalan noted that these additions include contributions from the recently acquired Metronet.

Total net customer additions were 2.4 million and increased 791 thousand year-over-year and reaching a record high of 139.9 million.

Churn trends strengthen customer retention narrative

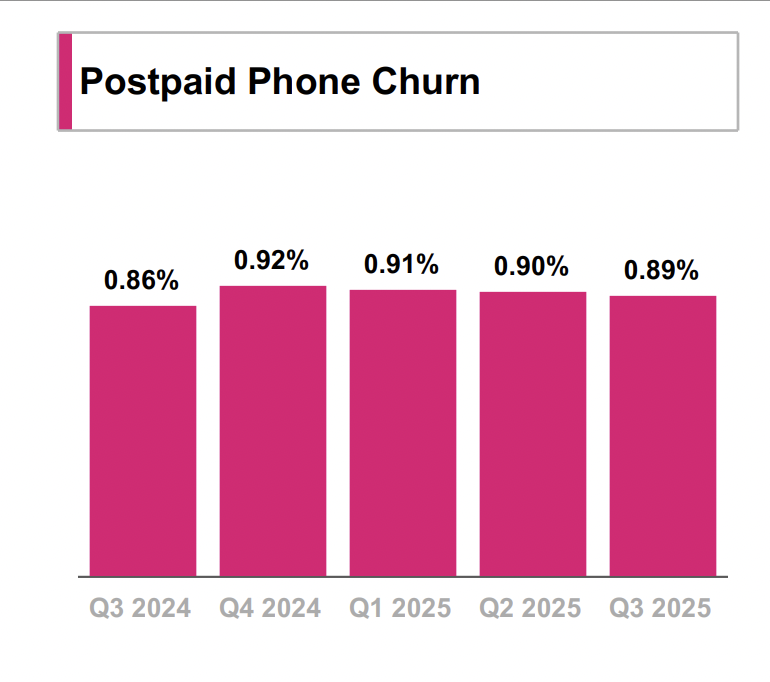

T-Mobile maintained its industry-leading churn performance in Q3 2025. Postpaid phone churn was 0.89%, nearly flat year-over-year (up just 3 basis points) — continuing to outperform peers. Prepaid churn improved slightly to 2.77%, down one basis point. These metrics highlight the operator’s continued customer loyalty gains as it expands its 5G and broadband footprint, reinforcing its claim as the “best in industry” for retention.

Revenue and profit: Growing service revenue, solid cash flow

Service revenues rose 9 % year-over-year to $18.2 billion, led by postpaid service revenue growth of 12 % to $14.9 billion. Total revenues reached $21.957 billion, an increase of 3.9 % from a year ago.

Net income for the quarter was $2.7 billion, or $2.41 diluted EPS, though that included an impairment expense of $208 million (about $0.18 per share) after tax. On the cash-flow side, T-Mobile reported operating cash flow of $7.457 billion (up 21 % year-over-year) and adjusted free cash flow of $4.818 billion. Core Adjusted EBITDA rose 6 % year-over-year to $8.7 billion.

Elevated capex and updated guidance

While many of the headline numbers impressed, T-Mobile also disclosed a significant increase in capital spending. Cash purchases of property and equipment (including capitalized interest) were $2.639 billion, up 35 % year-over-year. This reflects the company’s push to build more greenfield sites and assimilate incremental spend following its acquisition of UScellular.

Management raised its full-year 2025 guidance:

- Postpaid net customer additions are now expected to be between 7.2 million and 7.4 million (up from prior guidance of 6.1 million to 6.4 million).

- Core Adjusted EBITDA is guided to $33.7 billion-$33.9 billion (up from $33.3 billion-$33.7 billion).

- Net cash provided by operating activities is seen at $27.8 billion-$28.0 billion (versus $27.1 billion-$27.5 billion).

- Capital expenditures (cash purchases of property and equipment) are now expected to be approximately $10.0 billion — up $0.5 billion from prior guidance of $9.5 billion.

- Adjusted Free Cash Flow is expected at $17.8 billion-$18.0 billion.

Market reaction and investor considerations

Analyst commentary from Seeking Alpha’s Ahmed Farhath flagged a mixed reaction: While the subscriber growth and service revenue expansion were widely lauded, the sharp increase in capital expenditure and its potential strain on incremental return raised caution among investors. “T-Mobile US forecast strong subscriber metrics and also reported solid customer additions for the third quarter, but a half-billion-dollar surge in capex for the year, along with a revenue and profit miss, weighed on its shares after a brief premarket rally,” Farhath noted. The elevated spend implies the company is in heavy investment mode, which may compress margins or delay payback if growth slows or costs rise.

Bottom line

T-Mobile continues to emphasize its differentiated positioning: Its network is recognized as best-in-class (for example, by Opensignal for 5G coverage and reliability). Management says it has continued to “widen differentiation.” The strong additions of higher-value postpaid phone customers also help bolster average revenue per account (ARPA) and long-term monetization.

In Q3 2025, T-Mobile delivered standout customer and revenue growth, raised guidance, and demonstrated strong cash flow generation. However, the sharp rise in capital investment and the question of when and how that spend will translate into higher profitability remain areas to watch. With its raised guidance, the company shows confidence, but the market will be closely monitoring execution on the network build-out and whether the incremental investment yields the expected returns.