Synopsys still has to win regulatory approval in China for its $35 billion acquisition of Ansys

Synopys is getting closer to closing its $35 billion acquisition of engineering simulation and design software company Ansys, but it still needs to win regulatory approval in China for the transaction.

“We have already received merger clearance in every jurisdiction other than China based on the merits of our transaction and the significant benefits it is expected to bring to all our stakeholders and the future of technology innovation. We continue to work collaboratively with the State Administration for Market Regulation of China, and we are at an advanced stage in obtaining this final regulatory approval,” the company said in a short update released yesterday.

The Synopsys/Ansys merger was first announced in January 2024. It is by far the largest recent M&A transaction in the design, test and measurement space. As part of the regulatory approvals gained in the United States and the European Union, the combined Synopsys and Ansys will have to divest some assets due to anticompetitive concerns. Keysight Technologies will pick up the divested assets.

The assets that Synopsys and Ansys have to divest are related to semiconductor design and photonic light simulation, and are widely used. The FTC said that it had anticompetitive concerns about the merger in three areas: optical software tools, photonic software tools for designing and simulating photonic devices, plus power consumption analysis tools.

Specifically, the U.S. Federal Trade Commission has required Synopsys to let go of its optical software tools that allow engineers to design and simulate devices that generate, reflect or refract light, such as LED screens; and its photonic software tools for design and simulation of things like fiber optic cables. According to the proposed consent order, that includes Synopsys’ CODE V, LightTools, RSoft, LucidShape, Visualization and ImSym. (Read the FTC’s proposed consent order for the transaction here.) Ansys will have to divest its Register Transfer Level (RTL) power consumption analysis tools, with Keysight picking up those as well.

While Synopsys had expected the Ansys deal to close within the first half of the year, the approval process then got tangled up in new export regulations on electronic design technology exports from the U.S., which would affect Synopsys’ operations in China. Revenues from China account for about 10% of Synopsys’ revenues—although the percentage has been declining, due to what CEO Sassine Ghazi has said was due to a combination of the macroeconomic environment in China and the “cumulative impact of restrictions” on the country.

In other test news:

-Ultra Ethernet Transport (UET) saw its first live public demonstration at the recent Interop2025 conference, made real on the show floor by Spirent Communications, Juniper Networks and TOYO, marking what the partners called a “major milestone for the evolving Ultra Ethernet Consortium (UEC) ecosystem.”

The Ultra Ethernet Consortium (UEC) just released its inaugural UEC Specification 1.0 last month, to provide Ethernet-based networking for AI and high-performance computing (HPC) workloads.

“Validating performance and interoperability with emerging transport standards like UET is essential for ensuring next-generation infrastructure can meet the evolving demands of AI-driven networking,” said Praful Lalchandani, who is VP of products, data center platforms and AI solutions at Juniper Networks.

“Dramatic growth in AI applications and workloads continues to create challenges for the industry, and this public demonstration illustrates our dedication to helping industry partners to meet these challenges,” said Masatoshi Nishihara, GM at Spirent Japan.

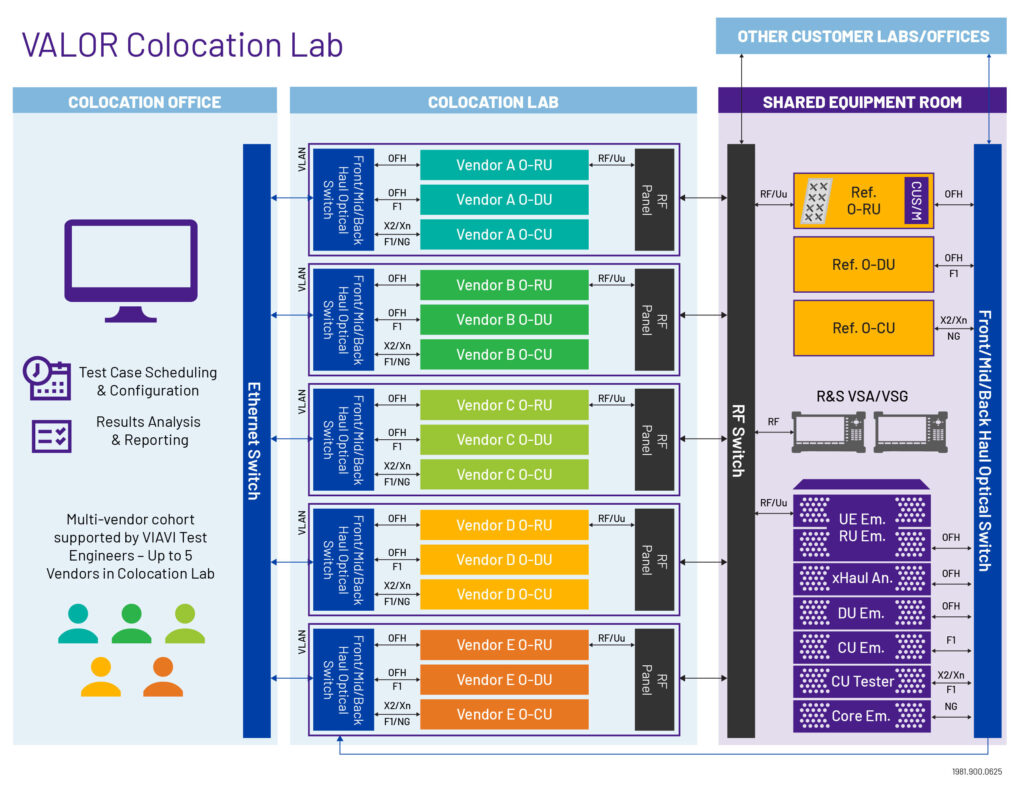

–Viavi Solutions has introduced new co-location options at its VIAVI Automated Lab-as-a-Service for Open RAN (VALOR) lab in Chandler, Arizona, with the semi-permanent test set-ups offering “more flexibility and capacity” than its on-demand labs for customers.

VALOR currently has the co-location lab plus two labs for on-demand test set-ups in the test-as-a-service facility to support Open RAN development.

The company laid out the available lab architecture set-ups in the infographic below:

“VALOR can now service both vendors who are looking for specific tests during the development and pre-certification process, as well as those seeking longer-term, comprehensive end-to-end and scalable testing,” said Erik Probstfield, Viavi’s senior director of VALOR. He added: “Ultimately, this accelerates the development of open, secure wireless ecosystems with industry-wide investment value significantly greater than the base federal funding.”

VALOR is federally funded through the Public Wireless Supply Chain Innovation Fund, run by the National Telecommunications and Information Administration (NTIA).

-The global network emulator market is expected to see a compound annual growth rate of nearly 8% through 2030, according to a new report from The Market Insights, due to the rapid migration of applications and services to cloud environments.

-Singapore-based test and measurement equipment company Harogic showcased its rugged handheld spectrum analyzer up to 40 GHz at the recent IMS 2025 conference in California.