Greetings from Canandaigua Lake (upstate NY – pictured), Jefferson City (Missouri), and Kansas City. The temps have heated up along with 2Q earnings releases, and stock prices for AT&T and Verizon are melting like double-dipped ice cream cones in the July heat. This week, after a very brief market commentary, we will take a look at Ma Bell and Big Red’s earnings. There’s a lot to cover.

Before going into the commentary, a quick note of thanks for the dozens of comments on the last Brief. We took a different tone highlighting start-up successes during the last recession, and many of you responded with stories and suggestions for future lists. We loved the feedback – keep it coming!

The Fortnight That Was

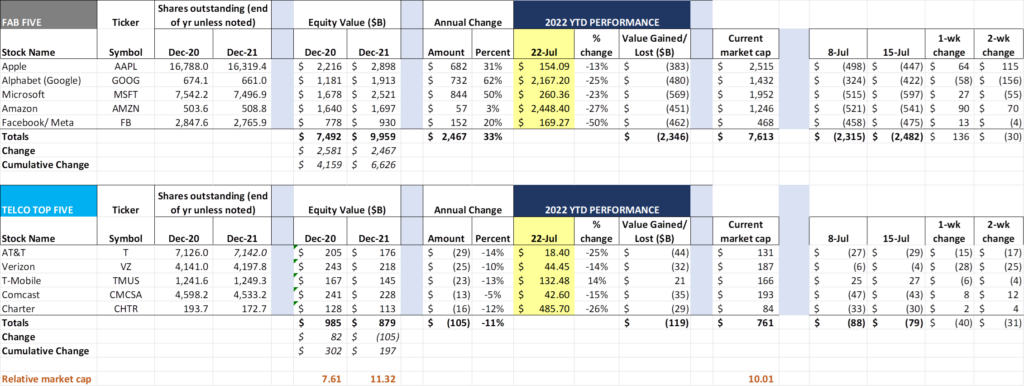

Editorial note: The Alphabet/ Google and Amazon stock splits will be correctly reflected after each reports earnings (by the next Brief). The equity market values are correct, but the share counts should each be 20x higher and the share price 20x lower.

While we discuss Verizon and AT&T earnings below, most earnings announcements are yet to come. Here’s the scorecard of earnings results for the remainder of the Fab Five/ Telco Top Five:

AT&T: Thursday, July 21

Verizon: Friday, July 22

Microsoft: Tuesday, July 26 (p.m.)

Google: Tuesday, July 26 (p.m.)

T-Mobile: Wednesday, July 27 (a.m.)

Meta: Wednesday, July 27 (p.m.)

Comcast: Thursday, July 28 (a.m.)

Apple: Thursday, July 28 (p.m.)

Amazon: Thursday, July 28 (p.m.)

Charter: Friday, July 29 (a.m.)

Despite earnings-related nosedives in other tech stocks (SNAP down 39%, PINS down 14% on Friday alone), the Fab Five held relatively steady last week with Alphabet the only loser in the group. Apple is successfully holding on to recent gains, while Google continues to show some near-term weakness.

The big Fab Five news was Amazon’s announcement that they would purchase One Medical, a health care provider, for $3.9 billion. More on the reasons and rationale for the acquisition here. Neil Lindsay, whom many ex-Sprinters remember well, will be leading the acquisition and integration effort (Amazon also owns online pharmacy PillPack and learned a lot from their now defunct venture with JP Morgan and Berkshire Hathaway). Interestingly, one of Neil’s colleagues at Sprint, Jeff Hallock, now runs Red Ventures’ Health care division which owns website properties such as www.healthgrades.com. Both have successfully made the transition to new industries.

The Telco Top Five value generation was dominated by Verizon and AT&T earnings which are analyzed below. AT&T was down $15 billion for the week and Verizon down $28 billion. While this has gone unnoticed by most in the analyst/ media world, it caught our eye that Comcast is again the market capitalization leader in US telecom – not because they have done particularly well this year (down $35 billion), but because they have done less poorly than Verizon. While Comcast announces earnings next week, we don’t think that there will be material downside surprises.

In another “you probably missed this” announcement, Moody’s announced last week that they were raising their debt rating on T-Mobile (here). That makes two out of three agencies with investment grade ratings. We are very interested in T-Mobile’s plans to address the current upcoming recession – they understand the dynamics of changing consumer demographics as well as (or perhaps better than) their peers. While their earnings headlines will still be focused on fixed wireless gains in rural markets, Sprint synergy attainment, and 5G deployments, their balance sheet is quickly becoming a competitive differentiator (more on that in a couple of weeks).

And, for those who follow the cable industry and the remarkable demise of Altice, Bloomberg announced on Thursday that they have engaged Goldman Sachs to possibly sell the Suddenlink cable unit. No doubt that Mediacom and Cable One will be taking a look – both would do a much better job of integrating Suddenlink’s operations than their current owner. Our hunch is Mediacom emerges the winner if the unit is actually sold.

One final note – Ericsson announced this week that they had closed on their $6.2 billion acquisition of Vonage announced late last year. While we understand the logic of the acquisition to the Ericsson product line, we wonder how effectively Ericsson will actually serve the current Vonage base. In a year where M&A has been less prevalent for larger carriers, this one is a real headscratcher.

AT&T and Verizon Earnings – What’s the Post-COVID Strategy?

AT&T and Verizon were the first two companies of the Fab Five/ Telco Top Five groups to announce 2Q earnings. While each company is addressing similar problems (e.g., deploying newly acquired C-Band spectrum, trying to gain broadband market share from other competitors, satisfying the needs of both dividend-hungry and share growth-hungry shareholders), they are solving some of them in very different ways.

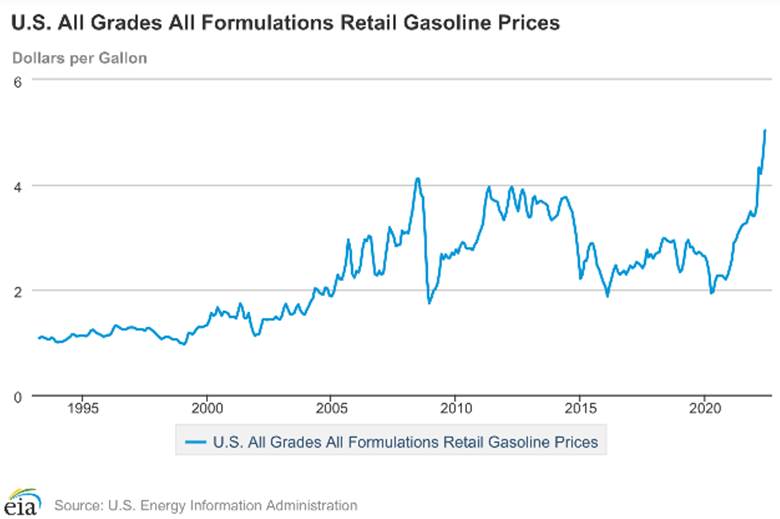

All of these changes are being made in light of an increasingly uncertain and geographically unique economic environment. Customers were better bill payers during COVID. Housing was more plentiful (and affordable) prior to COVID. Gas prices were between $2.60 and $2.70 per gallon for the second half of 2019 (chart nearby – accompanying data here). Today, a gallon of gas costs ~70% more ($4.32 per AAA) than it did three years ago.

And, during COVID, the T-Mobile/ Sprint merger closed (April 2020). Many people have been working over the last two years to integrate Sprint’s 2.5 GHz band into the T-Mobile “5G layer cake.” If Ookla Speedtest data is to be believed (and we like their work – recent results here), T-Mobile did a heck of a job. As we emerge from COVID, there’s an additional choice for most of America.

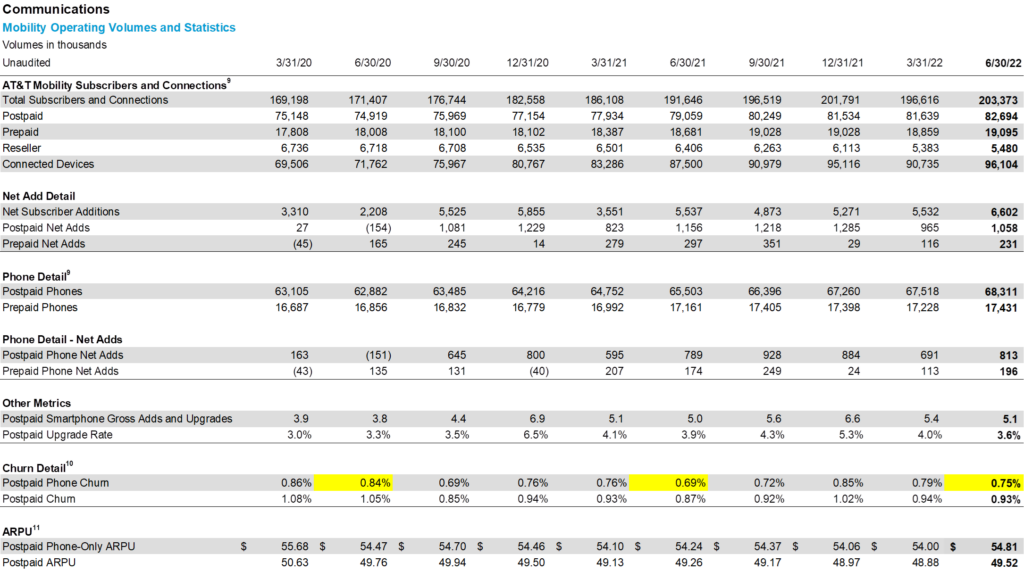

AT&T, as we have discussed in many Briefs, is focusing on deploying capital (fiber, primarily where they are the legacy phone company, and wireless on a nationwide basis) and retaining wireless customers. Here’s their scorecard for wireless (full materials here – highlights below added):

AT&T has grown their postpaid base by 5.4 million postpaid phone subscribers since John Stankey took office in 2Q 2020. They have also grown their prepaid base by over 0.5 million during the same period. Monthly churn is more than 10% lower than 2Q 2020 but slightly higher than last year’s levels. ARPU, whether measured on a phone only or total postpaid basis, is remarkably steady. Overall, wireless metrics are very good – some of the gains might have come from Sprint defections during the T-Mobile transition, but AT&T has kept most of their highest value customers and attracted a few others.

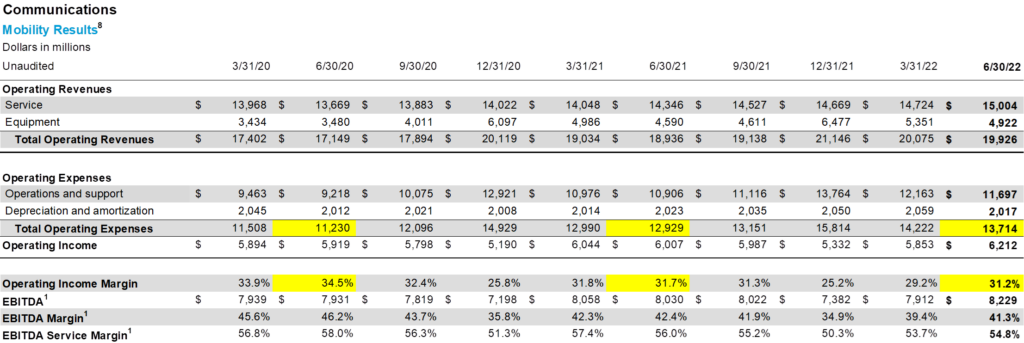

Traditionally, scale economies have come with growth, and 5.9 million subscribers should yield more mobility segment profits. As the quarterly trending chart shows below, however, that is not the case:

The combined 4G and 5G network is less profitable than the waning years of a 4G-only network (quarterly service revenue growth of $1.3 billion from 2Q 2020 to 2Q 2022, and quarterly operations and support growth of $2.5 billion over the same period). And this is before most C-Band capacity is deployed. The cost of increased market share has been lower margin percentages (even with AT&T’s continued cost reduction programs), and the trend is not encouraging. We struggle to see how the C-Band auction price ($23.4 billion for AT&T on spectrum alone; over $31 billion in total expenditures) will earn an after-tax return greater than our estimated cost of capital – by our calc, AT&T will need to generate an additional $2.6-$3.4 billion in annual after-tax profits to generate incremental economic value for the shareholder (Verizon has an even steeper hill to climb as we describe below).

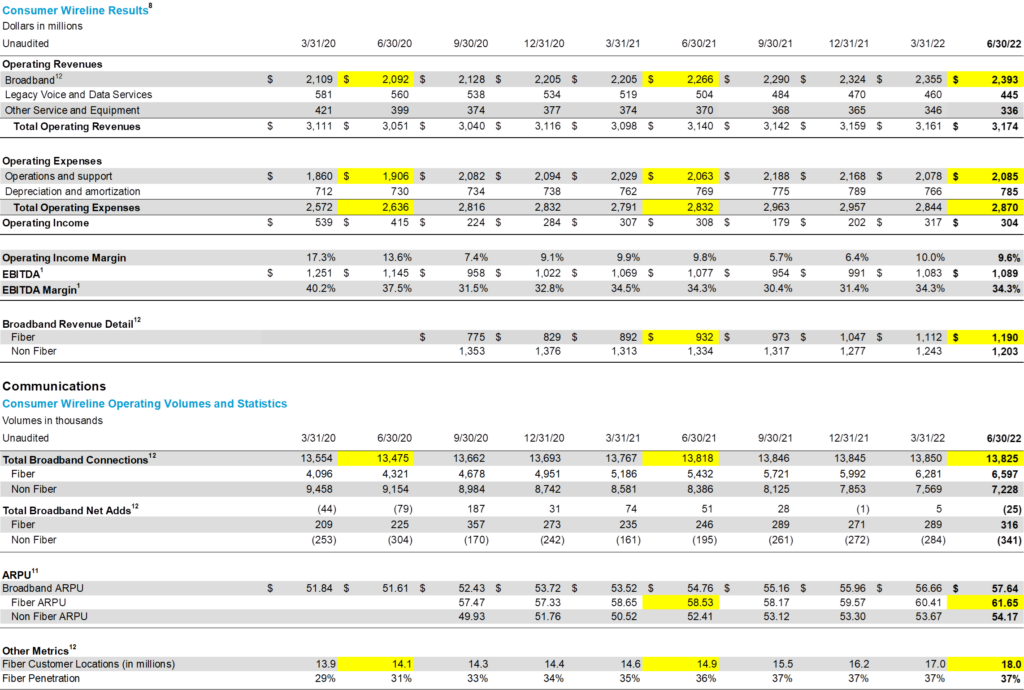

Wireless isn’t the only network in transition for AT&T – they are furiously deploying fiber to compete with cable in half of their traditional telephone exchanges. Here’s the chart for consumer wireline (financial and operational metrics reported together):

On the positive side, AT&T has their deployment engine humming, with 1.8 million new consumer fiber locations added the last six months, and 3.1 million over the last year. Per AT&T’s comments on their earnings call, they will likely reach 30 million locations by the end of 2023 and evaluate future builds based on government funding prospects and their ability to sustain/gain more than 45% market share in their deployed footprint.

The other encouraging sign in the table above is AT&T’s ARPU. For those of you who are not as close to AT&T’s pricing as we are at American Broadband, AT&T has adopted an “everyday low price” or ELP strategy for every fiber deployment. They use short-term prepaid card promotions, primarily for online order completion, as their only incentive. No install fees, no contracts, no extra Wi-Fi charges, no usage caps and (now) no HBO Max content promotions. And their baseline speed is a respectable 300 Mbps symmetric for $55/ mo.

This is a competitive offer, and one would expect to see an ARPU close to $55. To see Fiber ARPUs at nearly $62 and growing at 5% is encouraging to say the least. It highlights something we noted in previous discussions about Charter’s earnings: that there is an addressable market for higher broadband speeds if the network is engineered to meet the associated speed promise. Given the high overlap with Charter (Los Angeles, Dallas/ Ft Worth, Austin, San Antonio, St Louis), it’ll be interesting to see Charter’s ARPU growth percentage.

Like our discussion of the 4G + 5G scale diseconomies, the wireline network is also experiencing scale issues. Broadband service revenues are $301 million higher than 2Q 2020 (pre-fiber push), but operations and support expenses are $179 million higher for the same period (and fiber requires much less maintenance than copper). That’s better than wireless, but not good enough.

Our guess is that AT&T is experiencing share gains in the metro areas where they are expanding (e.g., the Spectrum overlap cities mentioned above + Chicago, Atlanta, Miami and other areas where expansion into fiber is greeted as a better alternative to cable), but that they are quickly moving up the cost curve in secondary and tertiary markets as DOCSIS 3.1 cable footprints expand. While new housing starts have slowed, they have not stopped, and we think that cable continues to beat most telco operators to the punch with new developments.

As a result, AT&T needs to be more decisive in exiting the ~25-27 million household footprint that they have indicated they will only serve with wireless (if at all) and shed these costs faster. A tough calculus given 2023 BEAD (federal/ state infrastructure) program decisions, but the costs of operating two networks are keeping consumer wireline margins down.

Then there’s the unusual comment made by CEO John Stankey at the end of his opening remarks in the context of overall weakness in the business wireline segment:

“Lastly, we saw inflation and wholesale network access charges we incur to provide services to customers outside of our footprint due to contractual resets. This cost pressure resulted in more than 20% of the segment’s year-over-year EBITDA decline. This pressure will be managed through opportunities to operate more efficiently, movement of traffic to alternate providers, symmetrical wholesale pricing adjustments and natural product migration trends.”

In response to the Sunday Brief reader who inquired about that comment, you don’t wake up one morning and find your access contracts have expired (or you have missed an annual spend requirement, or tripped a higher cost tier). Someone (we think it was CenturyLink, based on Verizon’s declining wholesale revenue line described below) raised AT&T’s rates several months ago, and not by a small amount, and the AT&T employee in charge forgot to tell their boss (and the boss’ boss). AT&T will likely retaliate (our interpretation of the “symmetrical” comment above) but CenturyLink has far less to lose then AT&T has to gain (and Verizon would gladly assist with wholesale FWA to CenturyLink for 10% less than pre-increase levels).

Bottom line: AT&T is making a lot of progress, but even the pared down (sans DirecTV, sans WarnerMedia) company might be too much of a transition to manage without additional margin declines. There’s no doubt that Ma Bell emerges stronger than they would have been under the Stevenson/ Stephens strategy, but can they weather the interim 8-10 quarters without a larger customer or shareholder revolt?

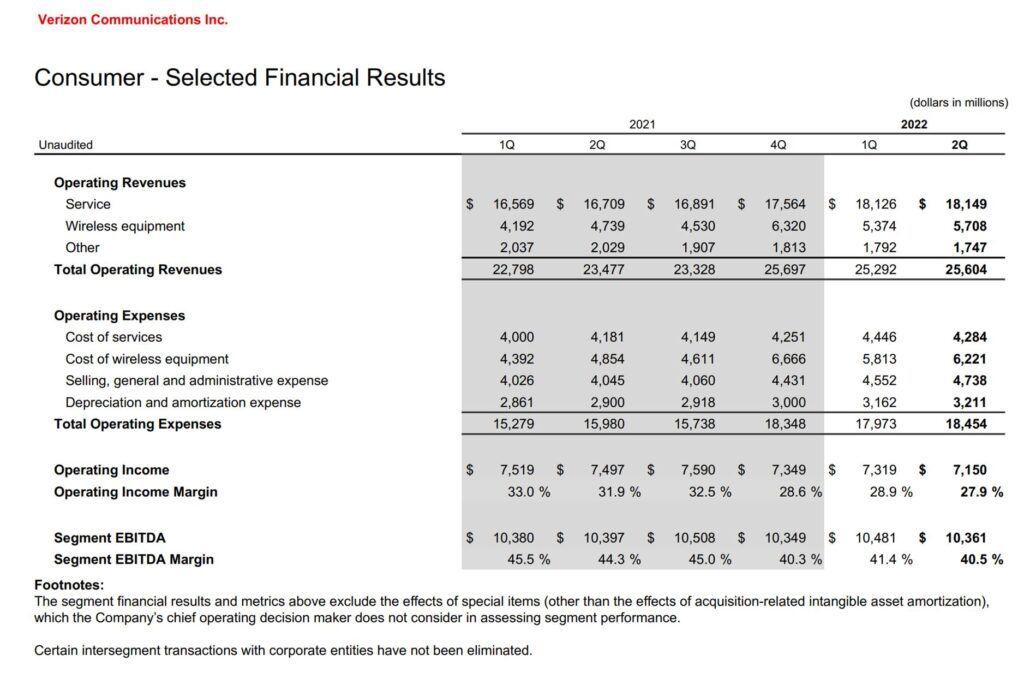

Verizon reported earnings on Friday, and they were also mixed (full package here). Business results were strong, C-Band deployment remains ahead of schedule, and fixed wireless was on fire. Why the $28 billion weekly capitalization loss (most of that on Friday) and the change in analyst conviction from optimism to pessimism?

Verizon’s consumer financial metrics tell the tale:

Operating income and margins were lower in 2Q than in the iPhone-influenced 4Q (gulp!). And that includes increasing wholesale revenues from the cable companies (~$500-600 million in EBITDA overall and at least $90 million of the quarter’s growth). EBITDA margins should be back in the mid-40s but are instead headed into the 30s. Verizon took some pricing increases and introduced a new pricing tier to attract more customers to their network, but those actions won’t see a full quarter of impact until the end of 2022. There’s no way to spin it: Verizon got caught flat-footed after the pandemic restrictions lifted, and clearly underestimated the willingness of their consumer base to try out alternatives (including cable). Unlike what we expect to see in T-Mobile’s results, Verizon is going to be playing catch-up for the rest of 2022.

The most interesting comment from the earnings conference call centered around Verizon’s recent device subsidy strategy, something we think has been critical to their 1Q and 2Q churn. Brett Feldman from Goldman Sachs led off the Q&A session with a question about the recovery timeline for the Consumer division, which elicited this response from CEO Hans Vestberg (our paraphrase, but it’s accurate – link here – minute 28 starts this exchange):

“We will be very cost-conscious and disciplined in the market… We don’t think it’s sustainable in the long term to continue with the subsidized model… In the high-end we are doing really well – you see the step-ups continuing… This is an issue with the low end and metered segment… We will be more surgical, and there will be no blanket decisions.”

Many have honed in on Hans’ comments to say that Verizon isgoing to make more blanket decisions (more content bundling restrictions, less Apple iPhone promotions, etc.). What we think the Verizon CEO said was “we don’t completely understand where the upper end of Tracfone ends and where the low end of Verizon begins.” No doubt that they have products and services to serve both but making the lowest tier too attractive might push cost-conscious consumers to these plans (more “step downs”). In turn, however, some part of the Tracfone asset could serve as a base to attract new Verizon postpaid customers (not addressed on the earnings call which is a surprise).

The table above shows that Verizon definitely has a cost issue, and, thanks to the continued cable wholesale EBITDA growth, it’s likely worse than we think. This would lead, we think, to price increases in the upper-end plans (perhaps with additional content options) by the end of the year.

Bottom line: Verizon has a terrific asset that needs to grow if they are going to earn their cost of capital ($45 billion in C-Band spectrum debt has to be paid off eventually). They have a head start on fixed wireless, especially in the business segment (keeping out-of-region access costs “on net”, unlike AT&T), and they have maintained positive FiOS growth even after a pandemic surge. They are losing their product leadership to T-Mobile, however, and appear to have been forced to respond with a subsidy-driven program which is not sustainable. This ship, in our opinion, cannot be righted without some revenue write downs and additional churn. Verizon is left with more challenges to manage coming out of the pandemic with more uncertainty than either of their wireless competitors.

T-Mobile earnings will be very interesting, and we will be listening intently. In two weeks, we will comment on their growth as well as Comcast, Charter, and the Fab Five (we think cable wireless growth will surpass most analyst estimates). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of July and go Royals and Sporting KC!