A new J.D. Power survey found low customer-satisfaction scores for EIP, despite wider acceptance

Equipment installment plans for mobile devices have officially swept the domestic wireless space, with just about every operator actively promoting plans that trade in a lower per-monthly rate plan price in return for customers making monthly payments on the full price of their mobile device.

However, a new survey from J.D. Power found customers on EIP plans are less satisfied from the attention they receive from their mobile operator than customers on more traditional subsidized plans that require a service contract.

The results are part of the “J.D. Power 2015 U.S. Wireless Customer Care Study – Vol. 2,” which found that overall satisfaction among customers who have an EIP is 15 points lower than among those who have a traditional service contract. The survey found that when contacting their carrier, “satisfaction is lower among EIP customers regardless of the care channel they use (lower by 22 points in [automated response systems] only; 13 points in ARS, then [customer service representative]; 10 points in walk-in; and 26 points in online).”

Lower satisfaction could be linked to the survey’s finding that EIP customers are more likely to contact their wireless carrier with questions or issues than customers with traditional contract plans during a three-month period (39% vs. 35%, respectively). The timeliness of that interaction could also be an issue, as the survey found that when using the ARS, then CSR channel, customers with EIPs were more likely to be transferred than customers with traditional contracts (43% vs. 40%, respectively), and they wait about one minute longer for their issue to be resolved (17.1 minutes vs. 15.9 minutes, respectively).

“The need for EIP customers to contact their carrier regarding their plan contributes to lower levels of satisfaction, especially when resolution of their issue isn’t timely,” explained Kirk Parsons, senior director and technology, media and telecom practice leader at J.D. Power. “Improving satisfaction among EIP customers is an opportunity for the industry as the share of such customers is rising. With respect to EIPs – or any new product or service release – to satisfy customers, carriers must anticipate questions and strive to improve response times, especially when addressing complex issues related to technology support.”

This could be a growing concern for mobile operators, as a new study from Strategy Analytics found EIP and device leases accounted for 54% of postpaid device activations during the first quarter, with further momentum seen in Q2 results from Verizon Wireless, AT&T Mobility and T-Mobile US. The report noted such plans are acting as financial catalysts for mobile carriers, and theoretically should appease consumers looking for quicker device upgrades or who want to keep their devices over a longer term.

“By giving users greater ownership of their device upgrade timing, EIPs meet the needs of both those with rapid device upgrade requirements and those happy to keep the same handset for 3-4 years,” explained Susan Welsh de Grimaldo, director of wireless operator strategies at Strategy Analytics.

T-Mobile US, Virgin Mobile USA tops in satisfaction

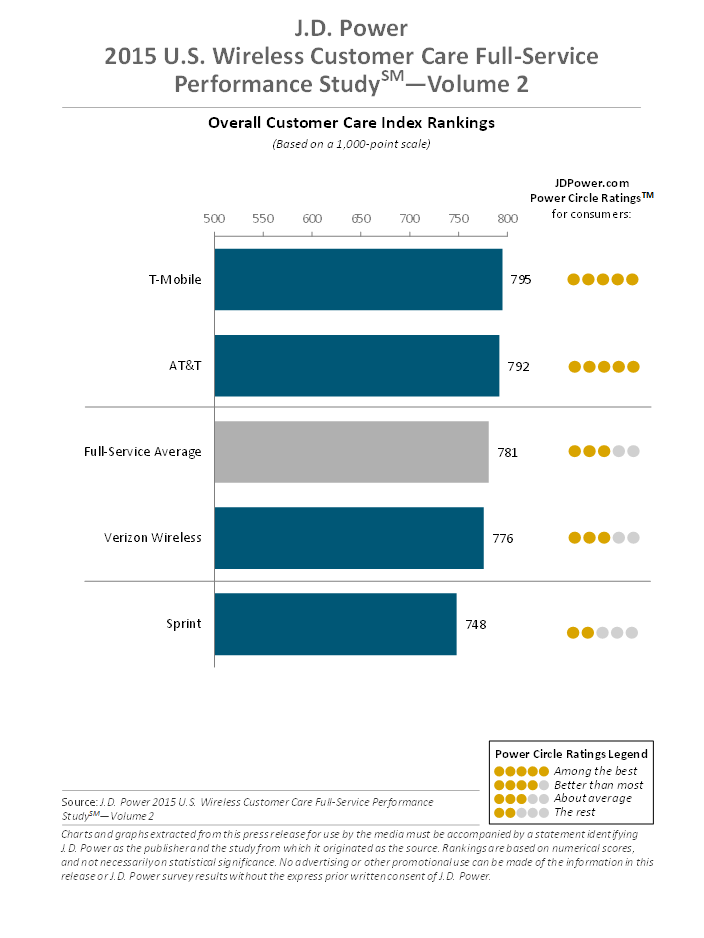

Among domestic mobile operators, the J.D. Power survey ranked T-Mobile US highest among “full-service” carriers with an overall score of 795 out of a possible 1,000 points. T-Mobile US was cited for strong performance “in the ARS, then CSR channel and performs above the full-service average in three of four service channels.”

T-Mobile US managed to just outscore AT&T Mobility, which posted a score of 792, with Verizon Wireless a distant No. 3 with a score of 776 and Sprint with a score of 748.

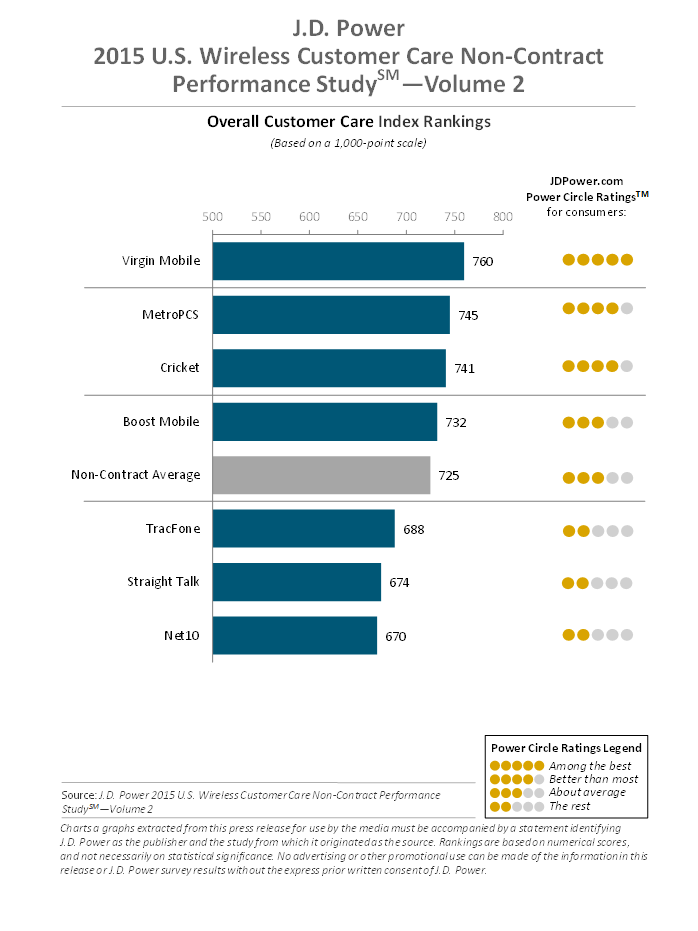

Among prepaid-focused mobile brands, Sprint’s Virgin Mobile USA offering came out on top with a score of 760, followed by T-Mobile US’ MetroPCS brand and AT&T Mobility’s Cricket Wireless.

Overall, customer satisfaction among full-service providers improved 8 points compared with Vol. 1 of the survey, while satisfaction with prepaid providers remained steady.

Bored? Why not follow me on Twitter