U.S. export controls cost Nvidia billions, but a pivot to sovereign AI and surging infrastructure demand helped deliver a $44.1B quarter

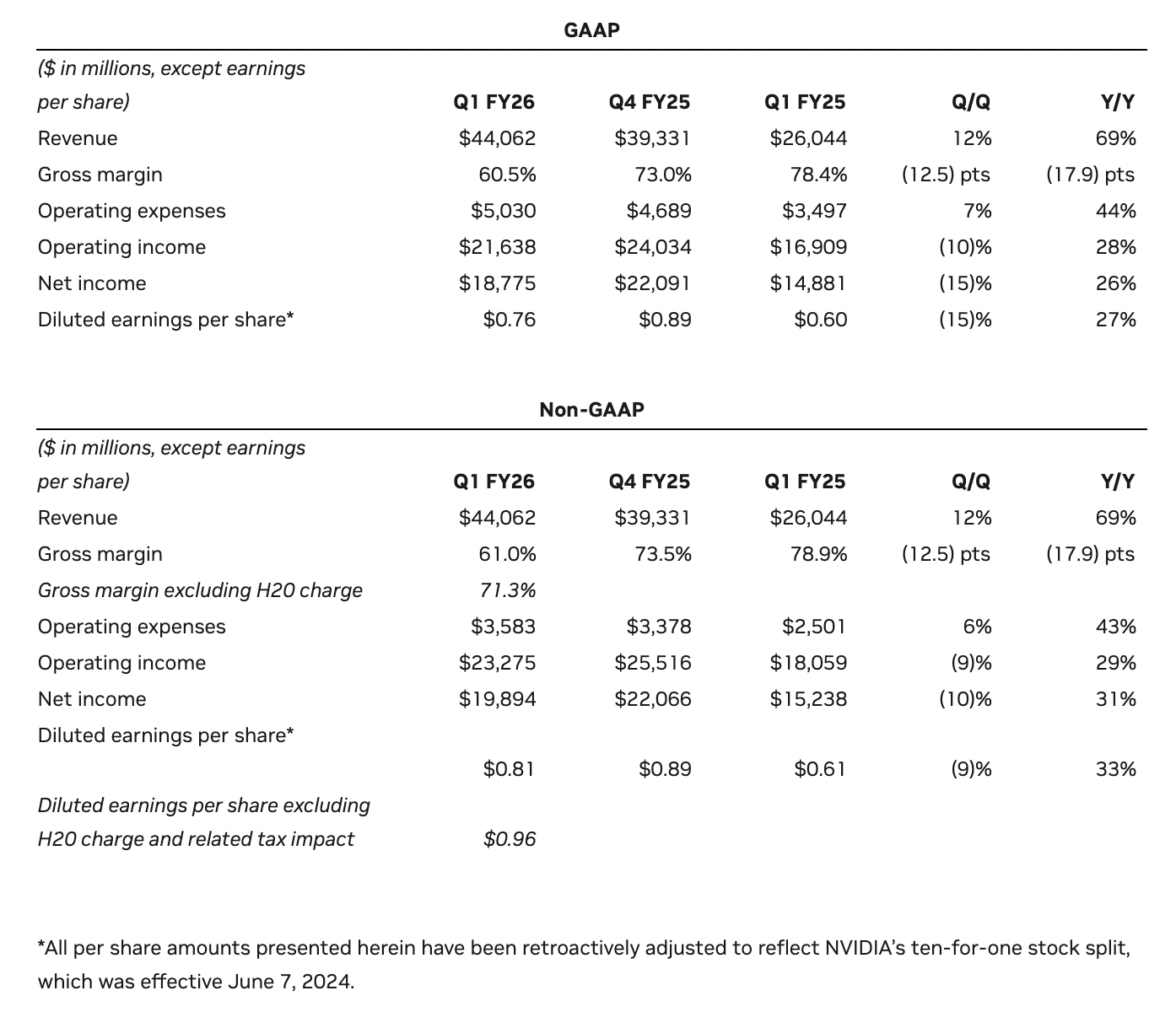

Nvidia reported a record-breaking fiscal first quarter of 2026 (for the quarter ending April 28, 2025), reaffirming its dominance in the AI chip market despite mounting U.S.–China export tensions. The company reported revenue of $44.1 billion, marking a 69% increase year-over-year and a 12% rise from the previous quarter.

In April 2025, the chip company was informed by the U.S. government that a license is required for exports of its H20 AI chips to China. “As a result of these new requirements, Nvidia incurred a $4.5 billion charge in the first quarter of fiscal 2026 associated with H20 excess inventory and purchase obligations as the demand for H20 diminished,” the company stated.

On a call with investors, Colette Kress, Nvidia executive vice president and CFO, stated: “We are still evaluating our limited options to supply data center compute products compliant with the U.S. government’s revised export control rules. Losing access to the China AI accelerator market, which we believe will grow to nearly $50 billion, would have a material adverse impact on our business going forward and benefit our foreign competitors in China and worldwide.”

Looking ahead, Nvidia anticipates an $8 billion revenue loss in Q2 stemming from these restrictions.

The data center segment, a key revenue driver for Nvidia, generated $39.1 billion in Q1, up 73% from the same period last year. This growth underscores the escalating global demand for AI infrastructure, even as the company navigates geopolitical hurdles. “Countries around the world are awakening to the importance of AI as an infrastructure… just as they had to build out infrastructure for electricity and Internet, you [have] to build out an infrastructure for AI… that creates a lot of opportunity,” CEO Jensen Huang told investors.

As China-related export restrictions tighten, Nvidia is leaning into sovereign AI as both a growth engine and a geopolitical hedge. By helping nations build their own AI infrastructure — complete with domestic data centers, custom models and localized compute — the company reduces its exposure to any single market and aligns itself with governments seeking digital autonomy. This shift not only offsets concentration risk in China but positions Nvidia as a key enabler of national AI strategies worldwide. “Sovereign AI is a new growth engine for Nvidia,” said Huang.

Market outlook and investor response

The company projects $45 billion in revenue for the next quarter, slightly below some forecasts, reflecting ongoing uncertainties in global AI chip trade policies.

However, despite these challenges, investor confidence in Nvidia remains robust. The company’s stock rose 5% in after-hours trading following the earnings report. Analysts believe that Nvidia’s strong data center performance and global demand for its AI chips will continue to drive growth, even amid geopolitical challenges. As of May 29, 2025, the chip company’s stock is trading at $134.81, reflecting a slight decrease from the previous close.

“The age of AI is here from AI infrastructures, inference at scale, sovereign AI, enterprise AI, and industrial AI, Nvidia is ready,” said Huang.

Q1 Fiscal 2026 Summary