T-Mobile US wins most of Opensignal’s network experience awards in its most recent test analysis

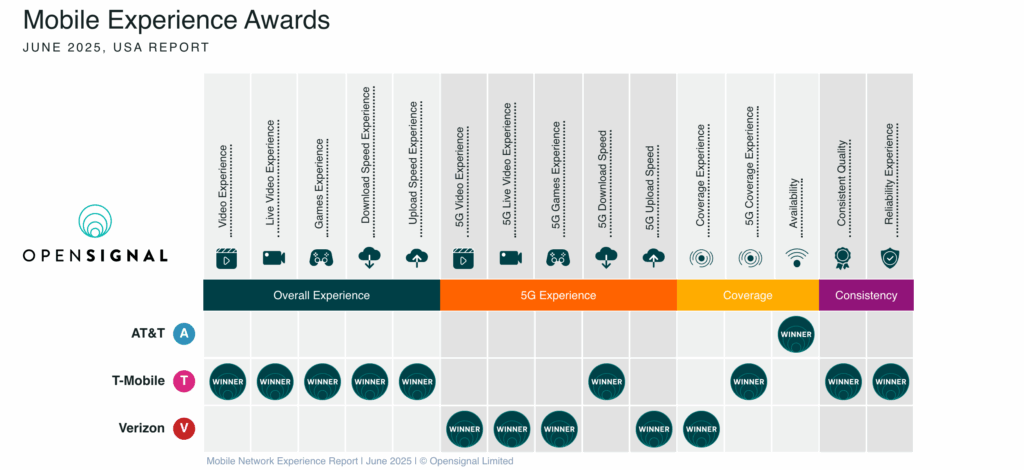

As T-Mobile US heralded its new Best Network award from Ookla, Opensignal’s new mobile network experience report for June further confirmed that the Magenta network is a dominant force—including in reliability. But Verizon and AT&T also had some notable positive results.

The Opensignal report analyzed mobile network performance over a three-month period from February to May 2025.

In the previous round of Opensignal’s analysis, T-Mobile US shared the reliability award with Verizon. T-Mo has now tipped into winning the award outright and repeated a win for consistent network quality as well.

In addition, T-Mobile US also racked up awards in 5G coverage, overall video experience, gaming experience and live video experience, plus overall and 5G-specific download speeds—where it blew away Verizon and AT&T by nearly 120 Mbps in overall download speeds and by more than 80 Mbps just in 5G download speeds.

However, Opensignal did note that while T-Mo’s lead over runner-up Verizon is all of 83 Mbps, the gap between them is decreasing rather than increasing. Since the previous report, T-Mobile US’ download speeds gained 14 Mbps, but Verizon gained 33 Mbps.

Verizon won several 5G-specific awards other than download speed, staking claims on 5G video and 5G live video experience, 5G gaming and 5G upload speeds.

AT&T, meanwhile, was the outright winner of just one of Opensignal’s awards: availability, which calculates the proportion of time that Opensignal users on the AT&T network had either a 3G, 4G or 5G connection. (Opensignal notes in its methodology that most availability metrics are collected indoors, because that is where users tend to run into issues with not being able to connect to the cellular network.)

Here’s a visual summary of the results from Opensignal:

UScellular has slower speeds but good video experience for users

In the markets where service from UScellular was available, Opensignal also looked at the relative performance of that operator—which is in the process of being acquired by T-Mobile US. So, if the merger gets approval, how does the UScellular network measure up to the greater T-Mo network?

In Opensignal’s analysis, UScellular tended to lag well behind the other operators in download speeds, but came closer on upload speeds. It distinguished itself particularly well in overall video experience in a number of states: Iowa, Maine and Wisconsin. And when it comes to 5G coverage, the UScellular network might help fill some gaps for T-Mobile: When Ookla looked at 5G coverage and availability metrics, UScellular was a standout in Iowa, Maine, Maryland, New Hampshire, Pennsylvania, Virginia and West Virginia. (Note: At the state level, T-Mobile US tended to dominate in the 5G coverage category, Verizon in overall coverage and AT&T in 5G availability.)

UScellular also clocked competitive 5G results in California, running neck-and-neck with T-Mobile US’ network in 5G video experience and 5G live video experience. It’s 5G download speeds fell significantly behind the three national carriers in California, though, clocking in at 111.3 Mbps compared to AT&T at 162 Mbps, Verizon at 177 Mbps and T-Mobile US at a blazing 253.7 Mbps.

At an event earlier this week, T-Mobile US executives credited its spectrum position, 5G Standalone roll-out and its tower count as the reasons for its network improvements that have been years in the making, most recently confirmed with Ookla’s Best Network award.

If the merger is approved, UScellular will shift its focus to being an infrastructure provider rather than a mobile network operator. T-Mobile US plans to purchase about 30% of UScellular’s spectrum outright and enter into a long-term lease for at least 2,000 UScellular-owned towers, in addition to the 600 sites on which it is already a tenant. Additionally, for up to one year after the transaction closes, T-Mo will lease additional spectrum that is already in use in UScellular’s network, to help smooth the transition for customers. UScellular has said that it plans to “opportunistically monetize its remaining spectrum assets.”

T-mobile US COO Srini Gopalan said this week that due to the network density that T-Mobile US has, plus its spectrum holdings and its network technology choices, T-Mobile US has a network lead of “a good two years” on Verizon and AT&T. “That lead is only going to expand. This is only going to get better,” he added.

While T-Mobile US has emphasized its “layer cake” spectrum approach for years, Gopalan pointed out that within the different spectrum types, T-Mobile US has put together a particularly advantageous spectrum position—not only in the volume of spectrum that it has, but in the relative position of its holdings compared to other operators. In the low-band airwaves, for example, T-Mobile US has 600 MHz compared to other carriers’ 700 MHz and 850 MHz. In the midband, it bought Sprint’s wealth of 2.5 GHz, while AT&T and Verizon are relying on the C-Band spectrum at 3.7 GHz.

T-Mo also spotlighted its T-Satellite Non-Terrestrial Network (NTN) service in partnership with LEO provider Starlink, which has been in beta mode since early this year but will officially switch to a commercial service as of July 23. Read more details on the lessons learned from the beta service here.