BT’s 2024/25 results show fibre gains amid slumping enterprise and consumer revenues. The UK telco is shrinking its international footprint, refocusing on domestic enterprise growth, and eyeing managed service expansion – which is a good model for most telcos, reckons Omdia.

In sum – what to know

Strategy shift – despite strong fibre sales, and in-line performance, BT’s enterprise revenue dropped 4% as it retreats from global markets, slashes products, and puts squarer focus on UK sales.

Shrewd move – analysts reckon its pivot is sensible, and might be the model for most of its peers: to quit chasing big global deals, and double-down on local adjacencies like security and managed apps.

Engine room – the national SME market, mostly forgotten about in early-adopter tech segments, is the single biggest opportunity for telcos to organise souped-up AI-geared box shifting as a managed service.

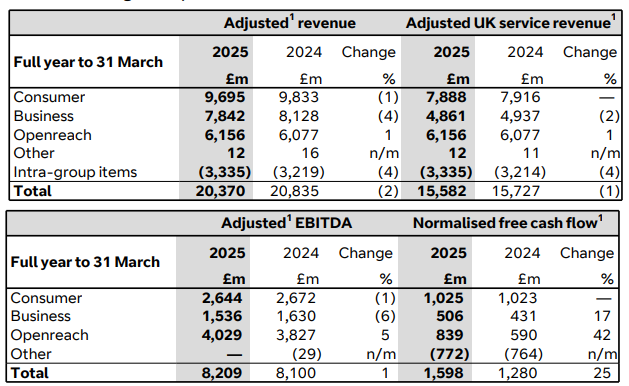

A quick look at BT’s full-year results for 2024/25, from yesterday, vis-a-vis what they say about the changing strategy at a changing telco in a changing market – and specifically about the enterprise strategy at a national (‘the national’) telco, attempting to reassert itself in its twitchy local market, in a troubled industrial sector, in a turbulent global economy. Well, the headline is that BT’s revenue is down two percent, versus 2023/24, as notable drops in its enterprise and consumer units (four percent and one percent) undercut good fibre sales.

Adjusted revenue slipped to £20.37 billion, from £20.835 for the same period a year ago. It blamed “international sales and handsets”. But Openreach, its standalone fibre infrastructure business, saw revenue and profit rally by one percent and five percent to £6.156 billion and £4.029 billion, which drove overall profit (EBITDA) and cash flow higher – by one percent and 25 percent to £8.2 billion and £1.6 billion, respectively. It called-out “record demand” at the end of the year for fibre-to-the-premise (FTTP; “net adds above 500,000 for the first time”).

But none of this was enough to compound its FTSE 100 showing as “one of the worst performing stocks”, sliding three percent on the day (May 22); nor to distract from the enterprise story, which rests on declines of four percent and six percent in revenue and profit terms (to £7.842 billion and £1.536 billion). In sum, BT takes 33 percent of its total revenue and 19 percent of its total profit from enterprises – versus 41 percent and 32 percent, respectively from consumers, and 26 percent and 49 percent from fibre infrastructure sales. (It might be noted, here, the latter are to broadband service providers in the UK, including BT Group businesses BT and EE, plus rivals like Sky and Vodafone).

The point is enterprise looks on a spreadsheet like more work for less money. We will come back to it.

Just on the results: market watchers reflected that the result is broadly in line with expectation, and BT cited “strong cost control”, which has already delivered £900 million of annualised cost savings, and a “step-up in focus and transformation” as reasons to be cheerful; it raised its full-year shareholder dividend by two percent (to 8.16p per share). The company has also raised its fibre “build target” by 20 percent to reach up to five new million UK premises in 2025/26, to meet a stated target of 25 million properties by the end of 2026.

It made hopeful noises about free cash flow (£3 billion by 2030), as well as its leadership team – which is “in place to take our strategy forward”, it stated. But what is that strategy, apart from fibre rollout in the UK? Because something is up with its enterprise sales, and something is afoot with its enterprise strategy. To recap: the business is turning inwards, away from global in-market operations. In February, BT Business announced a deal with Speed Fibre Group to sell its Irish wholesale and enterprise unit. It is getting rid of its Italian footprint as well.

“[BT] Business [has] continued to refocus on the UK,” it said. Meanwhile, BT blamed the revenue slump in its enterprise unit on international trading (“principally”). And yet its rationalisation crosses into its enterprise portfolio, as well; the company has reduced the number of products it sells by 20 percent, apparently – from 263 to 203. All of it is being done in the name of “modernisation”. So what gives? The punchiest response came from Camille Mendler, research director for telco B2B at analyst house Omdia. “The killer stat is that nine-percent drop in international [sales] – and, generally, its desire to sell more to smaller domestic businesses in a consolidating UK market.”

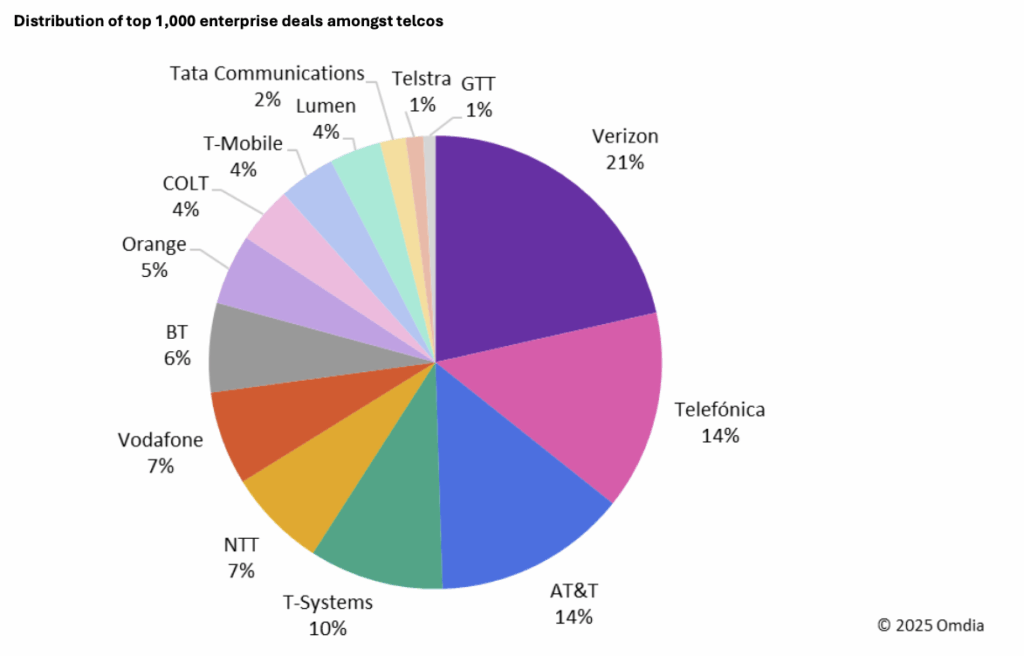

She stepped back, and explained: “BT’s ongoing international losses highlight an important lesson: telcos must go big or go home. There is a trillion-dollar growth opportunity in telco B2B but for 99 percent of operators, it does not lie with multinational enterprises. It is time to exit risky business and focus on rational adjacencies beyond connectivity. BT captured only a six percent share of the top 1,000 global enterprise deals among its service provider peers… Smart international alliances with technology and go-to-market partners now offer the only sustainable path forward.”

On the latter, BT pointed to deals with Equinix and Google Cloud in support of its developing Global Fabric proposition, which stitches together local metro-edge cloud-and-network services for enterprises to ‘shop’ for faster compute services via local operators and data centre partners. It covers over 30 Equinix data-centres, as of January. The arrangement with Google Cloud is about the cloud outfit’s Cloud WAN product, billed in BT’s financial commentary as a “planet-scale network”. Which seems to be the gist for multinationals: a network service (NaaS) outside of the UK, which rides on non-traditional telco infrastructure from cloud providers of different stripes.

But Mendler’s comments are interesting, more broadly. She supplied a breakdown of these enterprise deals (the top 1,000; see below), which says Verizon (Verizon Business) has the lion’s share of them – one in five (21 percent). Telefónica (Telefónica Tech?) and AT&T both take 14 percent (about one in seven) each; T-Systems, the IT SI unit attached to Deutsche Telekom, takes one in 10. The enterprise-integrator divisions at every other tier-one telco – including BT and Vodafone in the UK, and Orange in France, plus others – are fighting for the leftover scraps.

It will take some unpicking – which RCR will do, as it puts squarer focus on networking and computing resources in this mad tale about the strange economics of industrial AI, and how it is served up. But some footnotes: Omdia’s review of the telco community’s top-1,000 deals is based on the value of their existing contracts with enterprises. The average value is about $23 million, says Mendler. “There are usually a few billion dollar mega deals every year,” she says. The deals include both multi-national and national contracts; the latter tend to be big public sector deals.

BT notes in its results that it has just renewed its Emergency Services Network (ESN) setup in the UK, for example. Indeed, the Omdia data is hugely valuable. Most telcos do not provide much in the way of an enterprise breakdown; only 60 percent report any B2B numbers at all, says Mendler – “and often don’t break out enterprise and wholesale”. But what are we to think of BT’s strategy – to shut down in-market international sales, to go after big-sized parochial enterprise concerns in the UK, when the likes of Verizon Business appear to be hoovering-up at home and abroad?

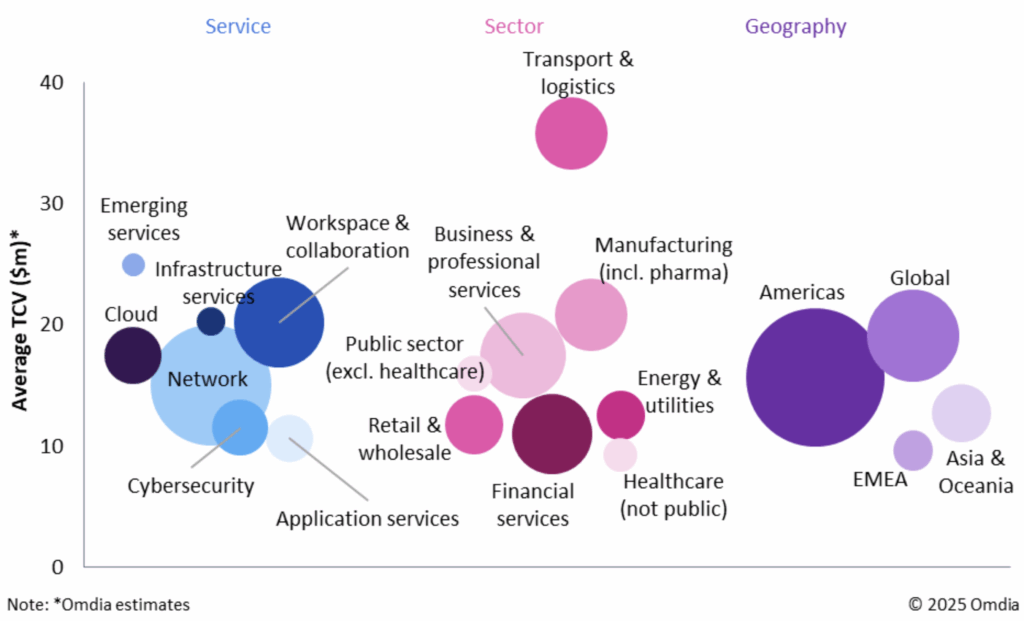

Mendler reflects: “Everyone has had a hard time with this part of the business, even the service providers that appear to be cornering the market.” And multi-national gigs might almost be perceived as vanity projects – the message goes. “The opportunity is with SMEs,” she says. “That is where telcos like BT can cross-sell managed digital and physical security, collaboration, managed apps; the digital wallet, beyond security, is up for grabs, for instance.” Interesting, and what RCR has said all along – that the SME market is where operators might just bring some kind of souped-up multi-layered box-shifting to bear to deliver private 5G networks and public 5G slices to the great engine room of Industry 4.0.

Of course, this is a limited view, and Mendler has another graphic, to show where the bundling of tools and applications into managed services deals will expand. She goes on: “Think: mid-market firms with around 200-2,000 staff, which have growing sophistication but few internal skills, where the IT wants to outsource management of all digital infrastructure. Think: public sector, where a former incumbent like BT is highly trusted for sovereign cloud, digital identity, public safety, slicing services, and so on. What BT is doing is correct: it must focus on a narrower set of growth opportunities instead of playing business model bingo.”

Very interesting; we will pick up again with Mendler, hopefully.