Editor’s Note: Welcome to our weekly Reality Check column. We’ve gathered a group of visionaries and veterans in the mobile industry to give their insights into the marketplace.

The telecommunications earnings season began with a bang this week with Verizon Communications Inc. (VZ), AT&T Inc. (T) and Apple Inc. (AAPL) all reporting earnings. Reading, analyzing and deciphering their phrases is an art more than a science.

This earnings season is no exception. If you had not looked at the actual numbers, you would have thought that AT&T Mobility went toe-to-toe with Verizon Wireless. While AT&T did a great job of base management (and upselling the feature phone base to integrated devices and smartphones), they lost the ability to attract new customers to their company. When all of the statistics are tallied, AT&T Mobility will likely have experienced their lowest share of gross adds since 2006.

To use a sports analogy, AT&T Mobility beat the spread. They lost, but they beat the spread. Here’s what I mean by they lost:

Note: Q1 2009 Verizon Wireless net additions is an estimate. All other sources are from the carriers earnings releases.

Since Q4 2009, Verizon Wireless has been on a tear, winning the net additions war against AT&T Mobility four out of the past six quarters. Just using these six quarters, Verizon Wireless has outpaced AT&T Mobility by 1.5 million net adds. Interestingly, more than half of the gain came in the most recent quarter.

Assuming the net gain is negligible between Sprint Nextel Corp. and T-Mobile USA Inc. (postpaid), Verizon Wireless captures an astounding 82% to 91% of the post-paid net additions for the wireless industry. Verizon Wireless was already outpacing AT&T Mobility in Q4 2010, before the iPhone and the Thunderbolt.

When your opponent outscores you by 15x after outscoring you by 2.2x in the previous quarter, how should the headlines look? Was AT&T Mobility really “unscathed” as one report suggested simply because the net add number was not negative? I liken this to a sports match where the star player doesn’t come out until the second quarter to play, leads the team to victory and the headline reads “Opposing team avoids devastating loss.” AT&T Mobility was routed, plain and simple. They beat expectations of a 1.1 million spread (the difference between their expected 100,000 loss and Verizon Wireless’ 1 million net additions), but they lost – significantly.

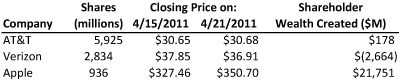

However, the real winner here is not the battlefield participants but the munitions supplier – Apple. Let’s look at the equity market gains of the past week for Apple, Verizon, and AT&T:

Apple created nearly $22 billion of shareholder value in the past week (and another $2 billion yesterday). That’s twice the value created for the shareholders of AT&T and Verizon year to date. Apple has created more shareholder value since the beginning of 2010 than Verizon’s total equity market value, and more value since the beginning of 2009 than AT&T’s current equity market value.

Apple now holds enough short- and long-term marketable securities ($65 billion) to pay off all of AT&T’s debt. And Apple, not AT&T, has leverage – with suppliers, with customers, and with apps developers. AT&T has some leverage because of its size (and it’ll get a lot bigger in 2012 with T-Mobile USA), but Apple has leverage with alternate wireless carriers, and, as they strongly hinted in their conference call, the party will not stop with two carriers in the United States.

Verizon’s $2.7 billion equity loss for the week is a sideshow, and AT&T’s ability to tread water is a yawner. The winner is the company that sold 19 million additional smartphone and 5 million tablet ecosystems, ready for FaceTime, Qik, Skype, and all sorts of future carrier-avoiding applications.

Without a doubt, Apple won the war. Verizon wins the battle against AT&T for industry share of postpaid decisions, and also wins on momentum. AT&T loses, but only by three touchdowns instead of four. They beat the spread.

To win the second quarter, AT&T Mobility needs to demonstrate why the Atrix is a better device than the Thunderbolt for enterprise customers (and there are some advantages), continue to beat the drum of simultaneous voice and data across their iPhone (perhaps allowing some call control for applications would be nice) and trumpet their integration capabilities for small business and residential customers.

AT&T had good gains for their other wireless products, but core earnings still flow from retail post-paid, and 62,000 net additions represents less than .1% growth on the current service revenue base. It’s time for an AT&T winning streak – are they up to the task?

Jim Patterson is CEO and co-founder of Mobile Symmetry, a start-up created for carriers to solve the problems of an increasingly mobile-only society. Patterson was most recently President – Wholesale Services for Sprint and has a career that spans over eighteen years in telecom and technology. Patterson welcomes your commentsatjim@mobilesymmetry.com.