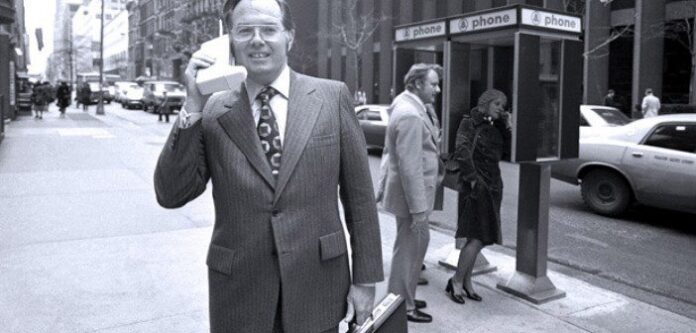

Editor’s Note: RCR Wireless News goes all in for “Throwback Thursdays,” tapping into our archives to resuscitate the top headlines from the past. Fire up the time machine, put on those sepia-tinted shades, set the date for #TBT and enjoy the memories!

LTE device numbers boom

The Global Mobile Suppliers Association reported this week that there are now more than 1,500 LTE-enabled user devices available, confirming more than 90% annual growth. The GSA said that 742 new LTE devices were launched in the past year, and the number of manufacturers increased 58% to 154 companies. Smartphones make up the largest category of devices, accounting for more than 40% of the total, but the GSA noted that LTE-enabled tablets and personal hotspots (MiFi) are also growing. Also, 99% of LTE smartphones are multi-mode and operate on both 4G and 3G networks. The most widely-used band for LTE continues to be 1800 MHz — however, LTE still faces significant spectrum fragmentation, as 1800 MHz represents less than half of LTE single-band or multi-band networks: 43%. Among LTE user devices, 589 using 1800 MHz (Band 3) have been announced, with an annual growth rate of 152%. TDD is continuing its emergence onto the LTE stage. While the majority of devices are still FDD, the GSA noted that 387 products can now operate in TD-LTE, which is 221 more than a year ago. Only about 11% of LTE mobile operators have deployed TDD — however, the technology is being used or trialed by some of the largest carriers in the world, including China Mobile. …Read more

Virtualization is coming, despite worries

A new report from Maravedis-Rethink predicts nearly three-fourth of mobile operators will deploy some form of network functions virtualization by 2018, noting the move to NFV will be one of the most important ways carriers will “transform their cost base and their service delivery in the next few years.” However, the firm cautions that hurdles will need to be overcome for carriers to realize the full potential of NFV. “This figure has already risen from our previous estimate of 67%, made six months ago indicating the accelerating momentum behind NFV,” explained Caroline Gabriel, research director at Maravedis-Rethink and author of the research note. “This quickening pace of adoption reflects rising confidence in the platform, often as part of an SDN strategy and the urgent need for operators to reduce costs and deliver new services more quickly and responsively.” In its report, “Pace of NFV uptake accelerates, despite many risks,” Maravedis-Rethink noted that carriers are targeting total cost of ownership savings of up to 35% over the next five years by the use of NFV, with savings coming from “key elements like the packet core.” The firm added that 16% of carriers it interviewed claimed NFV was a first step towards a broader software-defined networking policy that is expected to generate greater benefits. … Read more

Cisco aims for the cloud

Cisco says the sky’s the limit for the billion dollar cloud services business it announced today. The networking equipment giant says it will build “a network of clouds” along with a set of partners, including Telstra and Ingram Micro. Cisco says it plans to build the “world’s largest global Intercloud” for the Internet of Everything. Targeting service providers, businesses, and resellers, the Cisco intercloud will feature APIs for rapid application development. Partners will contribute technology and investment to the project, and Cisco itself plans to invest more than a billion dollars. “Together, we have the capability to enable a seamless world of many clouds in which our customers have the choice to enable the right, highly secure cloud for the right workload, while creating strategic advantages for rapid innovation, and ultimately, business growth,” said Robert Lloyd, president of development and sales, Cisco. Platform-as-a-service and infrastructure-as-a-service will be cornerstones of Cisco Cloud Services. Offerings will also include WebEX, Cisco’s Meraki cloud management, voice and contact center as a service, and desktop virtualization solutions from Cisco, VMware and Citrix. … Read more

Patent issues delay Microsoft’s purchase of Nokia’s handset business

Patents appear to be holding up Microsoft’s plan to purchase Nokia’s handset business. The $7.2 billion purchase price does not include Nokia’s patent portfolio. Instead of buying those patents, Microsoft plans to continue to license them after the deal closes. The deal terms call for a non-exclusive patent licensing arrangement, meaning that other companies can continue to license Nokia’s patents as well. Those other companies are thought to be holding up the closing by pressuring Chinese regulators. Google and Samsung are reportedly pressuring Chinese authorities to help limit the amount that Nokia will charge them to license its patents. Right now, competing device makers have leverage with Nokia since they license their own patents to Nokia’s smartphone unit. Going forward, Nokia’s primary business will be its NSN infrastructure unit, and it will not need to license as many device-related patents. The Microsoft Nokia deal was set to close this month, but now Nokia says talks with Asian regulators are delaying the closing. But the company is still hopeful that the deal will close next month. … Read more

Mergers highlight this week’s round-up of issues affecting the telecom capital markets as a T-Mobile executive comments on a potential merger with Sprint:

Sprint/T-Mobile merger speculation ramps up

There have been numerous developments in recent weeks regarding a potential merger of Sprint and T-Mobile assets. As RCR Wireless reported earlier, Sprint representatives Masayoshi Son and Dan Hesse met with U.S. officials last week to plead their case for the proposed merger, arguing that the resulting organization would be able to better compete with AT&T and Verizon in the U.S. mobile and wireless markets. T-Mobile executives have had their say in recent days as well. Reuters reported that the carrier’s CFO, Braxton Carter, reaffirmed the company’s dedication to getting a deal done, directing his comments toward investors and shareholders. “It’s not a question of if, it is a question of when,” Carter said at a recent telecom conference, according to the source. He later added, “To take a third-scale national player that has the scale benefits with the right business model could be very competitively enhancing in the U.S.” Skeptics of such a deal ever being completed point to the U.S. Department of Justice and Federal Communications Commission’s blocking of a 2011 attempt by AT&T to acquire T-Mobile. … Read more

AT&T weighs in on AWS-3

With the Federal Communications Commission’s planned AWS-3 auction expected to begin later this year, wireless carriers are getting out ahead of proposed rulemaking in hopes of influencing those plans. AT&T this week again got in on the lobbying, throwing its support behind rumored plans to include up to 40 megahertz of a planned 50 megahertz of paired spectrum set to be auctioned in the 1.7/2.1 GHz advanced wireless service band in economic area-sized chunks. The remaining 10 megahertz of paired spectrum is reportedly set to be set aside in commercial market area chunks. In commenting on a proposed draft order reportedly circulating at the FCC, AT&T VP of federal regulatory Joan Marsh said in a blog post: “Incorporation of the large block and license sizes will not only ensure that the FCC drives the greatest efficiencies out of this spectrum, but also that it attracts the most revenue at auction.” The FCC’s plans for EA licenses currently splits the country into 176 markets, while the CMA license plan counts 734 markets. The recently completed H-Block auction relied exclusively on the EA license size for the 10 megahertz of spectrum in the 1.9 GHz band up for bid. … Read more

Check out the RCR Wireless News Archives for more stories from the past.