With the advent of 4G and the start of the data era, subscribers have been increasing the total amount of data usage significantly year after year. ABI Research has found that the total global mobile data traffic usage, consisting of 2G through 5G, is expected to increase by a Compounded Annual Growth Rate (CAGR) of about 33% from 2022 to 2026. By 2026, mobile data traffic will reach approximately 3,100 Exabytes (EBs). Of the forecast 3,100 EBs in 2026, more than 50% will be carried by 5G technology.

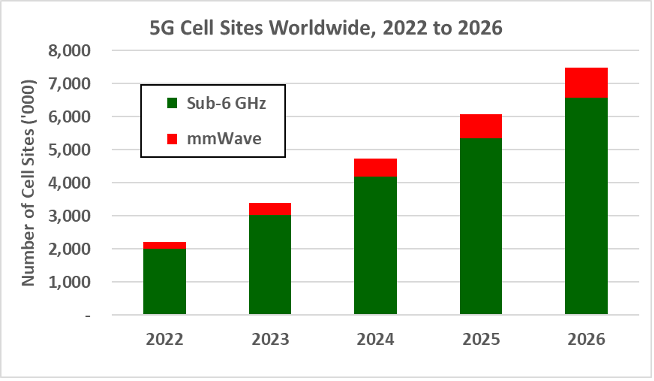

With the spectrum obtained from auctions, mobile operators will upgrade their cell sites to include 5G capabilities. 5G cell sites are expected to grow significantly at a CAGR of about 35% from 2022 to 2026, totaling approximately 7.4 million cell sites in 2026. Of those cell sites, sub-6 Gigahertz (GHz)-capable sites will make up more than 80%, accounting for approximately 6.5 million cell sites by 2026.

For mobile communication networks, the macro base station antenna is an essential piece of equipment at the cell site. The base station antenna transmits to and from end-user devices. Many of the mobile app innovations, such as ride-sharing services (e.g., Grab, Uber), social media and remote learning, would not be possible without a functioning mobile network. Connectivity, similar to water utilities, has become one of the underlying foundations of our modern society.

4G was already demanding, but 5G will require an expanded range of antenna solutions for both passive and active antennas (i.e., Massive Multiple Input Multiple Output (MIMO) solutions). A key difference between the two is the result of the integration of a Remote Radio Unit (RRU) into the antenna. Active antennas integrate the RRU together with the antenna array within the radome, while passive antennas have RRUs connected via a coax cable. There are also different types of passive antennas, such as those catering to Frequency Division Duplex (FDD) and/or Time Division Duplex (TDD), various port counts, and multibeam antennas.

Market potential

Passive antennas will continue to be in demand as mobile operators roll out their nationwide coverage. For example, China’s newest mobile operator, China Broadcasting Network (CBN), put up a tender for more than 480,000 5G macro base stations in the 700-Megahertz (MHz) band in 2021. In 2020, the worldwide investment by mobile operators in passive base station antennas accounted for approximately US$3.3 billion in revenue, which is expected to grow to more than US$4 billion by 2025.

While active antennas are products that Radio Access Network (RAN) Original Equipment Manufacturers (OEMs) provide, they still require the expertise and antenna array of the antenna manufacturers. Globally, active antenna revenue is expected to reach US$57 billion by 2025, growing at a CAGR of about 27% from 2020. The Asia-Pacific region will continue to represent the majority of the revenue throughout the forecast period, accounting for approximately 59% of total revenue in 2025.

Innovations and challenges

Base station antennas may “appear” to look almost identical from one generation to another; however, there is considerable innovation taking place within. These innovations include achieving improved electrical to Radio Frequency (RF) conversion (energy efficiency), passive intermodulation management, novel electronics, and RF component integrations within the antenna housing, reducing stresses from wind load and inclement weather, and working within the physical space constraints at the cell site. Recently, there has been significant development in the radiating element technology design within active-passive antennas, which have to be integrated in innovative ways to ensure a low level of mutual coupling between different bands.

For instance, PROSE (a Rosenberger company) integrates in its active-passive antenna solution the feature of high-strength, low-dielectric constant fiberglass radomes with new decoupling techniques, enabling greater transparency for the active antenna, greater reflectiveness for the passive antenna component, and improved modularity and better radio coverage characteristics. The underlying driver of this innovation is the increasing number of spectrum bands that mobile operators have to manage. It is an engineering and technological achievement to cater to more spectrum bands while maintaining, or enhancing, the overall performance of the antenna.

Conclusions

With mobile data traffic expected to increase to about 3,100 EBs by 2026 and new spectrum bands coming online, mobile operators will want to optimize their networks to meet future demands. This is achieved by tapping into these new spectrum assets and further enhancing their mobile networks. Any downtime or sub-par performance due to equipment, such as antennas, will have major consequences for subscriber quality of service.

Passive antennas have been the foundation of RAN architecture, but active antennas will be the drivers of future antenna investment as 5G continues to ramp up. For antenna manufacturers, it is crucial to have the technologies and expertise to support the rollout of 5G. These include technology allowing a seamless integration between active and passive components, as well as innovations, such as integrated radiating element technology design for both active and passive antenna components. Antenna vendors that are on the cutting edge of active and passive antenna design include CommScope, Ericsson, Huawei and PROSE. Antenna vendors will need to keep the RF innovation cycle going, while the antenna performance characteristics to cost ratio continue to ratchet up.