Initial Verizon 5G launch is fixed wireless offering

Fixed wireless has been around since the days of 2G but there are converging factors that suggest the best days are still ahead. In a recent economic analysis, Ericsson researchers see the fixed wireless opportunity as three-fold: “connecting the unconnected; build with precision; and wireless fiber.”

There are more than a billion unconnected households, according to the report, and economic conditions don’t make building out cabling–copper or fiber–possible; however, many of these locations are served by existing cellular networks. The “build with precision” concept would let operators look at prevailing market conditions and existing network resources to identify underserved markets without significant competition. Leveraging some existing assets and carefully pinpointing investment would allow operators to break into an adjacent market and create new revenues. Wireless fiber refers to offering up a service on par with a high-speed wired connection without the costly and time-consuming process to building out to each home or premise.

Verizon is perhaps the most prominent global carrier currently pursuing fixed wireless. The operator brought 5G to market initially with a fixed wireless service available in four cities–Houston, Indianapolis, Los Angeles and Sacramento. From radio nodes, Verizon uses its millimeter wave spectrum to deliver with average speeds around 300 Mbps, peaking around 1 Gbps, to consumer premise equipment located in a subscribers home. That service goes for $50 per month for current Verizon subs and $70 per month for non-Verizon customers.

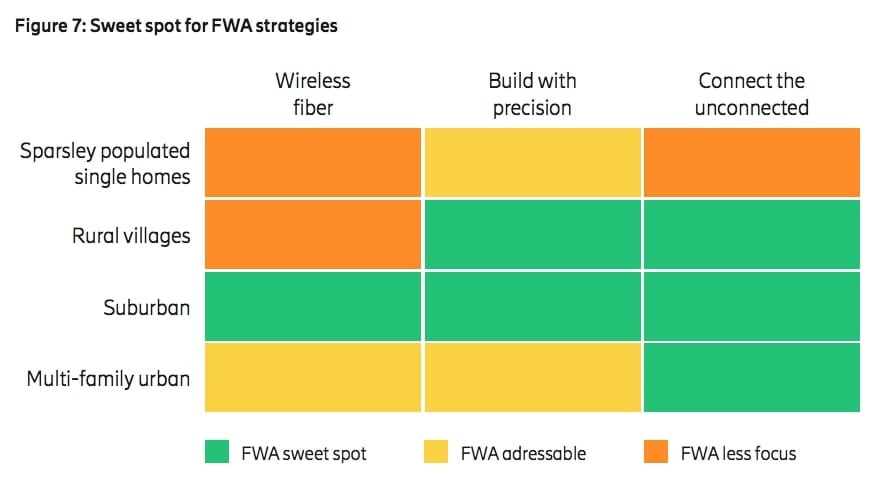

For the build with precision model, Ericsson sees the fixed wireless “sweet spot” as rural villages and suburban areas. Wireless fiber is best suited for suburban environments and, if the goal is connecting the unconnected, the best market areas are rural villages, suburban areas and multi-family urban dwellings. For all three options, “sparsely populated single family homes” aren’t ideal places to deploy, according to Ericsson. The graph below color codes that analysis.

From the report: “FWA will not be driven by technology, but rather the market opportunity for each operator in a specific geography, as with traditional fixed broadband. From this starting point, operators should select the combination of technologies and the spectrum strategy most suited to the market opportunity.”