In today’s mobile networks, revenue per transported bit is constantly decreasing, while the complexity of the network and traffic volumes are increasing. Hence, driving operational efficiency and reducing OPEX are of paramount importance to evolving network operators. One of the key areas for gaining increased efficiency is network optimization and troubleshooting. The challenge is, how to improve the optimization process to cope with the increasing traffic volume and network complexity without significant manpower increase, and to focus the efforts on areas that will deliver best measurable business value.

Traditional workflow in optimization process has been to focus on sites having most problems detected. Typically, site and cell-specific performance management counter data is used to get a network wide view of the problems and areas of optimization, using so called “Top offending site” analysis. The sites and cells with most critical problems are then further examined by looking deeper into the performance counter data, configuration data, and hardware alarms. As a last resort, drive test in the problem area is used to capture further details of the problem at hand. To minimize the need for costly and time consuming drive test, call trace collected from the network is increasingly used as a drill down data source to provide call level details of the problem.

Today most mobile networks are built with equipment from multiple network equipment manufacturers (NEMs). The above listed data feeds needed for optimization are all network vendor proprietary. NEMs typically also have optimization tools offered along with the network. This results in an optimization environment with mosaic of different tools for different data feeds and network vendors, creating inefficiencies in the practical optimization work flow.

Today network vendors employ a substantial service business, where running the operator networks is one of the prime responsibilities. Seldom is the network vendor the sole provider of network equipment to the operator, which further complicates the network optimization and troubleshooting environment. Cross licensing optimization tools from competing network vendor is not always possible.

Vendor-agnostic, business value centric optimization flow in multi-vendor network

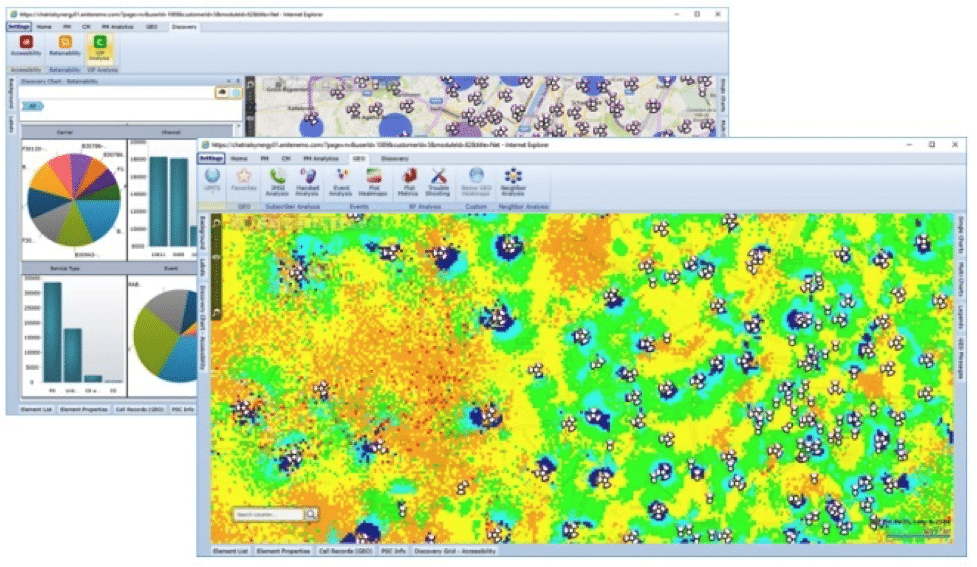

With Keysight’s Nemo Xynergy Geospatial Intelligence solution (Nemo Xynergy), the network performance and customer experience is determined by analyzing data extracted from the radio access network OSS (operations support system) interface. Each time a wireless terminal establishes or terminates either a circuit-switched or packet-switched connection, a call trace record is generated by the network OSS.

These records contain user information (identifiers), traffic type and destination information, radio network quality parameters, and bearer type indicating the type of service used (streaming video, conversational, etc.). The call trace records do not, however, contain the GPS coordinates of the mobile terminal, so the exact location of the terminal is not known to the network. The solution presented in Nemo Xynergy uses a proprietary algorithm analyzing the radio network parameters to accurately estimate the actual physical location of the terminal, thus allowing the information from the call trace records to be placed on a map.

Nemo Xynergy is able to extract OSS based call trace data from multiple network vendor’s equipment. Keysight has signed agreements with major network vendors under the OSSii initiative for licensed processing of the binary and proprietary call trace data of the different vendors. This makes Nemo Xynergy a future proof tool for call trace analytics, not relying on reverse engineering of the proprietary call trace data.

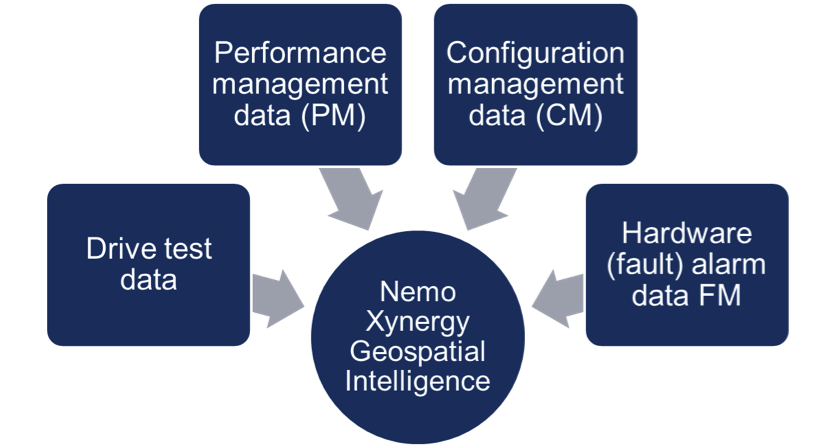

In addition to call trace records, Nemo Xynergy utilizes performance management (PM), network configuration (CM), network hardware alarms (FM), and drive test data as supplementary data sources. Nemo Xynergy correlates the supplementary data feeds seamlessly with the call trace records in various workflows and analyses to provide deeper insight and root cause analysis for QoS issues seen in radio access networks. This brings significant efficiency gain for the optimization work when the engineers don’t have to touch multiple tools to access all the needed data feeds.

Nemo Xynergy allows to filter and analyze the call trace data by individual subscribers and VIP users. This enables a paradigm change in the whole optimization workflow. It is possible to focus on solving first QoS issues perceived by the highest value subscribers. For example, focusing the optimization efforts to the 20% of the subscribers bringing in highest revenue will allow to reduce the churn of this important customer segment more effectively, driving better business value from the optimization efforts for both operators, as well as for managed service providers.

Analysis is possible on market level on all call records enabling statistically relevant correlation of problems and traffic patterns against various dimensions, such as subscriber, handset model, network node, and time for quick root cause analysis. Additionally, instant drilldown to individual transactions is possible for in-depth troubleshooting and analysis of specific problems.

Geolocation of real subscriber provides insight on the traffic density over geography. This information is crucial for deploying small/micro cells in optimal places. To evaluate the value of traffic density and to profile the applications used (e.g. business vs. recreational) in various areas is important, but it is also valuable to understand where certain user groups are located and which services they are using in a given physical location. For VIP users, the office, home, and mobility application usage profiles are important, and for machine-to-machine communication reliability and power consumption are key parameters which also depend heavily on the physical location.

The handset model plays a major role in the QoS perceived by end-users as RF performance varies between different handsets due to enclosure, antenna, and modem chipset. Interoperability between numerous handset variants and models and the networks poses a continuous challenge for maintaining good quality of service for all. Service providers have an increasing need for tools with the ability to correlate handset model information with network performance metrics.

Summary

Network operations is in constant cost pressure. At the same time, complexity of the mobile network optimization is increasing due to mixture of technologies, tools, network vendors and subcontracting chains, and ever increasing traffic volume. Nemo Xynergy addresses these optimization challenges with vendor-agnostics analysis capabilities for call trace, and other relevant RAN data feeds, significantly improving the efficiency of optimization work flow. Nemo Xynergy enables focusing the efforts on QoS issues perceived by the high-value subscribers to reduce churn in this important customer segment, hence driving maximum business value from the optimization work.

Keysight Network Testing develops and sells RF measurement and analysis equipment under the Nemo brand. Nemo Xynergy analytics solution is used by operators on 3 continents for analyzing drive test, RAN, and subscriber data.

About the author:

Matti Passoja, Director, Post-Processing Products at Keysight Network Testing. Matti is responsible for solution marketing at Keysight Network Testing (NT). This includes sales/channel enablement, outbound marketing, Go To Market (GTM) plan: Further Matti has 10+ year experience in R&D and product management of data collection and analytics