Top routing and switching vendors include Alcatel-Lucent, Brocade, Cisco, Huawei

Growing consumer demand for fixed and mobile broadband services is driving significant growth in the carrier routing and switching market, according to a new report from ACG Research.

The firm noted a 9.2% sequential and 3.1% year-over-year increase to $3 billion during the second quarter in the worldwide carrier routing and switching market, which it attributed to growth in fixed broadband traffic and mobile broadband traffic running across 3G and LTE networks. ACG found that core routing equipment witnessed an 11.1% sequential and 12.5% year-over-year increase to $638 million, while edge and switching equipment increased 8.7% sequentially and .9% year-over-year to $2.4 billion.

“New applications, increases in Internet data and video traffic continue to drive global router and switching markets,” ACG Research noted. “Cloud and content service providers have been rapidly expanding their data center capacities to handle the demand for new services. These drivers require flexible and scalable networks and vendors are seeing the benefits.”

Top equipment vendors in the space include Alcatel-Lucent, which posted a .3% sequential increase and 1.8% year-over-year decrease in revenue; Brocade, which saw flat sequential revenue and a .5% year-over-year increase; Cisco Systems, which was down 2.8% sequentially, but up .3% year-over-year; Huawei, which posted a .3% sequential increase and 1.7% year-over-year increase; and Juniper, which was up 1.5% sequentially, but down 1% year-over-year.

NFV, SDN not enough

ACG also noted a growing influence of virtualization technologies into the data center market that providers are looking to take advantage of in bolstering their networks in support of data center interconnectivity. The research firm predicts that by 2019 there will be 60% more data centers in the world’s metro areas and data center interconnect volumes will increase by more than 400%.

“Despite so many [proof of concepts] in [software-defined networking] and [network functions virtualization] being deployed, the overall market still needs scalable reliable routers for providers’ critical services,” explained Ray Mota, CEO of ACG. “Routers aren’t going away any time soon. What we will see is a variety of physical and virtual deployments with expanded TAM into webscalers that need carrier-grade virtual routers and high-performance MPLS switching.”

ACG added that traditional network architecture will have trouble keeping up with market demand, thus the growing interest in more robust NFV and SDN technologies that support automation services.

Bored? Why not follow me on Twitter

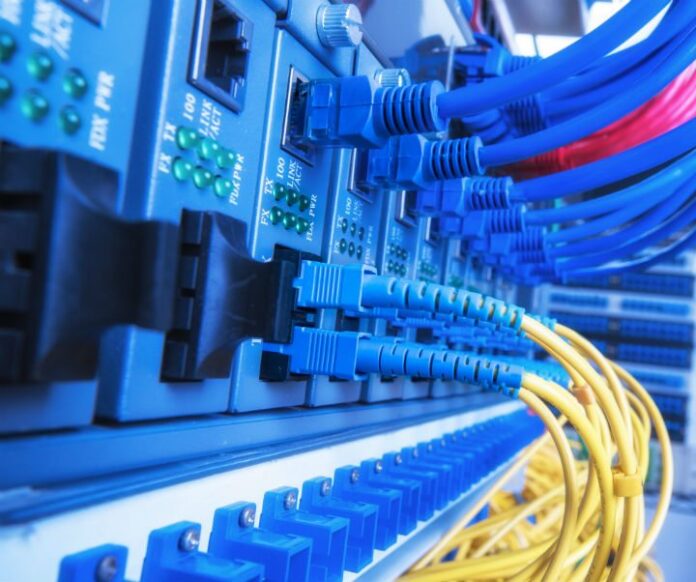

Photo copyright: wklzzz / 123RF Stock Photo