Nokia’s Network Infrastructure unit overtook Mobile Networks in Q2, reflecting a shift toward AI-driven IP and optical demand. Enterprise sales hit records, while traditional telco sales declined. Restructuring looms.

In sum – what to know:

AI supercycle – Network Infrastructure, led by optical and IP sales, outpaced Mobile Networks for the first time since early 2024, boosted by hyperscaler demand.

Enterprise rising – enterprise sales reached a record 16% of revenue, including with 30 private 5G deals; telco sales dropped below 80%, reflecting shift in customer mix.

New restructure – new chief Justin Hotard, overseeing his first full quarter, has promised a “unified vision” and internal reorg to align with AI-era demands.

The changing nature of Nokia’s networking business, and the broader telecoms market, is laid bare in the Finnish firm’s latest financial review, for the three months to the end of June. It shows how one of the world’s key network vendor companies has switched focus to network infrastructure, in reflection and pursuit of the ongoing “AI supercycle”. It also shows how its customer mix is changing, as sales to traditional mobile operators continue to rally, but confirm a downwards trend, and sales to enterprises are rising.

Nokia’s Mobile Networks business, selling cellular 5G gear to big mobile operators, was knocked into second place in the quarter as a revenue generation engine, behind its Network Infrastructure unit, selling sundry cable and fixed networks. As well, its results show a record quarter for enterprise sales, which accounted for almost 16 percent of its total revenues. “Underlying demand trends [for AI infrastructure] remained particularly strong,” said Nokia of its Network Infrastructure sales. It noted “significant order intake growth” from hyperscalers in the quarter.

Besides, the firm claimed 30 new private 5G deals in the quarter, finishing the period with 920 “customers” (or “logos”; indexed as customers by region, and not as network deployment contracts). These include both ‘campus’ edge sales of its DAC (and MXIE) platforms for local-area deployments, as well as wide-area macro-sized private 4G/5G deployments, counted separately as part of its Mobile Networks division. Headline deals in the quarter with Thames Freeport in the UK and Memphis Light, Gas and Water (MLGW) in the US fall into these different categories.

The company is restructuring, it seems, to integrate its networking operations and products. On the back of his first quarter in charge, Justin Hotard, president and chief executive at Nokia, talked about a “unified vision for the future of networks” which the company will set about during the rest of the year with some kind of internal organisational rejig to “unify” its corporate functions – in order to “simplify how we work, build a more cohesive culture, and begin to unlock operating leverage”. There will be an update at its Capital Markets Day in New York on November 19.

He explained its whole networking pitch in light of the new AI infrastructure race. He stated: “Connectivity is becoming a critical differentiator in the AI supercycle, not only for communication service providers and hyperscalers, but also for new areas like defense and national security. With our portfolio in mobile and fiber access, data center, and transport networks, Nokia is uniquely positioned to be a leader in this market transition… Our customers expect us to engage with them as one integrated company as they partner with us across our portfolio.”

As yesterday, the company explained-away its year-on-year decline in quarterly net sales and operating profit in the second quarter as a consequence of “outside-of-our-control” currency fluctuations, particularly the weaker US dollar (projected to cost it about €230 million in the the year), as well as US trade tariffs (worth between €50 million and €80 million, it expects). A 2024 “settlement benefit” also impacted its results, apparently. All in, the firm has wiped about €300 million of its full-year profit forecast, expecting to land at between €1.6 billion and €2.1 billion by the year-end.

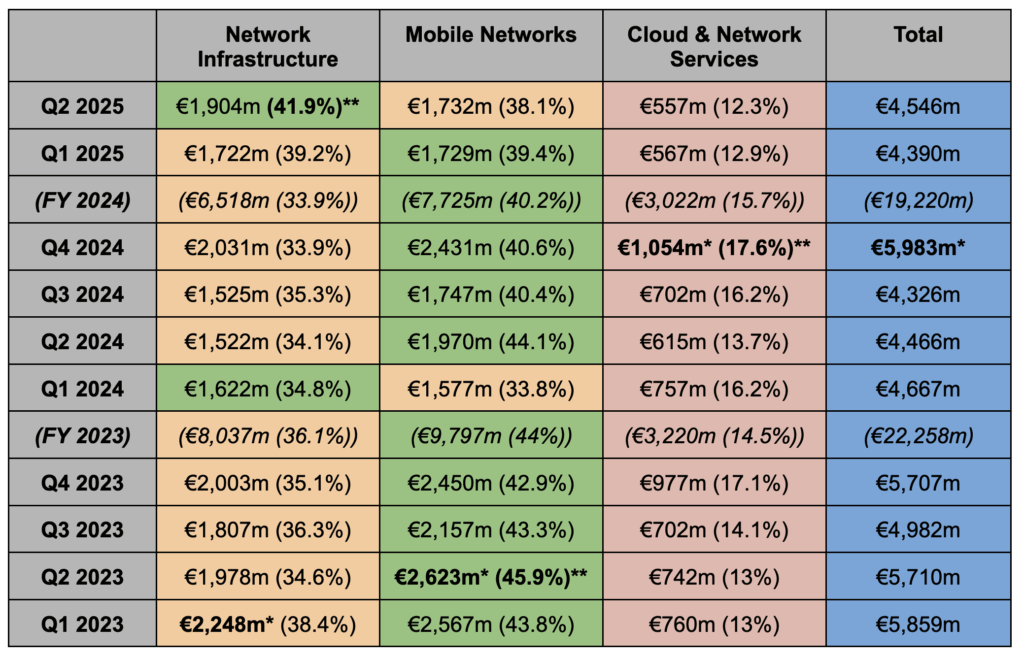

As such, its showing was arguably less reflective of its performance in the period. This is discussed in some detail below. But most interesting, perhaps, is the way Nokia’s business is shaping up in the AI era, as traditional mobile vendors and mobile operators jockey for position. As above, its non-cellular Network Infrastructure unit was its biggest quarterly revenue-generator – for the first time since the start of 2024 (see graphic below, where the highest earners are marked in green). It contributed almost 42 percent of total sales in the second quarter.

** highest-percentage quarterly sales contribution over 10 quarters (per segment)

It has been the fastest-growing part of Nokia’s business for some time; it is also the most profitable part. Its share has jumped since the acquisition of optical networking business Infinera last quarter, since integrated into its first full-quarter accounts. Over the last 10 quarters, Nokia’s Mobile Networks business has fallen from a mid-40s percentage-share of total revenue contribution to below 40 percent since the start of 2025; by contrast; its Network Infrastructure unit has gone from a mid-30s percentage contribution up above 40 percent.

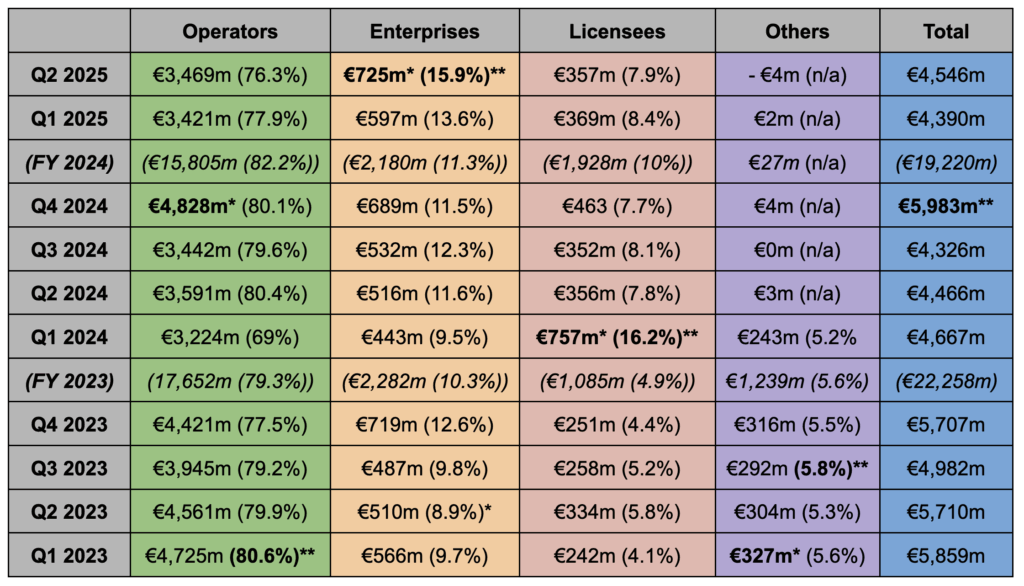

A look at Nokia’s customer mix since the start of 2023 supports this trend (see below) – even if it is confused by the sale of its Radio Frequency Systems (RFS) business, maker of cable and antenna systems, in early 2024, which has taken around €300 million off its books (and almost eliminated its ‘other’ accounting segment). But enterprise sales comprised a record 16 percent in the quarter, based on a record €725 million return. Meanwhile, sales to mobile operators (communication service providers) have slipped properly-below 80 percent since the start of 2025.

There is more to say, clearly, and more rewarding analysis to be done, particularly around the profit contributions of different product and customer groups, and by comparison with the likes of Ericsson and Huawei, notably; but time is tight, and the above tables tell a story. As a quick addition about the firm’s private 5G results (because RCR Wireless covers this sector closely): a return of 30 new private 5G contracts per quarter is about the going rate at Nokia, it seems – despite posting stronger private 5G scores in each of the last couple of quarters.

It is an imperfect measure, clearly – because repeat sales and expanded sales, as existing clients take new networks and launch new applications are not counted. But it is also a useful one to show broader growth in a nascent market. The fact growth is strong – in double-digits still, year-over-year – but hardly electric, should be taken to reflect the pace of industrial transformation, which is likely to last several decades. But the same “AI supercycle” will land in Industry 4.0, too, and drive private 5G sales in tandem. Nokia still looks like it is leading the charge.

Otherwise, Nokia’s latest results show net sales were down one percent on the year-ago quarter – as a comparable count (if currency rates had been steady). They would have grown three percent if not for this “settlement benefit”, the company said, and two percent on a reported basis thanks to new optical network sales via Infinera. Sales to the end of June were €4.546 billion, actually a nominal rise versus €4.466 a year ago. Meanwhile, group operating profit seemingly went into freefall in the period.

Reported operating profit was €81 million, or 1.8 percent of net sales – down by 81 percent from €432 million in the same period in 2024, and down from 9.7 percent as a proportion of net sales. Comparable operating profit decreased 29 percent to €301 million, and comparable margin was 6.6 percent. The difference between the reported and comparable figures, here, is mostly down to about €200 million in amortization and depreciation of acquired assets and existing properties, including plants, equipment, restructuring charges.

Plus, Nokia’s venture investments had a €50 million impact in the quarter as a result of exchange rate fluctuations. Its currency-related venture losses will be about €90 million across the whole year, it reckons – as a proportion of total weak-dollar losses of €230 million; the other €140 million will come as hits to operational profitability. The biggest single drain on Nokia’s performance was its ‘mobile networks’ unit, selling cellular 5G gear to operators. Net sales here declined 17 percent on a reported basis and 13 percent on a constant currency basis.

Net sales were €1.732 billion, from €2.078 billion in the year-ago quarter. As such, Mobile Networks contributed 38 percent of Nokia’s total sales, knocked into second place in the quarter as a Nokia revenue generation engine. The firm’s Network Infrastructure business contributed €1.904 billion in the period (about 42.5 percent of sales), now bolstered by the Infinera acquisition. The decline in its Mobile Networks unit was sharpest in the Americas (“primarily from… a contract resolution that benefited Q2 2024”), and to a lesser extent APAC; the EMEA region grew slightly.

Sales within its Network Infrastructure unit increased by 25 percent on a reported basis and eight percent on a constant currency basis. This growth was bumped by a full quarter of Infinera financials, contributing to a six percent constant-currency rise (80 percent, on a reported basis) for its Optical Networks sub-segment, which contributed €730 million (about 38 percent of its Network Infrastructure sales). By contrast, net sales in its IP Networks and Fixed Networks sub-segments increased by three percent and 17 percent, respectively (to €588 million and €586 million).

Sales to hyperscalers and enterprise customers in most regions raised both its IP and optical network sales, in line with the “AI supercycle” trend referenced by Hotard. Nokia said of its key optical networks proposition: “Underlying demand trends remained particularly strong… Growth reflected strength in North America, particularly with hyperscalers. Optical Networks saw continued success in the hyperscale market with significant order intake growth in the quarter.” Fixed-network supplies were bolstered by demand for FWA in India, notably.

Meanwhile, Nokia’s Cloud and Network Services division, responsible for its private 4G/5G campus proposition, saw net sales increase 10 percent on a reported basis and 14 percent on a constant currency basis, finishing the quarter at €557 million – about equivalent to its IP and fixed networks sub-units. Its Cloud and Network Services segment contributed about 12 percent to its total revenue. Nokia claimed 920 “customers”. This is a gain of 30 deals in the quarter.