Editor’s note: I’m in the habit of bookmarking on LinkedIn, books, magazines, movies, newspapers, and records, things I think are insightful and interesting. What I’m not in the habit of doing is ever revisiting those insightful, interesting bits of commentary and doing anything with them that would benefit anyone other than myself. This weekly column is an effort to correct that.

What is there to say about the double-edged sword that is the radio access network (RAN) that hasn’t already been said? Operators have to near-constantly go through the capital-intensive process of densifying, modernizing, and upgrading the RAN to expand coverage and deliver more capacity. And then there’s the ever-increasing ramp in operational complexity and cost that goes along with delivering service and otherwise keeping the thing running. As such, operators keep their heads on a swivel for opportunities to take capex and opex out of the RAN while figuring out how to monetize the thing beyond just selling connectivity.

Since circa 2018, Open RAN — via the operator-led O-RAN Alliance — has been working to standardize interfaces between central, distributed, and radio units, while also defining and commercializing the RAN Intelligent Controller (RIC) so various rApps and xApps can be used to, again, tame complexity and cost while adding capabilities that can, in turn, be monetized. Then it was all about Cloud RAN, a vendor-led initiative to turn the radio network into a horizontal cloud platform that can be used to, again, tame complexity and cost while adding capabilities that can, in turn, be monetized. Now, in keeping with the larger global technology cycle, it’s all about AI RAN where artificial intelligence is embedded throughout the RAN in order to, again, tame complexity and cost while adding capabilities that can, in turn, be monetized.

Note the pattern. Also note that the RAN is still operators’ biggest cost center, and that operators’ revenues, generally, remain flat.

Dell’Oro Group Vice President Stefan Pongratz, in a LinkedIn post today, teased new research on AI RAN. The key takeaways are:

- “AI RAN is happening.”

- “The technology will reach significant scale in the second half of 5G.”

- And “AI RAN is not expected to grow the overall RAN pie.”

Short-term, it’s “more about efficiency gains than new revenue streams. There is strong consensus that AI RAN can improve the user experience, enhance performance, reduce power consumption, and play a critical role in the broader automation journey. Unsurprisingly, however, there is greater skepticism about AI’s capability to reverse the flat revenue trajectory that has defined operators throughout the 4G and 5G cycles.” Oof.

The view from the AI-RAN Alliance

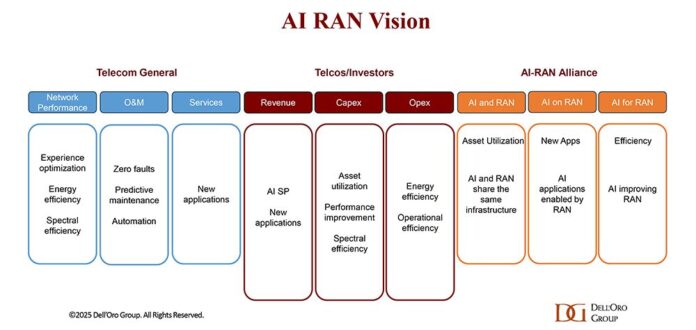

During the recent Telco AI Forum (available on demand here), I had the opportunity to catch up with AI-RAN Alliance Chairman Alex Choi, also a research fellow with SoftBank. At Mobile World Congress Barcelona 2024, the AI-RAN Alliance unveiled its foundational vision for AI for RAN, AI and RAN, and AI on RAN. Those respectively speak to “advancing RAN capabilities through AI to improve spectral efficiency, integrating AI and RAN processes to utilize infrastructure more effectively and generate new AI-driven revenue opportunities, [and] deploying AI services at the network edge through RAN to increase operational efficiency and offer new services to mobile users.”

As an aside, Pongratz said incumbent RAN vendors Ericsson, Huawei, Nokia, Samsung, and ZTE, “are well-positioned in the initial AI-RAN phase, driven primarily by AI-for-RAN upgrades leveraging the existing hardware.”

Back to our conversation with Choi. “We’ve made tremendous progress since our debut.” He said membership has passed 90 companies from 18 countries, and the alliance has demonstrated proofs-of-concept breakthroughs in areas like AI-native air interface design, deep learning for uplink channel estimation, mobility-aware power saving, advanced spectrum sensing, and dynamic AI model partitioning. The takeaway, Choi said, is “all these demos are not just hypothetical.” They validate the organization’s mission and signal movement “from concept to early real world experimentation.”

To scale this out in the real world, operators will need more RAN compute resources. That means more powerful CPUs and GPUs to accelerate AI workloads whether that’s in service of AI for RAN, AI and RAN, and/or AI on RAN. Bottomline, Choi said, the whole thing is in flux and there won’t be a one-size-fits-all approach to accelerating AI workloads.

He tracked the traditional approach to RAN processing as anchored in digital signal processors contained in an ASIC-based architecture. But, “We are seeing clear indications it’s evolving to a hybrid computing platform meaning combining CPUs and GPUs.” CPUs, for instance, are well-suited for Layer 2 and Layer 3 control plane tasks. When you get into compute-intensive Layer 1 tasks like signal processing or massive MIMO beamforming, there’s a case for GPU-enabled parallel processing. “It delivers clear cost/performance advantages,” Choi said.

“Realistically,” Choi said, “we will very likely see hybrid CPU and GPU platforms emerging as the dominant architecture for AI RAN in the coming years.” In some deployment scenarios, particularly dense urban environments with high and variable capacity demand, “It’s increasingly likely that accelerators like GPUs will be needed.”

Choi and I also discussed AI and RAN — think GPU-as-a-Service, what that means for network engineering teams, and so forth. Check out the session. But extending beyond AIOps for the RAN where AI delivers operational efficiencies to operators, the case for AI RAN potentially becomes necessary in the 6G era when the contra-forces of massive channel bandwidths and lack of spectrum will create a forcing function making AI RAN necessary.

6G, AI and MRSS

Choi described multi-radio access spectrum sharing (MRSS) as the mechanism to govern shared spectrum across 5G, 6G, Wi-Fi, satellite-based, and other radio access mediums. “As we move toward 6G, we are entering an era where spectrum sharing, massive bandwidth, and ultra-dense deployments make…conventional, manual network management completely impossible.”

AI models can predict spectrum occupancy and demand patterns based on historical and real-time data to enable proactive spectrum allocation before congestion or interference occurs. Reinforcement learning agents can continuously calibrate the optimal way to allocate spectrum across different access technologies. And AI agents, working across radio and edge sites, can autonomously balance traffic loads.

“Without artificial intelligence technology, the complexity and speed required for the efficient MRSS operation in 6G would be practically unmanageable, making AI-native RAN architecture in 6G an essential foundation for the future,” Choi said.

Now let’s return to the relationship between Open RAN, Cloud RAN, and AI RAN. This came up in a webinar I hosted last week with some smart folks from LitePoint, Spirent Communications, and VIAVI Solutions. We were talking about the state of play around Open RAN but in order to make that a comprehensive conversation it necessarily needed to (and did) include discussion of Open RAN, Cloud RAN and AI RAN. You can check out the full session here.

Suffice to say, my line of thinking is that these are complementary approaches to RAN evolution that are perhaps being characterized as mutually exclusive because that’s expedient to how established RAN vendors sell and deliver equipment. But the incumbent vendors engaged in O-RAN Alliance standardization efforts to protect their interests and steer the ecosystem. In doing so, they opened up some parts of their RAN stacks for integration with third-party hardware and software. Expect more of that in the AI RAN era because no one company — well, maybe exactly one company — can deliver everything needed for operators to do all three flavors of AI RAN.

To put that more succinctly, Open RAN is the interoperable foundation. Cloud RAN is the architecture. And AI RAN is the ambition.