CSPs must evolve with multi-capability networks, advanced antennas, and orchestration to meet agentic AI demands, rising data usage, new device types, and low-latency, high-throughput experiences while optimizing energy and coverage efficiency.

Migration from 4G to 5G has not been as dramatic as the migration from 3G to 4G, but end users and businesses are benefiting from 5G’s ample data buckets (often 300-800 GB) at generous pricing. This is evident in reported monthly data transfer stats from communications service providers (CSPs). In Australia, their data throughput jumped from 13.6 GB to 18.8 GB. Similarly, in Malaysia, their data throughput jumped from 22.4 GB to 24.3 GB. This trend is reported in multiple markets.

What is driving this? Certainly, consumers have increased the download and playback resolution of streaming videos from 720p to 1080p. But it is also because of the rise in AI usage. AI-based Large Language Models (LLMs) are shifting from traditional chatbots to agentic agents (capable of performing multi-step tasks). Agentic AI is a significant development. An AI agent is a software program that can interact with its physical or digital environment, collect data, and autonomously pursue human-set goals and complete tasks for users or other systems.

While some portable devices such as the Surface Pro 12 feature neural processing units (NPUs) capable of processing 45 tera (trillions of) operations per second (TOPS) – enough to handle AI-related workloads such as real-time language translation, intelligent note-taking, automated research summarization, AI-powered background blur and noise suppression. But more complex compute tasks – such as photorealistic image and video manipulation – will require processing in a data center. Which requires a good network uplink channel.

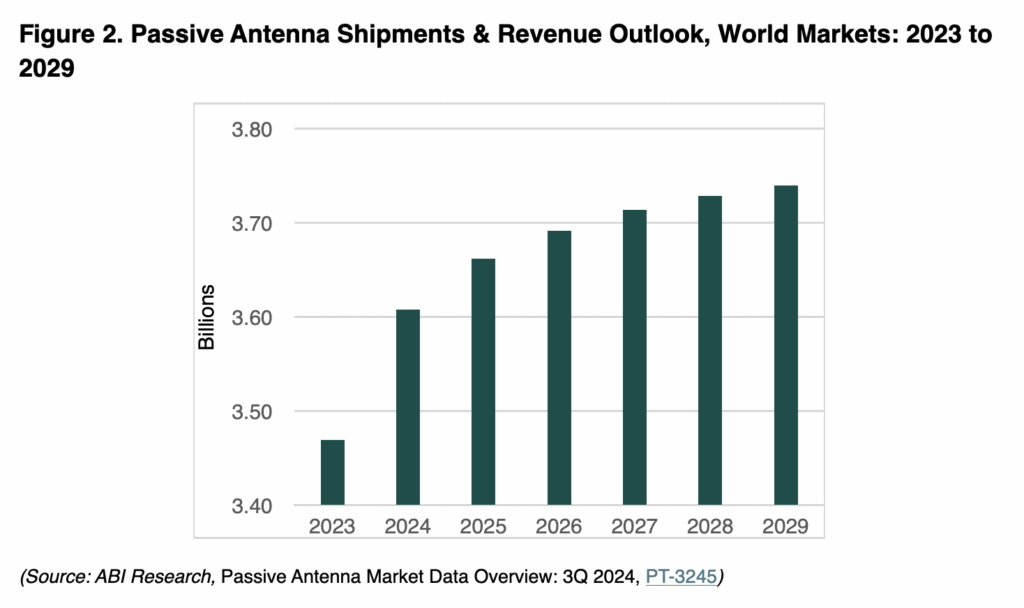

The momentum in AI development and initiatives is being witnessed in reported financial investments. ABI Research sees strong growth across both traditional AI – AI sensing, predictive AI, natural language processing (NLP) – and generative AI (gen AI), reaching US$467 billion in 2030, up from US$122 billion in 2024 (see Figure 1).

AI will have a number of impacts on CSP networks:

New connection types – these include AI glasses, AI-enabled vehicles, and AI-enabled robots.

Longer connection times – expected to grow 120%, up from 6.4 hours to 8.1 hours per person.

More compute tokens – likely to be up by between 150% and 500% by 2030.

Download / upload ratios – expected to shift from 15:1 in 2020 to 7:3 by 2030.

Managing trends

5G Advanced supports throughputs up to 10 Gbps on the downlink and 1 Gbps on the uplink, as well as reducing latencies further (to 4 milliseconds) and improving reliability (to 99.999%). But CSPs do need to focus on a key part of their network: the cellular antenna, sitting on top of each base station. Equipment vendors have come under pressure to handle an ever-greater range of cellular connectivity scenarios.

Some of the latest antenna design innovations in base station antenna design can be found in ‘extremely large antennas arrays’ (ELAAs). The number of antenna elements (AEs) in ELAAs has ramped up from 192 to 384. The innovation envelope is being pushed further by vendors such as Huawei, which has announced a ‘high-frequency active antenna unit’ (HAAU) with 1,024 to 2,048 AEs per antenna unit. ELAAs are valuable because the network can adjust the phase of each antenna’s signal, allowing for the superposition of radio frequency (RF) transmission at the end user’s location, resulting in a substantial data throughput boost.

ELAA antenna technology can be further complemented by orchestration technology. Coordinating thousands of antennas, potentially, across cell towers becomes substantially harder. This is where ‘holographic beam forming’ (HBF) steps up – effectively enabling a cluster of antennas to work like a hologram. Instead of updating cellular connection info on a sequential basis, all the antennas can share updates simultaneously. This parallel activity helps networks handle massive data flows more efficiently. This spread of ELAA AEs – which can operate in high, medium, and low spectrum bands – can help balance out traffic loads and coverage across a range of urban environments.

The network effectively becomes a ‘cell-free’ single network, rather than a multitude of cells.

Maximizing coverage

In addition to handling large clusters of data-hungry end users armed with smartphones, CSPs will need to handle novel user equipment (UE) such as unmanned aerial vehicles (UAVs) and smart-city IoT deployments. Cities don’t just expand horizontally; they also expand vertically, with skyscrapers going higher than 100 floors. While indoor small cells and distributed antenna system (DAS) solutions address some skyscraper requirements, outdoor base stations also have a role to play.

CSPs are deploying 180-degree beam antennas, rather than usual 120-degree antennas. In urban environments, solutions such as Huawei’s PanoAAU can project their coverage to serve the needs of UAVs and skyscrapers or deploy them in the country in a two-sector arrangement that reduces the total cost of ownership (TCO) profile, where agricultural buildings tend to be low-rise and spread out.

Monetizing experience

AI has been able to gain traction in the RAN and antenna domains with ‘AI RAN’. The purpose of AI RAN is to deliver “intent-driven” experience optimization, improve service availability, and support the scale-up of new services. At Mobile World Congress 2025 in Shanghai, Huawei demonstrated a solution (GainLeap) that utilizes an “intelligent service engine” to enable on-demand RAN service orchestration and flexibility – so end users can leverage different spectrum allocations (130 MHz, 190 MHz, 260 MHz) for standard, premium, and ultra-high throughput scenarios. CSPs could offer differentiated low-latency SLAs for premium gamers or ultra-critical enterprise applications, say.

Managing consumption

CSPs are asking equipment vendors to reduce the impact on the environment – which means using more environmentally-friendly materials, reducing the number of materials, and reducing wasted energy in RAN antennas. Huawei says its antenna technology (Leaf) delivers a 75% reduction in weight and a 20% improvement in energy consumption for antenna units (EasyAAU). On the materials front, several antenna manufacturers have declared that they are moving away from fiberglass to more recyclable plastic housings for their antennas.

Drawing conclusions

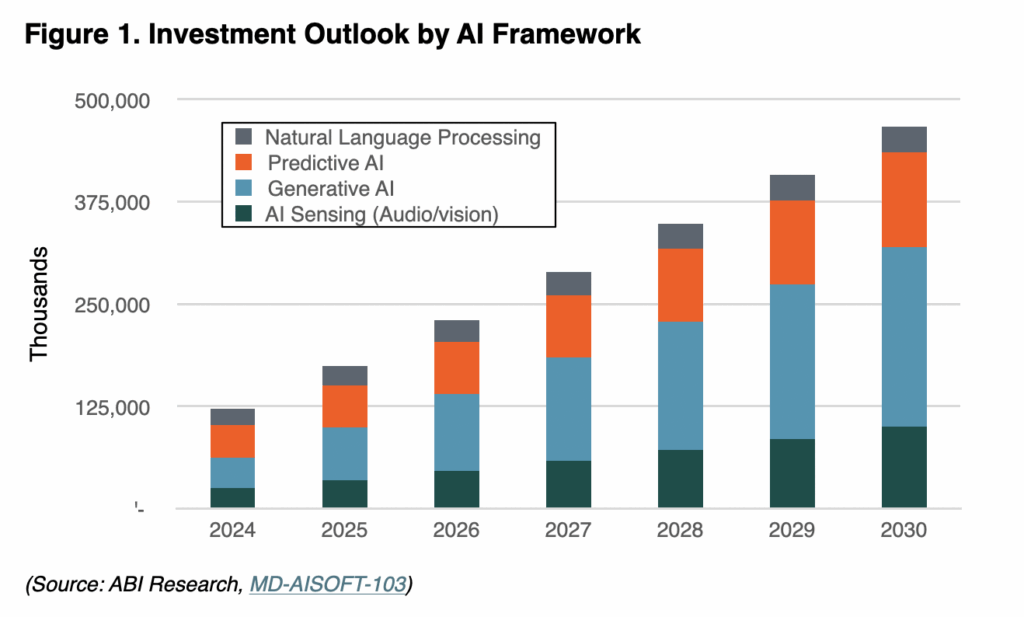

The cellular base station antenna is a vital component in a CSP’s network. The range of cellular-dependent devices will only expand – from UAVs to AI glasses. CSPs expect the antennas they deploy to deliver enhanced capacity, versatile coverage scenarios, and reduced environmental impact. The outlook for base station antenna deployments is still robust, despite the rapid build-out over the past 20 years. The passive antenna market experienced a 7% decline in 2023, but the market made a recovery in 2024, with an estimated US$3.6 billion in sales.

The market is expected to show growth through 2029, with a compound annual growth rate of 1.3%.