Greetings from Colorado, Nebraska, Iowa, and Missouri. We presented with Jeff Yount of Intermountain Infrastrucutre Group (IIG) at the UNITEL 2025 Executive Summit. Terrific discussions with several fiber and legislative leaders there, and many thanks to Matt Gilbert of UNITEL for the inclusion.

This week, after a shorter than normal market assessment, we will dive back into earnings reviews with a Verizon-centric perspective of phone growth, some commentary on Comcast’s broadband struggles, and then a couple of strategic planning questions for your next team meeting.

We have completed the transition to WordPress and appreciate the patience. We will publish an Interim Brief over Labor Day and will attempt to keep everyone abreast through the website and LinkedIn of the state BEAD award postings (West Virginia discussed below). We should see many/ most states post initial awards this week.

The fortnight that was

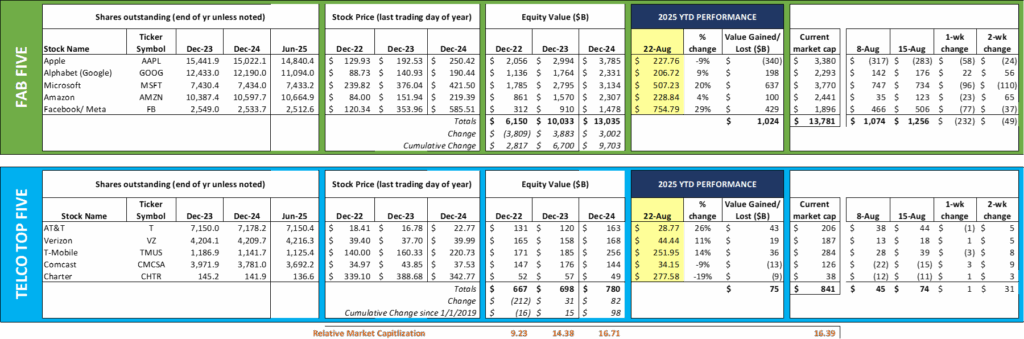

The summer stock market euphoria is cooling along with summer temperatures. The Fab Five lost $232 billion last week (Google was the only gainer) and has marked time since the last full Brief. The Telco Top Five gained a mere $1 billion last week but held on to their larger gains from two weeks prior (+$31 billion). Of the ten stocks we track, five (Meta, AT&T, Microsoft, T-Mobile, and Verizon) are up double digits and three (Apple, Comcast, and Charter) have lost value in 2025. It’s a mixed bag with more variance between stocks than we have seen in the last five years.

On the macroeconomic front, the Atlanta Fed revised their GDP estimate to 2.3% (from 2.5%) last Tuesday. The primary driver of the reduction was the latest housing starts release (here). Below is the 10-year trend in total (single-family and multi-family) housing starts from the St. Louis Federal Reserve. The decline in 2022 is highly correlated to the increase in interest rates by the Federal Reserve (which was triggered by decades-high inflation).

We have two takeaways from this chart: a) Post vs. Pre-COVID, the monthly housing start rate is up 15-20%, and b) the projected lift from materially lower interest rates in 2025 and 2026 would be ~200-250K additional monthly units. Even with post-COVID increase, there is an approximate 3.5-4.0 million shortage of homes in the US (FreddieMac study here). It would take 16 consecutive months of 250,000 incremental units to fill a 4 million home gap. Given the importance of home ownership to wealth creation, having a shortage of homes creates a gap that could widen the current wealth gap.

This chart has many uses for the broadband industry. Mortgage rates are ticking lower (latest are 6.58% for 30-year and 5.69% for 15-year fixed rate mortgages), but growth will not return with vigor to the housing market until 30-year rates are at or below 5% (a level last seen in April 2022). More homes equals more fiber and cable passings. This is one of the most closely tracked metrics for fiber and broadband providers, and why we include in our market analysis.

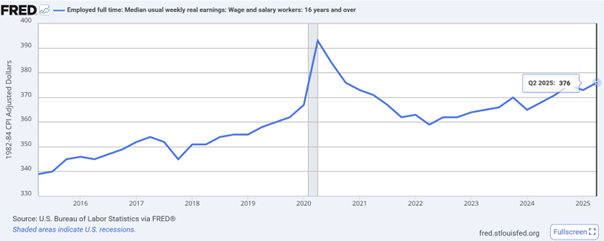

Affordability is also important to broadband and executive teams. Here is another chart from the St. Louis Federal Reserve showing real wage growth over the last ten years:

The growth in wages corresponds to the COVID checks and other government assistance provided during the pandemic. What is notable about the chart is that real wages have been rising steadily since the beginning of 2024, and are on a trajectory to match the 2020 peak by the end of 2026. Workers have ~6% more in their paychecks (after inflation) today than they had in the four years leading up to the pandemic, but they have less than they had during 2020. Improving affordability through higher real wages could lift housing starts despite higher interest rates.

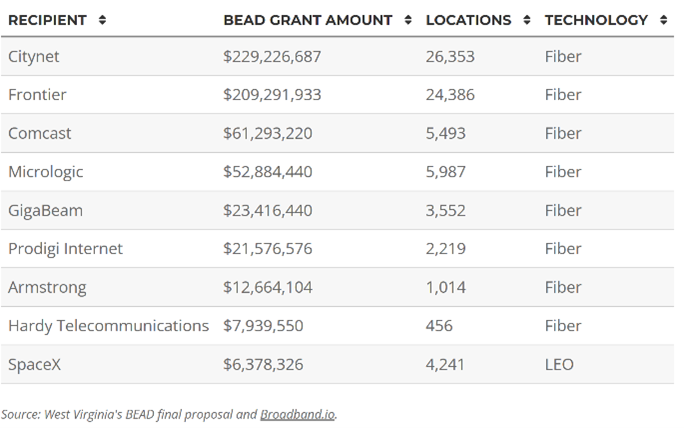

In broadband news, BEAD results were released for West Virginia, Virginia, and Louisiana (the latter two were discussed in our interim Brief here). West Virginia also released their preliminary awards this week, with nine companies selected (chart is from Light Reading’s article here):

While much of the focus has been on SpaceX (there is widespread speculation that Elon Musk will challenge the results – article from Broadband breakfast here), we think the real focus here should be on who is not included in this assessment. Altice, the dominant cable provider for West Virginia, is absent (Comcast won 5,493 passings which is a rounding error in their annual quarterly passings activity. They have cable exchanges in cities like Wheeling and Morgantown and Martinsburg that border southwest Pennsylvania).

Altice could be missing because they a) already have sufficient coverage, b) could not easily reach the unserved markets, or c) did not see a clear payback from investment even with a minimal match (per the press release here, carriers are picking up 22% of the total cost to reach 73,701 locations). Our view is that Altice’s loss is likely Citynet’s gain.

The other missing category are electric cooperatives. Harrison Electric, based in Clarksburg, WV, is well underway on their fiber deployment with several hundred connections already underway. None of the primary electric companies (American Electric Power is the largest utility provider in WV) received funding.

While small numbers, it’s clear that BEAD spending is going to come in far lower than the $42.3 billion allocated. This is in large part because of the FCC’s Enhanced ACAM program ($18 billion for rural telcos to deploy fiber throughout their exchanges) which was not considered in the original count of unserved and underserved locations. In addition, many current FTTH and cable companies are expanding as a result of standard “edge out” initiatives.

In Fab Five news, Google held their “Made by Google” event (video here) in Brooklyn last week. The biggest announcement was the launch of the Google Pixel X. Yes, this is the tenth year of showcase devices from Mountain View. The Pixel line has come a long way since then, and their tenth edition does not disappoint. Here is the overall takeaway from CNET (critical of everyone):

“The new Pixel 10 Pro series isn’t a big overhaul from the last generation, so those of you with a Pixel 9 Pro don’t need to consider upgrading. Probably ditto for anyone with the Pixel 8 Pro. If, however, you have a much older Pixel model or other Android phone — or if you’re looking for a change from Apple — you should consider Google’s new phones.

“The design of the Pixel 10 Pro series remains slick. The cameras performed well in our early tests, and the new AI-based tools like Magic Cue appear to be genuinely useful. Throw in the faster charging speeds, long software support and promised upgrades to the overall performance, and the Pixel 10 Pro and 10 Pro XL are shaping up to be superb flagship Android phones.”

Google has gone out of their way to tightly integrate Gemini (their Artificial Intelligence engine) into every aspect of the device. This gives it a head start against the iPhone (and, in our opinion, against a Samsung/ Bixby alternative). To the extent AI moves to mobile (we think it’s going to be critical to handset functionality by 2027 – Apple will ensure that when they begin to roll out Apple Intelligence), Google is going to have a major presence. And, with antitrust concerns still lingering with the Apple/ Google search engine relationship, it’s critical that Google have alternative outlets to increase their reach. Note: If any of our Sunday Brief readers purchase a Google Pixel X, we would be very interested in your initial impressions.

2Q earnings review (Part 3) — Verizon’s calculus

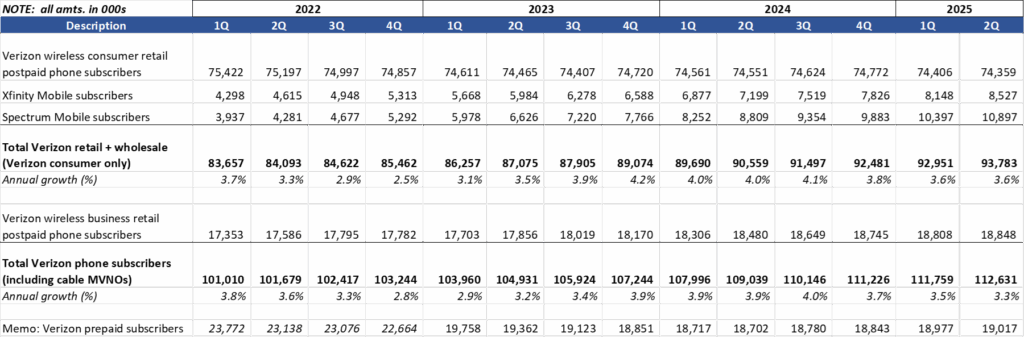

In Part One of our 2Q earnings review, we looked at the conundrum facing cable providers who are battling the newness of fiber. In the last full Brief, we looked at the contribution of prepaid phone subscribers and the upgrade process to postpaid for each of the Big Three wireless service providers. This week, we will focus on a chart we constructed in 2023 that forms the basis for whether Verizon is winning with their “wholesale vector” strategy. (This chart will be included in Excel format in next week’s Interim Brief):

Our data is compiled from quarterly reports from Verizon, Charter and Comcast. What the data shows is the overall postpaid phone subscriber growth on the Verizon network (3.5% or more for the last nine quarters). Assuming Verizon and Spectrum customers have similar/ converging usage characteristics (and with Spectrum at nearly 11 million customers, that’s probably the case), Verizon has been able to grow their network by 9.7 million subscribers over the last three years. Over that time, Verizon has lost 838K retail postpaid phone subscribers (roughly 1% of their base). But they have picked up 6.6 million subscribers from Spectrum and 3.9 million from Comcast.

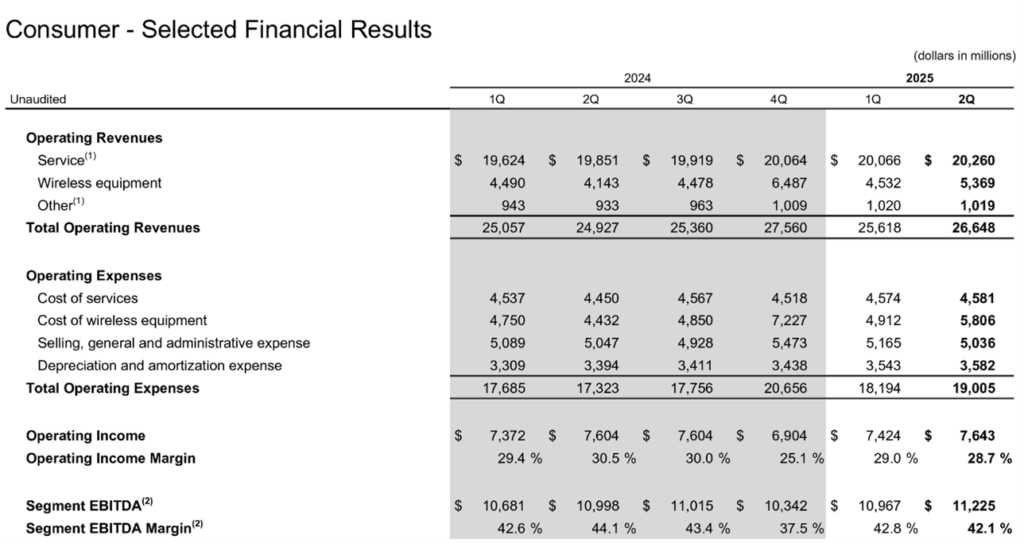

On a volume basis, this seems to be a winner – provided Verizon is earning a return above their cost of capital. We think the wholesale MVNO business is highly lucrative to Big Red. The company does not release specific data on how much the cable MVNO relationships generate, but they did recategorize their revenues in the consumer segment recently to provide greater MVNO visibility – here’s the 2Q schedule with revenues by category:

In 2Q 2024, service revenues + other totaled $20.784 billion. A year later, that figure had grown to $21.279 billion (2.4% growth). Retail service revenue growth was 2.1% but other revenues grew at a meaningful 9.2% year-over-year. For every dollar of service revenue growth (including other), cost of services grew 26 cents. This left $16.698 billion of gross profit excluding wireless equipment subsidies last quarter vs $16.334 billion in Q2 2024 (2.2% growth).

Per public comments from Verizon, the cost of adding (and operating) an MVNO customer is much lower than a retail customer. Some cable plans use deprioritized data (which, by definition, does not drive incremental capital) but others use premium data up to a prescribed level (20, 30 or 100GB depending on the plan) before moving to a deprioritized state. Said another way, the “other” revenues do not carry a zero cost, but it’s safe to assume that the cost of maintaining a $4 billion annualized revenue stream is low (maybe 15% – or $600 million in operating costs annually, with many of those allocated based on usage).

Add in business line growth, and Verizon’s subscribers (with ever-increasing usage) have grown nearly 12 million over the last three years with less effort than a retail-only strategy. Bottom line: Verizon may have lost the small business cable MVNO market to T-Mobile (announcement here), but the value being created by the residential MVNO product is feeding Verizon’s hefty capital budget. Without the cable MVNO, Verizon would be in a much worse place.

Strategy “deep thought” of the week: pairings

The telecom industry thinks that network evolution is the primary (or sole) driving force behind technology innovation, and this often morphs into the thought that network deployment alone will drive technology. Our thesis is that the impact of any network evolution is directly dependent on additional technological advancements to be successful, a true “impact = deployment + technology a,b,c” formula (“y = a + bx” for those of you who remember algebra and statistics). Said another way, any future network advancement (e.g., 6G) should couple with one or more technology advancements first and create successful co-dependencies.

In the case of 3G, it was the development of mobile chipsets and handset manufacturing process advancements (at an affordable price) that drive adoption. 3G deployments/ product simplification + Qualcomm and Samsung/Motorola innovations drove higher returns on invested capital.

Then came 4G. This technology spawned the smartphone industry (hardware and operating systems), but also benefitted from the removal of Selective Availability functionality within the current Global Positioning System (more in this Wikipedia article). Smartphone users numbered in the billions by 2012, creating version/upgrade complexity.

5G started in earnest six years ago (2019) and Apple released the 5G compatible iPhone 12 in late 2020. We were not believers in 5G hype (see one of our most-read articles called “About This Thing Called 5G”) and clearly stated at the time that software and hardware deeded to develop (we did not call it Artificial Intelligence at the time but the examples in the post clearly follow AI developments today) in tandem with networks for revenue and profit maximization.

Instead, the industry ran to fixed wireless success (FWA) as its “big idea” – which is an asset utilization solution as opposed to a product (although we thought of 5G as an access replacement in 2019/ early 2020 as well for business customers). Great product serving the broadband needs of millions of homes, but not on the same level of innovation as Google Maps or Uber.

Executive teams at telecom companies are faced with several strategic questions:

- Why spend more than the minimum amount of money on 6G in 2026 if 5G applications are just beginning to emerge?

- Is the rapid implementation of fiber (and continued investment in hybrid fiber coax) throughout the US a parallel technological development that actually helps 5G?

- Which technologies are not progressing as fast and require additional nudging from carriers to improve overall returns for the 5G platform (we have long argued that the TV needs to be replaced with something much smarter, perhaps from a company like Nvidia. We also think AT&T squandered the opportunity to make connected cars a reality a decade ago)?

- Are there other external factors (e.g., GPS) that could change their characteristics and rapidly impvove the economics of 5G networks?

We continue to come back to low-latency applications requiring consistently fast speeds as the ideal pairing for the next generation of 5G. There are some examples of collaboration, but the mobilization of AI or quantum computing or any other major technological development has not surfaced. The telecom company who solves it first will be the market cap and value creation leader.

We will analyze comments from several upcoming conferences for hints of 3Q performance in our next Brief. Meanwhile, if you have friends who are interested in being notified each time we publish a Brief, please have them sign up at www.sundaybrief.com.

Finally – Go Royals and Sporting KC!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.