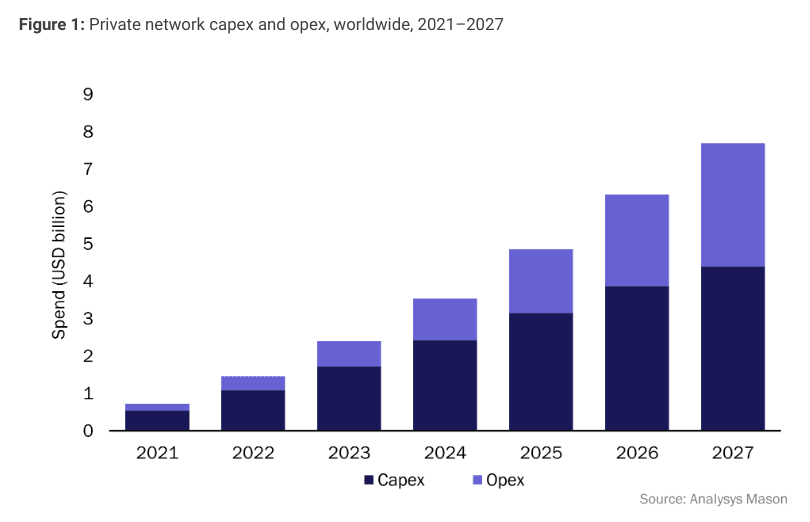

An addendum of sorts, to the piece Enterprise IoT Insights compiled at the end of last week (October 21), on private networks in numbers; Analysys Mason has just issued a report that says private LTE/5G network deployments are “growing rapidly”, to the point spending on them will reach $7.7 billion in 2027, with growth fixed a compound annual rate (CAGR) of 48 percent in the 2021-2027 period (six calendar years).

It calculates the CAGR for network deployments (separate of their value) will be 65 percent over the period, reaching 39,000 installations by 2027. Reversing the CAGR result suggests there are around 1,900 private LTE or 5G networks, according to the Analysys Mason review. This is broadly in line with the GSA figure, discussed in the previous article, of 889 deployments – counted per enterprise, per region, and not actually per network deployment.

There were some finer points to the discussion before, based on GSA market stats, but the conclusion was that average growth of enterprise deployments was “flat for the six months to the end of June”, and that the “whole market is in stasis, actually”. The figures from Analysys Mason look more robust, in terms of market growth (compared to the GSA review of market growth). But the firm warns of “challenges to adoption” by enterprises, and brings perspective. “This is a large figure in isolation, but appears small when compared to the spending on public network infrastructure,” it says of the $7.7 billion forecast.

It says spending could be “significant” if these challenges are addressed, suggesting the market will go faster after 2027 if certain issues are resolved.

It says spending could be “significant” if these challenges are addressed, suggesting the market will go faster after 2027 if certain issues are resolved.

The big challenges, it says, remain the task to abstract complexity in order to rationalise and scale rather-bespoke solutions to smaller firms, as well as “prohibitively high” costs compared to rival Wi-Fi infrastructure, and the general point that the wider SME market lacks “awareness and understanding”.

A statement says: “Complex and expensive private network propositions are out of reach of most enterprises.

Enterprises require simpler, affordable solutions with a service wrap that includes support for the network and the applications… Spending on private networks has the potential to grow even more quickly after the forecast period, but only if suppliers address these challenges to make their solutions accessible to a broader enterprise market.”

The overall market is valued at around $ billion today – and less-than at the end of 2021 – with most (around 85 percent?) deployed by large corporations using upfront cap-ex investments; the ratio will shift towards an op-ex model over time, with around 40 percent (?) of new private LTE and 5G network infrastructure and network services deployed on subscription by 2027.

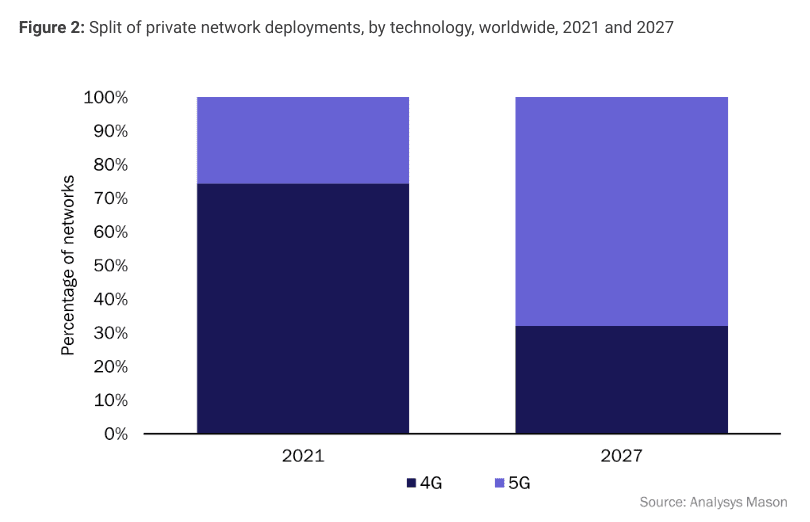

Other findings: 26 percent of (1,900) live private networks used 5G in 2021, rising to “almost half” by 2024, and “two thirds” (26,000, out of 39,000) by 2027; more than 50 percent of private networks in the manufacturing sector used 5G in 2021, rising to almost 90 percent by 2027. The GSA stats said 57 percent (507 of the 889) of deployments are LTE-only, as it stands, with further 165 running LTE alongside 5G (meaning 75 percent in total feature LTE).

Analysys Mason says 73 percent of “publicly announced private network deployments in North America” are based on LTE. It notes AWS is selling private LTE labelled as private 5G. “Many of the early use cases deployed using CBRS shared spectrum, in public sector education for example, do not require 5G capabilities,” it writes. GSA calculates 21 percent (189) of global enterprise deployments are 5G-only, and 39 percent feature 5G in some form.

GSA also says only 37 feature 5G SA. Analysys Mason reckons private 5G adoption is “higher in Western Europe and emerging Asia–Pacific (mainly China) than in North America” – used in 41 percent and 46 percent of private network deployments in these regions, respectively. Both firms say manufacturing is the number one venue for private 5G. “The manufacturing sector has been the leading early adopter of private 5G networks,” said the latter.

It adds: “Enterprises… are deploying 5G because it can achieve unique results in terms of automation. Manufacturing firms are investing to support new applications in the long term and believe that 5G will be the most suitable technology in the future to address requirements such as low latency.”

It adds: “Enterprises… are deploying 5G because it can achieve unique results in terms of automation. Manufacturing firms are investing to support new applications in the long term and believe that 5G will be the most suitable technology in the future to address requirements such as low latency.”

A summary statement adds: “Vendors and operators are placing a significant emphasis on…5G… in the industrial sector… However, there is still insufficient activity to address some of the barriers to adoption such as the higher cost of 5G relative to other network technologies and the complexity in deploying such networks.

“There is scope for the… market to grow significantly more quickly beyond 2027, but such growth will depend on suppliers doing more to address the barriers to adoption.”

As further reference, an article in Enterprise IoT Insights in July, reporting forecasts from Dell’Oro Group and Berg Insight, reads as follows…

Analyst house Dell’Oro Group has adjusted down its near-term forecast for the private LTE and 5G market. It said its calculations show that radio access network (RAN) shipments and revenues are “again coming in below expectations, resulting in another markdown”. The market will roughly double, it said, in the five year period between (and including) 2022 and 2026, finishing between $0.8 billion and $1 billion.

It said progress with deployment of private wireless small cells, specifically, among enterprises is “weaker than expected”. Its projection, for around 100 percent growth in the period, covers both macro RAN-cell and small RAN-cell installations. “Standalone private LTE/5G is now expected to account for a low single-digit share of the total RAN market by 2026,” it said. At the same time, its long-term (post-2026) forecast for the private cellular market remains the same, pegged as a “massive opportunity”.

Stefan Pongratz, vice president at Dell’Oro Group, commented: “We… still estimate private wireless is a massive opportunity. At the same time, the message we have communicated for some time still holds – we still envision the enterprise and industrial play is a long game. This, taken together with the fact that the standalone LTE/5G market is developing at a slower pace than previously expected, forms the basis for the near-term downgrade.”

The private wireless market remains a mostly-LTE affair. The number of private LTE and 5G networks will increase to 13,500 globally by 2026, according to rival analyst group Berg Insight; this is a 10-fold increase, roughly, from a figure today of “more than” 1,000 private LTE deployments and 300-odd private 5G deployments. The latter are mostly in pilot and trial mode, it should be noted. But early signs of scale are conspicuous, in multi-site, multi-market deals by the likes of Airbus, Dow Chemical, and Schneider Electric.

There is an argument, maintained by ABI Research, that most activity so far has been in ‘carpeted industries’, such as hospitality and education, particularly in the annexed CBRS-band in the US. Logic says this is because industrial grade 5G, available with post-15/16 3GPP releases of the 5G NR standard, and with availability of compatible industrial devices, are still mostly pending, and has put the anticipated Industry 4.0 rush from non-carpeted verticals on hold. This explains the position of Siemens, say, which considers 2023 the earliest for 5G-geared Industry 4.0 to progress in earnest, on the back of half-baked Release-16 level industrial 5G systems.

At the same time, the likes of Airbus and Dow Chemical, and others have already found serious industrial usage for LTE and LTE-like 5G systems. This is because – as Vodafone has neatly explained – certain “core applications” have emerged which either do not require much in the way of new ‘industrial’ devices, or else only require devices that have been fitted-early with 5G modules. But, as a new Enterprise IoT Insights report (serialised here) tells, this breaking of the industrial-5G chicken-and-egg dynamic is only observable so far among early adopters, invariably comprising major industrial firms.

Private 5G’s move into the mainstream still hinges on a long list of supply-side and demand-side hurdles, including the standard, the devices, the spectrum, the features, the ecosystem, and the sales channel. As per the Dell’Oro update, there is a long road to go.