Hyperscale operators dominate global data centre growth as on-premise facilities shrink by comparison. Cloud, AI, and regional dynamics are driving the shift, reshaping how and where data infrastructure scales worldwide.

In sum – what to know:

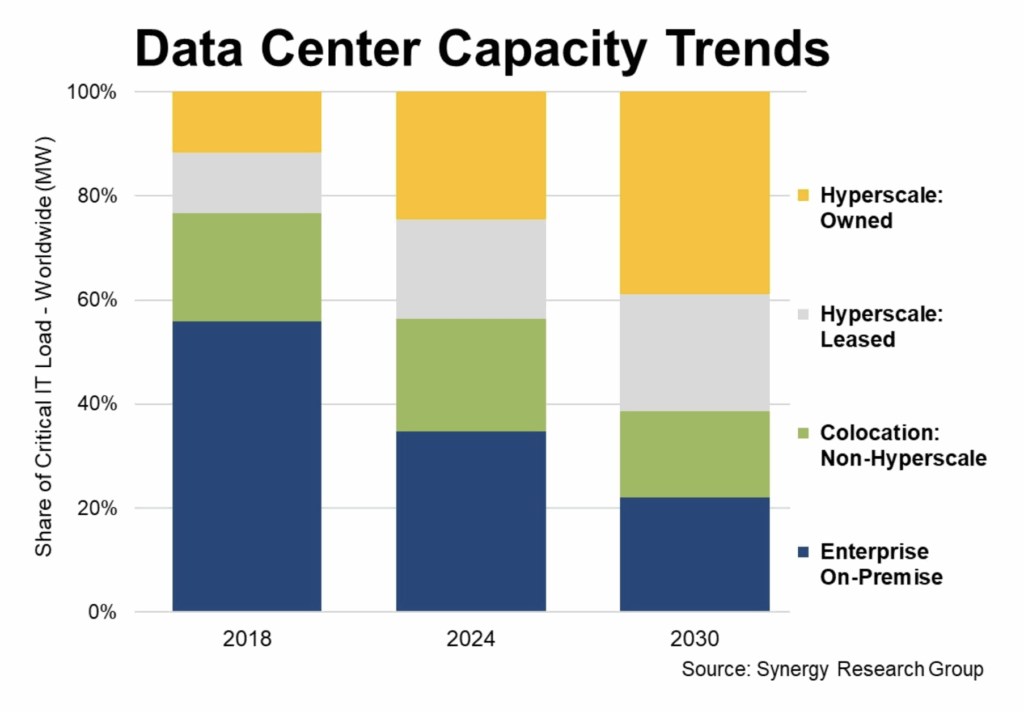

Hyper scale – big cloud firms like AWS and Google now control 44% of global data centre capacity, up sharply as on-premise facilities drop from 56% to 34% in six years.

AI drivers – hyperscale capacity will triple by 2030, reaching 61% of total capacity, driven by cloud and AI growth, while on-premise share continues to decline.

Regional twists – regional differences persist, with the US leading in hyperscale ownership, but all regions showing double-digit growth in data centre capacity.

An interesting report from Synergy Research Group about the global shift in data centre capacity, which says – logically, but also contrary to the kind of private edge drive that RCR Wireless often writes about in its (Industry 4.0) enterprise coverage – that hyperscalers are hyper-scaling faster than ever. Indeed, large cloud operators like AWS, Google, and Microsoft now control 44 percent of global data centre capacity, as of the first quarter of 2025, while privately-owned edge facilities have dropped from 56 percent to 34 percent of total capacity.

It is a major shift in the balance (over a period of six years), away from on-premise data centres. Over half of current hyperscale capacity, stretched across 1,189 data centres globally, is now in data centres that are built, owned, and operated by hyperscalers themselves. The balance is in leased facilities, it says. Non-hyperscale colocation capacity accounts for 22 percent of the total capacity. On-premise data centres comprise the rest – “just” 34 percent of the total, says Synergy Research Group. Six years ago, edge facilities comprised 56 percent of the total.

There are some micro-trends behind these figures. Hyperscale operators will account for 61 percent of all capacity by 2030. On-premise capacity will drop to just 22 percent over the same period. At the same time, capacity is growing in every locale, it seems. “Cloud and other key digital services have been the prime drivers behind data centre capacity expansion, and the dramatic rise of AI technology and applications is an added impetus,” commented John Dinsdale, a chief analyst at Synergy Research Group. Even so, capacity is growing fastest in hyperscale venues.

Indeed, hyperscale capacity will jump three-fold (200 percent) over the next six years, completely turbo-charging the hyperscalers’ share of the data centre market. Co-location facilities will see double-digit capacity growth in the period, but their share of total market capacity will diminish in the face of the hyperscale charge. On-premise data centres are seeing a boost (“after a sustained period of essentially no growth”) because of generative AI applications and GPU infrastructure. But their share will also slip – by a couple of percentage points per year over the period.

Another micro-trend in the data, based on quarterly tracking research, is the regional mix. Dinsdale said: “Hyperscale owned data centre capacity is much more prevalent in the US than in either the EMEA or APAC regions. Overall though, the trends are all heading in the same direction. All regions will see double-digit annual growth rates in overall data centre capacity over the forecast period, and all regions will see the hyperscale owned portion of that capacity growing by at least 20 percent per year.”