Nokia saw net sales rise by three percent last quarter and two percent in the whole of last year, even as margins slipped, partly because of investments and restructuring. Revenue growth came mostly from strong fiber-optic and data center demand, it said. Nokia is doubling down on its big-ticket network infrastructure strategy, focused on large-scale cellular and fibre deployments. Its other decisions still look strange.

In sum – what to know:

Optical and IP – longhaul/backhaul optical orders jumped 17% in Q4, and Nokia expanded its presence in data center IP routing and switching, targeting hyperscaler and AI customers.

Profit pressures – operating profit fell 37% in the quarter and 55% for the year, due to the Infinera acquisition and R&D spending, though comparable operating profit declined much less.

Strategic AI shift – the company is prioritizing ‘network infrastructure’ and ‘mobile infrastructure’ segments, slimming down legacy and campus-edge businesses, and targeting €2-2.5 billion in comparable operating profit for 2026.

Nokia has reported modest top-line growth in the quarter and the year, with net sales climbing three percent as demand for fiber-optic transport and data center connectivity, particularly from hyperscaler and AI-focused customers, offset softer performance in legacy units. Which mostly appears to justify the Finnish firm’s strategic pivot, announced in November, to a two-lane big-ticket infrastructure proposition around large-scale cellular and fibre networks – and away from its non-core businesses, however familiar, innovative, or market-leading they are.

Except some of its language around private networks still sounds funny, making its broader strategy still sound simplistic, and a little sad. More on this towards the bottom; but the top line results, which saw its share price slip by around 10 percent after the announcement (and rally since), are as follows..

Nokia’s 2025, in review

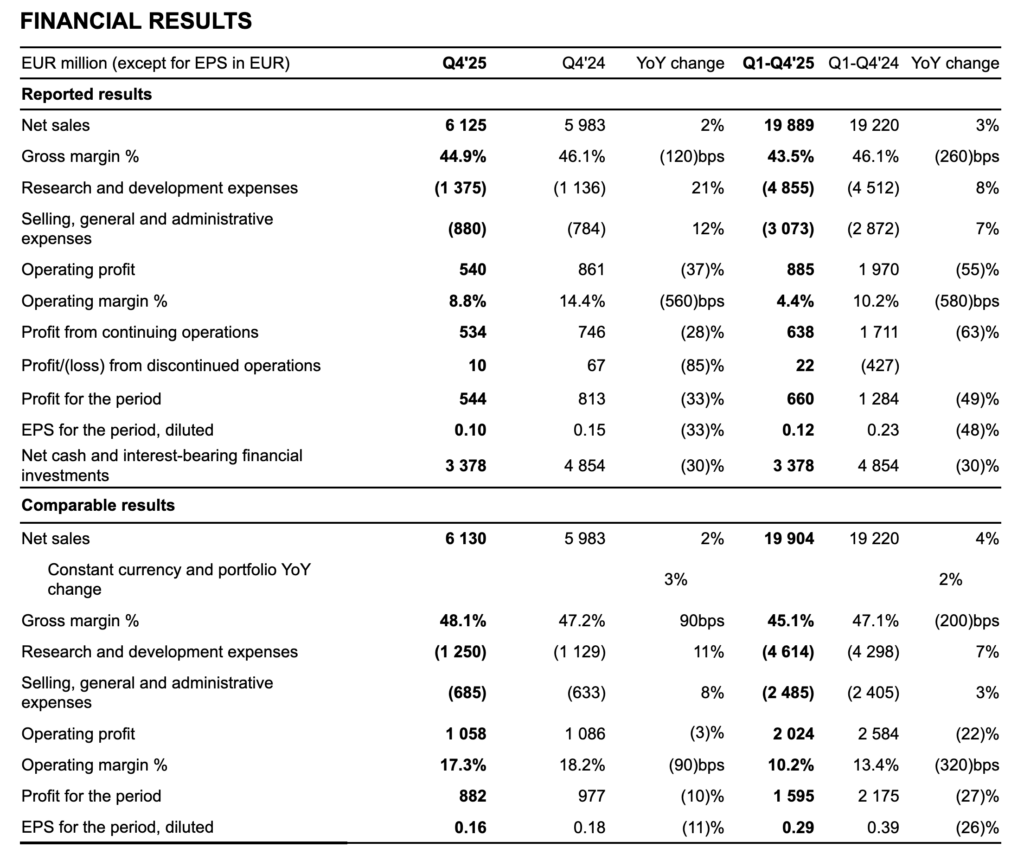

Nokia saw net sales climb by three percent in the fourth quarter versus the year-ago period, reaching €6.1 billion in the three months to the end of 2025; its full-year sales in 2025 were two percent higher year-on-year, finishing at €19.9 billion for the year, two percent higher than 2024 – on a constant currency and portfolio basis, as if exchanges rates weren’t a thing and the business had not bought or sold assets between times; they were up two percent and three percent, respectively, as reported figures. The Finnish firm said performance was “in line with expectations”.

Operating profit was down 37 percent in the quarter and 55 percent in the year – to €540 million and €885 million – on account of its acquisition of Infinera for $2.3 billion in early 2025, plus “growth-related investments in R&D”. On a comparable basis, operating profit was still down, but by considerably less – at just over €1 billion and just over €2 billion across the two periods, respectively, down by three percent and 22 percent versus 2024. Still, these returns finished “slightly above the midpoint of our guidance”, the company said.

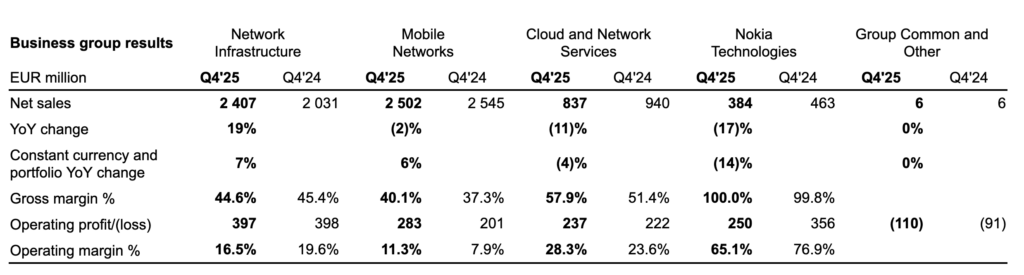

Profitability improved slightly in the quarter, with gross margin rising 0.9 percentage points to 48.1 percent – thanks to more improvements in its ‘mobile networks’ and ‘cloud and network services’ units, it said, even though its old ‘technologies’ business contributed less. But its full-year score was down by two percentage points to 45.1 percent. Operating margin was down by 0.9 percent in the quarter and 3.2 percent in the year – to 17.3 percent and 10.2 percent, respectively. The firm cited investments in growth areas, including to buy Infinera, plus lower gross margin.

Like for like, its historical business units saw quarterly net-sales improvements/declines as follows: ‘network infrastructure’ and ‘mobile networks’ were up by seven percent and six percent, to €2.5 billion and €2.5 billion, respectively; ‘cloud and network services’ and technologies’ businesses were both down, by four percent and 14 percent to €837 million and €384 million. There was no break-out or special mention of the company’s good work in the (campus-sized) private networks business, as under previous stewardship.

Nokia said it is targeting a loose €2-2.5 billion range for comparable operating profit in 2026 – so somewhere between flattish and steep growth, up to 25 percent at the top end (just over €2 billion in 2025 versus a top-line forecast of €2.5 billion in 2026).

‘Long-term’ AI paying off

Some detail was provided about each unit in an earnings call yesterday (January 30). Growth in network infrastructure in the quarter included a 17 percent jump in sales of longhaul/backhaul optical equipment to “AI and cloud” customers – to the tune of €2.4 billion (“in orders”). Justin Hotard, president and chief executive, said Nokia has “a long-term view”. He said: “Optical… will be an even more critical part… to support the AI super cycle. We are investing to capture near-term demand while maintaining a long-term perspective.”

He claimed early shipping and design wins for its 800G ZR and ZR+ items, including into “scaled deployments”. He cited “further progress” in internet protocol (IP) networks, in the routing and switching layer, for data centre, enterprise, and metro connectivity. He cited “order intake” inside data centres, plus launch of a new switching platform (7220 IXR H6, using Broadcom’s 102.4 Tbp Tomahawk 6 Ethernet switch silicon), a new agentic AI solution for event-driven automation management, and a design win for its newest data center switching platform.

“These are encouraging steps, and we continue to believe revenue will ramp over time as we expand our presence in this rapidly growing market,” he said. Meanwhile, ‘fixed networks’ – for last-mile IP and optical componentry – was flat, partly as it has “deprioritised” customer premises equipment products with its November rejig. “This reflected growth in fiber optical line terminals of 16% offset by softness in parts of the portfolio we are de-prioritizing,” said Hotard. There is more on its surplus carve-up and sell-off strategy below.

Otherwise, he said ‘mobile networks’ saw net sales grow by six percent in the quarter and hardly at all (“flat”, again) in the year, while ‘cloud and network services’ went the opposite way, effectively – four percent down in the quarter and six percent higher in the quarter, within a wider market that declined by two percent overall, apparently. “Our cloud-native core stack [is] growing faster than the market and improving profitability,” said Hotard. He cited deals with Telia, plus with Bharti Airtel (“collaboration”) for its ‘network-as-code’ API platform.

Seventy-five partners, including 43 telcos, are now using the latter. Its RAN business, united with its 5G/6G core network proposition within its new ‘mobile infrastructure’ business, saw “disciplined execution in a largely stable market”. The firm has new RAN deals with Telecom Italia, Telefonica Germany, and SoftBank; it is investing in 5G Advanced and open RAN, and it also has this $1 billion investment from Nvidia with an eye on 6G and AI-native networks. But it is worth considering Nokia’s progress here in light of its new structure.

Out with the good-old stuff

In November, Nokia said it will split its business into two segments to align with the “AI supercycle”. Its new priority units, active now, will deliver ‘network infrastructure’ and ‘mobile infrastructure’. The first comprises optical, IP, and fixed networks, and is pitched as its “growth segment”; the second combines its cellular core and radio portfolios (plus ‘technology standards’, formerly ‘technologies’), and drive its 6G ramp-up – presumably as a post-2030 ‘growth segment’, while it gambles on AI infra between times as telcos see out the last days of a grim 5G investment cycle.

As well, of course, Nokia has sidelined a bunch of non-priority affairs as ‘portfolio businesses’, and cut jobs left and right. These include its divisions for ‘enterprise campus edge’ solutions (its private 5G unit; part of its now-defunct ‘cloud and network services’ division), fixed-wireless access hardware (part of its old ‘network infrastructure’ unit), and microwave radio solutions (part of ‘mobile networks’). Everything is up for sale. About its private 5G business, which has done well over the past five years to break open the whole industrial market, Hotard didn’t say anything.

There were no questions about it from the city analysts on the call, either. Instead, he referenced Nokia’s decision to continue with larger macro-style private 5G deployments for certain sectors, and talked in a Q&A session about “encouraging progress on mission-critical… in select vertical markets that value, scale, security, and availability – obviously, things we bring from our legacy in this space [with] telcos”. Which makes very clear, if it wasn’t already, that Nokia is getting out of the excitable campus-edge market – where deals are more numerous, but smaller.

He also talked about Nokia’s work with military installations – which is curious, to an extent, given how many campus (or smaller) sized Nokia-made private 5G systems are already in use by military forces, particularly in the US. He referenced the creation of Nokia Defense, described as an “incubation unit to serve as the central R&D hub” for its “go-to-market for our defense portfolio”. He stated: “Our priority is to deliver defense-grade solutions based on Nokia’s mobile and network infrastructure technologies for Finland and other NATO countries. Nokia Defense also includes Nokia Federal Solutions in the US and includes the technology we acquired from Phoenix Group in 2024.”

He added: “Based on feedback from customers, we see growing demand for our 4G and 5G technology in military environments, both for national security and tactical applications. This is an area where we are continuing to invest, and we will share updates as we make further progress.” It is confusing, for sure, because Nokia’s campus systems, drone solutions, and developing lines of industrial devices and wearables, pioneered by and being-sold with its ‘enterprise campus edge’ division, are a major supplier of such “tactical” solutions for military usage.

But like it or not, Nokia’s focus is the same as everyone’s right now: how to hook up to the hyperscaler-AI gravy train. Hotard said: “Looking ahead, our focus is on disciplined execution to capture growth in AI and cloud and increase efficiency while we’re building a high-performance culture across ‘team Nokia’. We now have fewer, clearer priorities, a simplified operating model, and a strategy we are executing with speed and accountability. Network infrastructure remains our primary growth engine, particularly optical and IP networks, where we see strong structural demand.”

Mobile is so last year, seems to be the message – when traditional mobile is last-decade, and new mobile, like critical and tactical edge solutions, is so now.