Ericsson’s enterprise segment saw mixed Q2 results, with falling sales but improving profitability. Growth in wireless connectivity and key 5G wins partly offset weaker Vonage performance amid cautious customer investment.

In sum – what to know:

Lower sales – Enterprise sales fell 6% (adjusted), led by a 9% drop at Vonage, though enterprise wireless showed organic growth.

Better profits – Profitability improved, with adjusted EBITA loss narrowing from SEK 1.2bn to SEK 0.5bn due to cost reductions.

New contracts – Major 5G wins and new product developments, including edge AI and ZTNA, point to solid pipeline momentum.

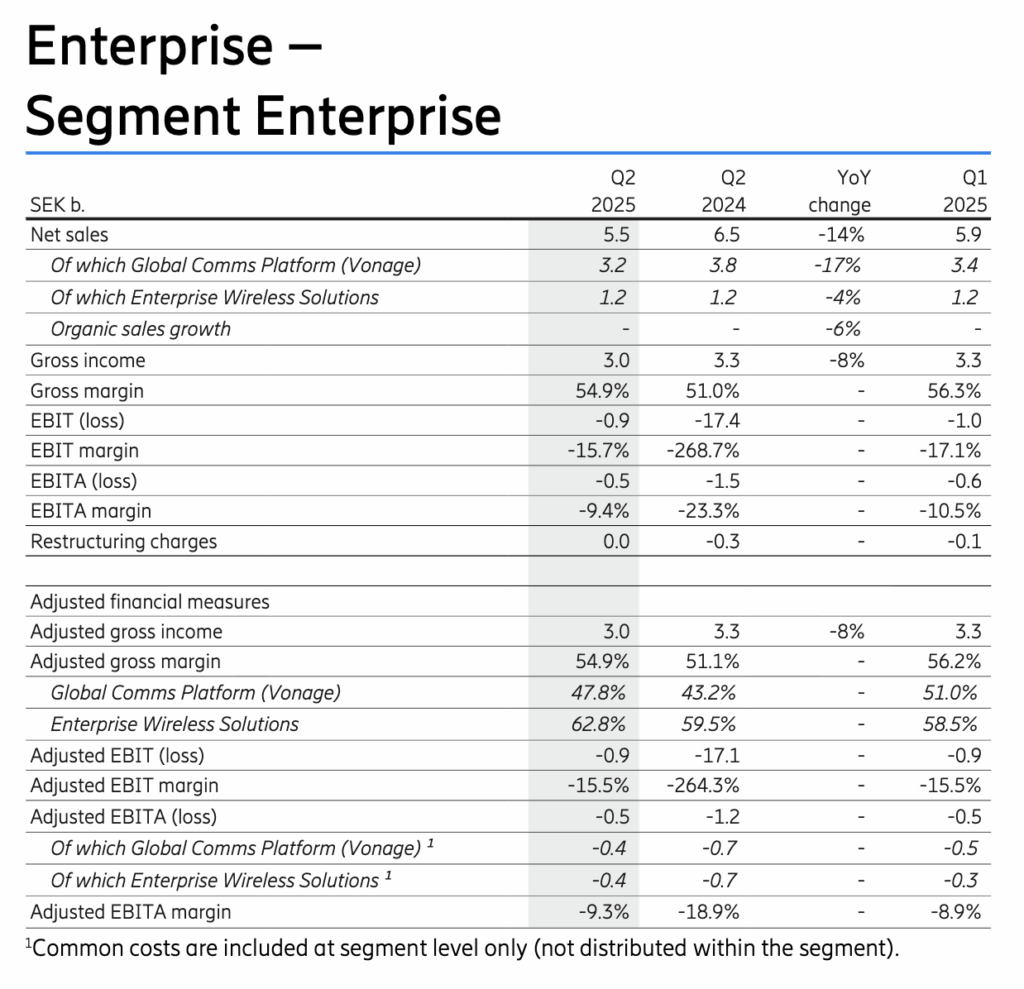

A quick snapshot and summary of Ericsson’s performance in the enterprise sector in the second quarter, to be considered with its full results, covered here. The Swedish vendor claimed “continuous growth” and ‘pipeline momentum’ for enterprise connectivity, even as adjusted sales slipped six percent on the year-ago quarter (and 14 percent as reported net sales figures), from SEK 6.5 billion to SEK 5.5 billion, and adjusted preliminary earnings (EBITA), the chief profitability metric, showed a loss of SEK 0.5 billion. But in the round, performance looked decent.

The unit’s adjusted EBITA showed an improvement in the quarter, from a loss of SEK 1.2 billion in the same period in 2024. This was down to reduced operational expenses in both its ‘enterprise wireless solutions’ business, responsible for its private networks and wireless wide-area network (WWAN) solutions, and its ‘global communications platform’ business, which accounts for its Vonage exploits. The two, together, represent the mainstays (about 80 percent, nominally) of Ericsson’s enterprise business segment. (The rest comprises ‘technologies and new businesses’.)

The overall decline in enterprise sales reflected a “more cautious customer investment environment”. It was mostly down to the latter, it seems. Net sales for the Vonage operation fell 17 percent year-on-year as a consequence of reduced activities in some countries – from SEK 3.8 billion to SEK 3.2 billion in the period (adjusted to nine percent). Enterprise wireless sales were down four percent on a reported basis – but returned the same value as a year ago (SEK 1.2 billion; which is a five percent jump as an organic basis). Organic growth for its enterprise wireless unit, mostly from higher WWAN sales, rallied in the period, and “partly offset” the rest of the segment.

By comparison, adjusted net sales in its bigger mobile networks segments – covering networks themselves and cloud software and services – both increased in the period, by three percent and one percent (to SEK 35.7 billion and SEK 14.4 billion, respectively). These twin units invariably comprise the lion’s share of its revenues (about 89 percent; SEK 50.1 billion out of SEK 56.1 billion). Börje Ekholm, president and chief executive at Ericsson, explained the group’s performance in terms of growth in the US, stability in Europe, and good industry sales of fixed wireless access (FWA) solutions.

But the firm’s enterprise sales look steady, too. Asa Tamsons, in charge of its enterprise wireless solutions division, pointed to big (public) private 5G wins in the quarter, with Newmont Corporation (for remote dozer control) and the city of Istres (for a camera network). Both deployments had been impossible, or just too expensive, with Wi-Fi, she said. As well, Tamsons highlighted Ericsson’s work in the quarter to expand its NetCloud SASE with clientless zero-trust network access (ZTNA) functionality (a “gamechanger for IT teams”, she said), and to tie-up with Supermicro on new edge AI capabilities (in “industries like retail, factories, and healthcare”).

She stated: “I’m more confident than ever in our vision for enterprise connectivity. Our momentum isn’t just about numbers – it is about real transformation for customers worldwide… I am encouraged by the momentum in our pipeline for continuous growth, strengthening our position as a leading partner for enterprises seeking 5G and advanced wireless solutions. We’re delivering real-world results faster than ever… Through summer, I see us continuing to unlock opportunities to scale impact, deepen partnerships, and continue redefining what’s possible when enterprises embrace next-generation connectivity.”