Private equity firm TPG is to buy Kepware and ThingWorx from PTC for up to $725 million. It marks a final shift in PTC’s Industry 4.0 strategy, and a tightening of focus on its industrial PLM portfolio. The deal also revives old questions about why big tech firms fail with IoT.

In sum – what to know:

PTC entrenches – PTC refocuses on its core Industry 4.0 engineering software; the sale of ThingWorx and Kepware will fund its CAD, PLM, ALM, and SLM portfolio.

TPG builds – TPG’s acquisition of ThingWorx and Kepware follows its purchase of GE Vernova’s Proficy business, and consolidates it in the industrial connectivity stack.

Learning curve – the move underscores how major tech firms have failed to translate industrial IoT into industrial growth, quitting to leave execution to specialist providers.

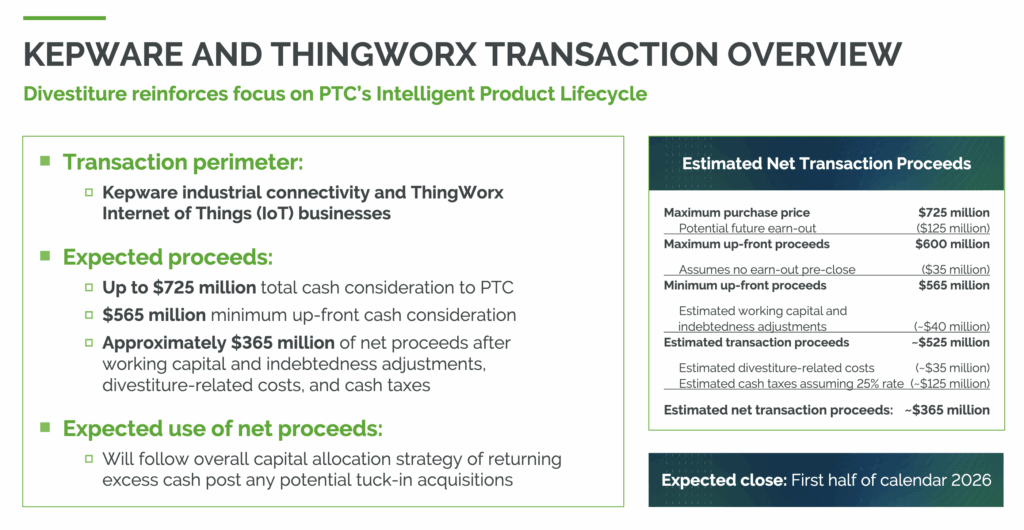

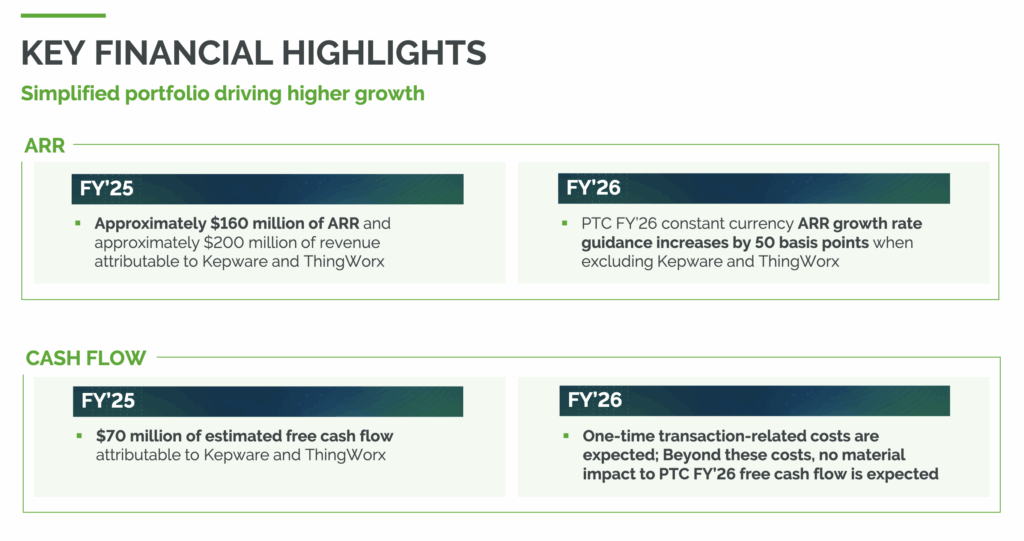

News last week that San Francisco based asset management firm TPG, formerly Texas Pacific Group, has agreed a deal to acquire Kepware and Thingworx from Boston-based industrial software company PTC looks like a good deal for both sides, and tells its own tale about big tech firms “not really knowing what to do” with IoT, suggested market watchers – a view that might as easily be expanded to cover their routine failures with industrial connectivity in general. PTC could get up to $725 million for the two units, and $565-$600 million “up-front”, when the deal closes next year – on twin Industry 4.0 assets that deliver about $200 million in annual revenue.

“That’s not a bad return on a business that wasn’t growing and generated only $200 million in revenue in the fiscal year just ended,” said Monica Schnitger, president and principal analyst at Schnitger Corporation, in an excellent review on LinkedIn, including a link to slides (see below) from an earnings call with the PTC leadership team. (Some of the reporting here comes via Schnitger.) PTC, which has been tipped for a sale, “in part or in whole” (as commonly rumoured, and as Schnitger said), for ages, said Kepware and ThingWorx will get “additional capital and expertise” for new Industry 4.0 growth under new ownership.

Schnitger quoted PTC on the call. “We could receive up to $725 million in total cash consideration if certain thresholds are achieved. We expect either $565 million or $600 million upfront, depending on performance during the period up to close. The $125 million future potential earn-out is based on criteria related to a potential future transaction by the buyer,” said PTC. The firm will will increase its focus on its ‘intelligent product lifecycle’ vision, it said – which means, effectively, it will entrench its Industry 4.0 game into its core ‘digital-thread’ product design and simulation tools (CAD, PLM, ALM, SLM) for engineering, manufacturing, and product development.

PTC acquired ThingWorx in 2013 for $112 million and Kepware in 2015 for $100 million. Here’s the PTC line, for the record: “Kepware facilitates connectivity between industrial automation devices and applications, acting as a communication platform [for] data exchange and integration across… industries including manufacturing, oil and gas, and utilities to simplify the process of collecting, monitoring, and controlling data from multiple sources. ThingWorx is a comprehensive IoT platform for industrial enterprises that connects systems, analyzes data, and enables the remote management of devices through a secure and scalable architecture.”

For an IoT crowd, in particular, ThingWorx was a seminal platform – and a mainstay of RCR coverage a decade ago, when Enterprise IoT Insights was still a going concern (before IoT became a line item in Industry 4.0 spreadsheets, and IoT coverage was absorbed into the RCR mothership). But that is an aside; the point is that ThingWorx, paired with Kepware, was once the great hope to knock-out industrial data silos to drive automation and intelligence. “It’s another example of a bigger technology company not really knowing what to do – or, probably more accurately, how to do it – with an IIoT platform,” reflected Matt Hatton, founding partner at Transforma Insights.

He added: “See also Software AG with Cumulocity, or GE with anything it has ever built. The principle was, I think, a solid one – to extend the way that PTC bridges digital and physical worlds. But to me it seemed like there was a gap between that vision and an execution which was just focused on the PLM/CAD core business.”

Here is Schnitger, again: “ThingWorx was, at the time, a toolkit touted as doing everything from managing intelligent chicken coops to helping deliver more consistent-quality beer – but the plan was to make PTC a major player in the then-emerging IoT [market]. It struggled over time as the early entrant faced more installation-ready IoT products… Kepware i[was acquired] to enhance its overall IoT offering by adding… industrial connectivity software, which simplified data collection, monitoring, and control. In recent years, product sales have stagnated, dragging down PTC’s overall financial performance.”

She added: “ThingWorx and Kepware are solid offerings that just didn’t fit with the PTC of today; when acquired, they were part of PTC’s ‘shiny-new-thing’ approach – ‘CAD is dead, let’s try PLM. Oh, that’s not cool enough – let’s try IoT’. And so on – ultimately slowing overall growth and affecting profitability. Sharpening the focus on its core… CAD, PLM, ALM, and SLM [businesses] will allow PTC to really address its users’ needs.”

But maybe they have found a happier home. TPG, which claims to have $286 billion of assets under management, and investment and operational teams “around the world”, will invest in the two businesses via TPG Capital, its US and European private equity platform. The impact on customers will be negligible in the short term, by all accounts. Both firms expect “business as usual” until the deal closes in the first half of 2026 – subject to regulatory approvals and other closing conditions. The deal follows its September agreement to purchase GE Vernova’s Proficy manufacturing software business, and should slot straight in.

Craig Resnick, vice president at ARC Advisory Group, said in a research note: “By bringing together TPG’s acquisitions of major industrial connectivity and IoT brands Kepware and ThingWorx with its recent purchase of Proficy, GE Vernova’s manufacturing software business, TPG is building a formidable industrial software portfolio. This strong combination provides manufacturers, processors, and OEMs with the flexibility to create integrated platforms built on proven solutions with extensive installed bases, unlocking new opportunities for innovation and operational excellence as AI continues to reshape the industrial landscape.”

Sam Barker, vice president for telecoms market research at Juniper Research, commented: “The IoT market continues to evolve, and more businesses are adopting connectivity as part of their own operations. It is notable that IoT is now being adopted by SMEs. This announcement demonstrates how TPG is focusing on providing scalability for enterprise IoT users. SMEs will want to explore the potential for IoT connectivity, rather than commit to an initial big investment without definitive ROI.”

Ignatius Daniel, principal analyst at QKS Group, called it a “defining move for the OT/IT ecosystem”, about how “connectivity and data orchestration are becoming strategic pillars of modern MES and smart manufacturing”. He commented on LinkedIn: “What’s the gameplay? Customers won’t judge the deal. The test is in continuity with clear roadmaps, support and licensing transitions and product updates. Rivals are already circling with edge-to-cloud bundles and migration strategy against any execution gaps, so execution speed becomes the only story that matters.”

PTC employs over 7,000 people; it claims around 30,000 customers globally. Press-released quotes from the two protagonists are included below.

Neil Barua, president and chief executive at PTC, said: “We’re pleased to reach this agreement… as we increase our focus on delivering our ‘intelligent product lifecycle’ vision… through our core CAD, PLM, ALM, and SLM offerings and the ongoing adoption of AI and SaaS. With our resources and investments concentrated in these areas, we are confident we can help our customers address their most pressing challenges by enabling them to fully leverage the value of their product data and to transform each stage of the product lifecycle.”

Art Heidrich, partner at TPG, said: “There is a generational opportunity to evolve and progress manufacturing through solutions that bridge the gap between operational and information technology. Kepware and ThingWorx are driving the digital transformation of the shop floor, helping customers manage and improve their production processes. We are excited to partner with PTC and look forward to supporting the next chapter of growth for these software platforms.”