Jim Patterson tackles the T-Mobile ‘to do’ list and looks at Samsung’s latest Galaxy smartphone

We have a lot to cover this week with T-Mobile US earnings and Samsung’s announcements from Mobile World Congress.

T-Mobile US ‘to do’ list

1. Continue to lead/dominate industry phone net additions (through lower churn in first quarter 2016, and through gross additions and churn in Q2-Q4 2016).

2. Within phone net additions, maintain overall porting ratio of 1.6 – 1.8.

3. Grow market share in recently launched 700 MHz markets (230 million potential customers covered).

4. Launch network (and T-Mobile US premier distribution) in additionally acquired markets.

5. Make business gains (small- and medium-sized enterprise, enterprise) a “reportable” number.

6. Continue to develop a comprehensive video strategy using Binge On as the capstone offer.

7. Fire on both cylinders (prepaid and postpaid growth) throughout 2016.

8. Maximize the impact of the next two “Un-carrier” moves (11 and 12).

9. Move from market share participant to market leadership in machine-to-machine.

10. Be prudent, yet strategically invest in 600 MHz spectrum.

While we had a lot of information already on T-Mobile US’ subscriber growth from their January pre-announcement, last week’s earnings conference call filled in the gaps on the fourth quarter and provided meaningful guidance for 2016.

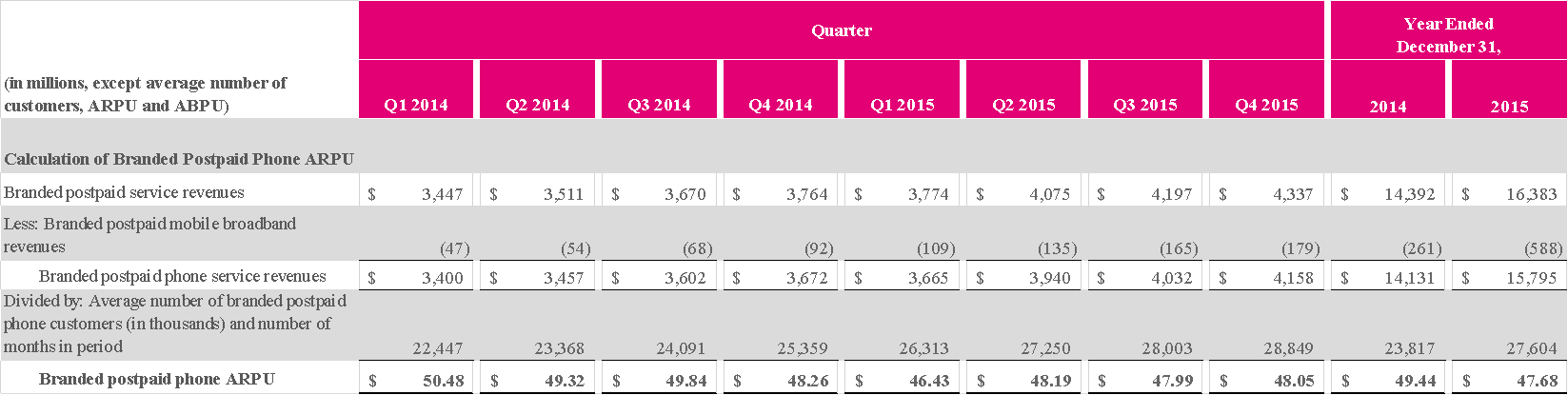

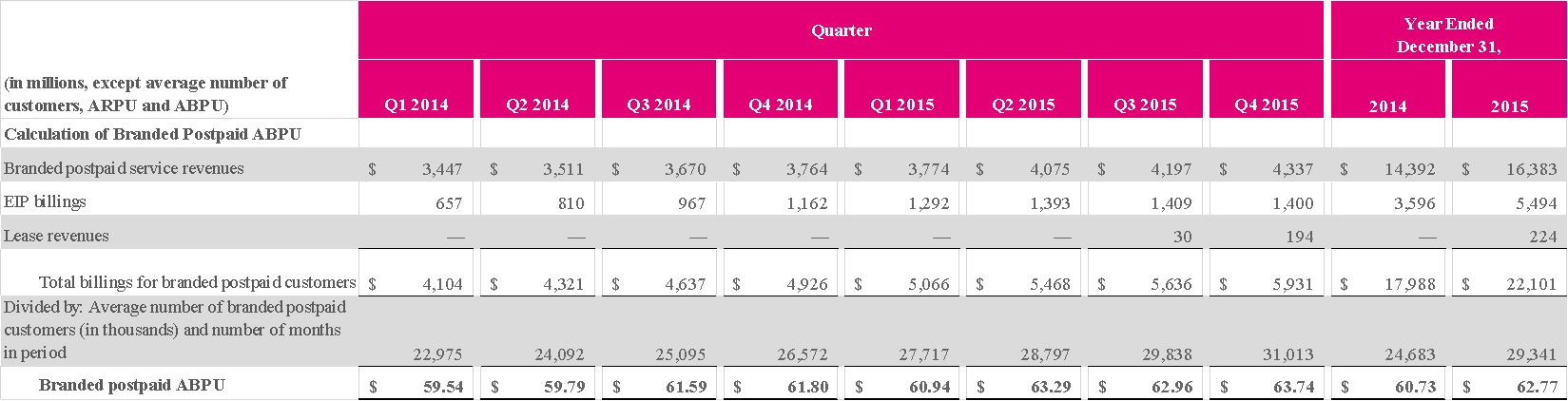

The most important words from T-Mobile US’ call were “stability” and “growth.” Have a look at their average revenue per user and average revenue by account statistics from their earnings release:

Phone service revenue growth is up 13.2% from Q4 2014 to Q4 2015. Average phone subscriber growth is up 13.8% over the same period. This translates into an ARPU loss of 0.44%. Headline: the full effect of all of the “Un-carrier” moves (with the exception of Binge On launched in Q4 2015) is less than 1% to service ARPU. And, as T-Mobile US COO Mike Sievert described on the conference call, the carrier has successfully been able to upgrade spending levels in accounts at a greater rate than the competition.

T-Mobile has begun to add tablets to their selling mix as well (many incoming customers are bringing tablets with them, costs continue to plummet and Sprint was also in the market in Q4 with a tablet offer) with 1 million tablets added in 2015. From the tables above, the average ARPU on tablets is $27.57 per month ($179 million in Q4 revenues divided by 2.164 million average users), which is also inline with or slightly ahead of the industry (tablet-only plans start at $20 per month for 2 gigabytes and each additional user is $20. A $10 discount applies to the tablet plan rate if the device is combined with a phone offer).

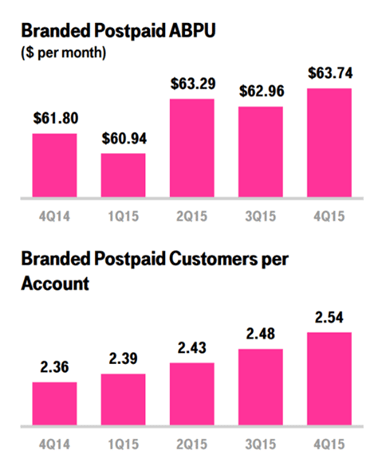

Combining service, equipment installment and leasing revenues, T-Mobile US managed to grow total postpaid average billings per user by 3.14% year-over-year ($61.80 to $63.74). AT&T’s phone-only ARPU plus Next billing (the closest surrogate to the T-Mobile US ABPU) grew from $65.87 to $68.91 or 4.62%, based entirely on growth in Next billings (phone-only ARPU was down 2% year-over-year). Sprint’s growth in ABPA is driven by a loss in accounts; ARPU decrease was 7.7% year-over-year.

To win in the newly bifurcated world (service and equipment revenues separated), carriers will need to offer services that compel users to grow their total spending (using Verizon Communications’ term, to “buy up”). This cannot happen unless the value equation is correct – network quality needs to match the monthly service revenues charged (and this service fee must be weighed against all of the other ways the consumer or small business could spend that money).

T-Mobile has figured out this equation:

1. Bring the customer in with the best device for their budget (all news devices are 700 MHz capable per comments made on the earnings call).

2. Add devices (preferably phone, but also tablets) as the customer realizes T-Mobile US offers a faster and/or more reliable service (note: this is true in many areas of the country, but not others).

3. Grow the relationship with Netflix, Hulu and others so customers associate their video viewing experiences with their mobile device, not their TV or their computer. Use the TV and/or other devices to display a larger version than a five or six-inch screen, but have the primary data ingestion point be T-Mobile US’ network.

4. Use this increasing dependency to grow the number of hours the customer can spend viewing content inside or outside the home.

This is a big change from the “bring any AT&T device” promotion employed just a few years ago (think before T-Mobile US had the iPhone and the aggressive efforts to employ a “bring-your-own-device” strategy). Given the deployment of 700 MHz spectrum to 190 million pops today (growing to 260 million pops with deployment of owned and newly acquired spectrum) and the corresponding reduction in traditional GSM capacity (which would be applicable on an older device), having new customers join the T-Mobile US experience on their best network is essential.

The other important headline from Q4 earnings is free cash flow generation. Over the past two years (2014 and 2015), T-Mobile US has burned through $1.3 billion in cash ($9.6 billion cash flow from operations less $16.8 billion in spectrum plus capital plus other short-term investments plus $5.9 billion in increased financing activities). Over that same period, they have added just under 12 million branded postpaid and prepaid customers, acquired two major blocks of spectrum (one of which has not been deployed), finished up the migration of MetroPCS and rolled out LTE coverage to more than 305 million pops. Headline: T-Mobile US has redefined financially prudent multitasking for the telecommunications industry.

With all of this growth comes growing pains. CFO Braxton Carter described a “substantial” systems re-architecture and overhaul that is keeping their general and administrative costs higher than normal (this should be expected when you grow 12 million net branded subscribers in 24 months). The pace of T-Mobile US premium retailers is probably not where management would like to be entering the year (management hopes to have 700 MHz network and distribution in place for 230 million pops this year). And, while the percentage growth rates (likely from small numbers) for business are strong, T-Mobile US needs an experienced partner who can bring in-building coverage to a new level (TW Telecom/Level 3 and/or Comcast would be my picks to challenge AT&T and Verizon’s enterprise chokehold).

Bottom line: If all of the other parts of the country stayed even on subscriber additions (churned customers = gross additions), and T-Mobile US were to have a stellar 700 MHz grand opening for new markets covering 20 million pops (in cities like Boston, San Francisco, San Diego, Las Vegas, etc.) and they were able to have four months of aggressive gains in another 20 million pops they recently acquired, the low end of their guidance of 2.4 million net new subscribers would be met (1.8 million from a full year of the first 20 million plus 600,000 subscribers from five months of the second 20 million). T-Mobile US’ 2016 future depends on new 700 MHz market launches and maintaining low churn levels across the total base.

Samsung launches new devices at MWC: first reactions

We just finished watching the Samsung Unpacked 2016 live stream and have to admit we came away feeling left out. Currently, we own and use a Samsung Galaxy S5 (the last Galaxy device with a replaceable battery) and a Galaxy S6 Edge. We’ve been Samsung fans since the Galaxy S3 and are still learning about features on each model.

Samsung has focused on two (maybe three) markets with this device: gamers (GPU up 60%); photography enthusiasts (dual-pixel capabilities; low light improvements); and gamers who are virtual-reality enthusiasts (including Facebook CEO Mark Zuckerberg who overshadowed the event with his appearance at the end of the session).

To Samsung’s credit, many of us have taken advantage of the Galaxy S5 to learn the art of cropping and also how to easily post to Facebook and Instagram (we also started to use Drop Box after purchasing the S5). We’ve taken first panoramic views with the Galaxy S6 Edge. We want to take better photos, but realize sometimes the camera can only do so much – sometimes it’s the user.

An incremental color splash is good (will we ever want to go back after using the S7?), but could you provide the ability to (voice) record a title for photos immediately as they are taken? Or generate an email of the photo to the most frequent photo recipients (which is likely a very small subset of the contact list) – insert more shortcuts to commonly used apps and recipients? Headline: Samsung has done a lot to improve the photography product – now it needs to improve the process. This is long overdue.

While Samsung is going to include a free Gear VR and some games to get me going (a huge incentive), will this entice user to make the Gear a regular part of their lives (some readers are as old as their 40s, and Gear is likely oriented towards the 20-year old set). To make a believer, Samsung needs to provide a NASCAR Daytona 500 experience over VR, or introductory rock climbing, or a tour of the Louvre or private language instruction. Simply making games better diminishes the market opportunity. Give us more “Deadliest Catch” – VR edition and less “Gunjack.”

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.