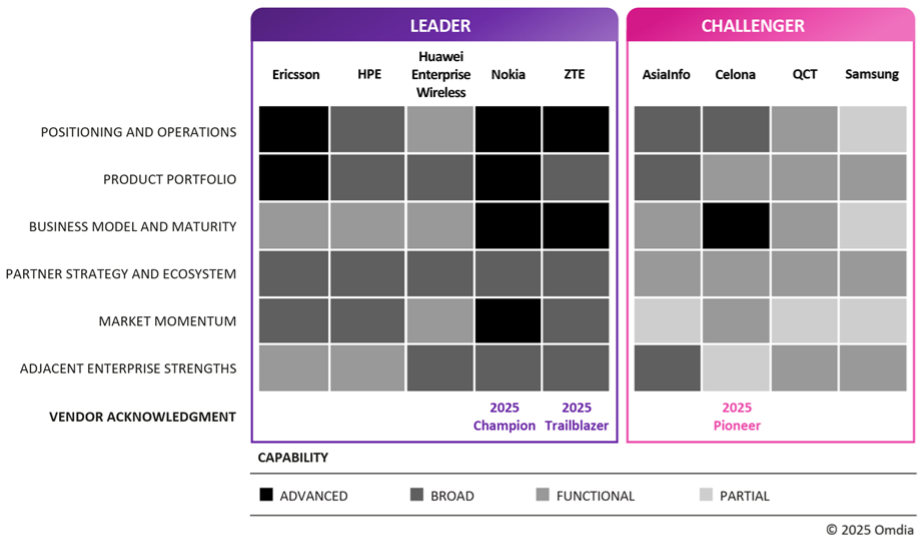

Omdia’s 2025 private 5G vendor review places Nokia top of the pile, leading from ZTE, Ericsson, and Celona (as prime movers), and exposing market gaps in strategy, distribution, and IT/OT integration across the board.

Market leaders – Omdia crowns Nokia as private 5G champ, leading from ZTE, Ericsson, Celona, and Huawei.

Industrial push – industrial edge and neutral host show keen activity; not much doing with Wi-Fi integration and AI.

Stumbling blocks – IT/OT integration represents the table stakes for private 5G; multi-tier distribution does not work.

Everyone loves a league table, and this one by Omdia is notable because, humbly, we think it gets it right – probably. Certainly, it is a closer reflection of the RCR view of the runners and riders in the private 5G game. And it works, versus dogs-dinner concoctions by other analysts (Gartner), because it compares apples with apples. Such that, in the final analysis, Nokia ranks top of the vendor pile, as the 2025 heavyweight champ (‘2025 Champion’; and not as a ‘challenger’ brand behind operators and integrators, mostly taking cues from the Finnish firm and its peers). Frankly, it is a much neater exercise, and a more logical result – which few would properly argue with in 2025.

As an aside, it might be noted that Kaleido Intelligence ran the rule over the private 5G vendor market in January – splitting it differently into hardware, software, management, and enablement disciplines – and came up with the same top-line ranking, with Nokia ahead of NTT Data overall, where the latter scored well for management and enablement (Transatel), as wrapped around hardware and software from the likes of Nokia (but mostly Celona, actually). But the big surprise in Omdia’s straight vendor-review is that Chinese firm ZTE ranks second, as ‘2025 Trailblazer’, ahead of Nokia’s Scandi arch-rival Ericsson, closing fast on the inside. Ericsson is one of three “leaders”, reckons Omdia.

But it doesn’t get a badge. Whereas Celona, the California startup and NTT favourite, does; Omdia hails it as a ‘2025 Pioneer’, one of only three with an “advanced” (read tiered op-ex) business model, and the “first” of any to “target simplicity in [its] product and pricing – [and] an enterprise-friendly experience”. For the latter, read IT-friendly, and be mindful these vendors are subtly picking IT/OT sides in their solutions and marketing. Equally, Omdia reflects that any vendor going too hard on this IT/OT divide has come unstuck. “Those that did not bridge the gap between… [have] struggled… Success requires the alignment of both from the outset,” it writes.

At the same time, Nokia and ZTE, plus the likes of Siemens (which gets a paragraph at the end as one-to-watch), draw on their OT blueprinting and solution design, where Celona, Ericsson, and HPE, plus others, push their IT creds. (All of them would dispute such a binary characterisation, but, hey, old narratives stick.) Certainly that line (IT-friendly) is one Celona likes to use, anyway – and one NTT Data likes to use about it. Ericsson and Celona are also praised, as stand-outs, for their work with neutral host systems to overhaul indoor wireless coverage – based on their work in the US, variously with the business teams at T-Mobile, AT&T, and Verizon.

Celona presumably ranks fourth, just outside the top spots. So does Huawei (Enterprise Wireless), curiously, which must have more customer references than any other outfit in this league table. But maybe its China-bent obscures its record somewhat, and Omdia does not rank it as “advanced” for anything at all (see image) – even describing its “position”, “model”, and “momentum” as “functional” at best. Ouch. At the same time, Omdia says Huawei has bigger enterprise targets – as it is “betting on large-scale wide-area private network opportunities such as grids and railways”. Which shows how the market is “maturing” as “solution-driven [and] vertical-focused”, apparently.

Asked about Huawei’s showing, Pablo Tomasi, the report’s author (and chair of a related session at FutureNet World on private 5G and AI), said: “Huawei is focused mostly on public-based private 5G networks. A lot of its references and case studies in China are [for] hybrid networks. Its focus on fully-dedicated private 5G has been modest. It is a strategic choice. It sees public-based stuff as its best bet. What emerged from my engagement with it, before and during the research, is it will target wide-area private network opportunities – with utilities, railways etc. Obvious to say, but if it wanted to focus on fully dedicated private networks it has the capabilities to excel.” Which puts us right.

Of the rest, Tomasi says HPE, which owns pioneer brand Athonet, does “not have a finished product yet” – a reference to the absence of home-made RAN to pair with its Athonet core. “Once ready, it could drive a far-reaching enterprise networking vision of Wi-Fi plus private 5G.” Samsung has “great potential” because of “far-reaching expertise” but is “yet to really focus”, says Tomasi. Others in the review are: AsiaInfo (“highly tailored solutions to meet sub-vertical needs such as in nuclear energy or wind farms”); and QCT (driving “campus networks for Industry 4.0 integrated with edge and AI”). AILINK, Mavenir, and Eviden also get a short profile, along with Siemens.

Certainly, as hinted, there are differences in all these vendors’ products, targets, and strategies. Interestingly, the review reflects on these companies’ channel activities, suggesting “attempts to create tier two and three (two/three-tiered?) distributor models [have] failed”. A statement says: “Vendors now recognize that private networks are highly specialized and require a few focused partners – not a wide distribution channel.” Which is why all of them are circling around parochial specialists like Future Technologies in the US, and Smart Mobile Labs in Germany – and just about every company Boldyn Networks has acquired or sought to acquire, plus the rest.

Nokia has taken a closer hand in its distribution activity, of late; Ericsson is on a total charm offensive in the channel, meanwhile (look on LinkedIn). Of the latter, Omdia says: “Ericsson has the optimum attention in this market now, though it still needs to work on synergies beyond connectivity – [with] edge, neutral host, network APIs.” But the real story in the Omdia review is about Nokia and ZTE – one should conclude. Nokia is rated as “advanced” on four out of six measures, and “broad” on both the others (see above); the ratio is flipped for ZTE, which still places it higher than every other vendor apart from Nokia.

In an email exchange, Tomasi reflected: “Nokia sets the pace in the market. Its first mover advantage is finished, and it needs to show its industrial bets can drive the company beyond connectivity. ZTE sees private 5G as the key to driving the transformation of verticals and is working to bring the OT world within this solution.”

He added: “There is an overwhelming focus from most vendors on industrial markets. A couple of trends/technologies that don’t seem to have a big impact yet are the 5G-plus-Wi-Fi story, and AI. While edge and industrial IoT tend are common bets, not every player is clearly making them. Some are focused on wide areas and others are more focused on campus opportunities. Neutral host is an interesting direction but questions remain about its synergy with private 5G. Significantly, strong partnerships with industrial players are still lacking – most of them are with OEM manufacturers, say, about integrating private 5G into mining equipment, for example.”