Satellite communications have been in use for decades now, providing connectivity to remote areas, acting as backup in disaster relief situations, and being a major access mechanism for television (TV) in certain parts of the world. Satellite use has been vital for government, military, and remote operations, while Geostationary Orbit (GEO) satellites are providing global coverage for voice, TV, and, in some cases, broadband Internet services.

The telco industry is now working toward the standardization and commercialization of the next generation of cellular standards, namely 5G. However, two factors are now forcing the satellite communications industry to get involved in terrestrial communications, which has not taken place in the past for two main reasons:

- Radio spectrum in lower frequencies is nearly exhausted, leading the telco industry to look at higher frequencies for 5G. The best candidate for a global band is 3.4 GHz to 3.8 GHz (part of the C-band spectrum = 4 GHz to 8 GHz), which has historically been used for GEO satellite communications. Parts of the band have been identified for terrestrial use by the previous ITU-R World Radiocommunication Conference (WRC), and many administrations have already repurposed parts of the band for terrestrial use or are in the process of preparing the band for 5G. Naturally, the satellite industry has become protective of spectrum allocated for its use and is discussing how satellites can be used as part of the 5G specification.

- Mobile service providers are pushing toward unconnected areas for two reasons: all markets are saturated, except for rural areas, and a desire to enable connectivity solutions more broadly. These areas have been difficult to connect using terrestrial communications from both a technology and financial perspective. Facebook and Google are trying to address these areas with balloons and drones, but their recent efforts (g., Project Loon providing patchy connectivity to Puerto Rico after Hurricane Maria) indicate that providing connectivity to these areas is not as easy as predicted. Therefore, satellite communications may be able to play a role in connecting areas that terrestrial communications cannot reach.

It is also important to note that, at the same time, the satellite industry is evolving to Low Earth Orbit (LEO) constellations, with OneWeb and SpaceX being two examples of new companies launching satellites to provide nearly ubiquitous connectivity across the world. These constellations have not yet been launched, but they have announced aggressive plans for their rollouts.

Satellite and terrestrial communications: A love-hate relationship

Mobile networks have rarely used satellite connections for backhaul in the past, because the high cost of single channel per carrier (SCPC) connections, coupled with relatively low bandwidth and high latency of GEO satellites have forced terrestrial operators to migrate to other technologies in areas where they could. For example, there is no match between the economics of fiber backhaul and satellite connections. The satellite industry has answered the cost issues with time-division multiple access (TDMA), where a single carrier is shared between sites for backhaul. However, even in this case, the cost is high, relative to terrestrial backhaul, and the reliability of the connection is also a challenge. Hence, satellite backhaul has primarily been used in very remote areas, where deployment of fiber, microwave RF, and copper might not be economical.

Connecting large geographic areas from the sky is not a new idea. For example, high altitude platform stations (HAPS) have been studied in academia and were considered in the past, even for urban areas. However, the rapid commercialization of 3G and 4G terrestrial networks did not leave an open window for HAPS to develop. This work continues with programs like Google’s Project Loon and Facebook’s Aquila drones as the most mature examples today, albeit they are far from being commercially deployed. And, in the operator market, DT partnered with Inmarsat and Nokia to launch the European Aviation Network, which is an integrated satellite and terrestrial network that offers travelers consistent broadband connectivity when flying over Europe.

These activities illustrate the love-hate relationship satellite and terrestrial communications have had, which brings the discussion to 5G. The latest WRC conference during 2015 identified parts of C-band as a potential 5G spectral band, while the European Commission also identified 3400 MHz to 3800 MHz as a key band for early 5G deployments in Europe. In any case, C-band utilization by satellite operators has been declining, and new generations of satellites now focus on the higher Ku and Ka bands.

Naturally, satellite operators are reacting to these developments and are now claiming that satellite communications should be an integral part of 5G. Could this be a viable way forward?

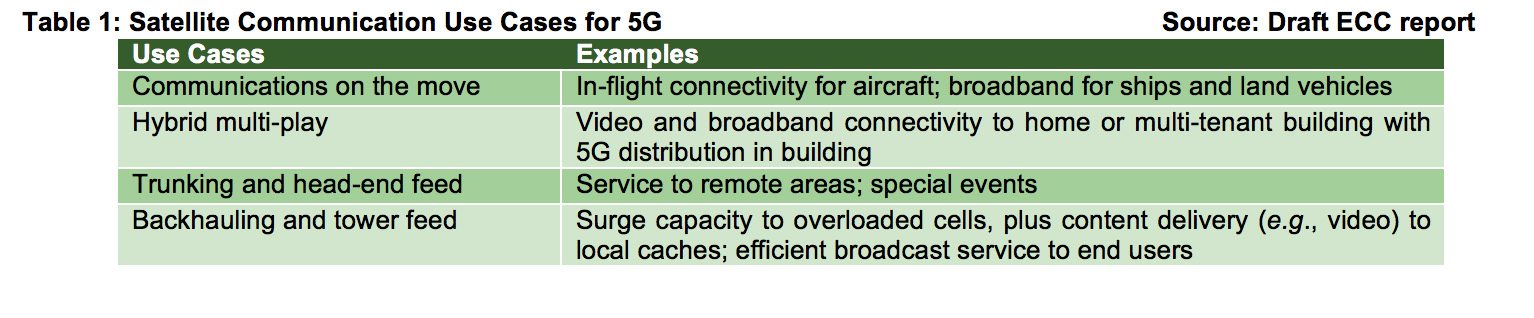

The “Satellite Solutions for 5G” proposal The satellite industry has come together to compile a document titled “Satellite Solutions for 5G,” which has now been submitted to the CEPT and is open for public consultation. This draft document outlines four use cases for satellite communications in 5G, as illustrated in Table 1 below.

Table 1: Satellite Communication Use Cases for 5G report Source: Draft ECC report

Within the terrestrial communications domain, the 3GPP is now discussing the inclusion of satellite communications in 3GPP Release 15 in the form of a Study Item (SI) captured in report TR38.811. Release 15 includes official 5G specifications, which are the result of various multi-year Work Items (WI) to be completed in June 2018.

These activities can be interpreted in two ways, according to the point of view of the party assessing them. On the one hand, the satellite industry could be perceived as protective of their assets and, thus, attempting to position their technology as a key component for 5G. On the other hand, the wide footprint satellite communications offer could benefit 5G deployments. However, to understand the potential overlap between the two worlds, it is necessary to assess the bigger picture and take into account how 5G will likely materialize during the first years of its deployment.

Satellite 5G: What is the potential overlap? 5G is positioned to focus on the enhanced mobile broadband (eMBB) use case for the first years of its operation and, in some cases, will focus on fixed wireless access (FWA) as part of early-stage operator rollouts. The likely competitive differentiation compared to 4G will be faster speeds and lower latency that will be available as soon as the 5G New Radio (NR) Standalone Access (SA) is deployed, which translates to Gbps speeds and latencies well below 50 ms. At the moment, neither of these differentiators is addressable by satellite communications platforms, as providing backhaul in the order of Gbps is too expensive, and sub-50 ms latencies can only be enabled by LEO constellations that simply have not yet been launched (SpaceX and OneWeb aim to address this space). This makes satellite communications a challenging choice for 5G eMBB because Tier One operators are deploying fiber for 5G backhaul and will deploy 5G in dense urban areas (where dark fiber may already be abundant), and not in rural areas where satellite backhaul may provide a competitive advantage. Moreover, the cost of millimeter Wave point-to-point links (including E-band, 70 GHz to 80 GHz) has declined significantly in the past few years, making this an alternative for rural connectivity, as these links can provide very high speeds.

The coming massive machine-type communications (mMTC) and ultra-reliable and low-latency communications (URLLC) may be a more fertile domain for satellite communications, but the complication is the lack of a clear business model on the operator’s part. Currently, IoT networks using existing 4G technology are still in deployment (e.g., LTE Cat-M and NB-IoT) and business models that enable economies of scale still need to be established. At the same time, there is competition from unlicensed spectrum IoT technologies, including Sigfox and LoRa. Mobile operators, by and large, are still experimenting with IoT business models and are not likely to deploy 5G for the mMTC use case for at least the next 3 to 5 years. The same is true for the URLLC business case, which is even more opaque: it took the U.S. government five years to decide on FirstNet, the nationwide U.S. first responder network, which will probably take several more years to deploy. A single operator, in a competitive market, will be further challenged in terms of business opportunity and model.

This leaves unicast and multicast for video content as a possible service opportunity, which has been considered in the past in terrestrial networks, but not used since content delivery networks (CDNs), codec improvements, and the evolution of 4G technology (with Gigabit LTE now available) have adequately addressed growing video traffic. There is also an added complexity for video content delivered by satellite: the need for a dedicated satellite antenna in the cell site, which is restricted in terms of real estate, particularly in dense urban areas.

To summarize: when considering current mobile operator challenges and the near-term deployment priorities for 5G, there is little room and opportunity for satellite communications. However, in the longer term, 5G will likely consolidate all other cellular generations into a single network, which will include rural and remote area communications where demand would not justify investment in infrastructure. In these remote areas, satellite communications, coupled with new constellations and new technologies (e.g., phased arrays) could play a complementary role, bringing connectivity to the unconnected and bridging the digital divide.