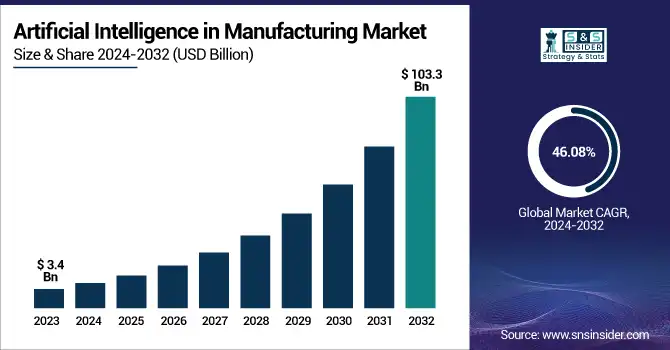

The industrial AI market in global manufacturing will be worth $103.3bn by 2032, a 20-times jump on 2023 – led by AI software platforms, computer vision, and APAC auto-makers.

In sum – what to know:

Big spenders – global AI spend in manufacturing will hit $103.3bn by 2032, up from $3.4bn in 2023 – a 20x increase.

Regional shift – US leads, but APAC will grow fastest, driven by electronics and automotive industries.

Component types – hardware leads today, but AI software and flexible platforms will outpace in growth.

The artificial intelligence (AI) market will grow at a compound annual rate (CAGR) of 46 percent in the manufacturing industry through to 2032, and be worth $103.3 billion by the end of the period. So says US-based market research group SNS Insider, which is hawking a new report on the subject. It represents astonishing growth; total spend on AI hardware, software, and devices in global manufacturing was just $3.4 billion in 2023. As such, SNS Insider is predicting an almost 20-times jump for industrial AI spend in less than a decade (2024-2032).

The firm has run the rule over major Industry 4.0 suppliers – notably IBM, Siemens, Microsoft, Alphabet, AWS, GE Digital, SAP, Oracle, Rockwell, NVIDIA, Intel, Schneider Electric, PTC, Fanuc, and ABB (as ordered in a press note by SNS Insider). The US ranks top for industrial AI, it seems. In 2023, the US market was valued at approximately $0.8 billion and is projected to reach $23.9 billion by 2032 – outrunning the market CAGR with around 45.73 percent compound growth per annum in the period to 2032.

US-native AI suppliers – as mostly featured in the above list – had a 32 percent revenue share in 2023. But SNS Insider reflected: “Rapid industrialization, smart manufacturing initiative by governments, and increasing AI adoption among emerging economies such as China, India, and South Korea will fuel APAC’s dominance during the forecast period – [delivering] the fastest CAGR.” It noted integration of AI into electronics and automotive manufacturing in the APAC region – for predictive maintenance, quality inspections, and “flexible production systems”.

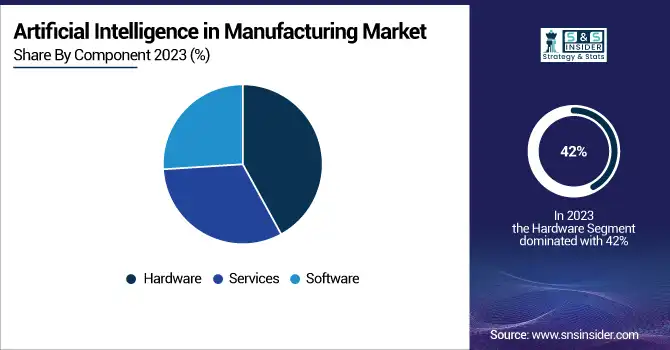

SNS Insider breaks down the industrial AI sector into componentry, applications, technologies, and usage. On the first count, it calculates the hardware segment drives most AI spend in Industry 4.0 – accounting for 42 percent of the revenue in 2023 – with high demand for AI-enabled sensors, edge devices, and embedded chips in manufacturing equipment, plus increased investments in robotics, automated material handling, and industrial cameras. But AI software, closer to 30-35 percent (see image), will see the highest CAGR in terms of total revenue-spend.

Logic says – SNS Insider does not (in its press release) – that software spend will outrun hardware spend in the forecast period. Industrial AI services is the other componentry segment, closer to 25 percent in terms of revenue share. It said: “Demand for flexible, subscription-based software platforms that can easily scale AI models and integrate with ERP and MES systems is driving innovation.” Which sounds like a software/services crossover. By application, production planning dominates, while predictive maintenance and machinery inspection are picking up.

The latter will see fastest growth. By technology, machine learning was top in 2023, with computer vision for quality control growing fastest. In usage, medical devices dominated in 2023, it seems; the “automobile” segment will grow fastest (“with smart production”) over the forecast period. It said: “AI enables automatic welding, painting, and inspecting parts, improving consistency and throughput. AI-powered flexible manufacturing is the competitive edge in a world where there is a growing shift from petrol cars to electric and driverless cars.”