Components in smartphones that relate to the Radio Frequency (RF) Front End (RFFE)—i.e., that provide the link between the modem/RF transceivers and antennas—are expanding exponentially as new network technologies (such as Multiple Input, Multiple Output [MIMO], Long-Term Evolution- [LTE]-Advanced Pro, and beyond to 5G) grip the market. This owes much to the host of multiple active radios and additional support of more spectrum bands and band aggregation required to make these new technologies a reality. There appears to be no slowdown in this increasing RFFE complexity or in the need to simplify the architecture, and this can only worsen as the market moves toward LTE-Advanced Pro and 5G.

This article, which is based on recent teardowns by ABI Research’s Teardown Service, looks at smartphone RFFE systems, as Original Equipment Manufacturers (OEMs) continue to migrate to modules to reduce footprint, to add bands, and to support advanced carrier aggregation levels.

Overview of smartphone RFFE design evolution

The RFFE system design is currently the remit of OEMs and has long been a key differentiating factor. These smartphone vendors have not outsourced the RFFE thus far for a number of reasons:

- Components supply diversification: OEMs procure different components from heterogeneous manufacturers with the aim of utilizing the different technologies offered by various vendors, taking advantage of the highly competitive RFFE landscape to reduce reliance on a single supplier across their smartphone product portfolio.

- Impact on industrial design: Due to radio propagation issues, RFFE components’ printed circuit board (PCB) layout is critically important to ensure that overall performance in the network is not compromised. This constraint means the RFFE system design becomes tightly correlated with the overall industrial design of the phone.

- Impact on performance and power consumption: Misplacement of any RFFE component could lead to a significant performance degradation of the phone and therefore could lead to an increase of its overall power consumption and consequent thermal issues.

- Regional disparities: Disparities and spectrum fragmentation across different regions means that OEMs need to create multiple variants powered by different Stock Keeping Units (SKUs) for the same model but without compromising the uniformity of the user experience. The OEMs should keep these variances in design in mind from the start so only minor changes are required in the factory to switch the product to fit a specific carrier, region, and bands.

- Device tiering: The ongoing market segmentation means OEMs have to create a multitude of phone models targeting different price tiers, each with its own differing RFFE technology requirements, with price sensitive technologies targeting lower tiers and performance sensitive technologies targeting higher tiers.

As RFFE system design complexity has increased significantly, a host of new components are required each time a new generation of access technologies is introduced. The increased number of access modes, bands, and band combinations supported in a single smartphone is making the design of these systems even more complex. OEMs have thus far relied on four technological advances to maintain these designs as follows:

- Reducing the size of RFFE components, such as Power Amplifiers (PAs), filters, and duplexers, thanks to the use of design innovation (multimode multiband PAs) and improved lithography for filters.

- Improving packaging technologies/modularization has enabled filters, duplexers, and multiplexer banks to shrink substantially while covering a wide spectrum of bands. These technologies also offer simplified integration with other components, including antenna switches and Low Noise Amplifiers (LNAs).

- Physical modularization has enabled new packaged solutions, such as FEMiDs (e., any module between the radio transceiver and the antenna but excluding PA modules) and PAMiDs (i.e. PA modules with integrated duplexers and switches).

- Advanced antenna tuning techniques allow a single antenna to be optimized over a large range of frequencies and for different modes of operation such as carrier aggregation.

These four technologies have grown out of an industry that has to support new access networks and a plethora of bands and band combinations. The basis for the architecture is band grouped modules, which are individual modules that support band groups (low band [under 1GHz], mid-band [1–2GHz], and high band [2–3Ghz]). PAs and FEMiDs are commonly found within this partition now. Expect to see 5G come into being in a similar manner by adding a new band group—mmWave (i.e., ultra-high bands)—that will require the addition of meticulously engineered modules.

RFFE suppliers’ positioning

The band group architecture has helped OEMs lessen the complexity of RFFE design while reducing footprint size and power consumption of the overall system. Companies such as Avago, Skyworks, and Qorvo have dominated the PAMiD market while Murata, Epcos, Taiyo Yuden, and Wisol handle most of the FEMiD market. Skyworks and Qorvo are transitioning into the FEMiD market as additional semiconductor content is added. Qualcomm has shown recently (in Q2 2018) that it is a significant player in both the PAMiD and FEMiD segments with competitive solutions for shipping in high profile devices. Infineon, JRC, NXP, and Maxscend cover the growing demand for LNAs and LNA modules.

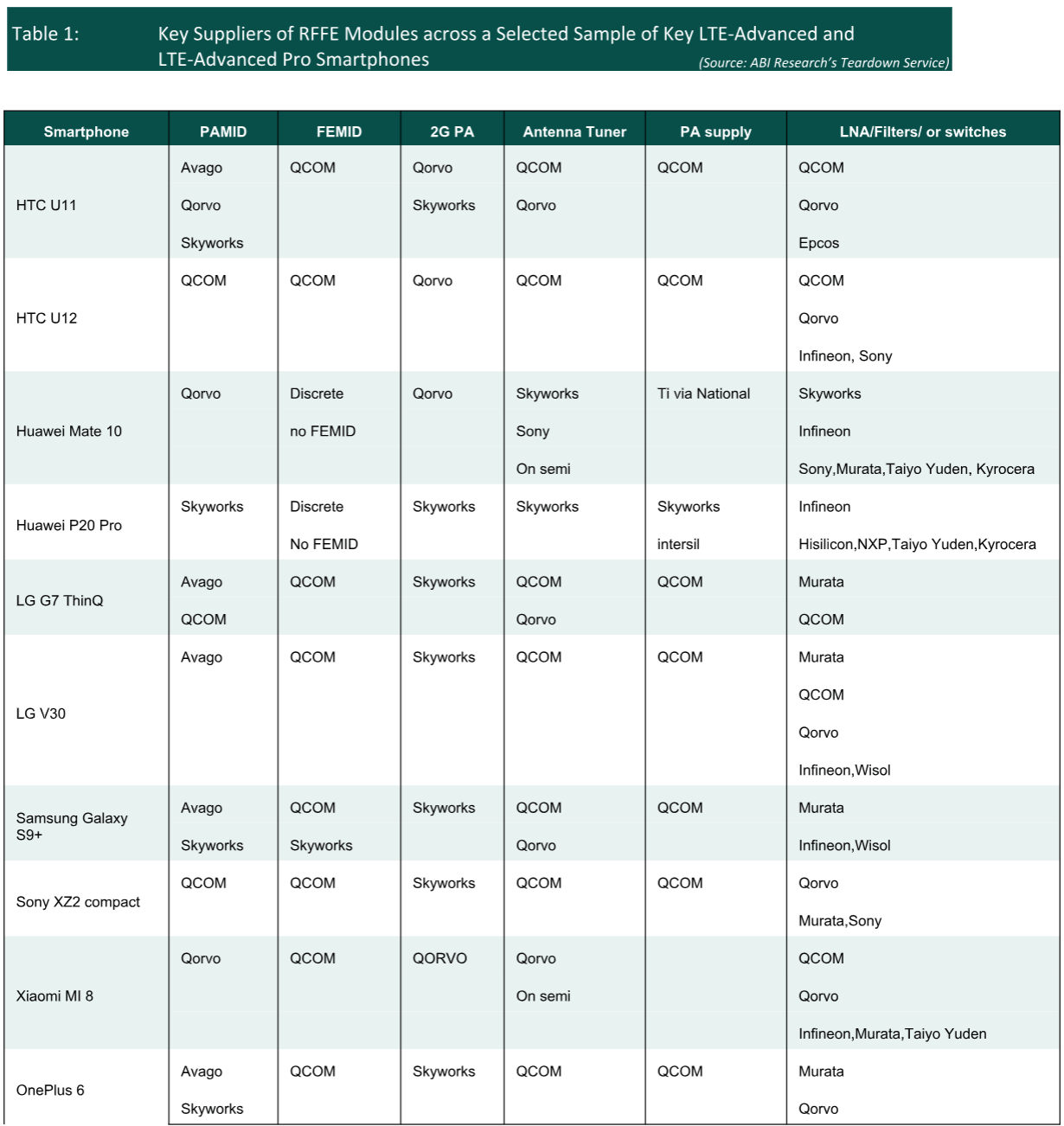

Table 1 provides a representative sample of LTE-Advanced and LTE-Advanced Pro smartphones, featuring different modules and module combinations from various vendors. In review of the data, a few interesting insights can be found. First, no one RFFE supplier dominates the market in any component category. Second, Qorvo, Skyworks, and Qualcomm find some content in almost all of the smartphones and offer the broadest range of RFFE products. Qorvo dominates in the Xiaomi MI 8, Skyworks in the Huawei P20 Pro, and Qualcomm in the HTC U11/U12, LG G7 ThinQ, and the Sony XZ2 compact. It is of significant interest that Qualcomm, known for their large-scale integrated chipsets and not for their RFFE, is listed here with long-time RFFE incumbents Qorvo and Skyworks. Qualcomm has taken a big step forward in the RFFE arena, as is shown in Table 1. They made it to this point not only with acquisitions (100 percent natural, Epcos, etc.) but also with some internal design expansion (e.g., PAs). On the other hand, the other long time RFFE supplier, Avago, seems to be content with focusing on PAMiDs and thus does not dominate in any smartphone market due to the lack of a complete product portfolio.

What is the next step in RFFE?

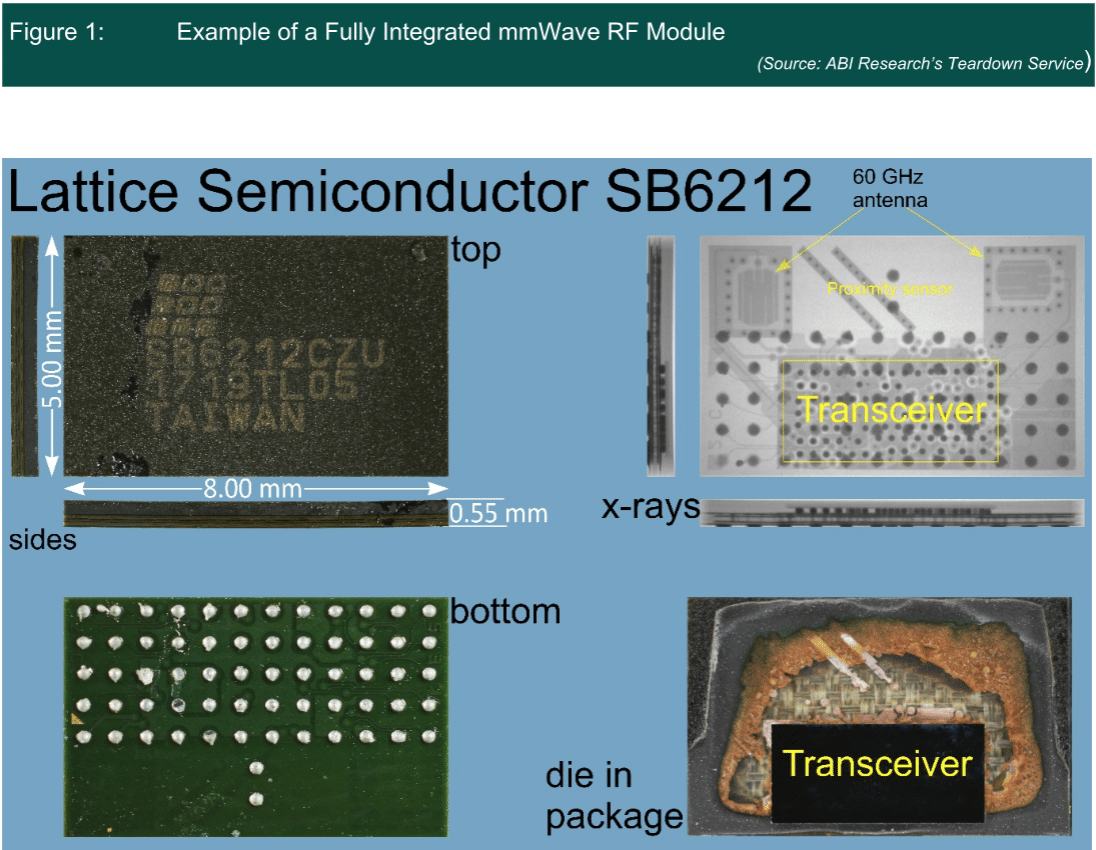

The mmWave RFFE designs will become even more complex. Specifically, expect the mmWave modules to not only integrate the PAs, filters, switches, and LNAs but also the antennas and antenna tuners (see Figure 1). ABI Research’s Teardown Service has already torn down one 60 GHz device (a proprietary 60 GHz link from Lattice semiconductor), and that device indeed included the antenna within the components package. Since 5G is more advanced than the Lattice example, expect to see multiple phased array antennas to enhance spherical coverage in upcoming 5G component packages.

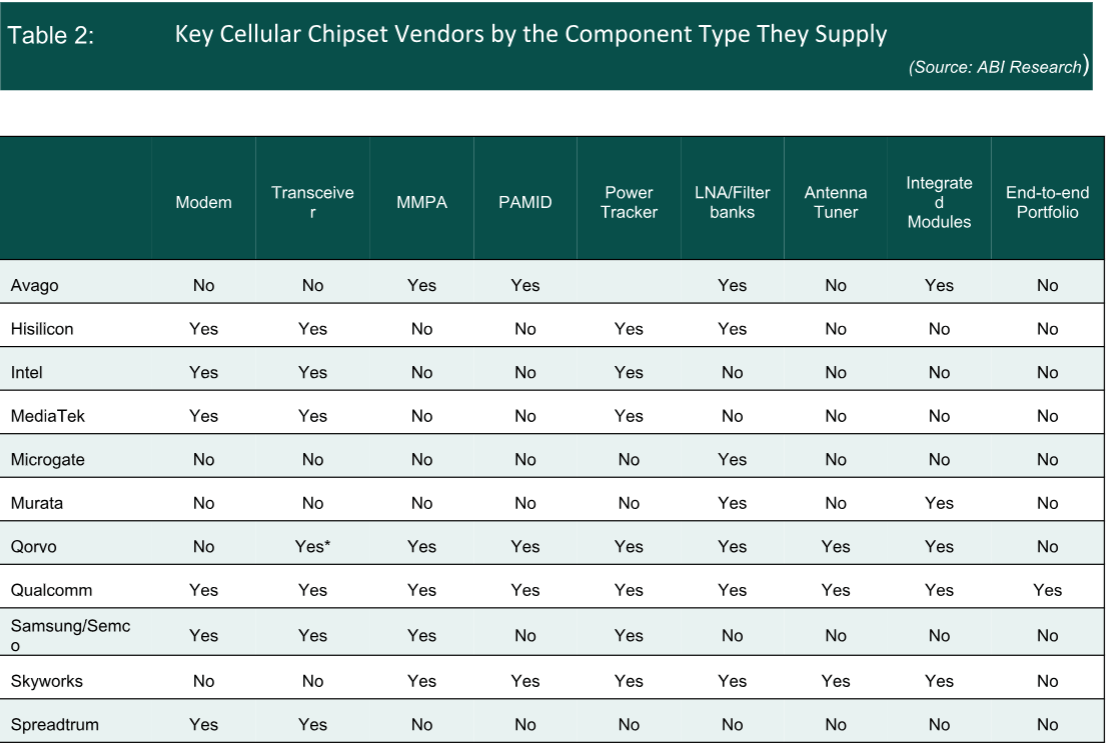

As the industry moves toward 5G, three RFFE suppliers will stand out as the most likely to succeed in the 5G RFFE market—Qorvo, Qualcomm, and Skyworks (see Table 2). These players are well positioned due to not only their current RFFE module experience but also their antenna tuning portfolio that flows directly into the needs of the 5G RFFE module (which includes the antenna). The question is: Within this small group of three, will Qualcomm’s additional portfolio of transceivers and modem give them additional advantages over their RFFE competitors?

In summary, OEMs have to ensure that their devices are capable of integrating innovative technologies brought by LTE-Advanced Pro and 5G without compromising the efficiency of their RFFE system designs, device form factor, time to market, and overall system cost. To achieve this goal, they will have to rationalize their RFFE component procurement to a handful of suppliers and, most importantly, make sure they pick the right partner—one with a rich RFFE portfolio and a strong 5G roadmap.