PLEASE NOTE – This is the last email edition of The Sunday Brief that we will distribute, going forward, you will receive an email from WordPress where the online edition is published. Each online edition includes a downloadable PDF of The Sunday Brief at the end of the post if that’s the preferred format. Thanks for your continued interest in this column, but as a result of our substantial online growth over the last three years, we are consolidating platforms. – Jim

Greetings from St Louis, Kansas City, and Cedar Rapids. Pictured is Jim facilitating a panel discussion at the MoKan Wireless Association’s 2025 Summer Lunch and Learn. Many thanks for Tony Sabatino (Diamond Communications), Sam McGuire (Murphy Tower) and Scott Frigon (Project Group) for their participation and insights.

This week’s Brief serves a more of a “halftime planner” than a 2Q earnings preview. We will take a look back at some of the events that have shaped our outlook for the remainder of the year and 2026. We also have plenty to discuss in the market commentary.

In addition to our contribution at the MoKan event last week, find us at the Midwest Peering Summit (MWPS) in St Paul, Minnesota, this coming week and the 19th Annual INDATEL Business Symposium July 22-24 in Kansas City. Make sure to come catch up if you plan on attending either show!

The fortnight that was

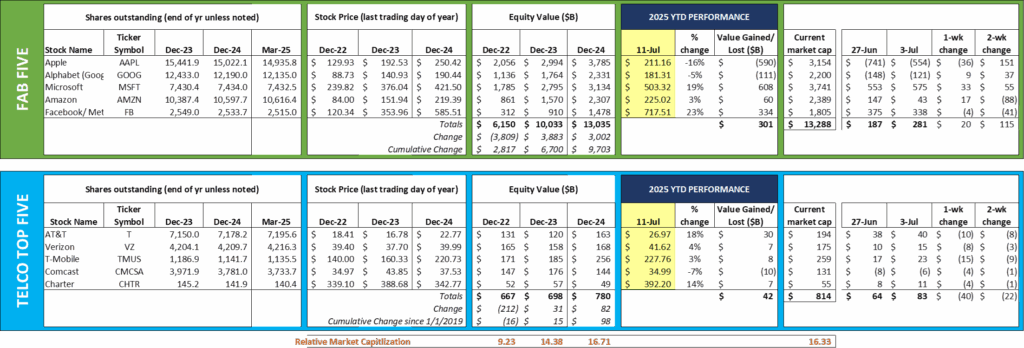

As we highlighted in the last Brief, tariffs and trade uncertainty continue to dominate market sentiment. The Fab Five were basically unchanged as a group over the last week (and still +$300 billion year-to-date). Each stock in the Telco Top Five, however lost value this week, and the group as whole gave back half of 2025’s gains. AT&T is still worth 11% more than Verizon (who celebrated their 25th year as a company on July 1 – CNBC interview of Hans Vertberg here) and Comcast + Charter are still worth about the same amount ($186 billion vs. $175 billion) as their wireless network supplier (Verizon). The flight to domestically-focused US telecoms has been short-lived, and investors are moving elsewhere for compelling returns.

One company that has not attracted a lot of investment this year has been Apple. Reasons for hesitancy to bid up the stock price of the Cupertino legend vary, with Apple’s reliance on hardware revenues, tariff uncertainty, and response to competitor artificial intelligence development activity cited most frequently. On Friday, Bloomberg posted a lengthy article on what Apple will be releasing over the next nine months. This includes:

- A revamped low-end iPhone called the 17e

- New iPad Air models

- New iPad Pro models

- A new Vision headset

- New MacBook Pro models (early 2026)

- New MacBook Air models (early 2026)

- New Apple Watch models (both low- and high-end)

Basically, they are refreshing everything except the iPhone, Siri, and iOS (which is refreshed annually and announced at the Worldwide Developers Conference every June). Each of these new hardware launches will be Apple Intelligence ready when it begins to launch next year (although full impact will not occur until 2027 per this Bloomberg article).

The market for AI talent continued to dominate headlines in July. After failing to come to agreement with OpenAI, agentic coding startup Windsurf agreed on Friday to a $2.4 billion licensing agreement with Google. Several Windsurf employees, including both of their co-founders, are joining Google’s DeepMind division. This follows last week’s announcement that a senior Apple executive, Rouming Pang, was departing for Meta thanks to a rumored $200 million signing bonus (Bloomberg article here). And these events follow Meta’s $14.8 billion investment in and acquihire of the Scale AI CEO in June (more on that from Reuters here). Twenty-five years ago, the signing bonus was a BMW – now it’s enough for certain employees to purchase an entire BMW dealership. Crazy times.

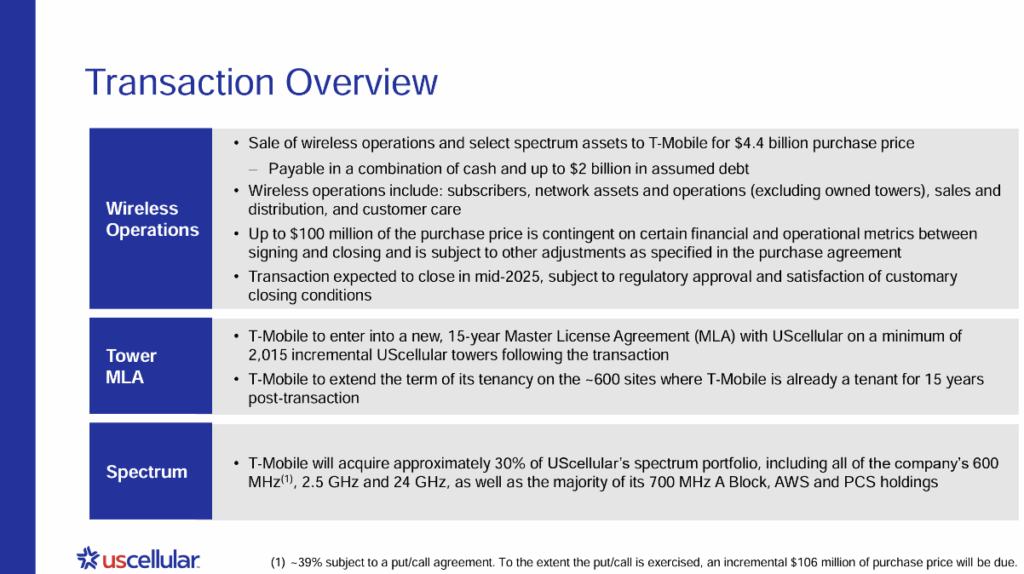

Amidst the craziness of super-sized signing bonuses and sky-high tarrif proposals, T-Mobile received clearance to purchase Metronet and the retail assets of US Cellular late Friday (FCC order here). For those of you who forgot what that transaction entails (or are not familiar with US Cellular), here’s a brief description from the original annoucnement:

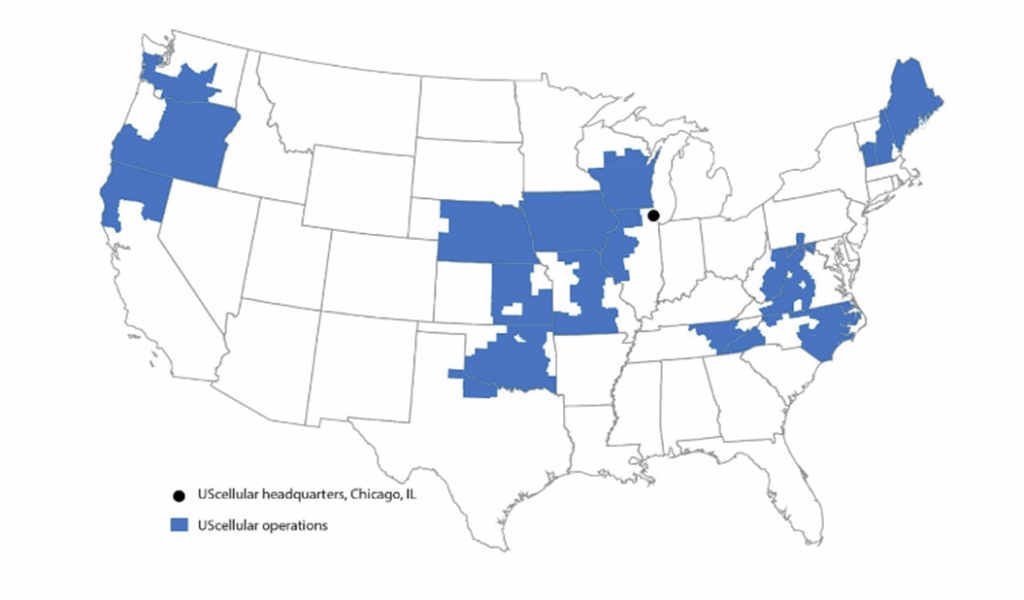

This transaction looks more like a MetroPCS acquisition than Sprint: some spectrum, lots of retail operations (including customer service), but no towers. It adds to T-Mobile’s 600 MHz and 2.5 GHz holdings without breaking spectrum caps. The incremental 2000+ site commitment solidifies T-Mobile’s strategy to improve coverage in secondary and tertiary markets (US Cellular map highlighting the dominant states is nearby). This means that T-Mobile’s coverage in states like Nebraska, Iowa, Missouri, Kansas, New Hampshire and Maine is going to improve. As we have noted previously, the value of the retail operations in the area surrounding the Kansas City area “donut hole” in the nearby picture cannot be overstated. US Cellular struggled for years with high roaming costs for customers who frequented Kansas City – with those customers receiving “owner’s economics” the overall penetration in the five-state area surrounding Kansas City (and Wichita) will improve.

That was not the only transaction that the FCC approved, however. They also approved T-Mobile’s Metronet investment. We have discussed this acquisition in previous Briefs (here and here) and believe that the company’s acquisition of fiber assets will help their overall performance in those areas. Look for T-Mobile to improve products and services for converged customers in the coming quarters. Here are a few areas where we should see T-Mobile’s impact:

- Lafayette and West Lafayette, IN (Purdue University). Around 230,000 total population (108,000 homes or apartment units) with half of the population under age 30 and median household income ~$62,000. Competitors include Frontier (mostly copper), Spectrum, and an electric-cooperative (Tipmont) fiber provider that does business as Wintek. T-Mobile does very well in college towns and Metronet has a solid reputation. Look for a push to complete any unbuilt areas and expansion to fixed wireless throughout Tippecanoe County.

- Rochester, MN (Mayo Clinic). Population similar to Lafayette (220,000) but one that is more evenly distributed (only 37% of the population under 30 years old). T-Mobile has a strong store presence throughout the town including both Sam’s and Costco locations. High median household income ($84K) thanks to the Mayo Clinic. Competitors include Quantum Fiber (soon to be owned by AT&T but in transition) and Spectrum. Metronet’s overall coverage (85%) is similar to Spectrum’s (92%) and far above CenturyLink/ Quantum/ AT&T (8%). Look for a high bandwidth focus on this market like the Fiber Founder’s Club pricing offered to Lumos subscribers.

- Quad Cities (IA/IL). We think this market has the highest potential for T-Mobile as it’s a great market for Metronet and US Cellular. 380,000 total population in the MSA with an age distribution similar to Rochester, MN, and $72K median household income. Competitors vary throughout the Quad Cities (Spectrum and Mediacom split the market; AT&T’s fiber percentage is low), making the opportunity to have a metro-wide offering particularly attractive. We see Quad Cities as an opportunity to serve business customers (particularly John Deere) and their employees with unparalleled service.

We see T-Mobile’s integration of Lumos, Metronet, and US Cellular into the Magenta network as one of the most important influencing events in the second half of 2026.

Influencing events

What could change the current trajectory of the telecommunications industry, and particularly each of their five largest participants? Here are our thoughts on three influencing factors:

- Changes in government policies. As a result of recently passed legislation, we now know more about the timing of the next spectrum auction and tax policy with respect to capital investment. On July 3, AT&T issued a press release committing to one million additional fiber homes passed per year starting in 2026. That’s not a huge commitment, but it’s directly related to the legislation.

A bigger development from the recently passed legislation is the requirement that the FCC and NTIA form a plan to auction 300 MHz of spectrum in the coming year.According to this RCR Wireless summary:

“The bill orders the Assistant Secretary of Commerce and the FCC to identify at least 800 megahertz of spectrum from within a wide swathe between 1.3 GHz to 10.5 GHz — and the bill mostly leaves it up to the FCC and the Assistant Secretary of Commerce for Communications and Information to determine exactly which bands will be up for sale.

The FCC has to auction at least 300 megahertz of spectrum in the near-term, including at least 100 megahertz of additional C-Band spectrum between 3.98-4.2 GHz. That C-Band spectrum auction has to be conducted within two years. The FCC and NTIA also have to find another 500 megahertz of federal spectrum to reallocate for commercial or shared use that supports “full-power commercial licensed use cases” — a specification which has long been the desire of CTIA and mobile network operators.”

There are many more details in the article, but the bottom line is that the legislation is looking for at least $85 billion in auction proceeds from the carriers from these actions. This is good news for the wireless carriers who need more spectrum capacity to keep up with handset data usage.

- Changes to the industry structure. Charter + Cox = New Cox (announced in May). AT&T purchases the mass markets fiber assets of Lumen (also announced in May). T-Mobile absorbs Metronet, Lumos, and US Cellular (all announced in 2024). Verizon buys Frontier (announced last September). These are just a few of the seemingly unending merger announcements impacting wireless and fiber players.

Who has not participated in industry consolidation to date? Here are some thoughts:

- Mid-sized cable providers (Mediacom, Cable One, Altice), all of whom serve suburban and rural markets. The traditional cable TV market is ripe for a re-clustering, particularly involving the Suddenlink division of Altice, Mediacom, parts of Charter Communications, and Cable One.

- Middle-mile fiber providers. For various reasons (a lot of them dating back to the 1980s and 1990s), we have a lot of middle-mile fiber providers in the US, and many times they are limited by state boundaries. There are many ownership issues to overcome, but this is a very good time to reduce the number of middle-mile providers from a few dozen to a few.

- A handful of very well-run firms. Companies like C Spire (fiber and wireless in MS, AL) and Altafiber (formerly Cincinnati Bell). There are six or seven others that make a lot of sense for a carrier to add to their portfolio. Provided their strategy does not change, we also think that T-Mobile could add a half dozen additional FTTH providers to their family without a material financial commitment.

3. Development of Artificial Intelligence. This has two impacts: a) data center construction is consuming considerable capacity for infrastructure and services that would normally be absorbed by the telecom industry (construction, electricians, HVAC installers, generator services, etc.), and b) ensuring a similar and consistent experience for AI results across wireless devices. What is the impact to the telecom industry of a 10 or 20 millisecond response time (95% confidence interval) for 5G networks?

What is the impact to the hundreds of billions of dollars invested if the industry cannot deliver an “AI” result to a mobile device? How close to the radio must the compute and storage be to ensure a consistent result and what impact does that have on the development and adoption of very low latency applications?

One of the carriers will emerge with a portfolio of service levels to meet AI’s many needs. But none of the carriers would pass that test today. T-Mobile is the closest – this is why we believe they will continue to pour billions into their network and core expansions.

The three items above impact each of the Telco Top Five (and most of the remainder of major industry players). But there are many single-company influencing events as well (e.g., what are the implications to a rejuvenated AT&T Business unit? Could Verizon shift their focus from the US to global – how does that impact their leadership?). Understanding the downstream impact of legislative decisions, industry consolidation, and adjacent industries is critical to developing a winning strategy.

That’s it for this week. Earnings get kicked off with Verizon on July 21. We will spend a lot of time in the next Brief looking at the Telco Top Five earnings results. Until then, if you have friends who would like to be on the email distribution, please have them sign up directly through the website.

Finally – Go Royals and Sporting KC!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.