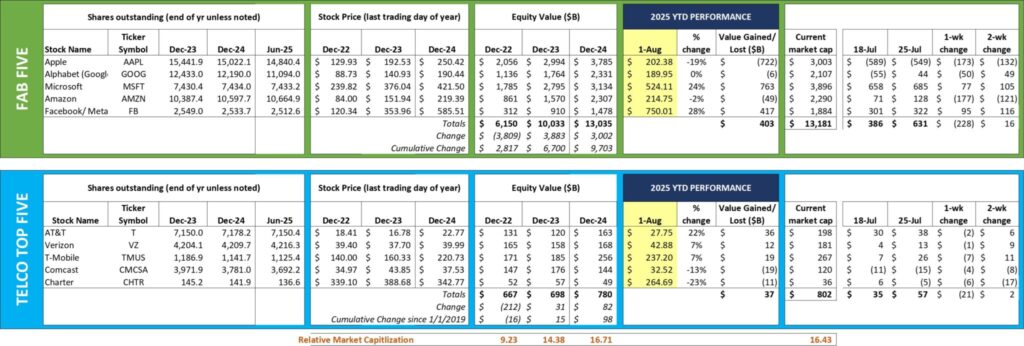

Over the last two weeks, the Fab Five were up $16 billion — basically no change on their $13.2 trillion total market capitalization

Given earnings growth in last week’s quarterly releases (four of the Fab Five reporting), one might expect more movement amongst the Fab Five. But the group was surprisingly quiet and the opening picture shows. Amazon and Apple, the two most heavily exposed to tariff volatility, closed lower for the week and started August with year-to-date losses. Meta, Microsoft, and Google (who reported last week) were not materially higher or lower.

Over the last two weeks (which includes all earnings), the Fab Five were up $16 billion — basically no change on their $13.2 trillion total market capitalization. After all of the news was digested, the groups’s value was unchanged.

The Telco Top Five lost $21 billion for the last week and gained $2 billion for the fortnight. The 2-week change tells a clear story: investors in telecom moved out of cable stocks and into wireless. As we have described in many previous Briefs, Charter+Comcast has a combined value that is $25 billion less than Verizon, and Big Red trails Ma Bell by $17 billion or roughly 10%.

Charter Communications’ market cap has decresed 37% since the beginning of July. We discussed why we think this is wildly overblown in last week’s Brief.

One article that appears to have been overlooked centers around Goldman Sachs’ sale (and J.P. Morgan Chase’s acquisition) of the Apple Pay portfolio and operations (Wall Street Journal article here). The following disclosure about the Apple Pay base is particularly interesting:

“As of the end of March, some 34% of Goldman’s credit-card balances are tied to people with less than a 660 credit score, on a scale that tops out at 850. At JPMorgan that figure was 15%, while at Capital One, which has for decades specialized in subprime cardholders, borrowers with a credit score of 660 or lower held 31% of balances.

Goldman cardholders were behind on payments by 30 days or more on roughly 4% of credit-card outstanding balances as of the end of March, according to Goldman’s financials. The delinquency rate on credit-card loans across all commercial banks was 3.05% for the same period, according to the latest data from the Federal Reserve.

Goldman had $2.45 billion set aside for potential future credit-card loan losses at the end of March.

Most credit-card issuers make up for having delinquent borrowers by charging late fees. But the Apple card with Goldman doesn’t charge late fees, wiping out a key revenue generator.

The combination of high subprime balances and no late fees has led several credit-card issuers to pass on pursuing the program, unless they could get it at a huge discount, people familiar with the process said.”

When Apple Pay started in 2019, we called it the “Wolf in Titanium’s (sheep) Clothing.” Looks like it was more of a dud than a star.

Download the chart below (which includes updated share counts and net debt balances for the Fab Five, something we will discuss next week.