Greetings from Nebraska, Missouri, Louisiana and Texas. There were many pictures to choose from over the past two weeks, but nothing says springtime in the bayou like a five-pound platter of crawfish. Taking out my contact lenses that night was tough (nothing like rubbing your eye with cayenne pepper), but it was worth it. Terrific team, terrific market opportunity, and lots of terrific food.

This week, after a full market commentary, we continue the State of Telecom series with a look at the competitive dynamics and market positioning of cable MVNO services. As many families look to save $10-15/ month to cover the increased cost to fill up their as tanks, cable’s family product becomes increasingly attractive. We will explore cable’s current value proposition and propose ways they could improve their market share.

The Week That Was

In the last edition of the Brief, we noted the single largest 2-week gain in the Fab Five market capitalization since we have been keeping tabs (which is soon to enter its 12th year). In the last two weeks, they gave back 35% of that $940 billion gain (-$329 billion). Many reasons are cited (war uncertainties, inflation shocks, rising interest rates, liquidation to cover tax bills, etc.), but we think that cumulative investor conservatism is more likely to blame. With 60% of 2021’s gains remaining, why not take a bit off the table in these troubled times and use that cash to diversify?

I have had several conversations with Brief readers since the beginning of the year, and there is no doubt that Amazon, Microsoft, Apple, and Alphabet are going to remain technology stalwarts (Facebook should also be added to the list despite their quixotic push into the metaverse). As we document each quarter, they have more cash than debt on their balance sheets (less attractive with higher inflation), and operating cash flows to cover most if not all of their total debt liabilities.

Each Fab Five stock could step up commercial paper operations (although the 2-year Treasury note at 2.5% is hardly anything to write home about), an option usually confined to top credits. They could also buy back shares with excess cash.

However, when valuations get low (too many drivers here to mention), the Fab Five tend to go hunting for other companies. Cloud, cybersecurity, AI/ML/VR/MR/AR, content and maybe even EV are mentioned as frequent targets. We would not be surprised to see global acquisitions, particularly in Europe. That is, assuming they can secure approval from the Federal Trade Commission, international government bodies, and state commissions (nearby picture courtesy of long-time friend and fellow Kansas Citian Neil Tenbrook).

What if Amazon bought Dollar Tree, Kohl’s, Pandora or even CVS as well as the rights to the NFL? Or if Apple bought Disney, Sony, Discovery/WarnerMedia or split the NFL rights with Amazon? Or Facebook bought some or all of Verizon, the closest thing to a national fiber last mile network to power the metaverse? Time is running out for Khan’s FTC to proactively establish a bipartisan redefinition of a monopoly and establish a framework for companies to follow.

In the absence of legislative certainty, we are left with Net Neutrality-esque retitling (Title II off today/ on tomorrow) – every new administration modifies the definition. No one wins in that situation. On top of this, retroactive merger challenges face a much higher uphill climb in the courts. While Chair Khan pushes strict enforcement of current privacy laws (something we see more the purview of the FCC – more here), the Fab Five board rooms are seeing opportunities to put cash to work.

The other big rumor out in the last two weeks centers around Apple’s potential foray into monthly equipment plans (more here in this Bloomberg article). While speculation has centered around leasing/ renting iPhones, we think that any program (likely incorporating the Goldman Sachs partnership with Apple Card) is going to be broad. There are substantial implications for this to the postpaid wireless carrier relationship. Transfer the phone payment to Apple, and carriers devolve to wireless utilities competing in local spot markets for subscriber usage. Apple controls the bidding platform and therefore the decision-making process. It’s like Best Buy 15 years ago, but worse.

How many years it would take to transfer to this market remains to be seen, but when Apple is worth more than 3x the Telco Top Five, it’s not surprising that they would make the tradeoff. We noted that this was “the beginning of the end” when Apple used the 2015 WWDC to launch monthly payments through the Apple Store. They followed that with the Apple Card launch in 2019 (link is to a Brief written in August 2019 — worth rereading). Then they analyzed data and developed a plan to ease into a carrier neutral platform. Then they successfully applied installment payments to iPads. And here we are.

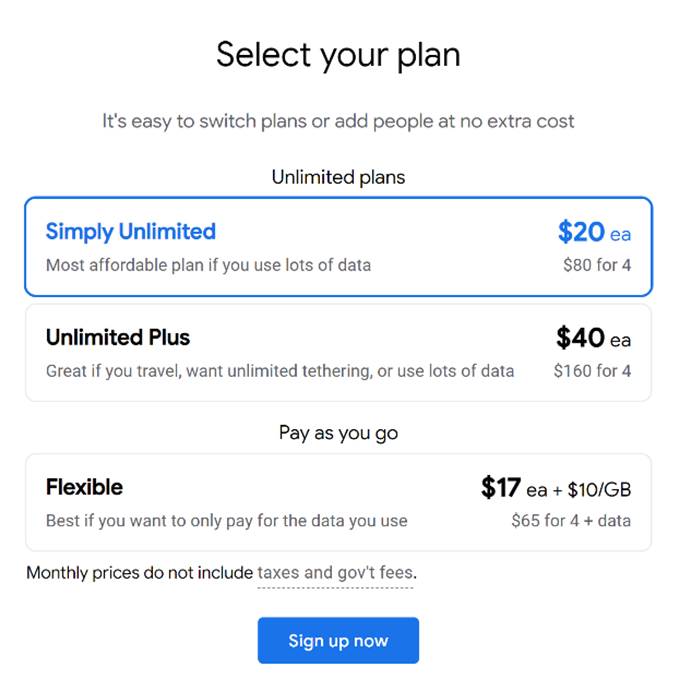

In a different yet similar vein, Google announced new plans for their Project Fi since our last Brief (see nearby chart for 4-line pricing). While individual and 2-line pricing is relatively uncompetitive, those families looking to economize could see some real savings. The only catch — no Apple device support, and the Samsung trade-in incentives are similar to those that Samsung offers through their website.

But, if you want to get a glimpse of where Apple could go (minus becoming a full MVNO, which we do not believe is something they are interested in), check Google’s Pixel Pass, which bundles the phone, one of several wireless service plans, and other features (like storage) into one low monthly service price. Here’s the full offer:

While Apple does not have YouTube, they do have Apple Music, Apple Care, and Apple Cloud. The Pixel Plan provides the proxy for what Apple could do. Where that would leave postpaid wireless service plans is anyone’s guess.

The State of Telecom (Part 2) – B&W

As we stated in last week’s Brief, there are three developments that deserve the attention of the telecommunications industry:

- Whether fixed wireless captures a meaningful share of the home broadband market;

- Whether cable MVNOs increase their share of gross adds in the wireless market; and

- How companies react to increased economic uncertainty and increased wage pressures.

Each of these developments has different dynamics at play. This week, we explore cable’s bandwidth and wireless (B&W) bundled future.

The cable industry used bundling as an effective means of containing competitive threats. Specifically, they used advantages in linear cable TV and broadband to set up a defensive moat against satellite providers. Then they established carrier-grade phone service (and benefitted from increased cellular cord-cutting) to eliminate telephone providers from most homes. Now, faced with the three-headed hydra of fixed wireless (see last week’s Brief), streaming/OTT content, and home-based communications alternatives (including FaceTime and Zoom), cable is challenged to create a better bundle.

Here’s the current situation assessment:

- Depending on the market, cable likely has 40-70% broadband market share (defined as all homes in the zip code, not merely those served by cable plant). We think that this market share will decrease more slowly than most analysts are currently estimating.

- Fiber to the home poses a greater threat to broadband services in most cases than fixed wireless. Note: we chose our words carefully. It is not the fiber bundle, but the introduction of a perceived superior service using newly installed infrastructure to the house.

- Most data accessed within a home occurs through Wi-Fi (versus cellular provider towers). How much varies widely by household, 5G deployment status (and speeds), and Wi-Fi access point/ smartphone quality. Said another way, if in-home coverage is poor, the home Internet Service Provider (e.g., Xfinity) is blamed more often than the wireless carrier (e.g., T-Mobile).

- Technology within the home (e.g., 4K televisions) drives increased data consumption. More devices with higher resolutions drive “step up” data demand quantities.

- Wireless providers are more eager to provide wholesale voice and data services to the cable industry due to increased capacity (driven by C-Band deployments) and also due to the development of bit prioritization algorithms which allow wireless carriers to offer data to cable companies at reduced rates.

- Cable’s entry into the MVNO business has been timid largely because of the economics, but also because of billing system and other operating support systems development that has recently been taken in-house. Cable couldn’t have scaled into family plans without incurring material losses.

- Wireless carriers are creating competitive advantages through broad-based network speed (T-Mobile), content bundling (Verizon), and the application of new customer promotions to all existing upgrading customers (AT&T). Particularly aggressive trade-in promotions are being used by device manufacturers and carriers to woo switchers. The cable industry (specifically Xfinity) began to increase promotional activity in 4Q 2021, but historically, cable has not tried to match the “Big Three”.

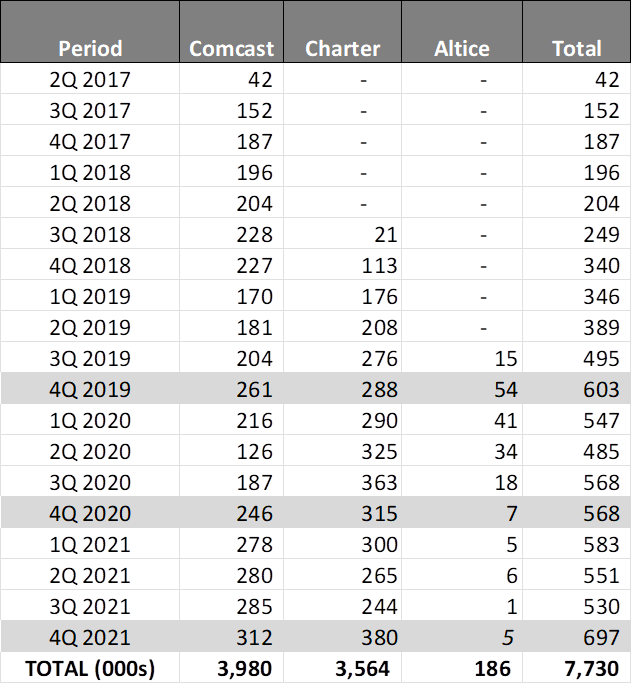

- Cable has been able to grow their net additions even with the continued competitive pressures (see nearby chart – Altice the exception as has been discussed in many previous Briefs). We estimate that both Xfinity Mobile (Comcast) and Spectrum Mobile (Charter) have ~3% market share of homes passed.

With these eight factors (and likely many more) as a backdrop, what should the cable industry do to drive additional value for their shareholders? Here are four quick thoughts:

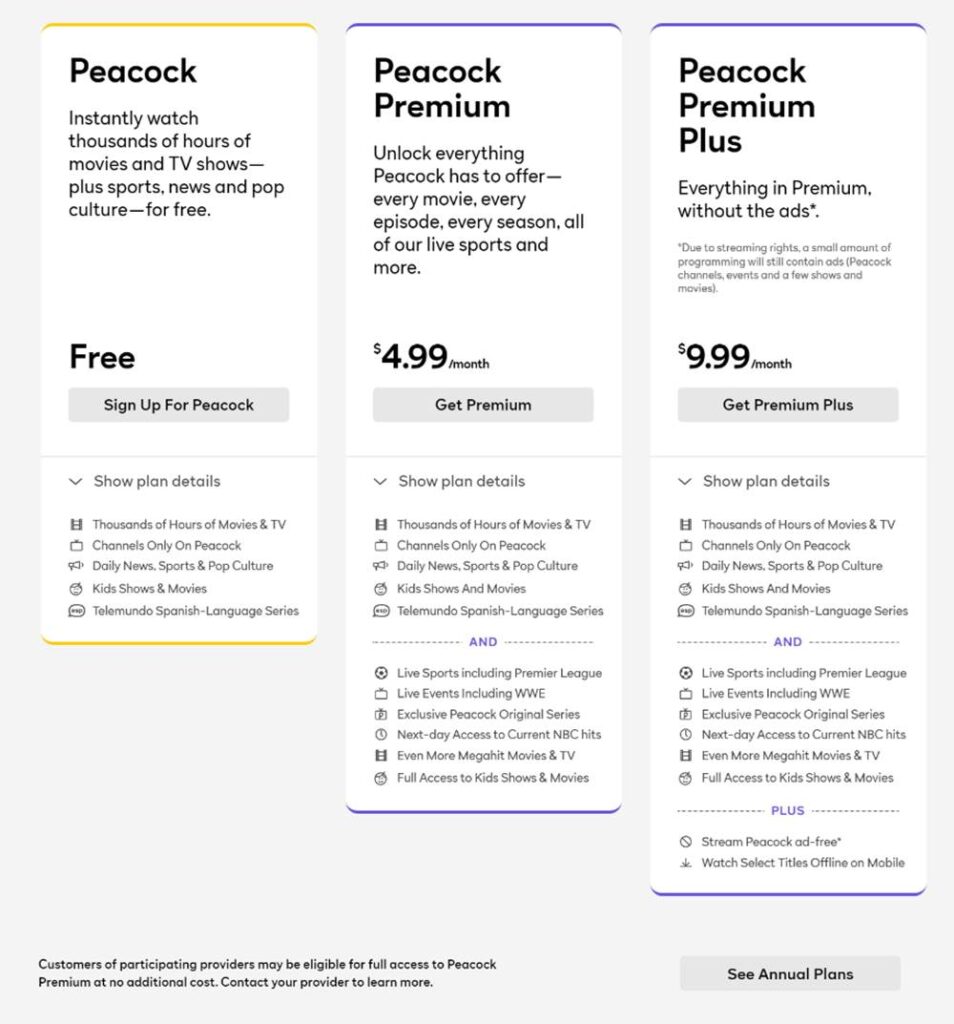

- Leverage Peacock. AT&T has HBO Max, Verizon has the Disney bundle, and T-Mobile has Netflix. Cable needs to have something, and soon. Increased amplification of the content choices that Peacock provides can only help Comcast (Peacock producer and primary distributor).

Spectrum entered into an arrangement to distribute Peacock programming with Comcast in December and is in the process of integrating offers into their video lineup. This is a good start, but many Spectrum Internet and Spectrum Mobile customers would rather have YouTube TV or nothing. Make the equation simple: “Buy Spectrum Internet and Spectrum Mobile and get ad-free Peacock on us.”

As we have mentioned in previous Briefs, promoting the Premium Plus product (see nearby features) would have the extra benefit of increasing the quantity of downloaded content. For example, prior to heading out on the family cross-country drive, members of a household might download an entire series to view onto their smartphone or tablet. This would significantly reduce any wireless carrier data charges.

Cable companies could use viewing data (with permission, of course) to suggest or even proactively download episodes of certain Peacock content to customers. No customers care about excess storage usage by Peacock, but they will care (a lot) if they buffer thanks to deprioritized data.

- Make it painless to try Spectrum Mobile and Xfinity Mobile. When T-Mobile introduced the iPhone (less than a decade ago – announcement here), they introduced a less-remembered iPhone promotion called “iPhone Test Drive” which allowed customers to try a new iPhone 5s with a T-Mobile SIM and compare against their current carrier.

T-Mobile didn’t have a lot of takers (and the logistics around phone return were, to put it mildly, challenging), and Magenta ultimately shelved this particular Uncarrier move. But the fact that they were willing to go to this extreme turned a lot of heads and increased investigation. There’s a derivative of this Uncarrier move that cable should try soon to get ahead of what will shortly be an onslaught of service alternatives.

- Use broadband & wireless (B&W) bundling to drive broadband adoption. We still marvel at the fact that both Comcast and Charter have spent very little external marketing dollars to grow their respective businesses. We are certain that their marketing departments would spend more if they could. But what about a simple product bundle like “buy Spectrum Mobile Unlimited Plus on two or more lines and get our fastest (1 Gbps) service for $49.99”? Where is the “All the Best” approach that Time Warner Cable so effectively used in the 2000s?

The cable industry suffers from the perception of being “good enough” but not “best in class.” While net promoter scores rise, the cable industry is not asking the question “If you had essentially the same broadband offering over fiber, would you switch?”, probably because they know most would. Improving the perception of “All the Best” is sorely needed, and, with Apple and Google seeking to redefine the wireless service industry, this would be a good time to be creating material competitive advantage.

- Find more commonality and create marketing likeness. Have a common theme (e.g., “part of the ____ network”) or a common spokesperson or a common cause. The best example of this is the Star Alliance in the airline industry. The cable industry was forced to have a common SSID for out-of-region Wi-Fi access, but having a blanket of coverage helped increase adoption. Incorporating that into their wireless offering would help.

There’s a lot more to discuss, but the bottom line if this: If cable acts quickly to increase share of wireless gross additions, they win. If they drag their feet, they will suffer. The degree of suffering is not linear (e.g, 10% less losses if they milk, the cash cow for an additional nine months), but event-driven (e.g., Verizon C-Band and therefore fixed wireless deployment; a wireless equivalent of the “Pepsi Challenge”, etc.). The cable industry has a unique opportunity to steer their future if they act soon. Otherwise, they will be steered by much bigger entities than Verizon and AT&T.

That’s it for this week’s Brief. In two weeks, we will look at economic drivers and their impact on the telecommunications industry. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Until then, go Royals, Sporting KC, and Davidson College Baseball!