Private 5G networks will grow due to demand for secure, high-quality connectivity—especially in manufacturing and energy. Lower costs, service models, and MNO resurgence are set to broaden adoption and scale.

In sum – what to know:

Average spend – will drop 40% by 2030 with lighter deployments and op-ex models.

Top industry – manufacturing will lead, with four in five taking 5G over 4G by 2030.

Largest scale – energy sector to drive $2.8B spend; MNOs poised to serve, mainly.

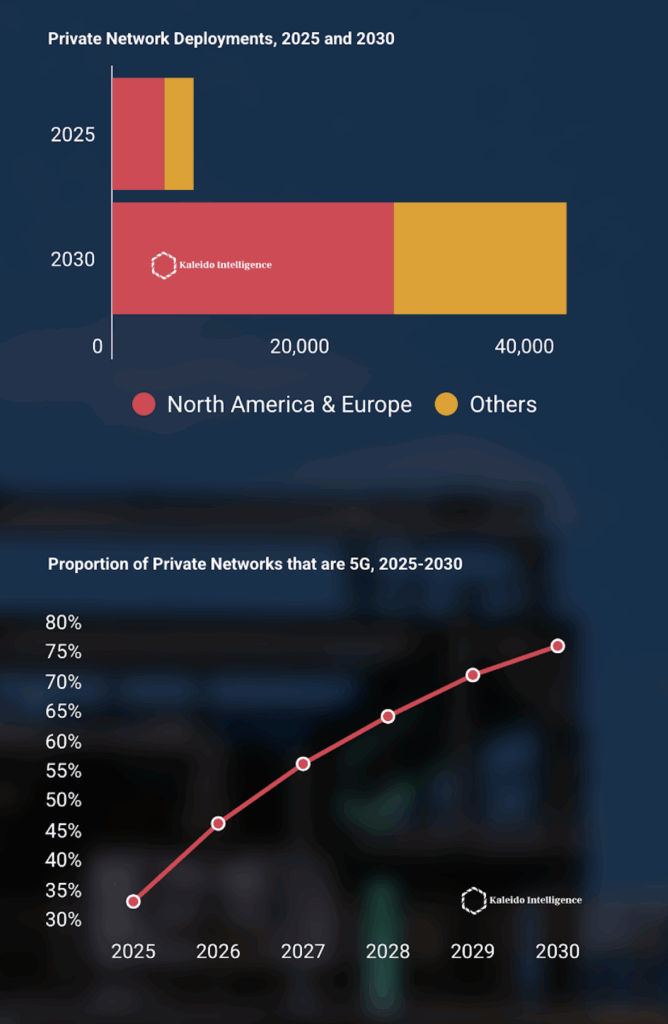

There will be over 40,000 private 4G and 5G networks in 2030, representing growth of nearly 500 percent to the end of the decade. The growth figure puts the 2025 total at somewhere between 7,000 and 8,000 deployments. So says analyst house Kaleido Intelligence, which also says almost 80 percent of active deployments will be private 5G at the end of the forecast period, rather than private 4G/LTE, and that over 60 percent will be in North America and Europe.

Only about 35 percent of private networks will be based on 5G by the end of 2025; the number will have completely “flipped” by 2030, when the lion’s share (78 percent) are 5G-based and just 22-percent still use 4G/LTE. Kaleido Intelligence has a new report (available here), and a new graphic to go with its headline announcement (see below). It says much of the expansion will come with “smaller businesses with large areas to cover”.

This is the sweet-spot for private 5G networks, the firm reasons – where the economics stack up versus Wi-Fi on the grounds that “consistent coverage and secure private connections are still top of mind for many enterprises”. But less dense networks will also reduce the average spend per network by almost 40 percent by 2030, it says. Alongside, incoming op-ex based (as-a-)service models will also make private 5G more accessible to smaller enterprises.

The annual op-ex spend on private networks will reach more than $2 billion by the end of the forecast period, it says; cap-ex deals will still dominate, accounting for over 70 percent of the total private network spend – equivalent to about $4.7 billion per annum, presumably (by working the figures backwards). There are a couple of forecast-factoids in the press notice about different segments, namely the manufacturing and energy/utilities markets.

The manufacturing industry, one of the seminal markets for private 4G and 5G installations, will drive the 5G shift because of its “need for automation and other highly quality-of-service use cases”. It will be the “biggest vertical for private 5G”, says Kaleido Intelligence, with 89 percent of its private networks using 5G by 2030. Meanwhile, the energy market is tied to a prediction about network operators (MNOs) in the delivery of private 5G systems.

The energy and utilities sector will generate a spend of about $2.8 billion by 2030, the firm says. (Which is a hefty share – of about 42 percent of the $4.7 billion total, if the figures in RCR’s envelope maths align.) Traditional MNOs are “best positioned” to “capitalise” on the opportunity to deploy macro-sized regional and national scale private 5G networks for smart grid operations, it says.

It writes: “Traditional network operators missed the boat on the first wave of private network deployments, being outpaced by more agile integrators and network equipment vendors. However, several MNOs are reinventing themselves to be able to compete in the market. Their own spectrum gives them a strong advantage for verticals which require large-scale coverage, such as for power grids, first responder networks and rail infrastructure.”

James Moar, author of the report, stated: “Investment in private 5G networks is about future-proofing and making responsive networks. While the benefits of private networks are often achievable with LTE, 5G architecture allows for network flexibility and customisation that can make the networks more secure, reliable and expansive compared to private LTE.”

Meanwhile, in other private 5G news…