Mother’s Day greetings from Missouri, Iowa, and, by the time most of you read this, Florida, home of the Conexon Ignite workshop (CellSite Solutions has been a longtime supplier of shelters to the electric cooperative community). Thanks to Randy Klindt and Jonathan Chambers for being gracious hosts. Our opening photo honors all mothers, including those, as ours, who have already passed. Your legacy remains!

We continue our earnings analysis this week with a look at two mysteries that we uncovered through our 10-Q readings. Because we did not publish an Interim Brief last week, we have included the full backup data file at the end of this week’s online Brief (here).

Many of you have asked about our appearance on The Week With Roger. Due to schedule conflicts, that appearance has now been set for mid-June with a link and additional details to follow. Following that, join us in St. Louis on Thursday, July 10th, at the MoKan Wireless Lunch and Learn. Additional details can be found here.

An additional administrative note – we will be publishing a Brief on Memorial Day weekend. It will follow the format that we have used in previous years: a short market commentary followed by 2-3 long format videos we think our readers will find useful and informative. Also, as we noted in the last Brief, we will be converting the email list to our new WordPress distribution over the next 90-120 days. Please pardon our dust as we have several thousand contacts to validate and move in the effort.

The fortnight that was

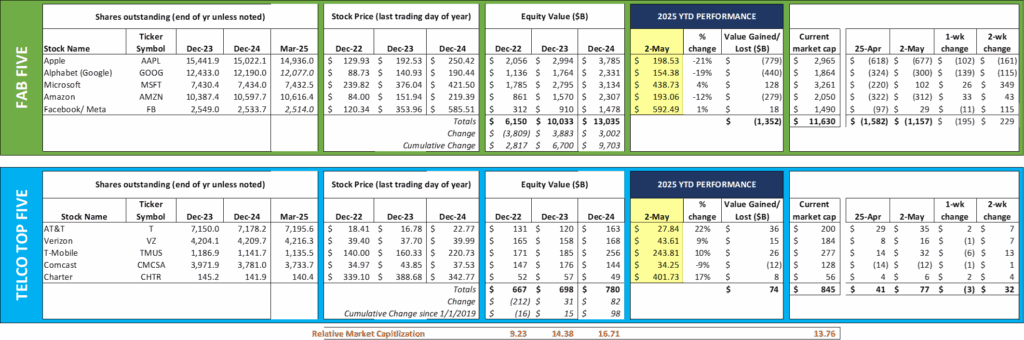

Note: We are still awaiting the 10-Q publication for Meta and have estimated the share counts for Alphabet. Each of the remaining share counts and corresponding market capitalizations have been validated.

Over the last two weeks, the Fab Five have gained $229 billion in market capitalization. Not every company is moving in tandem, however, as Apple and Google took a dive this week (more on why below), offsetting gains by Microsoft and Amazon. Surprisingly, Microsoft and Meta are now both higher year to date, and the Fab Five cumulative $1.35 trillion loss is at pre-Liberation Day (March 21st) levels.

The Telco Top Five continued to grow, increasing $32 billion over the last two weeks. Each stock is higher over that period and all but Comcast are in the black for 2025. As we share in most of the interim Brief posts, AT&T and Verizon are still $16 billion apart in market capitalization, T-Mobile is still worth more than two Comcasts, and Verizon now has a market value greater than the combined value of their two largest wholesale customers (Comcast and Charter). A lot has changed over the last three years: Entering 2022, Comcast had the highest market capitalization, followed by Verizon, AT&T and T-Mobile, and the difference between T-Mobile and Charter for last place was a mere $32 billion.

Court testimony by Apple executive Eddy Cue drove down the values of Google and Apple this week. Judge Amit Mehta is trying to determine the appropriate remedy for Google following his verdict that the company illegally monopolized the online search market. Per this synopsis from The Verge, “For the first time in 22 years, Cue said, Apple saw search volume decline in its Safari browser last month — a side effect of users seeking more information from AI chatbots.” This disclosure created a panic in Alphabet shares which lost as much as 9% of their value (see nearby 5-day chart), and prompted them to release the following statement on search:

“We continue to see overall query growth in Search. That includes an increase in total queries coming from Apple’s devices and platforms. More generally, as we enhance Search with new features, people are seeing that Google Search is more useful for more of their queries — and they’re accessing it for new things and in new ways, whether from browsers or the Google app, using their voice or Google Lens. We’re excited to continue this innovation and look forward to sharing more at Google I/O.”

For those of you who are not aware, Google’s annual I/O conference is May 20 and 21. We think that the market is concerned that Judge Mehta may concoct the worst possible remedy for both companies: Chrome is permanently divested, and the $20 billion search payment to Apple stops immediately. As many analysts (but especially Craig Moffett of Moffett Nathanson – Bloomberg interview here) have pointed out, the Google payment equates to 25% of Apple’s annual operating profits. That’s what keeps Eddy Cue up at night, per the testimony discussed in the link above.

We think that the Google I/O conference is important for another reason – Gemini. Google has aggressively worked to integrate AI into all its search results, creating a blurry line between the intelligence created by decades of search learnings versus recently developed large language models (LLMs). Could Gemini’s total intelligence outstrip twenty-five years of search by the time any verdict takes effect? Could LLMs for specific industries (e.g., LearnLM for education) replace some or all of the search queries originating today in Chrome? We think comments made at I/O could provide some clues (TechCrunch begins to outline them here).

If the loss of Google’s $20 billion payment isn’t enough, one of Apple’s officials, Alex Roman, was accused this week of lying under oath. Per this New York Times article released on Friday, Apple looked at many alternatives to circumvent the Epic Games ruling which forced Apple to provide an in-app alternative to using the company’s payment system:

“Apple created a task force, code-named Project Wisconsin, to respond to the order. It considered two different solutions. The first would allow apps to include links for online purchases in restricted locations, free of a commission. The second would allow apps to offer those links where they wished but force them to pay a 27 percent commission on sales. With links and no commission, Apple estimated it could lose hundreds of millions of dollars, even more than $1 billion. With a 27 percent commission, it would lose almost nothing.

Mr. Cook met with the team in June 2023. He reviewed a range of commission options, from 20 to 27 percent. He also evaluated analysis showing that few developers would leave Apple’s payment system for their own if there was a 27 percent commission, court records show. Eventually, he chose that rate while also approving a plan to restrict where apps put links for online purchases.

Afterward, Apple hired an economic consultant, Analysis Group, to write a report that Apple could use to justify its fees. The report concluded that Apple’s developer tools and distribution services were worth more than 30 percent of an app’s revenue.

Apple also created screens to discourage online purchases by making them seem scary and “dangerous,” court documents show. Mr. Cook weighed in, asking the team to revise a warning to emphasize Apple’s privacy and security. Rather than “You will no longer be transacting with Apple,” the company said: “Apple is not responsible for the privacy or security of purchases made on the web.”

When Apple revealed its 27 percent commission in January 2024, Epic filed a claim in court that Apple wasn’t complying with the judge’s order. Judge Gonzalez Rogers brought Apple and Epic back to court. Alex Roman, a vice president of finance, testified that Apple had made its final decision on its commission on Jan. 16, 2024. Executives also testified that the Analysis Group report had helped them set the commission rate.

Judge Gonzalez Rogers questioned whether Apple was telling the truth and asked the company to provide documents about its plans. It produced 89,000 documents but claimed a third of them were confidential. The court said those claims were “unsubstantiated” and forced Apple to turn over more than half of the documents.

The documents made clear that Mr. Roman had lied under oath, that the Analysis Group report was a “sham” and that Apple had “willfully” disregarded a court order, Judge Gonzalez Rogers said. She called it a “cover-up.”

If true, the results of their actions could be detrimental to the Cupertino giant. As the article states, Apple’s approach to the Epic Games ruling creates an aura of doubt about the company’s intention to comply with future court orders. How this particular case turns out will shape other pending cases and remedies. Needless to say, we will continue to track developments between Apple and Judge Gonzalez Rogers very closely.

Two Q1 earnings mysteries

We have spent considerable time looking through each of the Telco Top Five 10-Q filings released after their quarterly earnings. Here are three mysteries that we have solved as a result:

- Verizon’s consumer wireless service revenue growth was 1.8% in Q1 without non-retail revenues, and likely 1.2-2.3% without retail fixed wireless growth. Without their MVNO revenues (mostly from Comcast and Charter), the company’s growth would have been 1.8% vs. the 2.3% reported. Per the 10-Q, here is the breakdown of growth:

Using a conservative ARPU estimate, fixed wireless (FWA) contributed $100-110 million in Q1 growth. Removing that from the equation leaves non-FWA retail growth at 1.2-1.3%, with most of that coming from the price increases the company implemented in the quarter (a non-perpetual event). Even with meaningful FWA growth, T-Mobile’s comparable figure to the 1.3% posted by Verizon is ~4.7-4.9% (Magenta had a large decrease in wholesale revenues in the quarter thanks to the May 2024 closing of the Mint Mobile acquisition and additional Dish and Tracfone migrations).

Beyond FWA, Verizon is looking to the conversion of prepaid gross additions to postpaid as a meaningful source of growth (we have previously referred to this as Verizon’s “farm team” strategy). Per commentary from Sowmyanarayan Sampath, Verizon’s EVP of Consumer markets, on the most recent earnings call:

“earlier in the year, we had estimated that the market is likely to grow between 8 million and 8.5 million postpaid phones, both for the consumer and the business segment. Sitting where we are right now, we think that number holds. But remember that more than 50% of that is pre to postpaid migration, i.e., customers who are on prepaid plans migrating to postpaid.”

This strategy was effective for T-Mobile a decade ago, but we have concerns that economic conditions are changing (particularly interest rates), and aren’t sure that there is the same wiggle room for credit improvement that we saw in the previous low interest rate environment.

Bottom line: Verizon depends on embedded base ARPA growth and increased prepaid-to-postpaid conversions as the non-FWA, non-wholesale growth drivers. We think it’s a matter of time before wholesale and FWA make up the majority of consumer service revenue growth, and that is concerning.

- Verizon’s Q1 postpaid hiccup was not due (solely) to competitive activity in January, but also because of increased churn driven by pricing actions taken at the beginning of 2025. We discussed Frank Boulben’s comments at the Deutsche Bank Media, Internet and Telecom Conference in our March 25th Brief here. He led off the conference with the following statement about competitive intensity:

“We used to say that the holiday season starts earlier every year, Christmas comes early. This year, Christmas is lasting longer. At the beginning of quarter when we drop out of our holiday promotions, our peers did not. So we’ve seen an elevated level of competitive intensity in the quarter. We continue and have a disciplined approach. When we see less demand, we pull out of promotion. When we see demand picking up, like in March, we come back with the new promotion. So it’s been a challenging quarter from a competitive intensity standpoint.”

However, even when prompted by analysts in the Q&A, management was much more focused on the impact of pricing increases on postpaid churn. Per Verizon CEO Hans Vestberg on the Q1 earnings call:

“We did have a slow start on postpaid phone net adds, largely driven by elevated churn due to recent price ups and pressure from federal government accounts.”

Sampath provided additional details in his response:

“Look, we made a decision to price up certain cohorts in December and January, and they were the right trade-offs to make. It helped us lock our revenue for the rest of the year and it was the right thing to do. Look, in Q1, the cohorts that were priced up had higher elasticity than anticipated. And the higher churn can be largely attributed and isolated to those cohorts.”

In six weeks, the narrative changed from blaming iPhone promotion extensions to higher elasticity on December and January pricing actions. So which story is correct? The answer is both. Here’s a likely scenario:

- Verizon customers impacted by the price increase were notified in December and January

- Apple iPhone 16 volumes were underwhelming, and Apple created incentives with each carrier to move inventory

- Incentives and new programs (Comcast’s increased marketing and acquisition activity) carried into January

- Elasticity was more than anticipated because of a) an underwhelming iPhone launch, and b) Comcast’s customer acquisition efforts.

Bottom line: We are strong supporters of legacy plan pricing changes as economic conditions warrant. We also think that price locks do little over time to reduce industry churn. If each carrier has a lock, then promotions will be used to drive down values (see the history of broadband and the DSL price lock response for a good case study) and the mechanism will be ineffective.

That’s it for this week. The Memorial Day weekend Brief (May 24th) will be focused on several long-form interviews with telecom and related industry personnel. Until then, if you have friends who would like to be on the email distribution, please have them sign up directly through the website.

Finally – Go Royals, Sporting KC, and Davidson Baseball!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.