Despite leading AI adoption, only 25% of banks are using AI strategically, says a new BCG report. Their traditional advantages are being eroded as generative and agentic AI reshape competition, and force total transformation or a total loss of market relevance.

In sum – what to know:

Pilot projects – most banks are stuck in pilot projects, failing to scale AI for real competitive advantage amid accelerating gen AI disruption.

Old advantages – pricing power and customer loyalty are being eroded by AI systems, dismantling banks’ historic complexity-based advantages.

Total reset – banks must overhaul strategy, tech, and governance, or risk losing their places in a remade global financial ecosystem.

Despite its status as the most progressive market for AI adoption, only one in four banks are actually using AI to build any kind of serious competitive edge. So says a new report from Boston Consulting Group (BCG), which finds most are stuck in scattered low-impact pilots, tinkering at the edges – even as they might perceive that new generative AI and potential agentic AI initiatives are starting to accelerate disruption in others.

The report draws a number of conclusions, some of which are specific to banking, and some of which might be applied to any industry (and any new technology or change initiative within any industry). AI is a “strategic fault line” in banking, it says. The era of experimentation is over. Predictive, generative, and agentic AI are reshaping how banks operate, compete, and deliver value – forcing a redefinition of competitive advantage.

And most banks are not moving fast enough to stay relevant. Again, such a characterisation might be applied anywhere; but the report is about banking and banking is about the furthest along. In particular, generative AI is an “inflection point”, says BCG – accelerating AI’s impact, after long years and good application of predictive AI, and “amplifying both opportunities and risks”. Lots to ponder then, and the opportunities and risks are just sharper.

BCG writes: “Agentic AI propels this shift even further by moving AI from analysis into execution. Together, predictive, generative, and agentic AI are redefining the banking business – and eroding pillars that have long underpinned banks’ advantage.” Which is, maybe, the most interesting bit of the report, actually. Traditional banking advantages are being erodes; traditional profit levers are under pressure – in very specific ways.

“AI is reshaping the very foundations of financial competition – from how trust is built, to how value is delivered, to who controls the customer relationship. Traditional moats are being dismantled. Historically, banks benefited from complexity. Customers stayed put, pricing structures weren’t always clear, and financial products were tied to proprietary distribution channels. AI is eroding these advantages,” says BCG.

It explains: “AI agents will optimize financial decisions in real time, making it easier to switch providers… Banks that once relied on stickiness will need new ways to earn loyalty. AI-driven transparency will expose rate structures, fees, and lending terms in real time, eroding pricing power based on opacity. Banks will need to compete on financial value – offering transparent pricing – as well as intangible value: the timeliness and quality of advice and [understanding].

“AI-led financial decision making is shifting control from banks to digital platforms that act as financial gatekeepers. Generative AI is a hyper-accelerant in this evolution – enabling more autonomous, seamless, and personalized experiences that pull activity away from traditional banking channels. Agentic AI will amplify these changes, making it even harder for banks to own the customer relationship.”

Bank profit models face significant pressure as AI-driven underwriting and real-time credit risk assessments increase pricing transparency, reducing loan margins. Traditional advisory roles in wealth management and commercial banking are also being disrupted, with AI streamlining portfolio management and financial planning. To remain competitive, bankers must offer value beyond AI capabilities, making advisory services a key differentiator.

Fee-based transactional services are under threat too. AI-powered payment networks and embedded finance platforms are shifting transaction volumes outside traditional banking channels, forcing banks to reconsider their place in the financial ecosystem. And yet banks are cautious – notably because of ethical concerns and current limitations with generative AI. Investment reflects this caution.

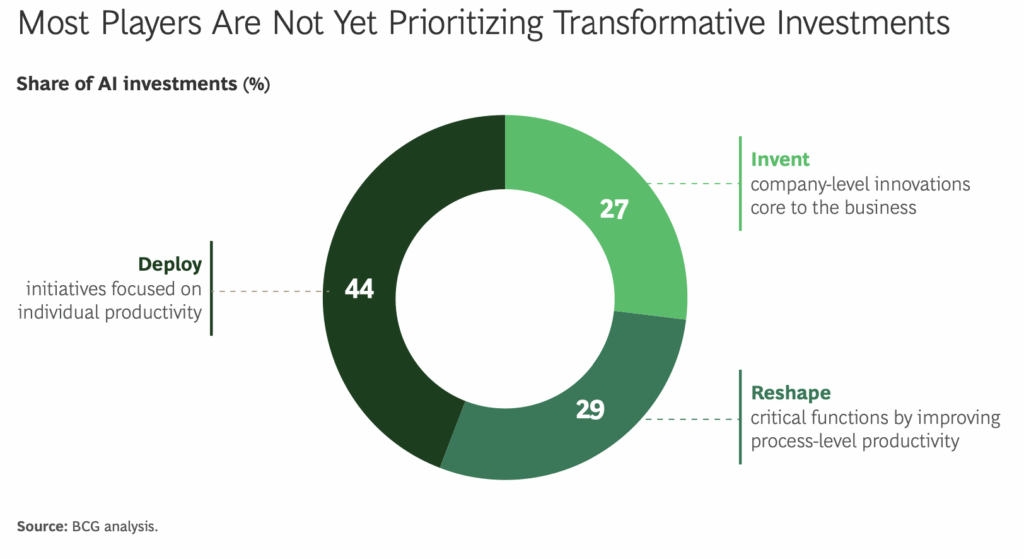

BCG’s AI Radar says a third of banks plan to invest over $25 million in AI in 2025 – which is somewhere between 0.5 percent to one percent of revenues. BCG writes: “But too much of this funding is going toward isolated productivity improvements rather than broader transformation. Such investments suggest that many banks are still playing it safe.” Additionally, 60 percent of banks lack clear financial metrics to track AI impact.

And we all know the IoT mantra: if you don’t measure, you don’t know, and you can’t improve. “Without clear metrics to ensure ongoing strategic alignment, they won’t generate the ROI they need,” says BCG. All of which sounds like a mess, of course – except that the survey reflects a moment in time, not just in banking, but in the whole global economy. And the BCG advice – carpe diem (get a good consultant) – applies to every enterprise vertical.

It calls for a total reset of strategy, technology, governance, and workforce – to survive the coming AI-driven reshuffle. Leadership, urgency, and full-scale investment will determine which banks shape the industry, it says – and which are shaped by it. “The next five years will define the next 30,” it writes. Sort your outdated tech stacks, fragmented data, and siloed AI models – is the message. Leadership is everything in this total industrial transmogrification.

Seek counsel – it basically screams. “Upgrade your strategy… Put AI at the center of tech and data… Own the AI governance agenda… Ready the organization… Act Now… Get started with no-regrets moves… Drive alignment through visibility and intent… Lead from the top.” Yadda yadda. You know it already, but there’s some interesting stuff in the report, including some good technical graphics about AI workloads and deployments.

BCG ends: “The opportunity is enormous – and fleeting. Banks that move decisively will define the future of financial services. The rest will compete for what’s left.”