From connectivity to cognition, how should telcos monetize AI at the edge?

Editor’s note: This is part 3 of a three-part series — please read How telecommunications operators can thrive in the software-centric era and The platformization imperative: Redefining telcos to compete in the cloud + AI era first.

As humans, we find comfort in predictability — in our habits, norms, and industry orthodoxies. Yet, as we explored in our first piece, predictability often becomes a competency trap: when markets shift, those clinging to old success patterns are left behind. In this final piece, we explore what comes next: reframing telecom networks not as static pipes for data, but as dynamic intelligence platforms that can spawn new revenue streams.

When Microsoft reinvented itself around Azure, it wasn’t simply launching a product; it was reshaping its identity. The company moved from perpetual software licensing to a consumption-based, elastic fabric of interconnected services. That shift created compounding value. Today, the same opportunity lies before the telecommunications industry.

The bubble isn’t the story, the transformation is

Every major technological wave begins with exuberance that outpaces reality. The dot-com bubble wasn’t a failure of the internet; it was a market correction — the digestion of enormous potential. Valuations crashed, but the infrastructure and behaviors it unleashed endured. Amazon, Google, and Salesforce were “bubble survivors” that went on to define modern enterprise computing.

Now, the same cycle is unfolding with AI. Many call it an “AI bubble,” pointing to inflated valuations and speculative startups. But underneath the noise lies a durable truth: AI is becoming infrastructure where competitive dynamics will be defined. Just as the early 2000s startup wave built the foundation for the cloud era, today’s AI cycle is constructing the groundwork for intelligent systems, inferencing fabrics, and distributed cognition at the edge.

The bubble is the correction, not the collapse. It clears hype and leaves capability behind. Those investing in real, scalable AI infrastructure — hyperscalers, chipmakers, and increasingly Telcos with edge presence — are preparing for the post-bubble world, when AI stops being a story and starts being a utility.

AI’s post “bubble” telco opportunity

Across the Telecommunications industry the sentiment is familiar; Telcos adopting AI to cut costs or improve customer satisfaction. These are valid goals — but they represent an efficiency mindset, not a growth strategy. Every major industry transformation starts with operational efficiency but scales through value creation. The real opportunity for Telcos is not to use AI to optimize how networks run, but to reinvent what networks enable.

AI inferencing at the edge represents that inflection point — where Telcos can move from connecting data to interpreting it, from being the transport layer to being the intelligence layer where proximity is the new power. At its core, AI inferencing is about proximity — the closer intelligence sits to the data, the faster and more contextually relevant it becomes. Telcos already operate one of the most geographically distributed compute fabrics in existence. Their edge presence, coupled with 5G’s latency and bandwidth capabilities, positions them to become the physical substrate of distributed AI.

In the post-bubble economy, this will be where fresh AI data lives; across a mesh of intelligent, local inferencing nodes. For Telcos, that’s not a cost center; it’s the next platform.

From ARPU to AI yield

Microsoft’s reframing from perpetual licensing to cloud consumption set off a wave of change ultimately reshaping how they built product, sold to customers and through partners, and ultimately how the markets evaluated their forward looking potential. We believe Telco’s are approaching a similar paradox and it’s up to them to write their new playbook for the AI era.

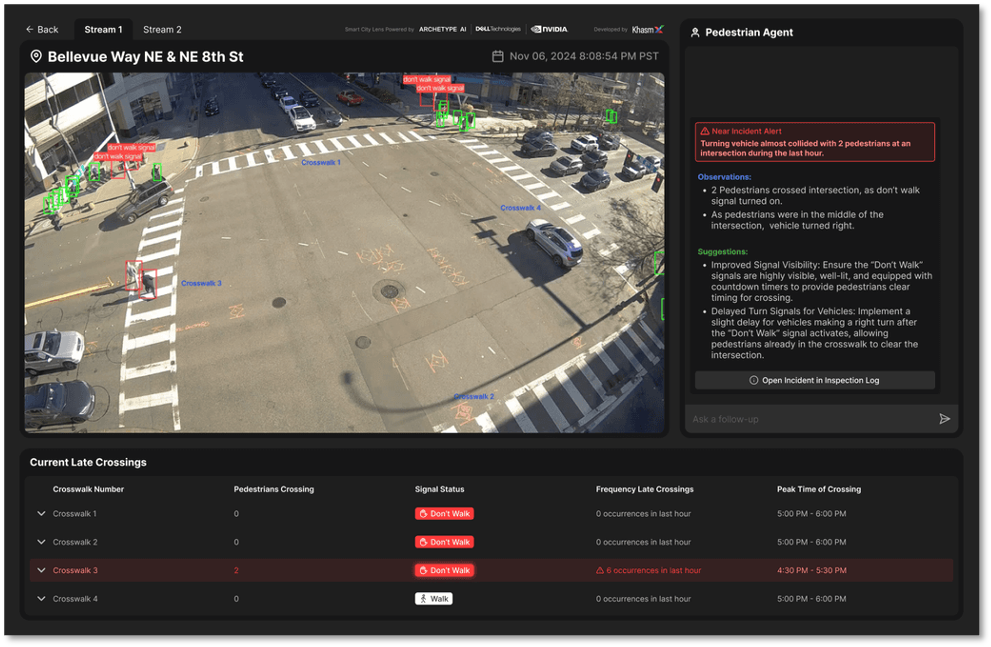

City of Bellevue’s Vision Zero is a perfect example of the Telco AI opportunity. It is a real-world demonstration of Edge AI can enable capabilities that were not possible before. Bellevue’s bold “Vision Zero” to reduce accident fatalities has brought together the innovation ecosystem where Telco is playing an important role in leveraging AI physical foundational model at the edge and giving traffic intersection insights that were just not possible before. The Telco business model here is not gigabyte-based ARPU but rather value-based revenue stream.

As workloads move to the edge, the Telco business model must evolve with them. Traditional metrics like ARPU or gigabytes consumed will give way to AI yield — revenue tied to inference cycles, latency guarantees, or decision throughput. In this world, the network is not selling bandwidth; it’s selling intelligence availability.

The winners will be those who design programmable, consumption-based models for AI workloads — where enterprises can deploy, scale, and measure performance as easily as they do in the cloud today.

The divergence of value: Cloud vs. connectivity

In 2008, the world’s technology and telecom leaders were almost peers in market value.

- Microsoft was valued at roughly $127 billion

- Google at $117 billion, and

- Amazon at just $29 billion — still viewed largely as an online retailer.

At the same time, the Big Four U.S. telcos — AT&T, Verizon, Sprint, and T-Mobile — together were worth just over $310 billion, slightly more than the combined value of those three future cloud titans. Fast forward to 2025, and the equation has flipped completely.

- Microsoft now stands at $3.85 trillion

- Alphabet (Google) at $2.98 trillion, and

- Amazon at $2.35 trillion.

Together, these three represent nearly $9.2 trillion in market capitalization; a 40× increase over 17 years. Meanwhile, the U.S. telecom sector, now consolidated into T-Mobile ($259B), AT&T ($193B), and Verizon ($184B), totals about $636 billion combined — barely a sixth of Microsoft’s value alone. The divergence isn’t about reach or infrastructure; it’s about where the value moved. Cloud players built scalable, software-defined platforms that turn compute and data into ecosystems. Telcos, by contrast, remained anchored in connectivity — indispensable, but commoditized.

Conclusion: From connectivity to cognition

Microsoft reinvented its platform strategy by betting on the cloud. Today, Telcos stand at a similar inflection point — but this time, the platform opportunity is at the edge. For decades, operators have lived within regulatory frameworks that shaped how they built, deployed, and monetized networks. These rules protected national infrastructure and ensured reliability — but they also built a culture of constraint.

Ironically, the companies redefining the future of data — hyperscalers, AI labs, and digital-native platforms operate almost entirely without such regulation. They move fast, experiment freely, and shape markets before policy catches up. That’s not to say Telcos should abandon their regulatory compliance; rather, it’s to highlight how regulation has become a mindset as much as a mandate.AI inferencing represents more than another workload; it’s the foundation of a new digital economy built on proximity, latency, and insight. The choice for Telcos is not whether to adopt AI, but whether to become the platform that enables it. Those who act now will redefine their role from moving bits to moving decisions — from connectivity to cognition. The next platform era has already begun; the question is who will own it.