The global market for cellular IoT module slipped by around two percent in terms of annual shipment volumes in 2023, compared to 2022. It is the first time the cellular IoT sales have shrunk over a 12 month period, according to Counterpoint Research, which has a new report about it. It cited supply chain disruption and reduced demand from certain enterprise and industrial IoT sectors. But the market will stabilise in 2024, said the firm, and see “substantial growth” in 2025 on the back of “widespread adoption” of 5G and 5G RedCap across all IoT categories.

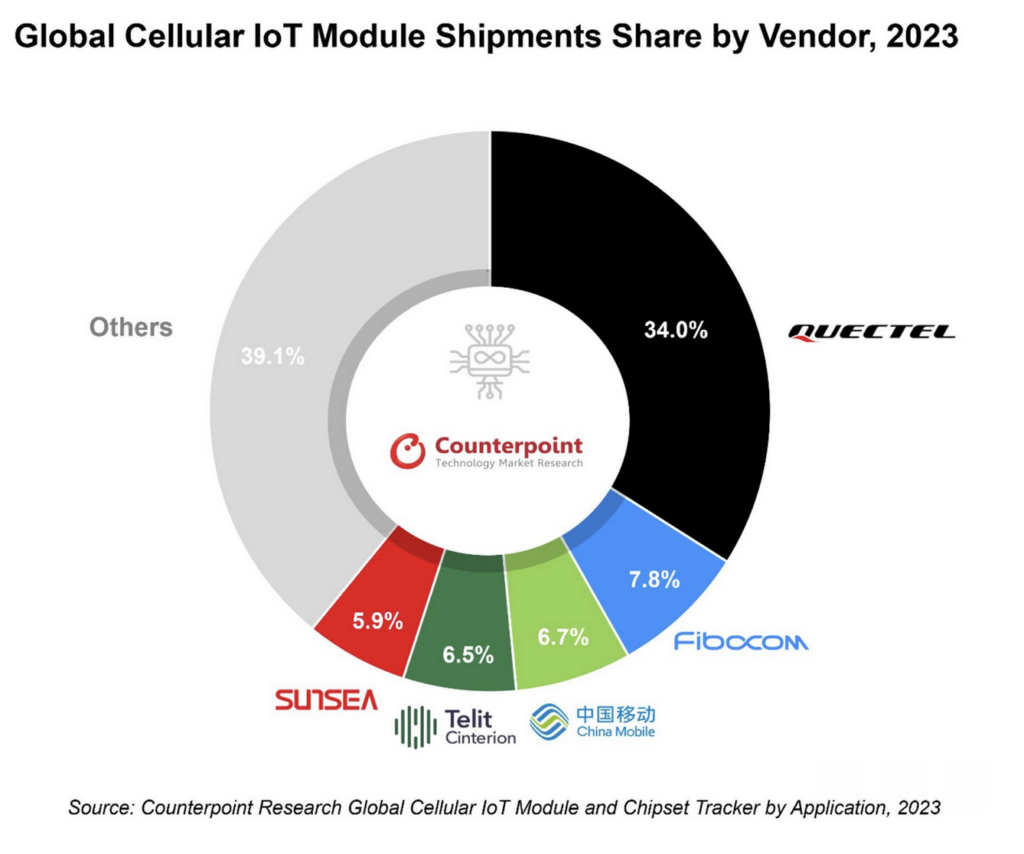

China-based Quectel maintained its lead as the biggest cellular IoT module maker by volume. But Quectel saw a decline in its market share because of weakened demand outside of China; its total share stands at 34 percent of the market – which still completely dwarfs its rivals. Quectel was followed in the rankings by Fibocom (7.8 percent) and China Mobile (6.7 percent), both also based in China; these companies claimed double-digit annual growth in sales, said Counterpoint Research.

China Mobile’s growth was driven by smart meters, asset trackers, and POS applications; Fibocom’s growth was driven by POS and telematics applications. The recent merger of European makers Telit and Thales propelled the combined business, Telit Cinterion, into fourth, with 6.5 percent. Telit is partnering with VVDN for local production in India, a key growth market. Quectel, incidentally, has partnered with Syrma SGS Technology to do the same.

Meanwhile, Chinese brands like Unionman, OpenLuat, Lierda, and Neoway have seen “significant growth” in smart metering, asset tracking, and POS terminals. The rest of the market, combined, contributes to 39 percent of total sales. Counterpoint Research said: “India and China have shown positive growth due to increasing demand in the smart meter, POS and asset tracking markets.”

Conversely, the rest of the world has seen sharper decline – “indicating a lack of expected market momentum,” according to the company. Anish Khajuria, research analyst at Counterpoint Research, commented: “In 2024, the IoT module market is expected to return to growth in the second half of the year with normalizing inventory levels and increasing demand in the smart meter, POS and automotive segments.”

Of various cellular IoT technology types, LTE (4G) Cat 1 bis grew the fastest in 2023, capturing over 22 percent of total shipments, said Counterpoint Research. In China, LTE Cat 1 bis has now become the primary cellular standard for POS, smart meter, telematics, and asset tracking – “owing to its affordability and energy efficiency”, said the firm. The market is slowly transitioning from LTE Cat 1 and NB-IoT to more efficient LTE Cat 1 bis, it added.

Around 12 percent of modules shipped in 2023 were equipped with AI capabilities at software or hardware level. “These modules are gaining popularity in high-end markets such as automotive, router/CPE and PC, facilitating the management of the escalating data load in these sectors,” said Counterpoint Research. It suggested 5G RedCap will drive uptake of cellular IoT in 2025 in smart meters, routers/CPE, POS systems, automotive solutions, and asset tracking applications.