Reconciliation bill text takes the lower 3 GHz, 6 GHz out of contention for auction. Where does this leave CBRS?

New mark-up language dropped last night for the federal budget bill, and it includes a reauthorization of federal spectrum auction authority through 2034 and a requirement to identify 600 megahertz of spectrum that can be auctioned for exclusive, licensed use—but it takes the lower 3 GHz and the 6 GHz unlicensed bands out of contention for auction.

The House Energy and Commerce Budget Reconciliation text will be considered this week. The proposed text requires the Federal Communications Commission and NTIA to identify 600 megahertz of spectrum to be identified for reallocation “on an exclusive, licensed basis” for mobile and/or fixed broadband services within two years, and for the FCC to auction at least 200 megahertz within three years. It does not specify which bands, but includes the caveat that auction proceeds must cover 110% of federal relocation or sharing costs.

The text also proposes that FCC auction authority be extended until 2034.

As Congress works to get President Trump’s “big, beautiful bill” through, it is seeking to make budget numbers work in part by bringing in additional revenue through lining up spectrum auctions. This requires a reauthorization of the Federal Communications Commission’s statutory authority to auction airwaves (which lapsed in early 2023) as well as raising the question of exactly which spectrum should be auctioned.

CTIA’s new President and CEO Ajit Pai wrote in a recent Wall Street Journal op-ed that the wireless industry needs at least 600 megahertz of spectrum to challenge China’s wireless technology leadership—exactly the amount which Congress wants to auction—and that auctioning so much spectrum could raise up to $200 billion.

But which spectrum would be auctioned? One of the long-standing sticking points in Congressional reauthorization of the FCC’s auction authority has been a lack of agreement on a spectrum pipeline. The spectrum environment is increasingly constrained and competitive: Mobile network operators want to support both mobile and bandwidth-hungry Fixed Wireless Access services. Space uses of spectrum are becoming more demanding as well. With the federal government and particularly, the Department of Defense, holding virtually all of the candidate bands for reallocation, what are the costs and the risks to national security, and how should commercial demands be balanced?

The Biden administration had sought study of nearly 2,800 megahertz of spectrum, with an emphasis on spectrum sharing as the default approach. The next bands teed up in that National Spectrum Strategy were 37 GHz, the lower 3 GHz band from 3.1-3.45 GHz and spectrum in the upper midband at 7-8 GHz. Those studies were supposed to include figuring out whether airborne radars and other federal systems in the lower 3 GHz band could be repacked, compressed or relocated to allow commercial use of the band.

In recent weeks, the House and Senate Armed Services Committees have been briefed on potential spectrum bands that the DoD sees as the most likely bands for shifting its existing systems, or conversion to commercial wireless use. According to two sources familiar with the content of the DoD spectrum briefings, some of the bands offered up as possibilities were not actually federal bands or bands in which DoD operates; nor was there a commitment from the agency to support reallocation of specific bands; and DoD didn’t address issues related to commercial incumbents.

“It’s one thing for DoD to say they could relocate their systems. It’s another thing for them to say they will,” said one of those sources.

Perhaps the most controversial part of that proposal was, according to published reports, the possible vacating of 100 megahertz of the CBRS band so that it could be re-auctioned for high-powered, exclusive use.

While mobile network operators including AT&T and T-Mobile US have been pushing for years for the FCC to allow higher-power operations in the CBRS band, to improve propagation and reduce the number of sites have to be deployed for a CBRS coverage layer, the proposal to actually move Priority Access License (PAL) holders and General Authorized Access (GAA) users out of the band is a much newer twist.

That proposal closely resembled an idea that has been around since late 2024, when AT&T EVP of Federal Regulatory Relations Rhonda Johnson floated a “new vision” for the 3 GHz band: Move CBRS users to the lower section of the 3 GHz band, at 3.1-3.3 GHz, and auction the CBRS spectrum at 3.55-3.7 GHz for licensed, full-power use that would also create contiguous operations for full-powered 5G from 3.4 GHz to the upper limit of the auctioned C-Band spectrum.

AT&T said in a statement provided to RCR Wireless News last week: “We continue to support the idea that a rethinking of the 3 GHz band can help unlock more mid-band spectrum to support 5G. This includes relocating CBRS to the lower 3 GHz range, expanding the amount of spectrum allocated to it, and then opening 3.55-3.7 GHz to auction for licensed, full-power use – all of which would help to realize the maximum potential of spectrum across the 3 GHz band.”

CBRS proponents reacted swiftly to the news that Congress might actually approve a plan that would relocate commercial CBRS users, with protests that such a move would destroy more than the significant, domestic development in the CBRS band—one in which the U.S. has established private wireless network leadership and in which around 450,000 CBRS devices are active, according to GSA figures—as well as likely kick off years of litigation if current license holders were abruptly kicked out of the band. If a CBRS relocation were undertaken, it wouldn’t be decisive or fast, said one of the sources familiar with the ongoing spectrum discussions on the Hill. “This is where the Congressional process ignores inconvenient realities,” the source added.

Dr. Robert Spalding, Brig Gen, USAF (Ret), is CEO of SEMPRE, which provides secure, hardened CBRS and Open RAN private networks for commercial and defense use cases including disaster recovery and detecting and elimonating drone threats. “One of the great things about CBRS is, we can go anywhere and set really fast. Our systems are designed to be deployed by anyone—you don’t need to know anything about cellular or cloud, you just plug it in, turn it up and operate it,” he said.

Spalding said that CBRS and O-RAN are the two pillars of supporting new entrants in the U.S. telecom market, and a unique technological advantage for a country which no longer has a major, home-grown infrastructure provider. “I believe that digital sovereignty is important. Data security is important,” he said. “I think not having a telecom [infrastructure] industry, from a national security perspective, puts America at risk.”

And, if small businesses which have been built around the availability of a developed CBRS infrastructure, chipset, module and device ecosystem were asked to move out of the band and start over, Spalding said, “I don’t think any of these companies survive. So that’s the terrible thing, and the big thing.”

“CBRS has made the United States the global leader in both dynamic spectrum management and private cellular networks, perfectly aligned with the Trump Administration’s directives to protect American innovation and to promote those American-led technologies abroad. And private networks are just one example of the range of CBRS use cases, with others including mobile network capacity augmentation, alternative mobile services, fixed wireless access, and next gen in-building neutral host solutions,” said Dave Wright, policy director for Spectrum for the Future, in a statement to RCR Wireless News.

He added: “CBRS’ immense value to American industry, businesses, and citizens is clear, and we hope to see our policymakers give it the consideration it deserves.”

The House committee mark-up text may assuage some of the concerns of CBRS advocates, as it appears to take the most direct path for migration off the table by carving 3.1-3.45 GHz out of contention as a candidate for auction. If they cannot migrate to the lower 3 GHz band, it may be that CBRS users aren’t asked to migrate at all—although that remains to be seen.

The bill also exempts 5.925-7.125 GHz from auction, which was allocated to unlicensed use—primarily Wi-Fi—under former FCC Chair Jessica Rosenworcel, despite pushback from the MNO community on the latter as well.

That doesn’t mean there are no likely changes ahead for CBRS—and they could very well improve the utility of the band, according to Iyad Tarazi, CEO of Federated Wireless, which supports CBRS deployments. Changes to CBRS operations have already increased the utility of the band, Tarazi said. “We still can do more. I think that would be great. That’s where I see this discussion going,” he said.

The FCC has had a proposed rulemaking in the works for awhile that reexamines CBRS operations, Tarazi noted. Enabling multiple options for higher power levels might be a potential middle-ground. Existing users could be grandfathered in, with their low-power operations protected, but the operating rules of PALs could changed to allow higher-power operations as well. Federated, he added, has modeled down to the household level that a number of changes to CBRS operations could safely be implemented without interfering with existing users or commercial-to-commercial sharing—which he said is a more frequently raised issue in the band than issues of sharing with the actual DoD incumbents. Better understanding of the systems, more advanced data capabilities and support from companies like NVIDIA can sharpen and refine CBRS sharing in a way that improve the utility of the band.

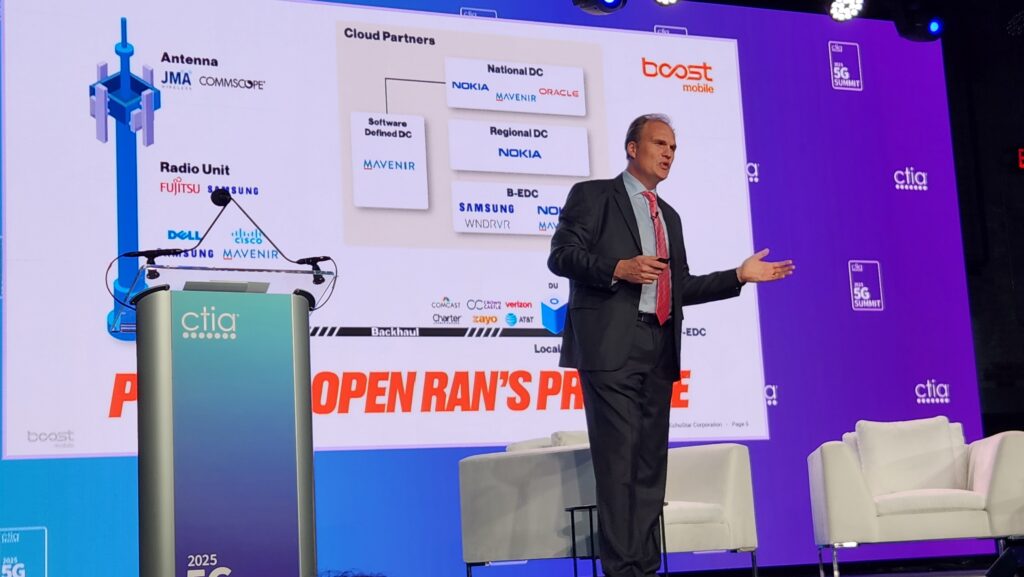

At last week’s CTIA 5G Summit, meanwhile, EchoStar CTO Eben Albertyn used part of his time on-stage to call for a refreshing of the CBRS band to include high-power operations, calling it a “win-win-win situation.” CBRS, he said is “a band that has shown us how we can have multiple people using the same band, and innovate in the same band. But the fact that it’s low-power means that its benefits have not been seen.” The “win-win-win”, as he laid it out, was that no auction needs to be held to change operating power levels; it would better utilize the band; and existing users would not be impacted, according to analysis that EchoStar has done.

“If we give it high power, we will significantly improve the utilization of over 100 megahertz of the most valuable spectrum that we have in the U.S., and we can do so very quickly,” Albertyn said, adding: “There are zero downsides to doing this.”