Greetings from Nashville, Cedar Rapids, and Kansas City. It has been a whirlwind of activity since Memorial Day, and the summer promises to be filled with even more headlines. The opening picture is of our first (and definitely not the last) Sunday Brief Fiber Connect get together. Ten of us gathered for an active discussion on the industry as well as some rabbit trails (including the pluses/ minuses of living in small but fibered towns like Sedalia, Missouri). Very fun time, and we will assurredly grow it to 20 in 2026 (Orlando).

This week, after a full market commentary, we will dive into earnings questions and the recent policy letter on BEAD from the Department of Commerce. Despite the deserved howls from states that had completed the process, the proposed changes actually make the proposition stronger and save taxpayers money. But they come with additional delays, which means that many underserved locations will not experience broadband speeds until 2028 or 2029. We will offer some thoughts based on our FTTH, ILEC, middle-mile and manufacturing experiences.

One additional administrative note – we will be publishing a Brief on June 22nd and will be converting those of you who are non-Wordpress email subscribers to WordPress the week of July 6th (no Brief on the Fouth of July weekend).

The fortnight that was

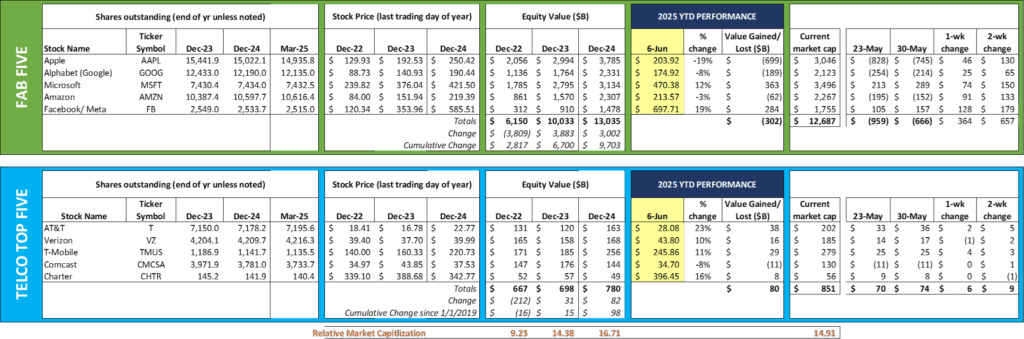

Since the Memorial Day holiday, the Fab Five has gained $657 billion in value, and two of the group (Microsoft and Meta) are up double digits in 2025. Even with the threat of resumed tariffs, continued wars, and persistently higher-than-desired interest rates, the Fab Five continue to increase in value, having doubled in the last 30 months. The Telco Top Five have also performed well as a group (+$6 billion in the last two weeks, $80 billion in 2025), and four of the top five are up double-digit percentages in 2025. As we have documented in past Briefs, AT&T is still worth $17 billion (9%) more than Verizon, and Big Red is still worth the same as Comcast and Charter combined.

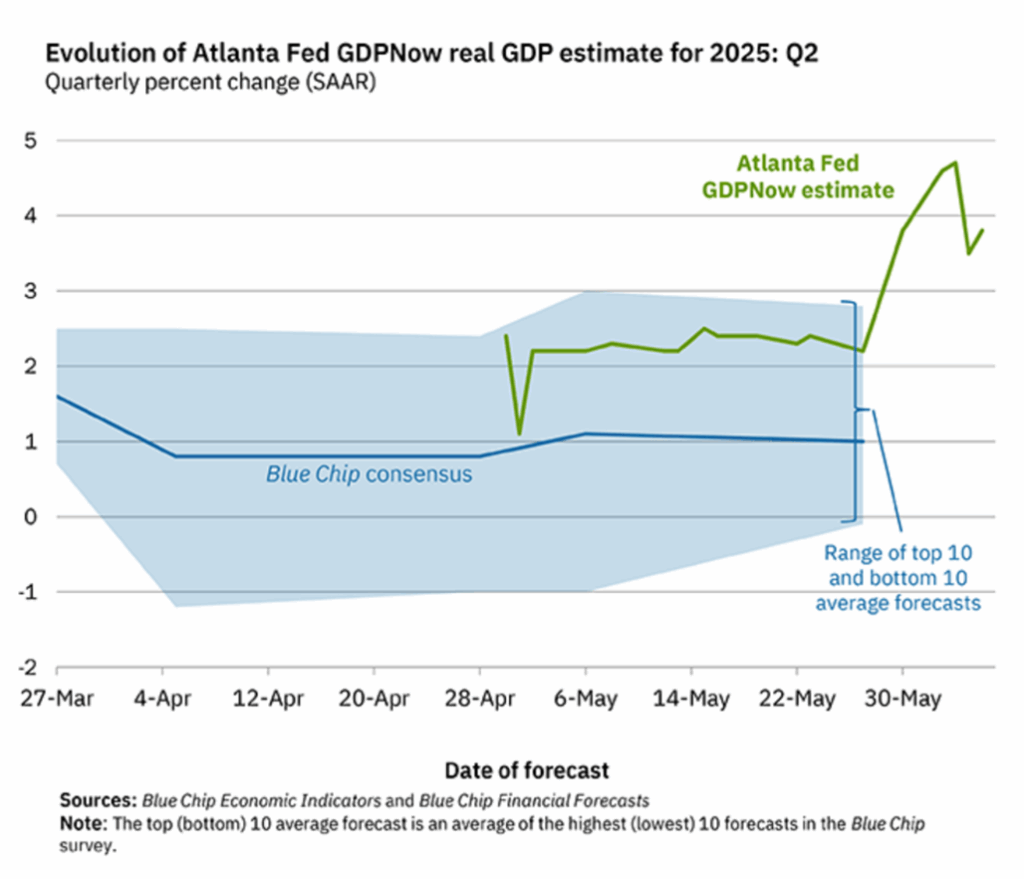

The level of 2Q economic growth remained a mystery as of this publication, as shown by the following Atlanta Fed GDPNow chart:

The jump in the GDPNow real GDP estimate was triggered by April’s tariff-induced goods trade deficit figures which showed a 46% drop. These figures have been updated to now include services (here). While it may not feel like we are growing at historically high levels, the US is importing less and exporting more. Whether these figures will change as import levels normalize is anyone’s guess, but it clearly shows that the country was not approaching a recession in the first quarter.

In addition to the trade deficit, last week’s May jobs figures showed a 139,000 increase in non-farm payrolls (which included 22,000 fewer federal government employees), a 4.2% unemployment rate (unchanged), and hourly earnings +3.9% on an annualized basis. Assuming inflation comes in at 2.5% or less (those figures are released next week), real wage growth should be consistent with pre-COVID levels.

State-by-state data shows that economic recovery continues to be inconsistent. The West (California = 5.3% unemployment rate, Nevada = 5.6%, Oregon = 4.7%, Washington = 4.4% and Arizona = 4.1%) is contributing to the economic malaise, while the Southeast and Midwest are performing nicely (Missouri unemployment = 3.9%, Florida = 3.7%, Georgia = 3.6%, Wisconsin and Virginia both at 3.3%).

The data indicate a steadily growing economy with a balance of trade-driven peaks and valleys. More people are returning to larger cities for work (see 2024 Census data released last month). These statistics should benefit Charter and AT&T with five of the top six fastest growing cities (absolute, not percentage) in Charter territory and six of the top seven in AT&T legacy exchanges.

The big event next week is Apple’s Worldwide Developer Conference (WWDC 2025). There are many changes planned to the look and feel of iOS, and some speculation that the shape of icons could change from squares to circles. What isn’t being announced, however, are meaningful improvements to Apple Intelligence. Improvements in language translation are important, as Google showed at their I/O conference. Apple needs a differentiator – quickly. More here in this excellent piece by Mark Gurman at Bloomberg.

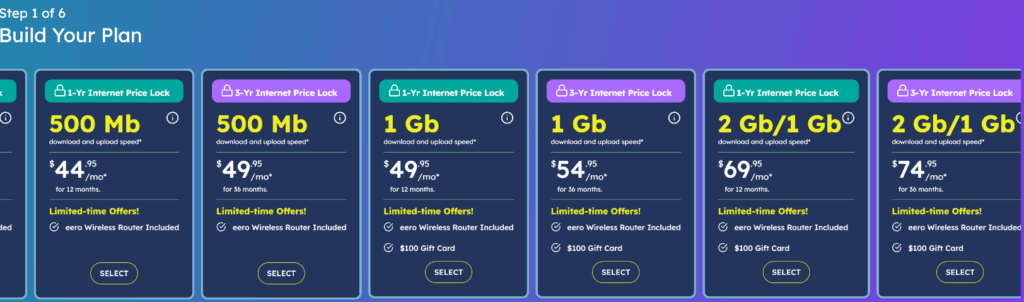

Fresh on the heels of the closing of their Lumos transaction in April (through a venture with EQT), T-Mobile announced refreshed broadband pricing (see nearby chart). Two interesting notes – 1) customers either receive a free speed bump or a $15/ mo. discount when they subscribe to T-Mobile wireless service, and 2) there is a Founders Club plan which does not require T-Mobile voice but includes 2 Gbps with a 10-year price lock for $70/ mo.

Interestingly, T-Mobile does not include the pricing for T-Mobile’s fixed wireless service in the same territory ($50/mo. standalone, or $35/mo. with a T-Mobile wireless plan). Given T-Mobile’s planned cell site improvements in the Lumos operating area, it will be interesting to see how their overall pricing structure evolves (we assume, for example, that a customer who walks into a T-Mobile retail store in a Lumos fiber area could still purchase 5G Home Internet if available).

If T-Mobile were to adopt the Lumos fiber price schedule for Metronet (transaction predicted to close this month or next), new customers would actually pay $30-35 more per month than currently shown on the Metronet home page on a comparable package. Here is an example of promotional pricing for Metronet in Lexington, KY:

Based on this fairly large disparity (driven in large part by density and competition), we think it’s most likely that T-Mobile will have different pricing for Metronet territories. The fiber offering will allow, however, the opportunity for T-Mobile to enhance the overall entertainment experience (e.g., including 4K Netflix for customers with T-Mobile Fiber Internet and wireless service).

T-Mobile has additional bundling options for 55+, first responders, and military that we should see in the next year. Our expectation is that Founders Plan pricing will cease once certain market penetration figures are achieved and that the company will focus on bundled content offers featuring Netflix, Hulu and MLB. We also speculated on a LinkedIn post that T-Mobile could take the bolder move of including a “pro” level AI engine (e.g., Gemini) in a future pricing or Founders plan.

2Q earnings preview (Part 1)

Most of our time in the next Brief will be spent examining “chinks in the armor” for each of the Telco Top Five. However, in advance of this analysis, there are a few quotes that we believe are worth exploring.

Quote #1 – Verizon: “Cable port ratios have peaked.” Here is the specific quote and context from Frank Boulben of Verizon at the TD Cowen Technology, Media & Telecom Conference (full transcript here):

“If I look at it with my retail hat, year on year, we see our port ratio with the cable companies improving. So I think they’ve peaked, and now they’re probably, even if they don’t disclose it, starting to incur some churn. That’s how we can explain the port ratio is starting to improve.”

We find this quote particularly interesting, as it clearly implies that the port-in volumes from cable are increasing (our interpretation of Frank’s comment is that port-out ratios to cable are flat, but port-in ratios from cable are improving). Frank also goes on later in his presentation to announce that Verizon 5G Home is mainly taking share from cable because their NPS scores are so low.

We think that cable has several more levers to pull, and that value-focused customers (particularly families) still like the predictability of the cable price point (which has been at $30/mo. with taxes included for several years at Spectrum). Said differently, it’s unlikely that the MVNO wireless experience is driving cable back to Verizon – it’s likely the breaking apart of the cable bundle (e.g., a decision to move to streaming video or recently increased broadband prices).

Overall, we found Frank’s upbeat presentation to be too rosy – if true, however, Big red will have a big 2Q beat.

Quote #2 – Comcast: “A real ‘What Just Happened?’ moment.” Jason Armstrong, Comcast’s CFO, was a terrific guest at May’s MoffettNathanson Media, Internet and Communications Conference. The entire transcript is a must read for anyone wanting to understand Comcast’s current and projected state. The quote below, while lengthy, can best be described as “when the rubber meets the road”:

“I think our hand in convergence is incredibly strong…. we’ve been largest broadband company for a long period of time. We have really happy customers. But we’ve seen — we just came off a quarter where we lost 199,000 broadband subscribers. And so that is a real what just happened a moment. There’s a real sense of urgency across the company. And as we look at, okay, why did this happen, I mean, the obvious answer is there’s just more competition in the market, right? There’s three fixed wireless companies. That’s not slowing, nor will it slow anytime soon, in my opinion. And there’s fiber competition that continues to creep into the footprint, it’s sort of 3%, 4%, 5% per year. That’s been true for a long period of time, but it’s just — it’s not slowing. So the competitive aspects are there. But then if you really say what are they poking on? Why would someone leave us for either fixed wireless maybe at the lower end or fiber at the higher end, really interesting sort of what comes back. Because what comes back is not I’m leaving you for network, that’s not — actually not how the consumer thinks of it. They’re not thinking fiber versus coax, that’s not how a consumer thinks about that. They think about speed, reliability, pricing transparency. It’s how you would think about it. It’s how I think about it.”

The reality of being a residential broadband service provider seems to be sinking in at Comcast. How the executive team thinks about current fiber providers needs to change. Yesterday’s cash-strapped, triple-play wanna bees are quickly being replaced by 1) a combination of consistent, value-focused single-play providers and 2) AT&T. That Comcast would treat the Texas threat of AT&T like they treated the threat of Grande Fiber decades ago is comical. It is very interesting that Comcast is coming to the conclusion that new technologies are not the threat, but new value propositions. Couple that with the fact that a Metronet or AT&T are delivering exceptional service (see the recent ACSI for fiber vs. non-fiber providers here) which reduces the likelihood that customers will return to Comcast, especially when they move, and the growth equation begins to be more limited.

We have maintained that the metric each analyst should ask is “What percentage of your broadband gross adds resulted from customers returning to Comcast (or Charter)?” The answer will be sobering, especially beyond the value-focused segment. We applaud Jason for saying the quiet parts out loud (particularly “sense of urgency”), but the hard work of building a wireless moat will take years of continuous commitment to build. Spectrum’s moat is larger and deeper, and Comcast would do well to mimic and surpass their MVNO partner if they want to regain the $50 billion of market capitalization they have lost in the last 18 months.

Another disappointing BEAD delay

Friday’s BEAD Restructuring Policy Notice delivered what many of the Fiber Connect participants expected – additional delays. The administration’s hoped for end of year awards (a year late) will likely be mid-2026 thanks to inevitable court challenges. Unserved and underserved customers in rural America are the losers in the end.

Here are the realities:

- Traditional cellular-based fixed wireless will continue to expand but will not fill the underserved and unserved areas outlined in most state plans. Simply put, densities are too low, roads and cell towers are too scarce (for mobile cellular traffic), and spectrum reach too short. T-Mobile backed REV and Swyft Fiber in Louisiana (announcement here) for a reason – wireless was not going to justify an extensive fiber buildout.

- Satellite costs consumers more each month than fiber. Starlink costs $360 up front and $120/ mo. Broadband from the nearby local electric cooperative costs $80/ month for 1 Gbps service with no up-front costs. We are completely baffled that the Department of Commerce has not engaged each electric utility into a “big, beautiful bargain” which would improve both the electrical grid and Internet services. It would be much harder to convince a cash-strapped rural telephone company to suddenly provide electricity.

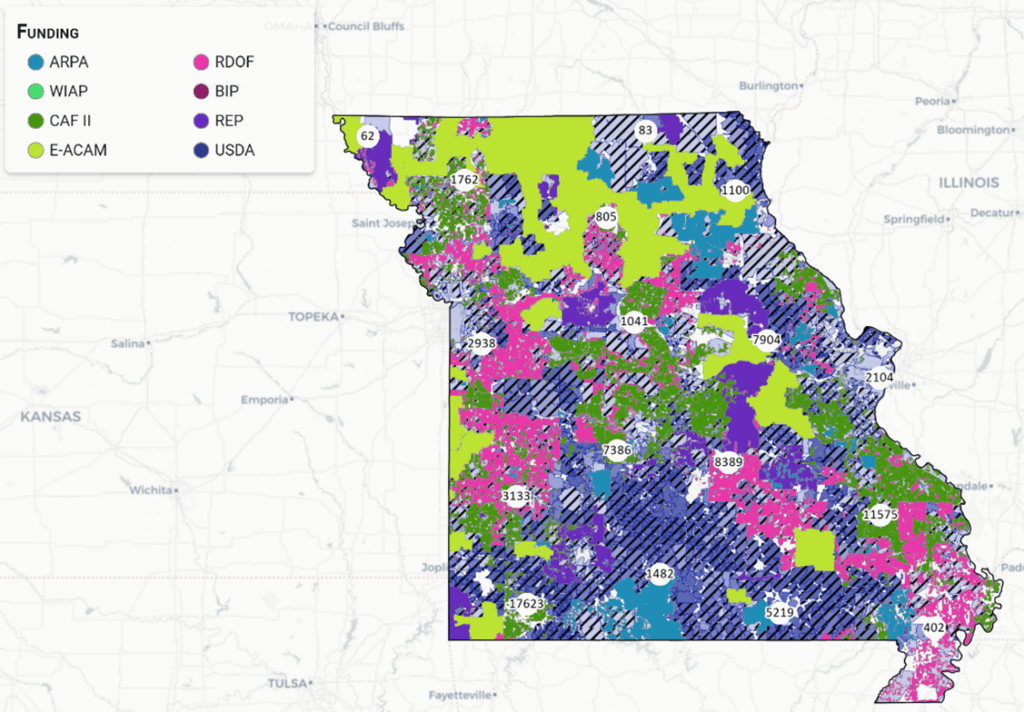

3. When additional program awards were issued (e.g., the October 2023 Enhanced ACAM additional $18 billion in funding from the FCC here), the amount allocated to each state did not change (and should have). Nearby is the Missouri Broadband map – the chartreuse green represents the areas that were underserved but now will be met by E-ACAM funding. By the time the funding levels were announced, the BEAD levels had already been established. The NTIA left hand did not know (or care) what the FCC right hand (E-ACAM) was doing.

We fail to understand why a Republican administration seeks to control the vast majority of broadband decisions at the federal level. Yet the BEAD funding levels, especially with E-ACAM, were extremely rich, causing states to seek out ways to spend budgets. Those who waited will win, yet tens of thousands will wait for affordable broadband due to subpar cellular coverage (eliminating fixed wireless as an option) and recertification timelines.

Consistently available broadband is a critical part of restoring opportunities in rural America. Follow the roads and bridges model – keep decisions local – and the mission will be accomplished on time and on budget.

That’s it for this week. Additional second quarter insights will be the topic of the next Brief. Until then, if you have friends who would like to be on the email distribution, please have them sign up directly through the website.

Finally – Go Royals and Sporting KC!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.