New manufacturing paradigms such as industrial automation come with stringent quality of service (QoS) requirements that apply both to companies’ production processes as well as the underlying telecommunication systems. As a result, companies expect their telcos to provide ultrahigh reliability and redundancy, advanced security features and a 24/7 peak performance.

Yet, guaranteeing such carrier-grade QoS specs using the existing public network infrastructure is no mean feat. That is why service providers’ enterprise customers have started to explore the opportunities private networks bring.

5G technology is bound to become an important driver of the next generation of private (wireless) networks, due to its design and performance specs. But it is not the only contender. New Wi-Fi developments such as Wi-Fi 6 (IEEE 802.11ax) and the upcoming Wi-Fi 7 (IEEE 802.11be) standard continue to keep up with 5G’s performance — not only when it comes to supporting high data rates, but also where latency, time synchronization accuracy and reliability are concerned. This article carefully weighs up the pros and cons of both technology options and outlines three potential tactics to deploy tomorrow’s private wireless communication networks.

And there is more to it. At the other end of the network, a (r)evolution could also be on the rise, as standard mobile terminals (and their chipsets in particular) risk being replaced by chips/devices that are fully tuned to enterprise customers’ unique needs and business considerations. Could this be the opportunity for new players to enter an ecosystem that just a few chip vendors have so far dominated?

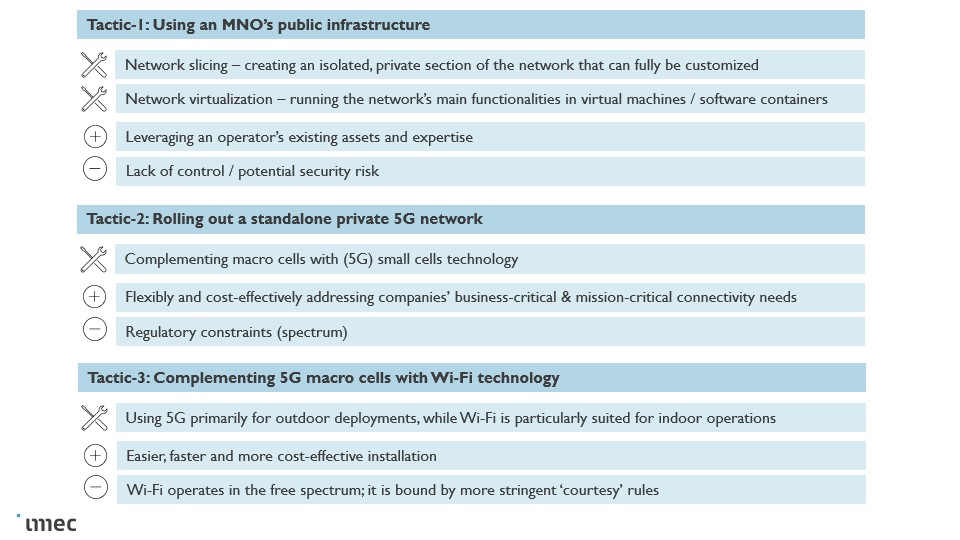

Tactic-1: Rolling out private 5G networks using an MNO’s public infrastructure

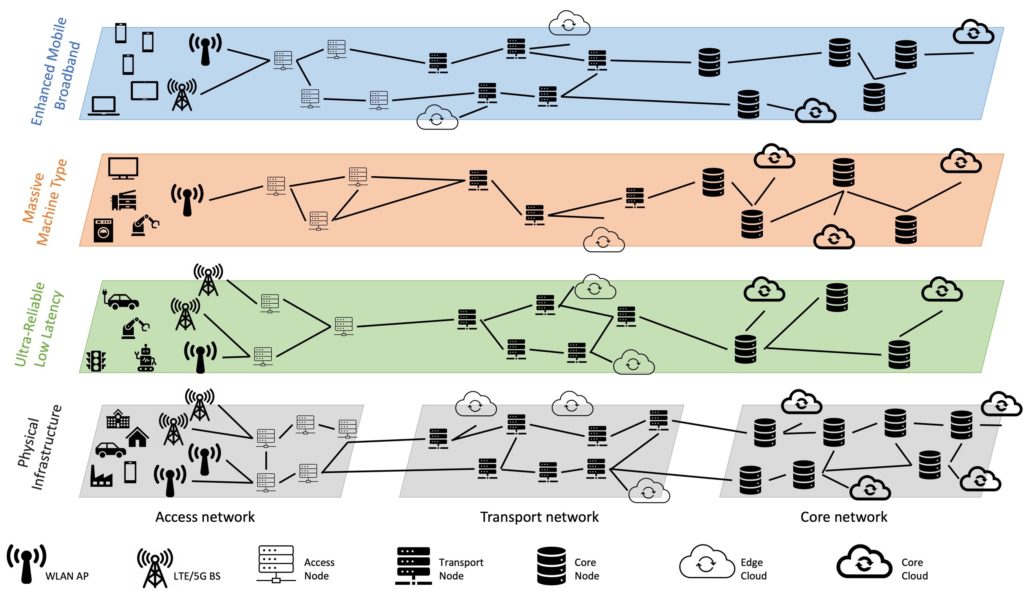

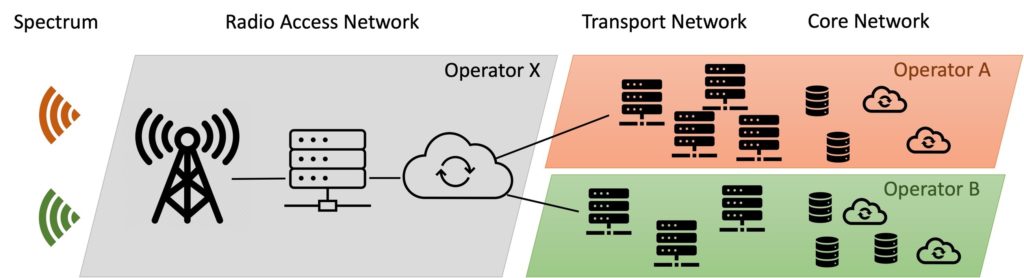

When participating in a 5G spectrum auction, mobile network operators (MNOs) typically commit to serving a wide geographical area. This makes MNOs well-positioned to meet enterprise customers’ private network requirements — slicing, virtualizing and sharing parts of their 5G infrastructure to create non-public networks (NPNs).

The secret recipe: network slicing

5G is particularly suited to supporting this business case. The technology comes with features such as network slicing, which enables an MNO to turn a ‘slice’ of its public network into an isolated, private section exclusively allocated to an (enterprise) customer, and that can be customized fully in terms of supported bandwidth, latency, QoS, etc.

This type of deployment tactic could make for an important win-win. The advantages from a telco’s perspective are obvious: a business case that builds on the MNO’s (existing) infrastructure, knowledge/expertise, and acquired spectrum, and complementing its voice, broadband Internet and/or managed services offering. Meanwhile, companies could also benefit significantly from this tactic because they do not need to invest in expensive (radio access and core network) equipment. Additionally, they are shielded from the complexity of setting up and managing a self-owned private 5G network.

But while this might seem the ultimate win-win at first, it is a strategy that also comes with its share of drawbacks. Most importantly, companies end up sending their (time-)sensitive and (business/mission-) critical data over a network they do not own nor control. Not only is this a security risk, but it might also increase signal delay.

Alternative flavors

Despite its potential drawbacks, the ‘private networks-as-a-service’ business model might be a good fit for companies in a telco’s (existing) 5G service area with little experience building and managing cellular networks.

But there is an alternative to the slicing approach that can be used to set up a private network leveraging an MNO’s public infrastructure. Instead, companies could decide to build on an MNO’s radio access infrastructure, yet immediately route all traffic to the enterprise network to avoid security breaches. In this model, the operator still takes care of all practical arrangements — the network’s roll-out, support of its SIM cards, network management, etc. — but with all data remaining under the corporate customer’s direct control.

Taking it a step further, companies could even consider only using the telco’s radio towers (the network’s most expensive piece of hardware) to custom-build and privately operate and manage their own network. Finally, they could opt to roll out a private 5G network from scratch and negotiate a spectrum deal with the local MNO.

In other words: different models exist to deploy a private 5G network reusing a public operator’s expertise and infrastructure. A lot depends on the investment companies are willing to make and their knowledge in building and managing a (cellular) network.

Hardware requirements (and the concept of network virtualization)

The deployment of a 5G network — from its antennas down to its core — is a vast CAPEX investment. Yet, thanks to 5G’s inherent network function virtualization support, software running on commodity servers can replace much of the network’s expensive, dedicated hardware.

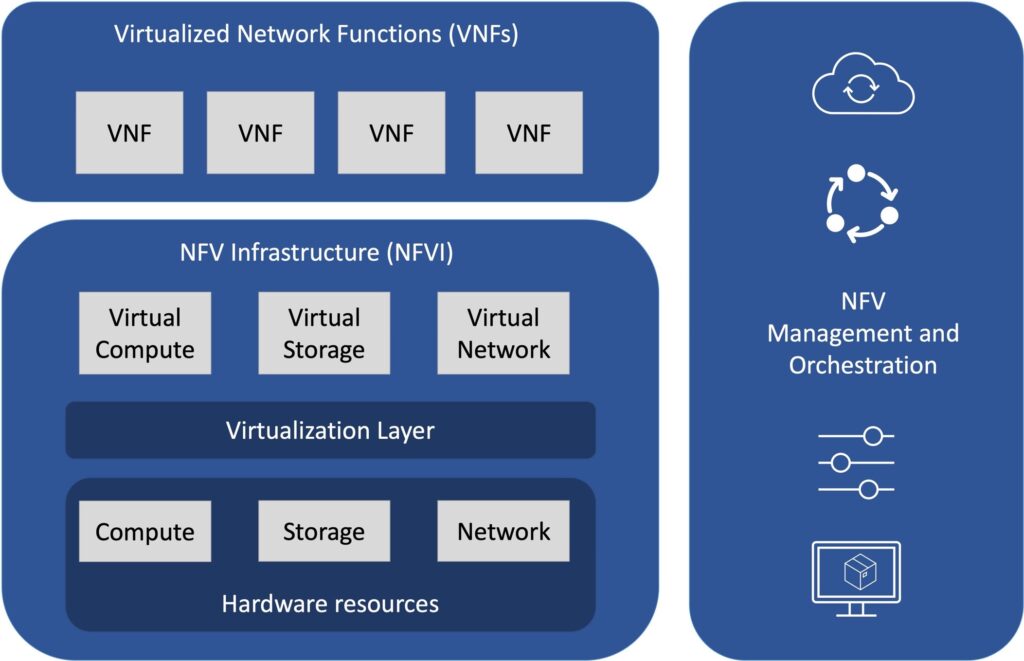

Not only is this more cost-effective, but also allows for a higher degree of flexibility. The concept of virtualization allows for composing and running the network’s main functionalities and associated management systems in virtual machines or software containers that can easily be duplicated (or upgraded) when additional capacity or extra functionalities are needed.

Figure 4: The network’s NFV infrastructure, with virtualized network functions (VNFs) on top. The latter can easily be duplicated (or upgraded) when additional capacity or extra functionalities are needed. Credits: Dries Naudts.

However, this does not mean that we can just get rid of all custom-built hardware. Antennas, for instance, still need to be rolled out. And the user terminals still require highly advanced chipsets to support 5G’s fast encoding/decoding mechanisms and ultra-reliable low-latency communications (URLLC) features.

Today, the production of those chipsets is in its early days. All we have currently are pre-commercial (3GPP Release 16) developments with limited URLLC support. This makes us wonder just how the 5G user terminal ecosystem will evolve. Will it continue to be dominated by just a few chip manufacturers, for whom the creation of custom-built URLLC-chipsets might not have the highest priority? Or is this an opportunity for new players to jump on board and start creating 5G radio modem chips aimed explicitly at the enterprise market? This is where the recently announced Chips Acts could make for a significant boost. Europe, for instance, divested chip manufacturing more than 20 years ago because it was too labor-intensive. Yet, driven by the EU Chips Act, this decision could be reversed in the weeks and months to come and create a whole new ecosystem.

Tactic-2: Setting up standalone private 5G networks

Since using an operator’s public infrastructure could lead to security breaches and introduce latency, organizations such as the 5G Alliance for Connected Industries and Automation (5G-ACIA) tend to favor the deployment of standalone private 5G networks. These are fully separated and isolated from an MNO’s public infrastructure.

The promise of 5G small cells

The roll-out of a standalone private 5G network might be a good fit at harbors, large industrial complexes and any other location where companies can join forces to contract a specialized (competitive) service provider for the network’s deployment and management.

Public and private networks share the same hardware challenges – both on the operator’s side and where the user terminals are concerned. Yet, while public networks primarily use macro cells to provide good (outdoor) coverage, private networks additionally employ small cells technology.

(5G) small cells have been designed to serve small outdoor areas as well as indoor locations and can be deployed more easily and cost-effectively than conventional wireless base stations. They are often combined with Open RAN-compliant technology, which allows for mixing and matching equipment and software from different radio access suppliers using standardized, open interfaces to ensure interoperability.

As such, mobile networks that flexibly address companies’ business-critical and mission-critical connectivity needs can be created cost-effectively. However, this whole tactic depends on the assumption that private network providers can effectively acquire 5G spectrum for local deployments – which, for now, is only possible in a few countries around the globe.

Acquiring spectrum for 5G campus networks: regulatory constraints

Today, in most countries, 5G spectrum auctions focus on countrywide deployments, with hardly any spectrum reserved for the roll-out of local, private 5G networks. This makes the deployment of campus networks a largely theoretical exercise for now. An exception to this rule is Germany, which has allocated 100 MHz of spectrum (between 3.70 & 3.80 GHz) to this specific business case. Other countries accommodating this use case include Australia, Spain and the U.S.

Tactic-3: Complementing 5G macro cells with Wi-Fi (for quick and cost-effective indoor deployments)

When it comes to rolling out private networks, the 5G community has been betting on the 5G URLLC feature, which targets a signal delay of no more than 1 millisecond, a time synchronization accuracy of no more than 1 microsecond, and a 99.999% reliability.

That being said, Wi-Fi also has its advantages – particularly when deploying indoor private networks. On the one hand, a Wi-Fi network can be installed a lot easier, faster and cheaper than a cellular one. And on the other hand, there is the compatibility factor: Wi-Fi (IEEE 802.11) and Ethernet (IEEE 802.3) — a communication technology that companies are familiar with already – belong to the same family of standards.

5G versus Wi-Fi

5G and Wi-Fi are similar technologies in terms of physical layer, wave forms, coding schemes and supporting mechanisms. They accommodate roughly the same bit rates and — in PoC tests — Wi-Fi has already shown that it is perfectly capable of supporting URLLC-like features.

The main difference is that 5G uses licensed spectrum that is exclusively allocated to a telecom operator, while Wi-Fi operates in the free spectrum and is, therefore, bound by more stringent ‘courtesy’ rules. These courtesy rules require a Wi-Fi device to verify that no other devices or technologies are using that same radio band before it can use the free spectrum. As a result, each time a wireless packet is transmitted, an – unpredictable – shorter or longer pause must be inserted. And that could increase latency.

Yet, as the wireless spectrum is technology agnostic, it would be perfectly possible to allocate part of it to Wi-Fi technology — similarly to freeing up local spectrum for the deployment of a private 5G network. That would allow for setting up a Wi-Fi network free from those more stringent rules.

As a matter of fact, we see this fight for the same spectrum happening already. On the one hand, 5G’s 3GPP Release 16 brings 5G in the unlicensed spectrum bands (NR-U). But, on the other hand, we see Wi-Fi expanding beyond its 2.4 GHz and 5 GHz bands as well — with Wi-Fi 6E (an extension of Wi-Fi 6) entering the 6 GHz band. This provides much more spectrum than the 100 MHz currently reserved for private campus networks and allows for better, more stable connections – and faster speeds.

So, ultimately, 5G and Wi-Fi are very likely to coexist. Even when it comes to supporting private networks. Because of their wider range, cellular technologies such as 5G will have a slight advantage for outdoor deployments; and Wi-Fi is a priori suited for indoor operations.

Wi-Fi hardware: the backward compatibility issue (and related opportunities)

In the Wi-Fi domain as well, the underlying hardware – including the radio terminals — has become increasingly complex. When creating a Wi-Fi access point for the consumer market, one must make sure it is backward-compatible with all previous releases of the Wi-Fi standard. That makes the development of new Wi-Fi chips cumbersome and more expensive.

For the professional market, however, having this backward compatibility is unnecessary. This, in turn, opens the market for new players interested in launching terminals with optimized feature sets for the professional market; for customers willing to pay for customization and performance as long as it suits their business case.