We measured spectrum usage in two markets and were able to verify that T-Mobile and AT&T are using spectrum licenses on loan from others to improve their wireless services.

National U.S. operators T-Mobile, Verizon and AT&T were loaned spectrum licenses that were not being used by their existing license holders to increase their network capacity for 60 days beginning in mid-March. The Federal Communications Commission (FCC) granted access to the additional spectrum so the wireless operators could handle potential increased network demand as COVID-19 cases continued to rise in the U.S. and large portions of the country fell under stay-at-home orders.

DISH Network was instrumental in all three of these spectrum deals. The company provided licenses in the 600 MHz band to T-Mobile and provided 20 MHz of its AWS-4 (Band 66) and all of its 700 MHz spectrum to AT&T. Verizon has permission to use the AWS-3 spectrum licenses from Northstar Wireless and SNR Wireless and DISH has a financial relationship with those two firms.

However, Verizon CEO Hans Vestberg said in the company’s recent first quarter earnings call with investors that Verizon has not yet needed to use any of the temporary AWS-3 spectrum licenses because it has been able to manage the extra usage on the network without them. Vestberg called those licenses an “insurance” in case the company couldn’t keep up with the extra constraints on the network.

Mobile operators around the U.S. reported surges in network usage starting in mid-March as Americans were asked to stay home from work and school to prevent further spread of the virus. According to a global study of network traffic by Nokia Deepfield, immediately after the stay-at-home orders were issued, the company saw weekday peak traffic increase more than 45% and in some cases 50% more than what was typical usage before the stay-at-home orders were issued. In addition, the company saw weekend evening peak traffic increases 20% to 40% over their pre-lockdown levels.

T-Mobile and 600 MHz

T-Mobile’s extra spectrum licenses that it borrowed temporarily in the 600 MHz spectrum band came from DISH and a group of other companies including Comcast, Bluewater, Channel 51, NewLevel, LB Holdings and Omega Wireless. However, DISH is the biggest spectrum holder of the group — it owns about 20 MHz, on average, of 600 MHz spectrum nationwide, according to the Lightshed Research, a New York-based financial analyst firm.

The FCC issued an order granting T-Mobile access on March 15th and the company was able to quickly deploy the additional 600 MHz spectrum. The company didn’t have to dispatch technicians to towers and instead only had to deploy software to use the new spectrum.

Because T-Mobile already had a large percentage of customers with devices that worked on the 600 MHz spectrum band it could quickly access that additional spectrum and alleviate any capacity issues.

Aurora Insight used its proprietary network of sensors to measure radio frequency spectrum in the Denver area. On March 18th we did not detect any activity, however beginning on March 24th, 2020 we detected T-Mobile using Dish’s 600 MHz spectrum. This was just nine days after the FCC order was signed.

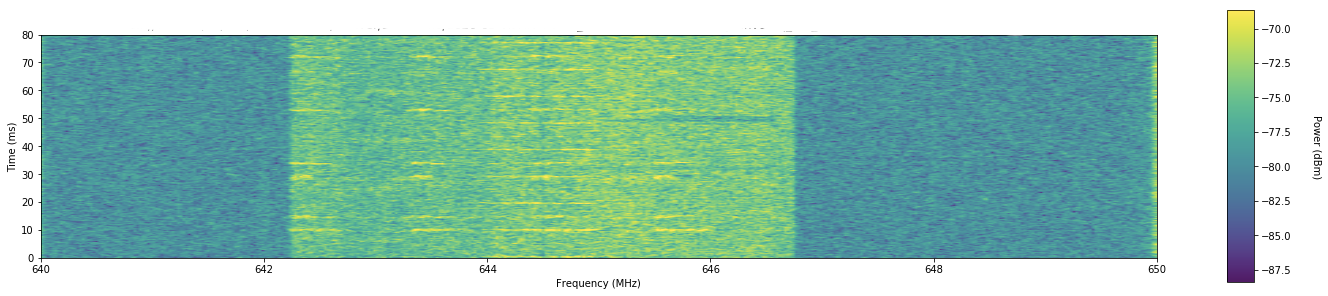

The image above shows power-based activity measurements in the 640-650 MHz spectrum band. As you can see there is a 5 MHz channel beginning at 642 MHz (indicated in the yellow) that indicates T-Mobile is broadcasting in this spectrum range. Our data science team was able to determine that T-Mobile deployed a 5 MHz channel in the F Block at 642 MHz spectrum, which is licensed by DISH, and is using that spectrum for its 4G LTE service.

AWS-4 and AT&T

With AT&T, DISH provided 20 MHz of its AWS-4 (Band 66) and all of its 700 MHz spectrum. In addition, it has also provided AT&T with access to its AWS-4 spectrum in Puerto Rico and the U.S. Virgin Islands.

AT&T’s agreement involves AWS-4 spectrum. AT&T already uses AWS-3 spectrum. Because of this, AT&T customers that have a fairly new device should be able to benefit from the additional spectrum.

The FCC granted AT&T temporary access to DISH’s spectrum on March 20th and on April 1st, Aurora Insight detected AT&T using Dish’s AWS-4 spectrum in the Arlington, Va., market.

Again, using our proprietary network of sensors to measure radio frequency spectrum, we were able to detect that just 11 days after the FCC issued its order AT&T was already using Dish’s AWS-4 spectrum.

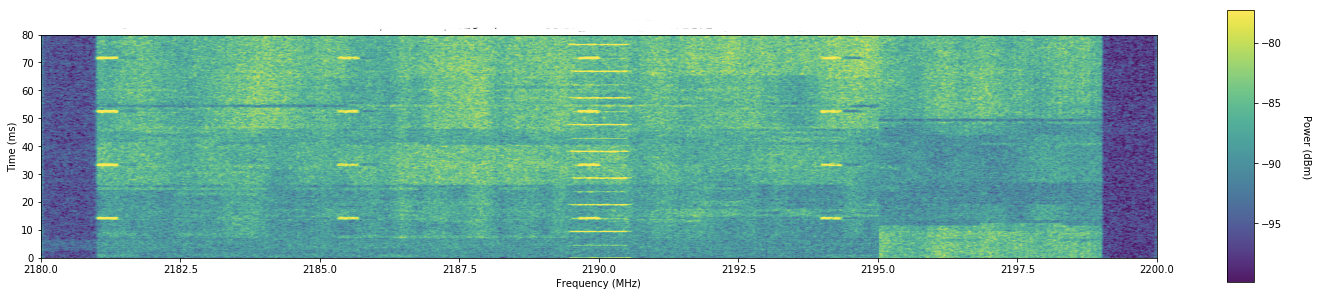

The image above shows power-based activity measurements in the 2180-2200 MHz spectrum band, which is known as AWS-4, Band 70. DISH’s AWS-4 spectrum holdings are comprised of AWS-4 spectrum from the range. As you can see (indicated in the blue-green color), AT&T is broadcasting its 4G LTE in that spectrum range.

Conclusion

Borrowing of spectrum licenses is very unusual in the wireless industry. Prior to the COVID-19 pandemic, there had only been a few temporary spectrum borrowing arrangements. These temporary deals usually involved just one spectrum license in a certain area – such as near a stadium or venue –and only lasted for a day or two.

But there are already signs that this could become a more common occurrence. In late April T-Mobile entered into a three-year arrangement with LB License Co., which is controlled by the venture capital firm Columbia Capital, to lease 600 MHz spectrum from Columbia for a fee. The deal gives T-Mobile immediate access to between 10 MHz and 30 MHz of 600 MHz spectrum in various markets including St. Louis, San Francisco, Seattle, Philadelphia, Chicago, Boston and Los Angeles.

Aurora Insight provides a one-of-a-kind service that accurately and impartially measures the radio frequency spectrum, providing valuable insights to the communications industry.