Greetings from soggy Kansas City and Cedar Rapids. Pictured is the crew from this year’s CellSite Solutions 2025 INDATEL Summit dinner. Nine different companies represented in the picture – an absolutely amazing time. Thanks to all who participated, and we look forward to seeing some of you at the 2025 UNITEL Executive Summit in Omaha next month.

Five of the ten companies we track issued earnings reports this week. Four of those were from the Telco Top Five (Comcast announces earnings next week). We have spent a lot of time this week analyzing each announcement, and after some thought, decided on “Battling New” as a title. There is a lot to cover with this week’s earnings, so the market commentary will be minimal.

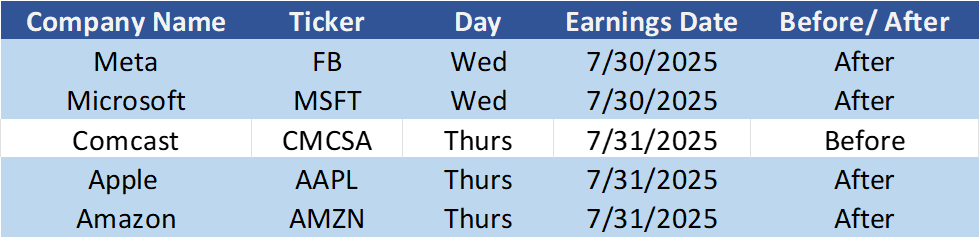

Speaking of earnings, here is next week’s schedule for the remaining five companies:

The fortnight that was

July is coming to a close, yet tariff uncertainty has begun to abate. The market is beginning to build in a reciprocal 15% tariff rate for each of the United States large trading partners, and many CEOs are echoing praise for the Big Beautiful Bill (especially for the ten stocks we track, because of the permancy of the expensing of capital investments).

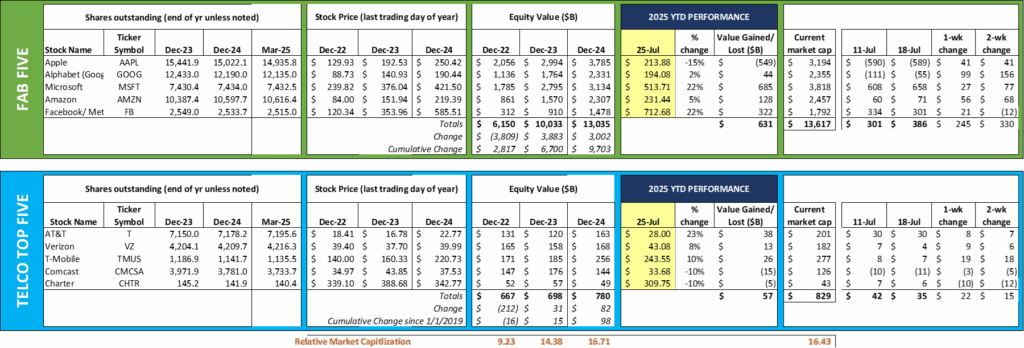

Against this backdrop, and in anticipation of this week’s earnings, the Fab Five were up $245 billion this week and are up $631 billion so far in 2025. Only Apple is in negative territory for 2025 and both Amazon and Facebook are up more than 20% year-to-date. Each Fab Five stock (including Apple – see discussion below as to why) gained.

Contrast that with the Telco Top Five who had a mixed week (+$22 billion for the week, +$57 billion year-to-date) with cable stocks pressured (Charter had it’s worst 1-day performance in its history). The earnings performance from AT&T prompted noted telecom analyst (and Sunday Brief reader) Craig Moffett to proclaim them as the “consensus best choice for investors in U.S. Telecom.” Times have changed.

Google was the only Fab Five stock to announce last week, and they announced that they would be spending $10 billion more on capital as a result of improved demand and recently passed legislation (now $85 billion for 2025). When asked about how Google will spend the additional $10 billion amidst supply constraints, Google CEO Sundar Pichai responded:

“On the CapEx stuff, obviously, we are seeing strong momentum across our portfolio, especially in Cloud. You are right, it’s a tight supply environment and we are investing more to expand. But there is obviously a time delay between this additional investment will play out in future years. So, that’s why both of them are true at the same time.”

We interpret this response to mean that Google will be focusing on things like land, permitting, readiness and even structures which can all be secured prior to the availability of the supply-constrained items (generators, HVAC, and other important components to building the data center). Google has assessed additional capital spending this year against the incremental tax savings and appears to have decided to purchase some items now rather than wait (a very wise move in our opinion).

While it will be a few weeks until we discuss net debt, it is interesting to note that Google’s negative net debt dropped by $13 billion from the previous quarter and slightly less than $16 billion from 2Q 2024. But the company still has $71.5 billion in negative net debt, and that figure only looks at cash and marketable securities assets. When you consider the value of non-marketable investments (we are assuming much of this is AI-related companies), the net debt figure is actually better than it was in 2Q 2024 even with significant capital spending. The value accretion of Google’s Artificial Intelligence investments is creating additional opportunity to increase infrastructure spending (which supports the accelerated development of many of those non-marketable investments).

In other Fab Five news, Apple announced a $500 million agreement ($200 million of this in an upfront payment) earlier this month to purchase magnets produced from MP Materials, the largest producer/ recycler of rare earth minerals in North America. For more details on the agreement and to get a deeper dive into MP Materials, check out these two articles from The Wall Street Journal here and here.

In other Apple news, the company is receiving praise for their latest iOS (26) update from Beta users. We covered the laundry list of improvements in a previous Brief (here) but thought this update from Macrumors was worth linking to for those iPhone users who want to know which announced features will land in the latest release. While their AI efforts are lagging, they are doing their best to improve the functionality of other parts of the iPhone (and other Apple hardware).

Finally, amidst 9,000 recent layoffs (and 15,000 in 2025), Microsoft CEO Satya Nadella penned an all employee note titled “Recommitting to our why, what, and how.” He addresses the layoffs head on:

“ I also want to acknowledge the uncertainty and seeming incongruence of the times we’re in. By every objective measure, Microsoft is thriving—our market performance, strategic positioning, and growth all point up and to the right. We’re investing more in CapEx than ever before. Our overall headcount is relatively unchanged, and some of the talent and expertise in our industry and at Microsoft is being recognized and rewarded at levels never seen before. And yet, at the same time, we’ve undergone layoffs.

“This is the enigma of success in an industry that has no franchise value. Progress isn’t linear. It’s dynamic, sometimes dissonant, and always demanding. But it’s also a new opportunity for us to shape, lead through, and have greater impact than ever before.

“The success we want to achieve will be defined by our ability to go through this difficult process of “unlearning” and “learning.” It requires us to meet changing customer needs, by continuing to maintain and scale our current business, while also creating new categories with new business models and a new production function. This is inherently hard, and few companies can do both.”

Those are powerful statements and reasons to be fans of Mr. Nadella. Even while investing in infrastructure at record levels, Microsoft is keen enough to recognize and eliminate personnel who will be replaced by Artificial Intelligence. His statement that the company must go through the difficult process of “unlearning” and “learning” recognizes that having these resources at the company would actually hinder their ability to use and improve their newly developed technologies. Sometimes those actions are easier to recognize than implement, and Microsoft deserves credit for taking this leap even as the company’s value grows.

2Q earnings review (part 1) — battling new

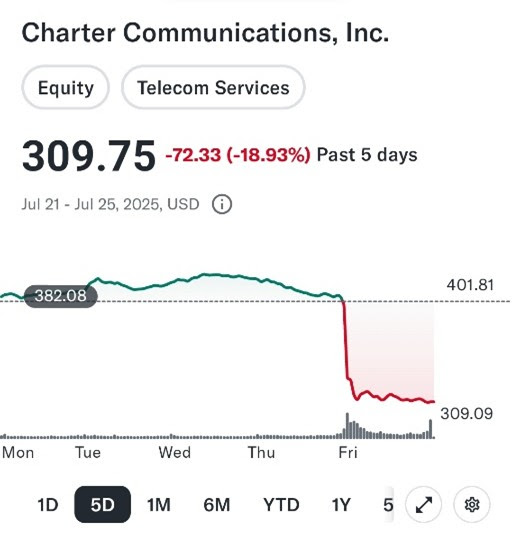

Four of the Telco Top Five announced earnings last week. Charter capped off the week with a quarterly earnings report that missed subscriber and revenue metrics, and the share price was hammered (see nearby 5-day chart). We were around when Charter had their December 2022 surprise (Brief here), a 16% drop as a result of additional capital guidance on their rural initiative investment. Friday’s intraday drop was greater (18.5%) than December 2022 on an earnings miss that was less newsworthy than the rural infrastructure initiative. Why the drop?

Charter and Comcast (and to a lesser extent, Altice) are battling new. Fiber is new. It requires homeowners to be present while a technician pulls a fiber (most times) into the home. There are few components. And, if the network is configured correctly, it’s fast.

Fiber is now a national initiative with greater economies of scale than previous efforts (Fiber Connect had over 5,000 attendees this year – far more than any cable-focused trade event). It’s very capital intensive but can be leveraged to serve multiple segments (nearby cell sites, anchor institutions, and even data centers). Increasingly, fiber is being buried, leaving it less susceptible to storms and automobile accidents. With the exception of local (to the home) cuts, fiber generates far fewer tickets than Hybrid Fiber Coax (HFC – used for most cable broadband) or Digital Subscriber Lines (DSL – the legacy broadband initially deployed two decades ago).

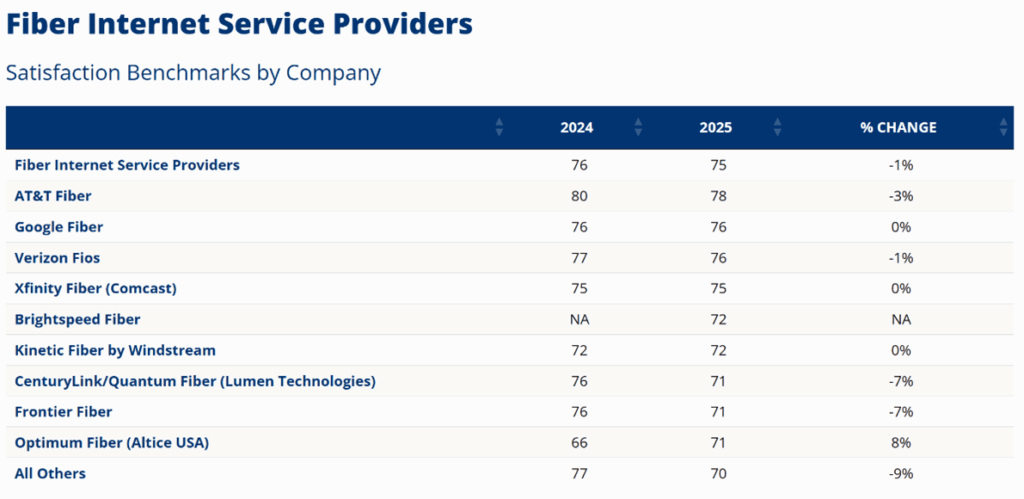

Most importantly, however, it’s new. There will come a day when fiber to our homes is old, but for now, it’s new, and it works well. The recent (May) ACSI results back this up. Here is the table listing the satisfaction rates for fiber providers:

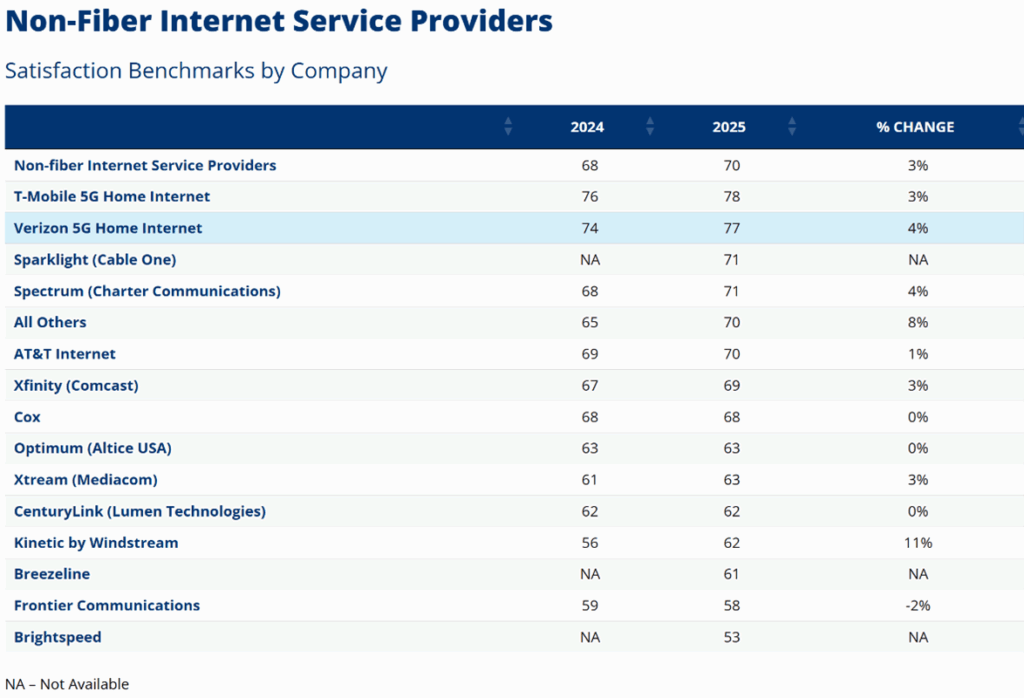

With the exception of Altice Fiber (their HFC score is also below), satisfaction is flat or dropping with fiber providers. But AT&T, who is a primary competitor to Charter in Texas, California and Florida, has very high satisfaction. Verizon Fios, now into its third decade of deployments (and Charter’s primary competitor in New York City), continues to maintain a high satisfaction level. Here’s how HFC, fixed wireless and DSL-based technologies compare:

Fixed wireless (referred to by Charter as “Cellphone Internet”) has a higher score and is improving faster than HFC or DSL technologies. We estimate that there is a seven point gap between fiber and non-fiber Internet Service Providers when fixed wireless is removed, a material gap.

Spectrum outperforms everyone but Cable One (who benefits from many recent plant upgrades and expansions). Brightspeed and Frontier (soon to be purchased by Verizon – still about half of the homes passed) are dead last. Comcast has improved but is still in the middle (and just ahead of Cox).

Charter needs a new battle plan against the newness of fixed wireless and fiber. Being able to bundle mobile with Internet is great, and to the extent that Charter has not attached mobile upsell to every customer touchpoint, they should (we have long believed that they would be better off giving all 2-line or more mobile customers 1 Gbps speeds in the home for life, and recreating the Time Warner Cable “All the Best” product). But Charter was early out of the gates with an “all points” sales strategy for Spectrum Mobile, and it has paid off handsomely.

Second, Charter needs to turn each technology upgrade into a marketable event (“we’re newer”). When FTTH providers open up a new development (or street), they launch local marketing efforts including door-to-door, social media, and crazy things like ice cream trucks. As the technology upgrades occur, Charter needs to consider itself the challenger and have a meaningful switching proposition (perhaps a Xumo-equipped TV with every winback) to counter the in-home investment the FTTH homeowner believes that they have made with fiber.

Finally, after the technology upgrades have been made, Charter should publish their local results:

- Actual speed test results (before and after)

- Trouble tickets (before and after)

- Customer testimonials from switchers (from fiber back to Charter)

Bottom line: Charter (and cable) need to win on each product – mobile, broadband, and video. The fact that they also offer discounts when customers buy more is not the product, but the bundling value proposition. As painful as achieving it may be, Charter should set an objective of switching 30% of those customers who have voluntarily moved to FTTH back to HFC broadband and separately win over 60% or more of the movers who can choose between the two technologies. Until they can show material switching and moving wins, the picture will continue to get worse. As Charter CEO Chris Winfrey indicated on their earnings call, there are marketing changes needed, and this includes a revamp of their local messages to achieve the aforementioned goals.

We have many more events to talk about in the next Brief. Fixed wireless growth is not accelerating but is steady, which is important in a stagnant homebuilding environment. Comcast and Charter (and Cox) have selected T-Mobile as their network for small business customer needs (the strategic implications of this are very large). T-Mobile closed their Metronet transaction last week and will close their US Cellular acquisition on July 31. Each of these topics is worth its own Brief, but we will attempt to concisely summarize the state of the telecommunications industry in less than 2,000 words in two weeks.

Until then, if you have friends who would like to subscribe, please have them sign up directly through the website.

Finally – Go Royals and Sporting KC!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.