Editor’s Note: Welcome to our weekly Reality Check column. We’ve gathered a group of visionaries and veterans in the mobile industry to give their insights into the marketplace.

Greetings from Kansas City, where, after spending nine days in India, I have learned never to complain about traffic (and other life gripes) again. Several of you asked about my observations of India as it relates to this column, and I will keep them brief: a) Prepaid service dominates and expands the addressable market; b) With number portability just being introduced in India, it’s a “Wild West” mentality for challengers which means U.S. levels of advertising; c) BlackBerry and Android (not Apple) are the aspirational devices that the middle class can afford (all of the BlackBerry devices being turned in for Verizon iPhones have to go somewhere); and d) the expansion of 3G and soon 4G data in India represents the next $10 billion opportunity in the telecom industry.

All in a country of 1.2 billion, with an addressable market of 400 million to 500 million and an economy growing at 8% to 9% per year. Lots of opportunity to grow, especially for smart phones and the applications that make them great.

While I was away, the rest of the telecom crowd (except for Charter Communications) announced fourth-quarter and full-year earnings. As the faithful readers know from previous Reality Checks, this is the “quant” edition, so be prepared.

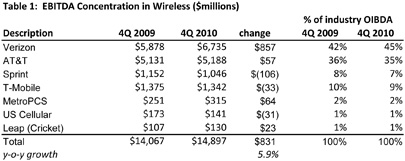

Award #1: Wireless OIBDA/ EBITDA expansion. As we discussed with the third-quarter earnings review, the best measure of health in the wireless industry (and a good gauge of future capital expansion) for any company is EBITDA growth. This growth is very hard to come by right now, unless carriers can a) raise prices, or b) change their relative cost structure. Contract or post-paid carriers also have a disproportionate increase in data costs (meaning access and transport from the cell tower to the IP backbone network), and smart-phone subsidies. Here’s the look at the wireless industry EBITDA for each of the major U.S. wireless players for 4Q: