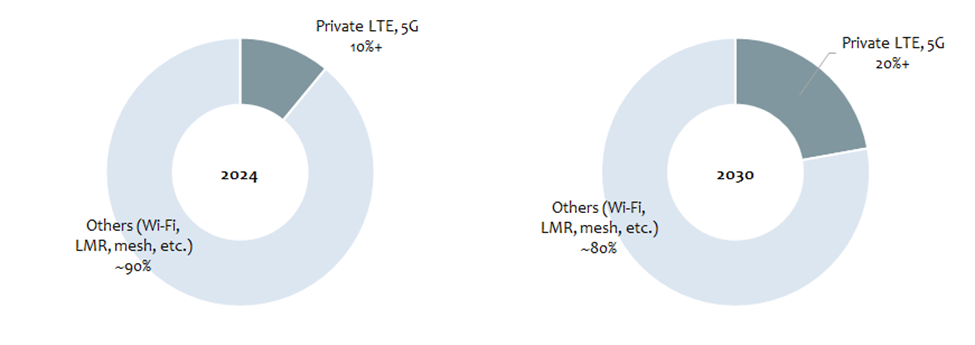

Mobile Experts predicts private 5G (and 4G) will double its market share of enterprise wireless by 2030 – versus Wi-Fi and mesh networks etc. Growth is steady but fragmented, with industrial sectors seeing the strongest, if slower-than-expected, adoption.

In sum – what to know:

Double share – Private 4G/5G will rise from 10% to 20% of enterprise sales in five years.

Industry 4.0 – sales strongest in industrial, though fragmentation is slowing progress.

Long tail – there is a “deep enough pool of opportunity for 25 years of growth”, says firm.

An update on the private 5G market from analyst house Mobile Experts, and a quick one for the weekend: the private cellular will more than double its share of the broader market for enterprise wireless networking equipment in the next five years. This is the big takeaway – or a big one, at least – from a new report the firm has just published, disseminated to press under the header, ‘private 5G marches toward wider adoption’.

Mobile Experts forecasts a “deep enough pool of opportunity for 25 years of growth”.

Its press note does not say much, actually; there is a 67-page report for sale, and it looks detailed (30 “charts and illustrations”; a five-year forecast for eight different verticals, etc). It talked about challenges in the market with fragmentation, notably between different enterprises in different verticals. “While rapid growth was expected, the reality has been slower,” the firm stated. “This is not a single market with a uniform set of requirements.”

It added: “Instead, it is a collection of niche applications and vertical markets, each with unique integration requirements, devices, and spectrum needs.” Which, of course, most market watchers, and everyone directly engaged in the discipline, knows very well. But an email inquiry yielded a little more information; Mobile Experts issued a graphic to explain the double-share growth in private 4G and 5G over the next five years (see below).

Like others, the firm counts private 4G/5G in two categories: hard-core ‘industrial’ private cellular for “heavy” industries like mining, oil and gas, manufacturing, ports, and railways; and ‘enterprise’ private cellular for so-called “carpeted” or ”light” vertical sectors, such as healthcare, education, retail, and venues. Combined, their share will double in terms of annual equipment sales over five years – versus standard Wi-Fi, LMR (Land Mobile Radio), and sundry mesh and other technologies.

As per the graphic, these legacy enterprise networking technologies will account for 80 percent of sales in 2030, down from 90 percent today; conversely, private cellular, of both sorts, will account for 20 percent, up from 10 percent today. Which is a useful frame of reference for predicting the market. Kyung Mun, principal analyst at Mobile Experts, responded: “As you see, private LTE (4G) and 5G will coexist with Wi-Fi and other technologies for a very long time.”

He added: “We are seeing better traction in the industrial private cellular segment, where business-critical applications that require wide coverage and mobility favour LTE and 5G over Wi-Fi. The market is steadily growing, but not at an exponential pace as many had hoped. There are macro and micro factors that have contributed to this, but market awareness is growing (albeit at a tepid pace) and differs by vertical segments.”

It does not provide any hard figures, outside of the paid report. The mixed message – about “better traction”, “steady” growth, and “tepid pace” – should not be a surprise. The value of private cellular appears very real. (At writing, RCR Wireless has just returned from a peak behind the scenes of the weekend tech setup on Portsmouth harbour, ahead of the UK leg of the SailGP race, where Ericsson’s private 5G is a “revelation” – says the event organiser.)

But enterprises – particularly in the industrial sector, where value is arguably highest, and where vendors’ early sales focus has been trained – are slow-moving entities, with long-term legacy assets to sweat, and long-term future tech to get right. So, to editorialise: what did we expect? In the end, the forecast from Mobile Experts tells of a part of the telecoms market showing double digit growth – and 100 percent growth in terms of market share.

Which sounds positive. Indeed, Mobile Experts forecasts a “deep enough pool of opportunity for 25 years of growth.”

Mun said: “Enterprises are dealing with an increasing workload, including [with] AI, that requires high-performance, reliable, and secure networks. There is deep demand for better connectivity in the market… We see great examples of [industrial] companies achieving a fantastic ROI on private LTE networks. With a need for reliable connectivity with wide coverage and mobility support, this market has a deep enough pool of opportunity for 25 years of growth.”

Mobile Experts said it has a new tool called the ‘Readiness Wheel’ to gauge the maturity of various technology and business factors for the market to scale up. The firm has applied it to the manufacturing, energy, utilities, logistics, transportation, mining, and government sectors in its report – to “make the future path of each market crystal clear”, it said. The report is available here.