Vodafone posted a 5.5% rise in service revenue in Q1 (to June 30), beating expectations, despite a reversal at its big German op-co, albeit a slowing one, and softening growth in its home market in the UK, where the Three merger is playing out. Its outlook remains unchanged.

Positive outlook – good results, particularly in the rest of Europe and Africa; decent business sales.

Germany stable – improved wholesale and business sales partly offset a hit from bulk TV deals.

UK, slower – good fixed sales, but business and consumer contract churn, and Three integration.

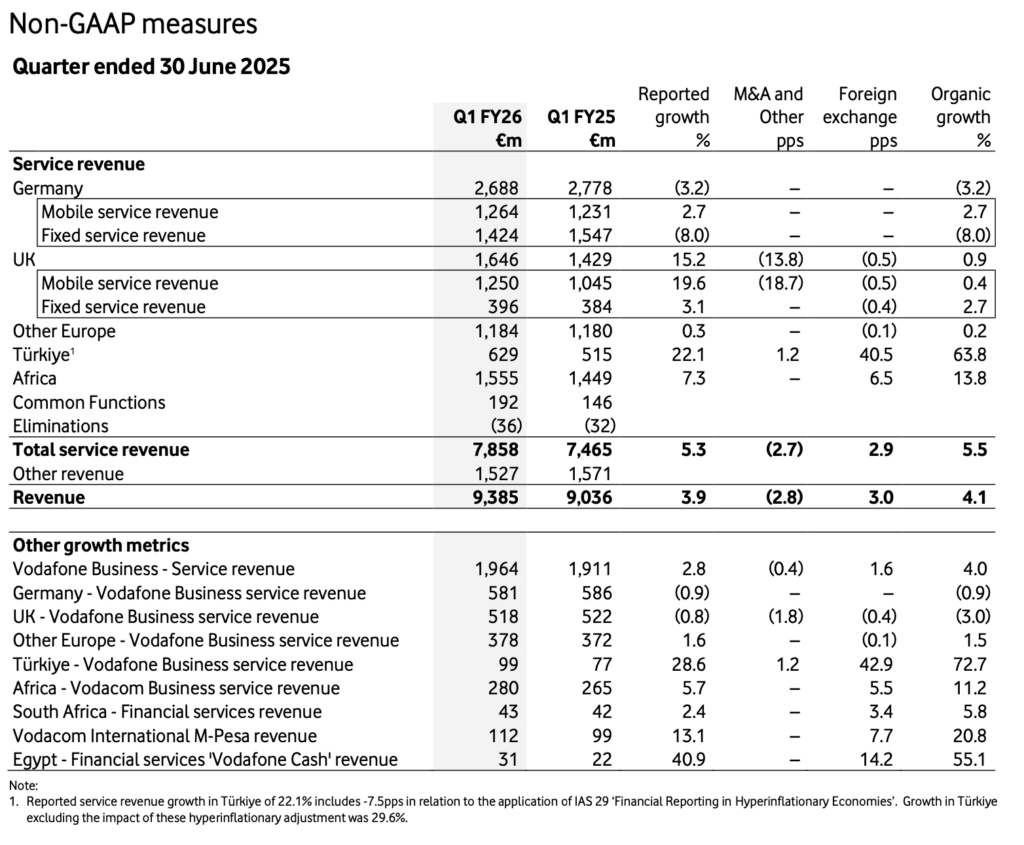

Vodafone reported a 5.5 percent jump in group service revenue to €7.86 billion in the quarter ending June 30, exceeding expectations of 4.9 percent. The company’s first-quarter (2025/26) figures revealed a further decline in Germany, its largest market, but a slower one – with a 3.2 percent reversal, down from a six percent decline in the previous quarter. At home in the UK, its other big market, organic service revenue was 0.9 percent higher, down from 3.4 percent last quarter – partly due to merger-related disruption following its tie-up with UK operator Three.

Together, these markets contributed 55 percent of the group’s total service revenue (€2.688 billion and €1.646 billion, respectively), across all segments. Its outlook is unchanged with full-year profit guidance set between €11.3 and €11.6 billion – up from €10.9 billion expected in 2025. Shares rose four percent on the results, and are up over 20 percent in the year-to-date. The group’s total revenue increased by 3.9 percent to €9.4 billion in the first quarter. Adjusted EBITDA rose 4.9 percent to €2.7 billion, supported by a 0.2 percent margin improvement to 29.3 percent.

Wholesale and business sales drove its improvement in Germany, versus last quarter – respectively with higher revenue from the migration of 1&1 roaming customers (driving mobile service revenue up 2.7 percent), and the “phasing of digital services projects” (offset by ARPU pressure in the enterprise sector; meaning business service revenue declined by 0.9 percent). The decline, overall, was down to the impact from the end of bulk TV contracting in ‘multi-dwelling units’ (MDUs) – apartments, condominiums, duplexes, and such – on its fixed-line business.

Its broadband, television, and mobile bases in Germany all declined in the period. Vodafone Germany is in the midst of slashing 3,200 staff in the country.

In the UK, mobile service revenue grew by 0.4 percent with higher wholesale and lower subscriber returns. It also cited “business project milestones” from the fourth quarter, and a changed consumer mix with the Three merger. Fixed service revenue was up by 2.7 percent, with 44,000 new customers; business revenue declined by three percent due to “planned managed services contract terminations” and lower ARPU – “partially offset by good demand for fixed connectivity and digital services”.

Its mobile base declined by 46,000 in the quarter because of the “timing of large contract disconnections in Business and Three UK Consumer customer losses”. The new VodafoneThree company in the UK will invest £11 billion over 10 years in 5G infrastructure, and generate cost and capex synergies of £700 million per annum – by the fifth year after its completion. VodafoneThree is now the biggest mobile network operator in the UK with 28.8 million customers.

In the rest of the group’s footprint, Türkiye was the standout, with service revenue up by 29.6 percent. In Europe – excluding Germany and the UK, but including Türkiye – organic service revenue growth was 0.2 percent higher, with good sales to enterprises across the region, and declining sales to consumers in Portugal and Romania. Africa also performed well, with growth of 13.8 percent in the quarter, notably in Egypt and across its Vodacom operations, including from financial services.

A page in its report showing adjusted non-GAAP results (as above), including for Vodafone Business, says enterprise sales (via Vodafone Business) climbed four percent across all territories to €1.964 billion. There is no mention anywhere of the performance of Vodafone IoT, spun off from the rest of the group in April 2024, but still owned by it.

Margherita Della Valle, chief executive at Vodafone Group, commented: “Germany has started its improvement trajectory and our emerging markets are delivering strong broad – based growth. In the UK, we have completed the merger with Three and are moving quickly to combine our networks to benefit customers. Today, we reiterate our full year guidance of growth in profit and cash flow. After two years of transformation and change, Vodafone is now well positioned for multi – year growth across both Europe and Africa.”