U.S. Department of Justice ordered Keysight to do more divestment and include channel emulation in the assets going to Viavi Solutions

In a new development in Keysight Technologies’ pending acquisition of Spirent Communications, Viavi Solutions is getting a bit more of Spirent than originally thought.

Viavi is now going to get Spirent Communications’ channel emulation capabilities, along with Spirent’s high-speed Ethernet and network security assets, as part of the U.S. Department of Justice’s requirements on Keysight’s Spirent buy.

Keysight beat out Viavi in a bidding war for Spirent Communications in a nearly $1.5 billion deal. That pending transaction already involved required divestments of Spirent’s high-speed Ethernet and network security testing assets—which Viavi had agreed to buy for $425 million. Now, Spirent’s channel emulation capabilities have been added to the asset bundle that Viavi is acquiring.

In a DoJ filing with the U.S. District Court in Washington, D.C., the agency said that together, Keysight and Spirent account for approximately 85% of the U.S. market in high-speed Ethernet testing. DoJ also said that in the network security testing market, each of the two companies earns more than double the revenue of any competitors and that the combined company would have market share of at least 60% domestically.

In RF channel emulators, DoJ said that the combined market share of the two companies would be more than 50%. “The market for RF channel emulators is already highly concentrated and would become significantly more concentrated after the proposed merger,” the agency said.

Spirent Communications reported last month that revenue and orders were both “in line with our plan and in line with the same period last year” in a trading update. In its trading update, Spirent said that its market drivers remain intact” and it maintained strong orders. The company added that there were “some slight delays for our assurance solutions, however this was offset by strong demand for high-speed Ethernet due to growing demand for 800G, our new AI solution and support for data centre builds.”

Keysight expects the Spirent transaction to close by the end of July, although it is still working through regulatory approvals with Chinese authorities.

Viavi will acquire the associated Spirent businesses shortly after closing.

In other test news:

-Test companies are gearing up for this year’s IMS 2025 conference in San Francisco, set for June 15-19. Rohde & Schwarz will be showcasing its solutions for phase noise testing and a new vector network analyzer—and R&S is also teasing the debut of a new instrument that it describes as a “game-changing analyzer that will overcome the limitations of today’s measurement methods,” which has multiple input ports and cross-correlation capabilities and will support “completely new measurement scenarios in RF system testing.” That instrument will make its first appearance at IMS.

Keysight Technologies, meanwhile, plans to highlight its RF circuit emulation capabilities at IMS, plus phase noise testing and the capabilities of its vector network analyzer portfolio, among other demonstrations and talks from its experts.

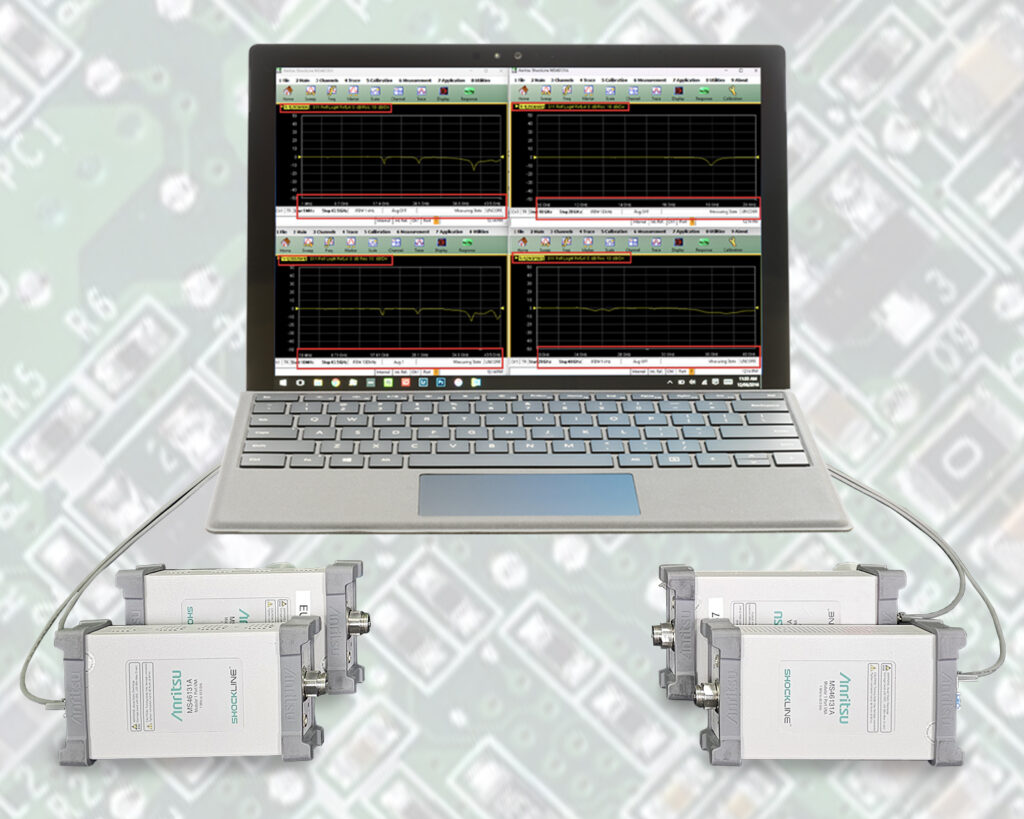

–Anritsu has added a new “simultaneous sweep” capability to its ShockLine MS46131A VNA, so that synchronized, one-port S-parameter measurements can be taken across up to four of the VNA units, which of which can be independently configured. “The result is significantly reduced test time and enhanced flexibility for a wide range of measurement scenarios,” the test company said in a release.

Anritsu said the new functionality is useful for things like remote test set-ups in anechoic chambers, multi-band antenna testing for LTE and Wi-Fi 7, and 5G testing in Frequency Range 2 between 24 GHz and 52 GHz, or in the FR3 range from 7.125-24.25 GHz.

-ICYMI: How are tariffs impacting test companies? While the details of tariffs and trade restrictions are changing week to week, there are some overarching strategy points made by executives during their Q1 investor calls that offer insights into how test equipment companies are navigating the uncertainties. Read perspectives from Viavi Solutions and Teledyne in this piece, and from Keysight Technologies and Teradyne here.