The hype and expectations around 5G continue to build, but the reality is that Long Term Evolution (LTE) is still going to be a significant part of the mobile cellular landscape for several years to come. Not only does LTE support several of today’s mobile applications, but its infrastructure will also be an integral part of many 5G Non-Standalone (NSA) and 5G Standalone (SA) architectures.

4G serves as the foundation for several mobile applications

Several mainstream applications will continue to be supported by 4G/LTE mobile infrastructure. In particular, Mobile Broadband (MBB), the Internet of Things (IoT), Voice over LTE (VoLTE), and Fixed Wireless Access (FWA) will continue to rely on 4G/LTE:

- There are currently more than 3.8 billion LTE subscribers for MBB globally and the number is expected to reach a high point of 3.9 billion by 2022. There are a few factors for this increasing trend. The first is the migration of 2G/3G users to 4G/LTE as operators plan switch-offs for 2G/3G networks. Secondly, the device ecosystem for 4G/LTE has matured, allowing 4G/LTE users to obtain mobile phones at very affordable rates (i.e., as low as US$30 for feature phones and US$100 for smartphones). This has encouraged and allowed previously unconnected users to jump onto the LTE bandwagon. This has also encouraged investments in modernizing mobile networks for LTE and making 5G networks future ready in regions such as Latin America and Southeast Asia. Due to the wide adoption of MBB, mobile data traffic is expected to increase by a CAGR of 35% from 2021 to 2025. By 2025, worldwide mobile data traffic will reach approximately 2,700 Exabytes (EB) annually. In 2025, approximately 50% of this will continue to be carried by 4G/LTE technology.

- According to ABI Research, the installed base of cellular IoT devices will see a growth of 7X globally by 2026, driven primarily by the Narrowband (NB)-IoT, LTE-M, and CAT-1 segments. NB-IoT is the most optimized technology to replace legacy 2G Machine-to-Machine (M2M) in the 5G era. Its module shipments are expected to make up more than 30% of the total shipments (753.8 million) by 2024 and NB-IoT caters specifically to small data transmission packets, which helps reduce the overall Total Cost of Ownership of NB-IoT modules and drives its adoption.

- VoLTE enables a High-Definition voice experience for LTE with greater capacity compared to 2G and 3G. Globally, based on General Services Administration (GSA) data, there are at least 280 operators investing in VoLTE and 228 operators that have commercially launched VoLTE. VoLTE is also a key voice solution for 5G, irrespective of whether the network is in NSA mode or SA mode. VoLTE is, therefore, an integral technology of “5G Voice.” Device availability and support are crucial for any technological adoption. For VoLTE, there are more than 2,500 mobile devices that support VoLTE.

- Fixed Wireless Access (FWA) provides broadband services to households and customers without the need for physical connections via fiber or cable. This is beneficial for areas where fixed broadband deployments are challenging, such as in rural or even suburban communities. As of the end of 2020, only 50% of the world’s households have access to fixed broadband connectivity. The rest of the global population relies heavily on mobile cellular networks to connect to the Internet. LTE-based FWA broadband access is a commercially competitive technology for broadband access in many markets, given its advantages in speed of rollout and cost compared to fixed-line fiber-optic. Based on ABI Research’s research, LTE-based FWA subscriptions account for more than 62 million in 2020, while 5G-based is about 3% of the total number of subscriptions as of the end of 4Q-2020. LTE-based FWA subscriptions will grow to more than 118 million subscribers, while 5G-based FWA subscriptions will represent 27% of total subscriptions by 2025.

All these applications depend on a reliable and versatile 4G/LTE mobile network. With the expected growth in demand and usage of 4G/LTE, mobile operators certainly need to ensure that their mobile network can meet these requirements and can deliver Quality of Experience.

Current 4G infrastructure is an important part of future 5G networks

According to the GSA, as of March 2021, 150 mobile networks had launched in NSA mode and 7 in SA mode. In NSA mode, the 5G network is dependent on the 4G/LTE as an “anchor” for the mobile network. The coverage and capabilities of LTE are important factors for a quality 5G user experience. In addition, sub-3 GHz offers an alternative for 5G where mobile operators lack access to the 3.5 GHz band or face challenges in deploying 5G in the 3.5 GHz band. Therefore, the investment and infrastructure for LTE needs to be future orientated to deliver the 5G capabilities. Mobile operators often need to classify their operations into 1) coverage-centric areas; and 2) capacity-build areas.

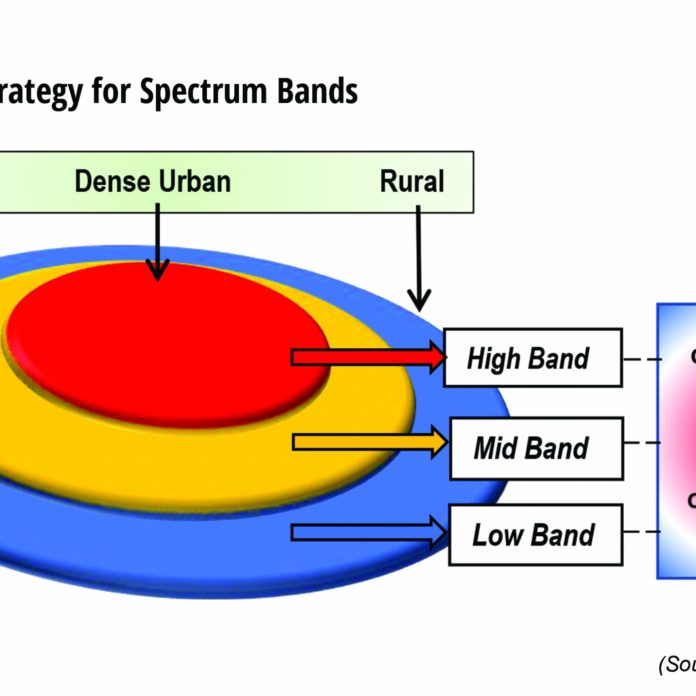

Figure 1: Layer Cake Strategy for Spectrum Bands

For coverage-centric areas, the telco can use the low band to meet its requirement of providing wide coverage, including in rural areas. This is because low bands, below 1 GHz, can propagate further compared to higher frequency bands. In addition, low bands can provide indoor coverage due to their ability to penetrate through walls, an issue faced by higher frequency bands. This makes low bands a priced asset for mobile operators. To future proof their infrastructure, mobile operators can deploy a 4T4R base station solution to meet demand. The 4T4R solution will be able to achieve better spectral efficiency and boost capacity compared to a 2T2R solution.

For capacity-centric areas, such as in urban centers, mobile operators face the challenge of high population density and mobility of their users. In these areas, the high band (i.e., mmWave) or the mid bands (e.g., 3.5 GHz bands) can be used to meet capacity demands and certain level of coverage. However, users tend to congregate in the same locations (e.g., in their offices) at the same time of the day, which creates network congestion. While mobile operators can choose to increase the number of sites in the area, it is often challenging and costly to do so. Therefore, to resolve the congestion and cope with future demands, operators can deploy massive Multiple Input, Multiple Output (MIMO) antenna solutions to expand network capacity. However, financial constraints may require mobile operators to consider alternatives, such as 8T8R antenna solutions, to boost capacity demand in urban areas. Both solutions are suitable for operators looking to future proof their long-term network investments.

Summary and conclusion

5G does hold significant promise for mobile telcos, but they will also need to maximize the Return on Investment (ROI) from their 4G spectrum and infrastructure. 4G/LTE mobile infrastructure will provide a vital supporting role for MBB, NB-IoT, FWA, and VoLTE.

A reliable and robust 4G/LTE mobile infrastructure will be needed by mobile operators, even as we progress into the 5G era. For developed markets, a robust 4G/LTE mobile network will help mobile operators pivot quickly toward 5G NSA mode or to re-farm the sub-3 GHz bands for 5G. Meanwhile, the use of 4G/LTE for developing markets will be crucial to provide quality mobile broadband to areas where mobile cellular adoption is much lower. For mobile operators, it is important to consider the future demands and requirements of their mobile networks when evaluating solutions. This will ensure optimal investment in equipment and prevent unnecessary hardware swap-outs in the future.